Adam Smith Awards

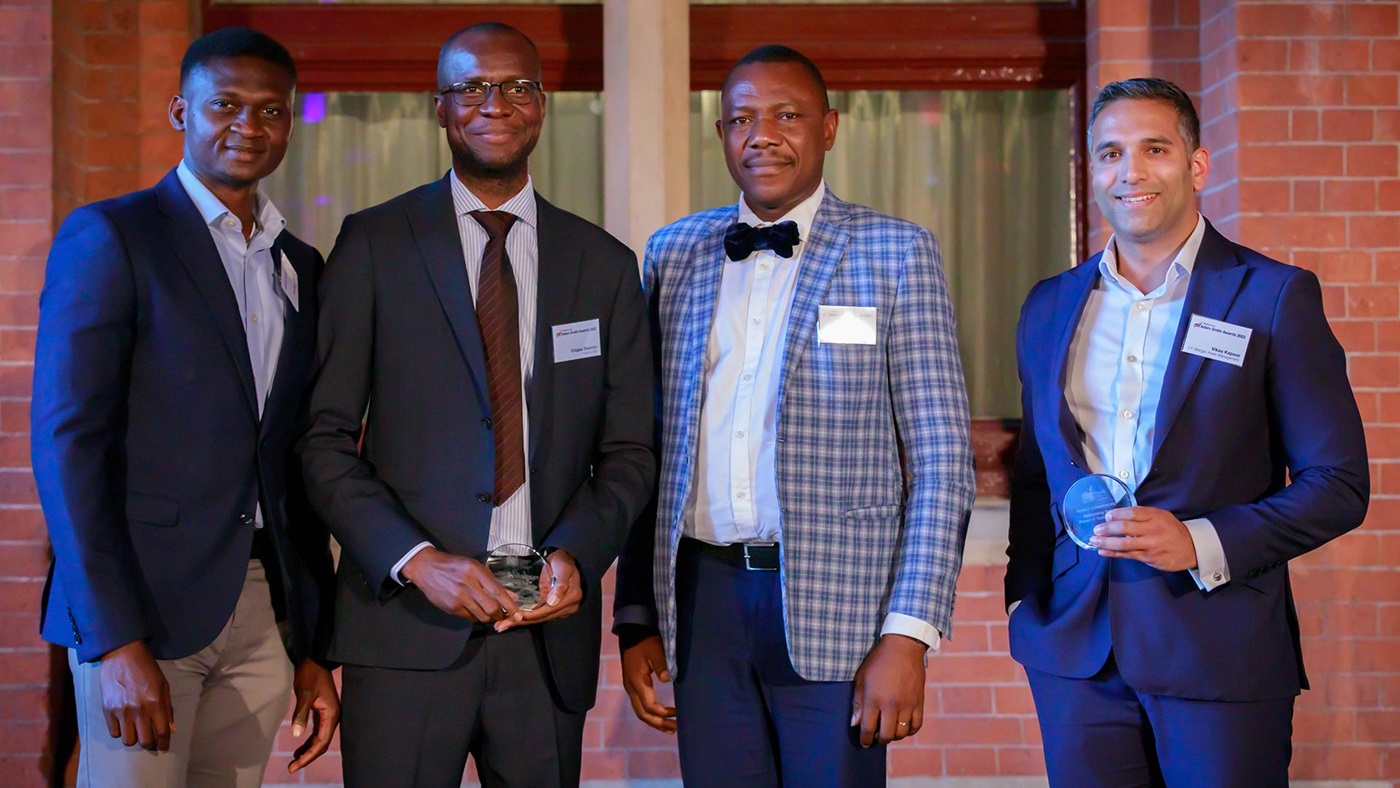

Congratulations to all our 2022 Adam Smith Awards winners.

The scale of Ericsson’s US$27bn operation is massive and the regionalised approach created key stresses on Ericsson’s programme, which in 2016 drove the treasury team to begin a five-year transformation with the focus on increased control, efficiency and visibility. “We started by taking a critical look at all pieces of the programme: people, process, and technology,” recalls Magnus Attoff, Head of Digital Transformation and Financial Risk Management. The scale of what was addressed is emphasised here; Ericsson has operations in more than 180 countries with bank accounts in over 150 countries and over 100 currencies.

In 2016, FedEx, a then US$50bn corporation acquired European delivery company TNT Express. Today FedEx is a US$92bn company (annual revenue). FedEx faced the huge challenge of integrating two legacy global cash management structures with the objective of attaining visibility and control of global liquidity and laying the foundations for automated and scalable cash management processes globally.

