A new dawn for Asia’s cash investors

Basel III is set to dramatically change how banks view deposits; a development that is already having an impact on corporate liquidity management. In this article, Kheng Leong Cheah, Head of Global Liquidity Sales, Asia Pacific at J.P. Morgan Asset Management, explains the implications of Basel III and shares his thoughts related to this topic with corporate treasurers in Asia Pacific.

Kheng Leong Cheah

Head of Global Liquidity Sales, Asia Pacific

What are the key objectives of Basel III and what does this mean for how banks will manage their balance sheets going forward?

Basel III is a set of reform measures developed by the Basel Committee on Banking Supervision in the wake of the 2008 financial crisis. It is focused primarily on the liabilities that the banks hold – building on the framework set out under Basel I and Basel II, which were more interested in the asset side of the balance sheet. Ultimately the goal of the regulation is to strengthen capital adequacy and bolster banking supervision by setting the standards for bank capital, liquidity and leverage.

As the centrepiece of the Basel III liquidity framework, the Liquidity Coverage Ratio (LCR) aims to ensure banks are able to meet their liquidity needs in times of serious stress. More precisely, banks are required to hold a sufficient stock of unencumbered high-quality liquid assets (HQLA) that can be converted into cash within one-day – without a decrease in value – to meet banks’ needs in a 30-day stress scenario.

The LCR is changing how a bank views a clients’ deposits. The LCR rules reflect assumptions around what liabilities will leave the bank in times of stress, and a run-off factor applied to all deposits. Those that are deemed to be more likely to leave first – unsecured wholesale funding by a financial services company under the US interpretation for example – attracting a 100% run-off rate. Operational deposits, cash used for payments and the day-to-day running of the businesses, are seen as least likely to leave in a stress scenario and so receive the lowest run-off rate.

For the 30 banks deemed global systemically important financial institutions (G-SIFIs), there are additional requirements. All banks with the G-SIFI label are required to provide even more stability in times of market stress. As a result, on top of the requirements all banks must meet under the LCR, these institutions are also required to hold an additional 1% to 2.5% depending on the size of the bank. Consequently, non-operational deposits are becoming less profitable – and over time the banks are likely to seek to minimise this type of deposit.

So what does all this mean for the corporate investor?

Corporate investors need to understand that going forward their deposit banks will be splitting their deposits into two buckets. In one bucket will be operational cash and in the other, non-operational cash.

Given that non-operating deposits are becoming ever more unattractive to banks under the LCR rules, we are likely to see increasing instances of banks turning away some corporate deposits. Indeed, this is a trend we are already seeing a lot of in the US and Europe. It means corporates are going to need to pay a lot more attention to how they manage their banking relationships, and look to diversify their short-term investments, potentially by using a greater number of off-balance sheet vehicles to do so.

Corporates in Asia are said to be holding more cash than companies in any other region. Would you say that given this trend Basel III is especially significant for companies in Asia?

The Asia Pacific region has evidently been on a higher growth trajectory of late, certainly relative to the economies of the US and Europe. So corporates based here have been growing at a much faster pace and using a considerable amount of their spare capital to invest in growing their businesses through merger and acquisition (M&A) or research and development (R&D).

But that being said, we have in recent years begun to see a slowdown in some of the region’s major economies, most notably China and Japan. Consequently, the pace of corporate growth has also slowed and many companies have started to stockpile cash to provide a buffer in this uncertain environment.

The numbers are quite staggering. Japanese companies, for instance, are holding close to US$3trn. In China, corporates are holding roughly US$1.2trn in cash and this figure is growing rapidly. Given that bank deposits remain, by far, the most popular investment vehicle in Asia, that is a lot of non-operating cash currently sitting on the balance sheets of the region’s banks. And once Basel III truly begins to bite in the region, that is a lot of cash that corporates may need to find a home for.

