At the 2021 Women in Treasury EMEA Forum, four experts discussed their career journeys and shared their insights on how to make the right decisions, take risks and switch between different disciplines. They also spoke about the importance of mentorship and sponsorship, and what hybrid working means for gender equality.

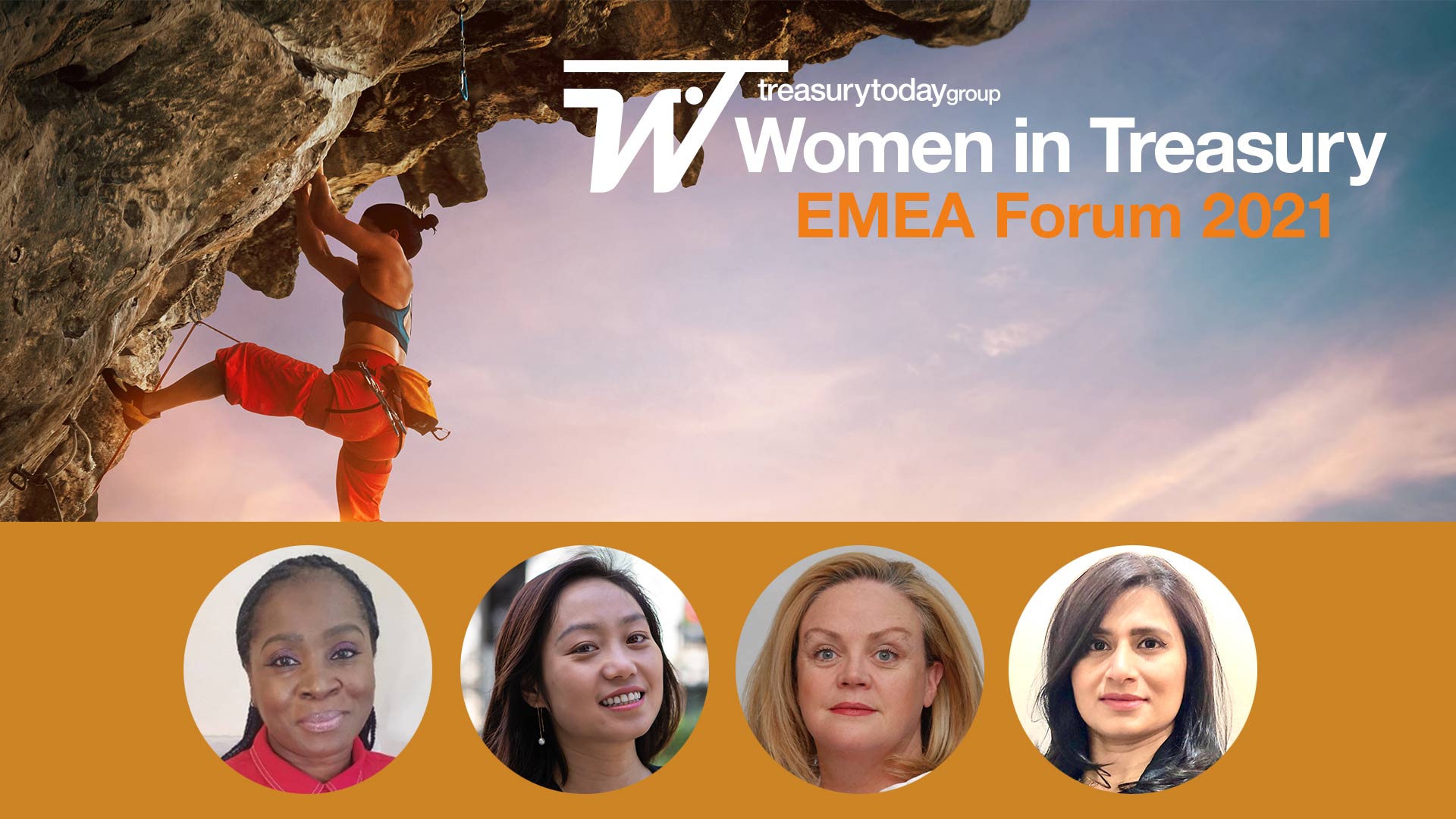

On 16th September, Treasury Today’s Women in Treasury EMEA Forum took place as a digital event. Sophie Jackson, Treasury Today’s Publisher & Head of Strategic Content and Meg Coates, Publisher & Head of Operations, hosted an informative discussion about navigating a successful career, remote working and the importance of community. They were joined by four expert panellists:

- Kemi Bolarin, Head of Treasury Europe, GXO Logistics

- Yang Xu, Senior Vice President, Global Treasurer & Corporate Development, Kraft Heinz

- Cara Savas, European Regional Head of Sales for Global Banking Clients, Global Liquidity and Cash Management, HSBC

- Priyanka Rath, Head of Global Liquidity Product Solutions Specialists, Treasury Services, J.P. Morgan

Mapping out a career path

The panellists shared the different journeys that had brought them to their current roles, and the decisions they had made along the way.

Priyanka explained that having been born and raised in India, she initially pursued mechanical engineering, before realising it was not right for her. An IT role at Oracle Financial Services brought the opportunity for extensive travel. Then, after getting married, she and her husband decided they would both pursue an MBA in France. “The MBA experience opened up my mind – it enabled me to switch industry and work for a bank,” Priyanka reflected. “I found that pitching to treasurers and CFOs was my calling – I absolutely love being in liquidity and working with talented colleagues and people across the industry.”

Yang said she was raised in a small town in China before a scholarship took her to study in Europe. After initially starting in treasury and deciding to pursue a more general finance path, she spent a number of years working in finance roles before joining Kraft Heinz as Global Treasurer. More recently, a promotion led her to move from Chicago to the Netherlands.

Cara, meanwhile, described her upbringing in the west of Ireland as the youngest of seven children, and the route that took her to a career in international banking. “It was a real time of change in treasury in the 1990s, with the euro, treasury centres and tech centres,” she recalled. Following a gap in which she focused on childcare responsibilities, Cara joined HSBC, and sees her current role as a culmination of all her international experience.

And Kemi explained how after qualifying as a chartered accountant, she was introduced to treasury in her internship year, and was drawn to the variety and diversity of the role. Kemi previously changed roles during the 2008 financial crisis, and the COVID-19 pandemic once again brought some major career decisions: after leaving her previous role after 12 years, she had planned to do some consultancy – but on her last day she was offered a role setting up a new treasury department for a spin-off company, and was subsequently recruited to her current role at GXO Logistics. “The quiet period that lockdown gave to me served as a boost in confidence,” Kemi reflected.

Making the right moves

With some questions from the audience focusing on the challenges involved in moving between different disciplines, the delegates shared their views on the benefits that such a move can bring. For treasury professionals looking to move into banking, Cara observed that “treasury experience is priceless in banks – we’re always trying to understand the client mindset. So don’t think of it as a disadvantage, and use your network of bankers to help you make that bridge.”

Priyanka added that a useful approach is for candidates to tailor their CVs to the requirements of different roles and highlight the skills and experience that are most relevant. “So if you’re applying for a banking position, elevate your CV to address what you can do to leverage your corporate treasury experience to make it work in banking, versus what you’ve done in the past.”

Kemi noted the value of taking steps to appear more robust and therefore appeal more broadly to future employers. She added that she had attended many courses on LinkedIn Learning to develop new skills.

And in response to a question about moving from financial reporting into treasury, Yang said that in her company, people often call her for a virtual coffee chat because they are curious about treasury. “Having a genuine understanding and interest in treasury is a huge plus,” she commented. While moving to treasury might be easier within the current organisation, she noted that a general finance background, such as FP&A;, can certainly be beneficial for a treasury role, particularly in light of the growing focus on working as a business partner.