It used to take Sony Group’s FX team 15 minutes to centrally hedge FX trades for the group’s subsidiaries in a laborious, manual process requiring multiple entries and validations to prevent errors. Implementing an end-to-end automation of FX hedging processes for all Sony Group’s subsidiaries globally is truly best practice.

The vast majority of Easa Saleh Al Gurg Group’s (ESAG’s) supplier payments are managed through HSBC’s Host2Host Connect, which is an automated solution for secure electronic data transfers that are sent between the banks and corporates. For onsite payments to vendor through cash and/or cheques; the entities were using petty cash or personal credit cards. The challenge here was to identify a solution that would enable ESAG to fully bridge the gap and create a process that aligned with the Group’s 2025 vision of achieving complete digitisation.

Pepco sources directly from its suppliers from various countries. Globally, the group has around 2,000 suppliers in total, with 115 strategic suppliers that are based in Asia including, amongst others, Bangladesh, India and China. It is these strategic suppliers that are addressed in the first phase of the solution described. Historically, Pepco’s payment terms to its suppliers in Bangladesh, India and China were extremely short because it believed that pricing, which is key to its business model, would be impacted by extended terms, as suppliers would have to finance the payment terms themselves at a relatively high cost in-country. During COVID-19, lockdowns in various of Pepco’s operating countries resulted in stores being closed and/or restrictions on the merchandise sold, which resulted in lower footfall and basket size.

Adecco took advantage of a post summer issuance window and was able to achieve market-leading terms across its three bond tranches. On 6th September 2021, Adecco successfully raised approximately €230m through the placement of 5,100,000 new shares at a price of CHF49.60 per new share.

Tesco wanted to support its many suppliers in the UK and the Republic of Ireland (ROI) tackling climate change to access lower funding costs.

The challenge was simple: overhaul a sub optimal payments and treasury process that relied on fragmented technology leading to inefficiencies and operational risk, particularly regulatory and sanctions risk. The company sought to end all manual payments processes and bring in central oversight, visibility and control.

Nike desired a nimble treasury solution to support accelerated growth in digital and to support the firm’s Consumer Direct Acceleration strategy.

International Organization for Migration (IOM) sought to overhaul its cash management, payments-on-behalf-of (POBO) and processes around sharing donor receipt data. The challenge lay in its operations spanning 170 countries and the requirement to expend funds locally via accounts with approximately 200 banks. The IOM’s funding is received centrally into bank accounts in the US and Europe from which it funds local bank accounts, not just in major currencies but in most worldwide exotic currencies too.

Operations in Kenya started in 2014 and over the past eight years the company continues to secure a strong pay-as-you-go market share, estimated by the company at ~60% (by volume), an active customer base of approximately 1.3 million (>10 million cumulative), has 116 walk-in stores, 8,800 active agents and employs 840 permanent staff. The company has sold over 17 million products thus replacing kerosene lanterns and other non-renewable lighting products with affordable solar products thereby impacting more than 65 million lives.

Neptune Energy Group Limited needed to optimise their in-house bank (IHB) and accounts payable functions and build a future-proof structure. The treasury team faced considerable liquidity management challenges due to a decentralised structure that relied on cash pooling to meet the global needs of the business.

GE is a global player in healthcare, energy and aviation and has large operations globally, including in the Middle East and Africa. Considering that several countries in the Middle East, Turkey, and Africa (META) in which GE operates are trapped liquidity markets, this opens GE up to risk including cash visibility, returns on trapped liquidity and idle balances, depreciation of currencies, repatriation processes and more.

The corporate treasury team faced considerable challenges in managing liquidity and reducing foreign exchange (FX) costs and risks. The team was incurring negative interest in EUR balances and, as a result, was searching for solutions to reduce costs and streamline operational processes. The treasury team began by scoping out its current practices, looking at account structures and cash balances. Part of this review involved examining global euro account fees, which were deemed to be excessive. The team set about finding a solution to optimise the yield across the company’s major currency, USD, the EUR, as well as GBP. At the same time, treasury was interested in streamlining the cash process by introducing automation.

Masterworks administers its payment operations in-house with an objective to facilitate multiple payment options for investors. This aim required its payment operations to support timely reconciliation of investor payments, irrespective of payment method, and to develop an integrated workflow to identify and resolve payment exceptions as they arise.

Toby Shore is a longstanding contributor to the success of Emirates Global Aluminium (EGA), joining in 2008 and in the role of Senior Director, Group Treasury, Risk & Insurance for the firm since 2010.

Lisa Chan is the Director of Global Treasury for Airbnb and Treasury Today’s 2022 Woman of the Year recipient. Based on the US West Coast Lisa works for an organisation that, doubtlessly, most of us will be familiar with and that specialises in offering home stays and lodging through a technology platform that connects hosts with guests across the world.

