In the second instalment of our Fintech Focus series, Treasury Today takes a look at Canadian start-up, Overbond. Their CEO, Vuk Magdelinic, explains how the company looks to revolutionise the primary bond issuance process and details what advantages this could offer to corporate treasurers.

Vuk Magdelinic

CEO

Tell us a bit about yourself and your background. How did you get into fintech and why did you want to build a solution for the capital markets?

Before founding Overbond, I spent over ten years in capital markets and technology. This included leading numerous large digital transformation projects at global banks including Deutsche Bank and BNY Mellon. I also have experience working on the trading floor for CIBC Fixed Income in Toronto trading structured products. Through all these experiences I have noticed numerous inefficiencies in the financial world and especially in the capital markets and the primary bond origination process.

What makes fintech such an exciting space and what do you find most interesting about it?

Innovation in the securities market is not only long overdue, but essential in driving a more efficient and collaborative bond issuance process. It’s very important to see a fintech start-up delivering on its vision for a completely digital bond market that benefits issuers, dealers, and investors. It is incredibly rewarding to transform what is now a largely manual, legacy system so that all participants in the bond market benefit from the increased transparency and efficiencies.

How did you find the transition from the consulting/banking industry to building a fintech product?

The transition from the client focus perspective was really non-existent, I continued to think about the same type of clients and how we can bring value to them by solving their core operational, technology or process problems. In that regard, being laser-focused on client value, fintech providers and consulting providers are very similar.

Does regulation pose a challenge to fintech?

Regulation is actually helping drive adoption of fintech solutions in the primary bond issuance space. MAR regulation out of Europe in particular and its extraterritorial implications to institutions across the larger global capital markets community mandates higher scrutiny in the ‘sounding’ process – which is the pre-deal launch communication that Overbond specialises in. To ensure compliance with MAR across the global dealer community, the Overbond platform streamlines deal and non-deal related communication.

How do you expect fintech to develop, especially in the corporate space, in the years to come?

Transparency Market Research reported that the market for predictive analytics software will reach US$6.5bn by 2019. That’s because predictive intelligence can increase accuracy in decision-making, and subsequently profitability. The market is already showing indications of significant success. Unsurprisingly, innovators developing applications within financial services are growing bolder in their efforts to perform tasks that may have seemed impossible just a few years ago.

Where do you think that fintech can have a real impact for corporate treasurers?

There will be many areas where fintech can deliver significant benefit to treasurers, and we believe that improving how they monitor their borrowing programme and how they undergo analysis and due diligence for new bond issuers is one of the most exciting. By digitising the entire deal execution process, issuers can get to market faster to take advantage of favourable market timing and access a broader investor base and we really feel this will impact treasurers in the most positive way.

This will help reduce the cost of new issuance by standardising all aspects of deal execution, drive operational efficiencies by reducing the issuance time and provide an opportunity to optimise cash management by enabling opportunistic offerings. All these aspects directly help treasurers’ mandates.

What is more, issuers can also manage funding targets with dealers and investors, allowing for a more vibrant and efficient primary market process. Issuers can access valuable market insights to make sound funding decisions and build stronger relationships with their investor base.

Digital bond origination in action

The bond issuance process is outdated and is ripe for change, at least that is the view of Vuk Magdelinic, CEO at Overbond. And his company is looking to bring the industry into the 21st century by making the space more digital, transparent, and secure.