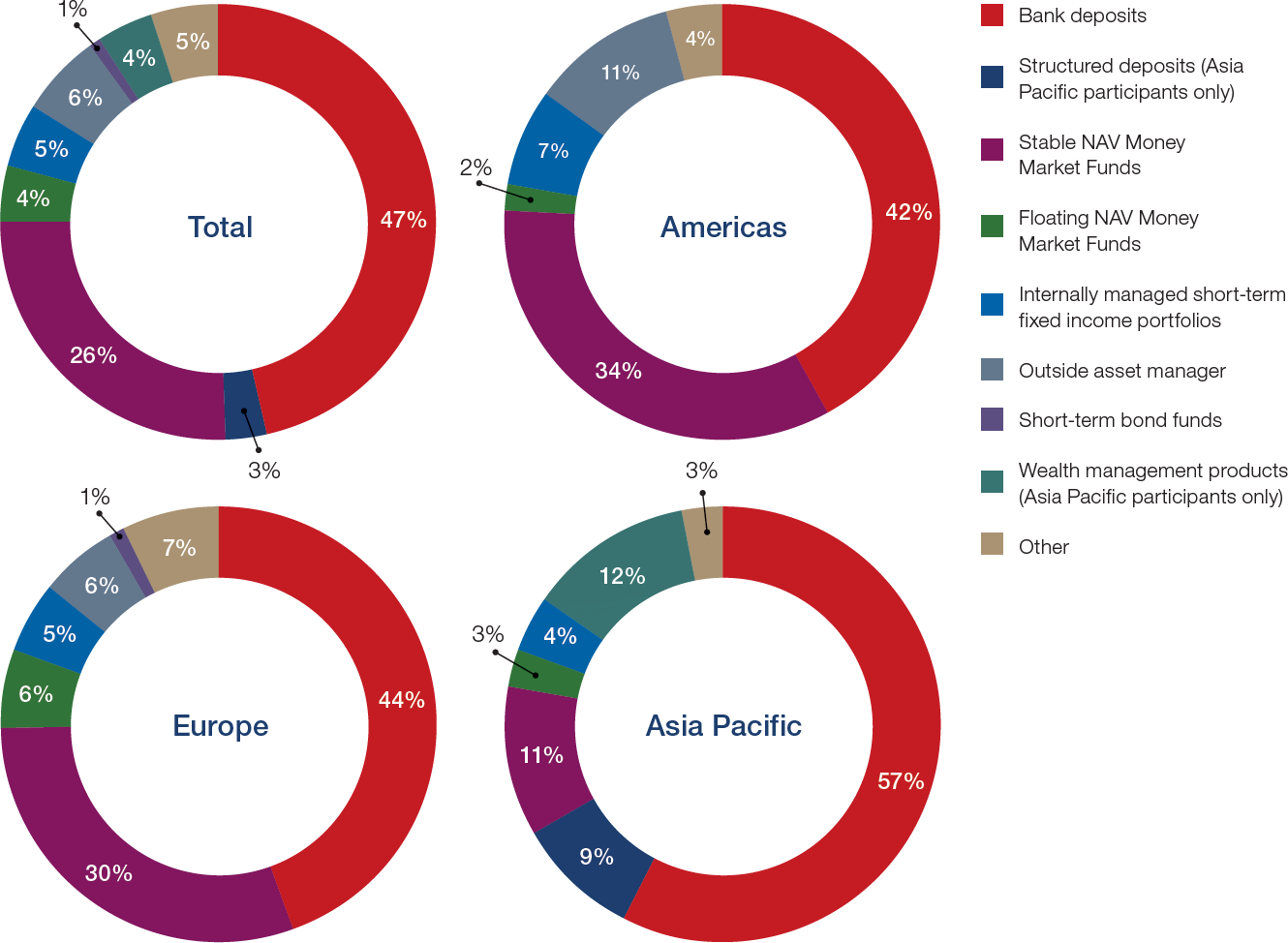

Chart 1: Average cash allocation across peer groups by region

Source: J.P. Morgan Global Liquidity Investment PeerViewSM; as of 21st October 2015

On that note, how has Basel III impacted Asia to date, compared to Europe and the US, for instance?

Although the final deadline for all banks around the world to be compliant with Basel III does not hit until 31st March 2019, we have already seen many banks, especially those in Europe and the US, taking a proactive approach and adjusting to meet the new requirements earlier than required.