After arranging US$17.5bn of syndicated committed facilities in December 2020, the AstraZeneca (AZ) treasury team of just 19 (small for the size and complexity of a group with over US$37bn turnover) led by Jonathan Slade, Group Treasurer, set about the task of preparing for the Alexion acquisition closing in 2021.

Micro Focus had an in-house banking (IHB) solution, but it only covered half of the business. The company recognised a significant opportunity to better optimise its cash pooling and treasury workflow by expanding the IHB across the entire business and introducing a cashless netting solution.

L’Oréal created SalonCentric, the premier distributor of salon professional products in the US. SalonCentric operates more than 580 physical stores in 48 US states, has more than 400 salon business partners, and serves as one of the largest online business-to-business (B2B) ecommerce platforms in the professional beauty industry.

In 2020, Fertiglobe began looking for a global bank to support its treasury transformation journey. With multiple banking relationships throughout the region, an important objective for the company was to centralise the cash balances of operating and trading entities into a single primary bank account each day. As part of the firm’s growth strategy, its primary goals were to: streamline and automate operations with a single global channel; improve self-funding and interest rate optimisation and gain greater visibility and control over liquidity.

The business has experienced significant growth in recent years following multiple acquisitions and the growth of e-commerce, with the COVID-19 pandemic providing an additional surge in demand for online shopping. DS Smith’s focus on sustainable packaging has become increasingly important, as clients increasingly adopt reusable and recyclable packaging as part of their commitment to sustainability.

In January 2020, Danfoss announced the €3bn acquisition of Eaton’s hydraulics business. The transaction was transformational, adding €2bn to Danfoss’s €6.3bn annual sales (2019). The nature of this acquisition was unusual because rather than acquiring a consolidated group of entities with holding company and multiple subsidiaries, Danfoss acquired assets and standalone hydraulic entities from Eaton. It involved more than 30 standalone transactions (on a country-by-country basis), 13 share deals (existing hydraulic legal entities), and 21 asset deals (hydraulic assets transferred into new Danfoss legal entities). No Eaton treasury resources were transferred and Danfoss treasury headcount expanded from ten to just 12 (one of which was temporary to manage the project).

Comcast’s global reach and scale creates a unique set of challenges. The company had accumulated more than 80 bank relationships and over 3,800 bank accounts across hundreds of entities. Cash and liquidity management structures were complex and fragmented, with multiple cash pools. In September 2019, Comcast embarked on a harmonisation and transformation project, with a view to rationalising bank relationships and accounts, simplifying cash and liquidity management and leveraging technology.

Careem Egypt was looking for a convenient and cost-effective mode of payment for the captains in Egypt. Captains registered with Careem provide ride-hailing services to the customers and are paid on a per-trip basis. As the captains are not directly employed by Careem, it could be challenging for some of them to open a bank account due to certain requirements, such as the average balance maintenance and salary credits. If they succeed in opening a bank account, there are further challenges in maintaining them.

A primary treasury goal was maximising working capital and optimising cash flow. A comprehensive commercial card programme, consisting of virtual cards, purchasing card (P-Card), central travel card and travel and expense (T&E) card programmes in both US and Canada, was key in supporting these goals by delivering days payable outstanding (DPO) extension and rebate.

In 2020, the North American division of Diageo decided to review its existing supply chain finance (SCF) programme and put the business out to tender. The programme aimed to strengthen the supply chain by offering early payment of invoices to suppliers. Diageo’s treasury and procurement functions were keen to re-invigorate the programme and were open to a fresh approach as a result. The goal was to have more suppliers taking up early payment, thus spreading the benefits of enhanced cash flow to more companies.

The company recognised the unstoppable momentum behind the energy transition and has committed to providing practical solutions to help deliver a net-zero future. To accelerate this journey and capitalise on the emerging opportunities in building the low-carbon energy systems of the future, Wood sought a funding solution that was both strategically priced and extended the maturity of its current facilities to enable long-term investment in its sustainability journey and growth of its business.

Turkey has set the bar high in its efforts to promote the expansion of renewable energy resources with plans to commission 10GW of solar capacity by 2027 with domestically produced and locally sourced solar PV modules. Therefore, the government introduced the Renewable Energy Resource Areas (YEKA), a pipeline for renewable projects.

In 2020, PageGroup set the following headline sustainability objectives for its business: To positively change over one million lives in the ten years to 2030. To target an increase in gender diversity within its senior management 50/50 by 2030. Establish a meaningful global sustainability business by 2026. To become carbon net zero with the ambition of becoming carbon positive by 2026.

