Photo of Andrew Grant, Neptune Energy Group.

Andrew Grant

Assistant Treasurer

Neptune is one of the largest independent exploration and production companies in Europe.

in partnership with

Neptune deploys in-house bank with virtual accounts and on-behalf-of solution across EMEA

The challenge

Neptune Energy Group Limited needed to optimise their in-house bank (IHB) and accounts payable functions and build a future-proof structure. The treasury team faced considerable liquidity management challenges due to a decentralised structure that relied on cash pooling to meet the global needs of the business.

By modernising and upgrading its liquidity management tools, the treasury team’s objective was to increase visibility and control of liquidity and simplify and improve the accounts’ payable function. This entailed achieving better funding of currency positions and fewer transfers, which were as many as ten to 12 each day. The team hoped to reduce delays in the funding process related to currency cut-off times. The back office team looked to achieve faster reconciliation to improve cash visibility and allow the global group to access both international and local clearing in Neptune’s main operating currencies.

“We envisioned these advancements as a way to accomplish better working capital management, reduce physical foreign exchange (FX) on a daily basis and improve controls,” explains Andrew Grant, Assistant Treasurer. Additionally, treasury set out to reduce administrative, legal, and operational fees, while delivering better visibility into bank charges and streamlining the reporting process. To accomplish these critically important objectives, the team decided to replace the company’s existing cash pools and consolidate cash management with a single provider.

The solution

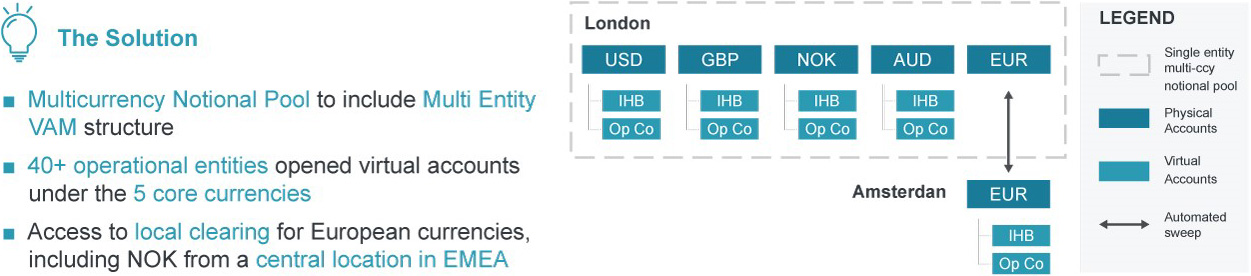

Neptune implemented a centralised structure with an IHB operated by corporate treasury. Working with banking partner, J.P. Morgan, cash management was consolidated replacing the existing cash pools with a best in class multi-currency pool leveraging virtual accounts.

Best practice and innovation

Treasury employed a single entity notional pool structure in EMEA under the company’s IHB for five core currencies, allowing the team to retain a very lean and centralised liquidity management set-up. In addition, a multi-entity virtual account management (VAM) structure was implemented for each currency in scope. Each structure incorporated a single virtual account per entity per currency (90+ virtual accounts in total, allowing for physical account rationalisation). The team also utilised payments on behalf of (POBO) and receipts on behalf of (ROBO) at the operating level to simplify accounts payable and ease intercompany settlement with funding, payroll and accounts payable to be managed through the virtual account solution. These solutions were fully integrated with Neptune’s treasury management and ERP systems and existing SWIFT connectivity.

The implementation of cross-border automated sweeps allowed the consolidation of accounts outside the centralised structure and a multi-currency process that enabled access to local clearing in foreign currencies, centralising liquidity and cash management processes and reducing transactional costs.

Key benefits

- Cost savings.

- Number of banking partners/bank accounts reduced.

- Process efficiencies.

- Risk mitigated.

- Improved visibility.

- Future proof solution.

As a result of this initiative, the back office team is now able to close and reconcile net cash positions per currency by 9-10am instead of 12pm, dramatically improving visibility. The notional pooling and VAM structure eases the physical FX process and funds deployed. Notional pooling is delivering better working capital management, while reducing physical FX each day.