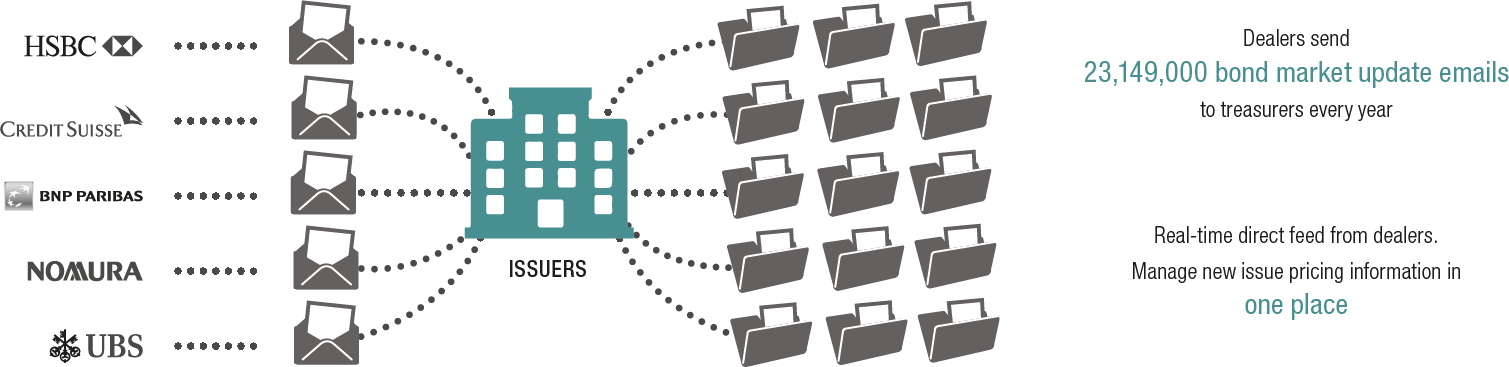

“Fixed income capital markets, and more specifically bond origination within it, is one of the few asset classes still relying on time-consuming, manual processes,” says Magdelinic. “Emails, spreadsheets, and phone calls are still the main channels for information exchange for issuers, dealers and investors, with dealers sending upwards of hundreds of millions of bond market update emails globally and treasurers spending hundreds of thousands of hours managing bond market information per year.”

Digitally connecting the bond market

Source: Overbond

As the first end-to-end new bond issuance platform, Overbond is looking to transform how global investment banks, institutional investors, corporations, and governments connect by digitising and streamlining all aspects of primary bond origination workflow.

Coming together

The Overbond platform facilitates improved digital connectivity with secure real-time communication among market participants, creating an extensive dealer, issuer and investor opportunity network. In addition, Magdelinic notes that the platform provides advanced data analytics and data visualisation as well as end-to-end digital execution capabilities. “This workflow benefits everyone in the primary bond market through higher transparency, optimised price discovery, and investor diversification – all while reducing infrastructure and transaction costs for issuers, dealers and investors,” he says.

The bond market is a traditional market which to this day relies on legacy, manual processes. In recent years, there has been rapid growth in global bond new issuance, thanks to the low yield environment. Meanwhile, due to increasingly stringent regulations following the financial crisis, dealers’ ability to make the market has decreased significantly, leading to overall secondary market illiquidity.

“Secondary market liquidity or frequent trading activity as we know serves as primary proxy to pricing new bonds,” says Magdelinic. “In the situation where secondary market trades that could serve as benchmarks and main confidence builders around pricing are very rare, the debt capital markets calls for the adoption of innovative technology like Overbond. It can help market participants build confidence through digital processing of information, managing relationships with a larger number of investors and issuers, and executing transactions more efficiently.”

Issuers can also expect the platform to increase their exposure to the investor base, delivering diversification, better access to capital and “stronger relationships with the providers of capital.” The latter could be key in allowing improved price discovery, claims Magdelinic.

Building it up

With a growing client base of more than 100 institutional clients, including some of the largest corporate bond issuers, dealers and investors, Overbond plans to continue building partnerships to allow greater efficiencies throughout the bond issuance process.

Magdelinic believes that the corporate treasury community, in particular, will benefit from the Overbond platform on multiple levels. “For instance, treasurers can rely on the data-driven relationship management module to optimise dealer coverage and expand the investor base.”

Furthermore, Overbond provides corporate issuers with a secure and regulatory compliant electronic communication channel to better gauge market demand with investors. “This can lead to the better cost of funding, optimisation of the entire borrowing programme, more opportunistic issuances and more frequent issuance mandates,” says Magdelinic. “Treasurers also have the ability to instantly convert indications of interest into a deal, whether it be a private placement or public offering.”

Company timeline

- December 2015Founded.

- April 2016Overbond was introduced as the first end-to-end, two-way pricing communication tool for bond issuers and dealers.

- June 2016Overbond closed a US$7.5m seed financing round with Morrison Financial Services Ltd.

- October 2016H2 Ventures and KPMG’s annual Fintech 100 Report named Overbond as one of their 50 emerging fintech stars of tomorrow for 2016.

- November 2016Overbond was selected as a CIX Top 20 Company. In the same month, Thomson Reuters announced a global partnership and fixed-income market data integration with the Overbond Platform.

- December 2016DBRS Credit Ratings was integrated with the Overbond Platform, providing market participants with valuable credit rating information and portfolio investment data analysis.

- January 2017OverbondX was launched – an integrated Deal Execution module within the Overbond platform. OverbondX enables issuers of any size to digitally facilitate execution of both private placement and public offerings.

- February 2017Overbond announced its launch in New York.

Source: Overbond