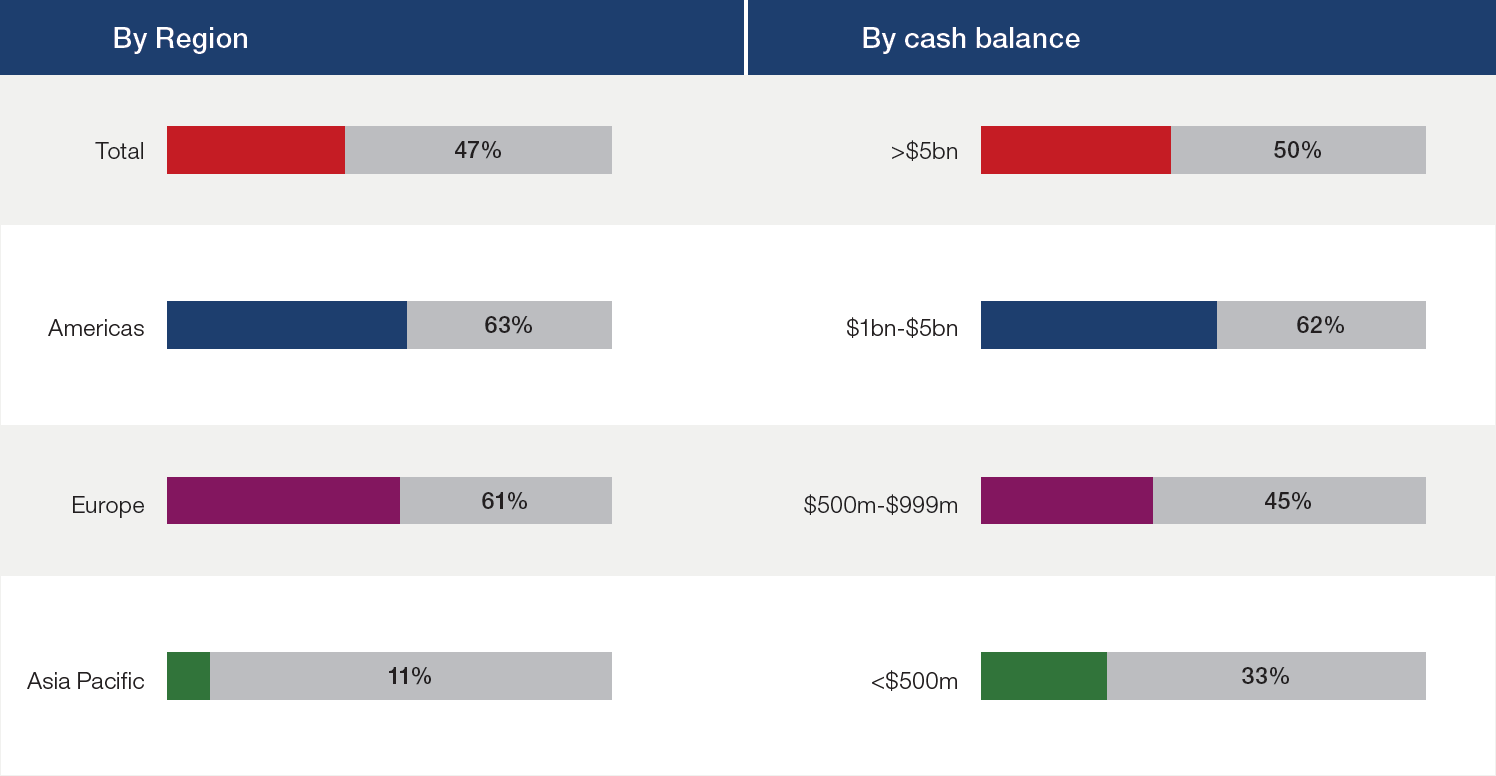

Yet this is not the case in Asia Pacific, where compliance with Basel III is progressing at a much more gradual pace. This is reflected in the banks’ treatment of deposits. The 2015 J.P. Morgan Global Liquidity Investment PeerViewSM (PeerViewSM) study, for instance, found that in both the Americas and Europe, over 60% of corporates who stated that they were likely to decrease bank deposits had been encouraged by their banks to move non-operating deposits off the balance sheet. In Asia Pacific, the equivalent figure stands at 11%.

This perhaps explains the regional differences we see in corporate short-term investments. Our PeerViewSM study, for instance, indicated that just under 60% of corporate cash is allocated to the banks, compared to 42% and 44% in the Americas and Europe respectively. Meanwhile, cash allocated to money market funds (MMFs) in Asia Pacific stands at 14%; that’s noticeably lower than the 36% for the Americas and Europe.

Of course, the numbers can be partially explained by the fact that the MMF industry is generally more developed in Europe and the US. Also, since corporates here in Asia have only recently been in a growth cycle they have had little need to think about managing large stockpiles of excess cash. But as we noted earlier, this is now beginning to change. With all the additional cash that corporates in Asia have recently been accumulating, corporates do need to begin thinking about alternative short-term investment products as M&A and other growth investment opportunities begin to dry up.

This requirement will only become more acute over the coming months and years as more banks begin to align themselves to the Basel III landscape. That means there is going to be a lot of work to be done by corporates and their banking partners here in Asia. Now is really the time for treasurers to begin thinking about how deposits will be treated moving forward and the difficult short-term investment decisions that lie ahead. For those treasurers who have not already started discussing the impact of Basel III internally and externally, it would be prudent to now begin this exercise.

Chart 2: Of those likely to decrease bank deposits, % encouraged by bank to move nonoperating deposits off balance sheet

Source: J.P. Morgan Global Liquidity Investment PeerViewSM; as of 21st October 2015

What options are available to a company considering off-balance sheet options and how can J.P. Morgan Asset Management help companies with these liquidity solutions?

There are various ways corporate treasurers can begin to invest in off-balance sheet products. At an elementary level, it would be wise to begin looking at the different alternative investment options, understanding how these work and whether their company investment policy permits the use of such products. Typically, MMFs are the product best suited to shorter-term investment needs. For longer-term investments, corporates might wish to consider short-term bond funds or investment funds in the debt space with a one to two-year investment horizon.

Of course, the suitability of each of these products will come down to each individual corporates’ cash requirements and risk appetite. It is therefore a sensible step to begin segmenting cash into buckets of operating and non-operating cash and to predict how these tranches will be treated by the banks. To avoid a mad rush to find appropriate investment options as the Basel III deadline edges closer, it would be a good idea for corporate investors to begin having conversations with their banks and asset managers in order to ascertain which products best suit their needs.

Throughout the region many corporate treasury departments are in the same position. Treasurers know that Basel III is coming, and in Asia they are working hard to understand the potential implications of the regulation on short-term investments so they can adjust their strategies accordingly. J.P. Morgan Asset Management has a wealth of experience helping clients on this journey around the world and, as the impact of Basel III begins to be felt in Asia Pacific, our team of investment professionals will be ready to answer clients’ questions and find solutions to meet their investment needs in the post-Basel III world.