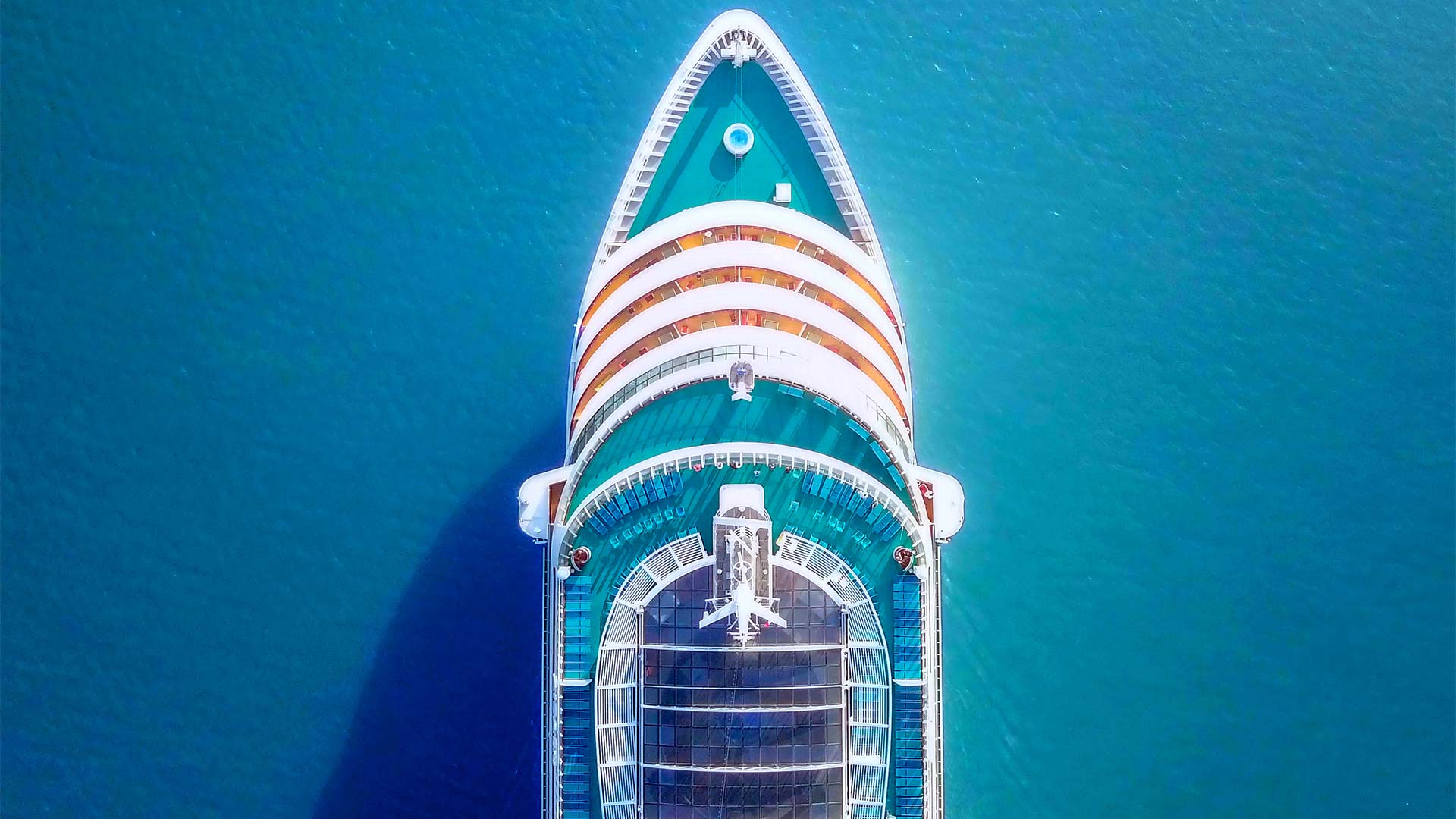

When the pandemic hit, cruise ship operator Carnival Corporation had to scramble to secure enough liquidity to survive. Carnival’s Corporate Treasurer Darrell Campbell explains how he navigated the crisis, and his priorities going forward in a revealing insight into liquidity management.