The value of community and mentorship

Turning to the importance of community spaces, Priyanka noted that “When we create a community, we create a sense of belonging – it’s laying the foundation for many generations to come. That’s imperative because it means women looking up and seeing so many accomplished women treasurers will think, ‘If they can do it, so can I.’” She reflected that a strong community can bring many benefits, such as sharing wisdom through discussions, and helping women access tailored treasury courses that can help them in their careers by adding to their skillsets.

“It’s absolutely imperative to bring together like-minded individuals who genuinely want to help and benefit from each other’s experience, advice and wisdom,” Priyanka added. “We have a few established initiatives within J.P. Morgan that I’m a senior sponsor on, and I’m passionate about enabling upcoming talent within the firm and beyond.”

Kemi said that she realised during the pandemic that she had neglected professional networking for many years – but the rise of virtual networking has taken off the pressure involved in arranging physical meetings and enabled her to expand her network.

The speakers also discussed the need to balance time given to the community with their other responsibilities. As Yang noted, “We often get lost in the mist of giving” – but equally, she reflected that she had reached her current position as a result of good advice and support from the community. By sharing something that resonates, she said, it is possible to “change the trajectory of someone’s professional and personal life.”

Moving to the topic of mentorship, Cara argued it was important to understand the difference between a mentor and a sponsor, adding that women are often “over mentored and under sponsored.” She explained that whereas a mentor is anyone who can give you advice on anything, a sponsor is much more specific – namely “someone senior who can help you and use their personal clout to advocate for you.”

As Sophie explained, Treasury Today’s new interactive Within hub will provide an opportunity for people to indicate their interest in a mentoring arrangement. The hub, which will be launched imminently, will also include resources, videos and a chat room.

As sponsor of the Women in Treasury Study, we are proud to be a key part of the community Treasury Today has created for women in the treasury industry – especially during the past 18 months, when support for each other from that community was both essential and tangible. We encourage you to continue to challenge the status quo by taking the lead in promoting conversations around diversity and female progression within your company and acting as a role model for those women coming up behind you.

Lessons from the pandemic

The speakers discussed the impact that the switch to hybrid working models post-pandemic will have on gender equality.

Yang said that her company intends to adopt a hybrid working model for the future, with people expected to come into the office several days a week, but not for the whole week. “There’s been a lot of debate and reflection on why this is necessary and how this helps, or hurts, certain populations,” she said. Moving forward, she added, the focus was expected to be on seeing the workplace as somewhere people can interact and collaborate – in contrast to the five days a week approach of the past.

In terms of the impact on gender equality, Cara observed that the people who have historically had to leave work early to collect children have tended to be female – but that the rise of hybrid working could offer an opportunity for more balance. “My hope is that if everyone is in the office less, that burden will by default be shared more,” she said. “It’s the chance of a lifetime for us now to get it balanced out.”

Turning to the important topic of mental health, Priyanka said the challenges of the last 18 months have brought people back in touch with their most human side. “This has been a tough year – people have missed out on family events and have not been able to say their final goodbyes to loved ones. I think it takes us back to the basics of checking in on everyone – and if you notice something is not right, offering an extra helping hand.” Equally, she said, it is important to have some time for yourself – “you can’t pour from an empty cup.”

Representation and risk taking

Turning to the importance of representation, Kemi spoke about her experience of returning to the UK from Nigeria in the 1990s, and the importance for everyone to have stories, characters and images they can relate to. When it comes to being an active agent of progress, she noted the need to “step up and be seen, and show people now and in the future that there’s somebody like you in this profession.”

Also important is allyship. “It’s about collaborative effort. It’s about working towards a common goal,” said Kemi. “And it’s about building a truly global community – one that is intersectional, inclusive, and representative of every aspect, every race, every gender and every culture within the community.”

Finally, the panellists spoke about how to embrace risk taking while building a career. Cara said she is less afraid of failing now than she was when she used to be. She added, “Your inventory of skills is what makes you. What you’ve done in particular roles has helped you with that – but it’s yours, and if you leave a company or go into a different industry, you still have it. So the risk is not as big as it looks sometimes.”