Teva decided to refinance its debt to align its maturity profile and projected cash generation. ESG was a key factor to incorporate as Teva was looking to boost its ESG journey by creating a link between financing and ESG targets.

Sharjah’s police force needed to overhaul risk management in its finance department, reviewing all operations and procedures in line with new governance criteria. The finance department had no clear sight of key risks or mitigation procedures.

Inefficiencies and laboured processes in its Payments Solution Desk processes left Microsoft facing heightened risk. Business decisions were taking longer, deadlines missed, and deals lost.

Kellogg’s sought to transform its cash forecasting processes, introducing more efficiency, accuracy, and the ability to draw valuable insights across its global operations. It also sought to use FX transaction data at invoice level to develop a daily currency hedging position, with the long-term goal of creating an 18-month rolling hedge programme.

Kitopi’s finance team had to process fund transfers and pay vendors and staff using automated clearing house (ACH) and priority payments. In a manual process, spreadsheets were also used to track and reconcile payments and both payment initiation and reconciliation became increasingly cumbersome and time-consuming when the business grew during the pandemic. In short, Kitopi needed a more automated solution that would easily scale as their business grew.

Nigeria LNG Limited (NLNG) treasury team was struggling to manage its billions of dollars of cash held primarily in money market funds (MMFs). Challenges included working with multiple fund providers via telephone and paper communication; trade placement could take several hours; and the team needed to consolidate to a single bank, yet banks required additional approvals when wiring to settle MMF transactions.

Royal DSM sought root and branch automation of its FX hedging programme. Group treasury at the company runs a short-term FX trading programme to ensure DSM’s different companies and units can internally hedge their open currency positions.

Bosch sought to build a new payments strategy for one of its fastest growing subsidiaries, Azena, among the first companies within the Bosch group to launch a B2B e-commerce marketplace connecting software suppliers to customers all over the world. Bosch had already designed and developed a payment strategy for the Azena marketplace aligned with its own digital payment strategy.

Roche has an industry-leading treasury set-up; innovation, automation and digitisation are top priorities. Cash pooling is an important component of how the company finances its operations. However, in Saudi Arabia, where Roche has had a sales affiliate since 2017, this has long been a challenge.

Henkel employs 634 people in Algeria, and despite the COVID-19 global pandemic, Henkel Algeria managed to increase sales, especially on household products which were directly linked to the changes in consumers’ hygiene habits due to the virus spread. Henkel Algeria’s biggest challenge and ambitions are to keep up with increasing competitiveness on the local market brought by local manufacturers and to contribute to Henkel’s global sustainability ambitions.

Glovo needed to achieve visibility and control over its fragmented cash management operations across a dynamic, diverse and highly complex mix of countries. Glovo was connected to as many as 50 different banks and had extremely limited visibility of its cash.

Mantrac treasury managed multiple online banking systems to access information and operate several accounts across the countries it operated in, resulting in time-consuming and inefficient processes. As a result, treasury management, based in the UAE, embarked on this initiative to increase centralisation of treasury activities, including cash management, trade and working capital facilities.

The Body Shop Treasury Team wanted to have greater visibility over global liquidity and cash. As the company grew, it established more than 40 banking relationships and multiple accounts in some markets where each store had its own account. These accounts were managed across 12 different banking platforms.

The company’s primary focus is implementing technology into specific projects, with targeted goals such as risk management and improved efficiency to integrate processes and platforms into its treasury management system; the overarching aim is always to do more with less.

Microsoft uses foreign exchange rates for its products worldwide, translating US dollar prices into global prices in more than 70 local currencies, impacting tens of billions in revenue per product and channel across its commercial and consumer businesses. To manage financial risk and maximise revenue, the company closely track the variance between market FX rates and its Microsoft pricing FX rates to maintain global Cloud pricing parity.

When a re-organisation reduced headcount by half, the treasury team needed a more modern technology strategy that could quickly introduce process efficiencies, particularly around foreign exchange (FX) workflow. With the leaner team, major concerns included ensuring that all treasury tasks could still be completed on time, and that no required payments would slip through the cracks.

Jayna Bundy’s career spans 22 years across banking, insurance, software and devices industries. Diversity, inclusion, belonging and giving back to the community are core to everything Jayna does.

Prudential’s treasury team drove significant outcomes in 2021 against the backdrop of the enterprise’s transformation efforts of becoming a higher growth, less market sensitive and more nimble company. The team managed Prudential’s capital position, shareholder distributions and debt reduction to accomplish its strategic objectives while satisfying the enterprise’s capital and risk objectives. The team also launched several innovative initiatives to support the company’s growth agenda.