Over the last year cruise ship operator Carnival Corporation has raised over US$22bn in emergency funding to stay afloat in a sweeping liquidity strategy. At first it was just about survival, executing capital market transactions with the greatest likelihood of success in a highly challenging environment, which wouldn’t handcuff the company in the years to come. Next, the priority was debt transactions that fitted Carnival’s maturity towers with the flexibility to pre-pay, followed by debt conversions as the economic environment began to improve. Most recently, and with dry land finally in sight as the vaccines roll out and the company has begun to sell cruises again, Carnival has stepped back into the unsecured market able to issue bonds not backed by its ships or other assets once again.

One shot

Survival, and what turned out to just be the start of the process, involved securing a comprehensive combination of debt, equity and convertible debt via a package of over US$6.5bn in early April 2020. “We had one shot to convince investors,” recalls Campbell, speaking from his home in Miami, Florida, explaining that his key consideration at that time was making sure there was enough equity underpinning the capital structure, and navigating a pivot to the secured debt market when the unsecured debt market abruptly closed.

Generating financial models based around different scenarios in such a period of huge unknowns was hard enough. Add in articulating them “on the flack” to a new and unknown investor group and it turned positively challenging. “The group of investors we were targeting were high yield. Even though our credit rating was still investment grade, we looked like a high yield company. Our messaging had to be precise, our timing had to be precise and planning for what came next had to be precise.”

Shoring up liquidity came at a cost. On one hand Carnival was locked into a higher rate of borrowing than normal on a secured basis – although the team set this at three years with the view that the company would then be able to refinance at a more favourable rate and without collateral. On the other, a necessary US$600m equity offering in early April coincided with a historic low in the stock price. “Given the circumstances, this was our best course of action. We had to make sure we had the liquidity,” says Campbell.

Two months later and another swathe of transactions followed, with Carnival approaching a new set of investors with US dollar and euro term loan B issuances for a combined US$2.8bn last June. This time the debt was structured to give the company the flexibility to pre-pay with call options in anticipation of the recovery. Meanwhile, as Carnival’s outlook began to improve because of its stronger liquidity position, the next tranche of debt came at a better rate.

Come August, the team started to approach investors to convert the debt issued in the heat of the crisis to equity. “This was important to help us deleverage,” he says, adding how timing on this seam of the strategy also coincided with a rebound in the company’s share price to US$14 a share from a low of US$7.80.

In the next wave of financing, against the backdrop of the continued rebound in the share price, Carnival launched a US$1bn ATM programme, followed by another US$1.5bn in October. “When we got to September, we started looking at ways to issue more common stock,” says Campbell. “By this time, we had enough liquidity even in the worst-case scenario and news of the vaccine was starting to come out.” At this point the company also began restarting cruises off to Italy and Germany. It was also able to opportunistically return to the unsecured debt market, borrowing US$2bn in November in a bond offering not backed by its ships.

Cutting costs

Cutting costs is just as important in successful liquidity management. Carnival has sold 19 older and less efficient ships over the past year. Admittedly the vessels only represent 3% of the company’s operating income, but not paying servicing costs meaningfully impacts the company’s cost structure. “The new ships coming in are larger and more efficient. This will help to further improve our cost structure as we return to service,” says Campbell. Elsewhere, while maintaining compliance, environmental protection and safety, the company significantly reduced its operating and general and administrative costs and deferred all unnecessary capital expenditure.

As for those new vessels already under construction, the team has put in place deferrals of some principle payments with export credit agencies and banks. “It’s in the best interests of ECAs that we continue to operate successfully and build ships in their countries,” he says.

At the end of last November, Campbell says the company had around US$9.5bn in liquidity. With an estimated 1Q2021 cash burn of US$600m a month, he is confident that even if Carnival’s revenues continue to languish through 2021, the current cash pile will be enough to get the company through the year. Crediting the strategy to his small treasury team working alongside a broader finance, Counsel and legal team within the company plus investment banking partners, he says he will continue to look at opportunistic transactions around refinancing higher coupon debt through the course of this year.