With the economic weather for the year ahead shrouded in uncertainty, corporate borrowers on Asia’s capital markets are not guaranteed such an easy ride in the next 12 months. Liability management exercises may well be on the agenda for some corporate treasurers.

Is Asia’s debt binge coming to an end? After three successive years of record debt sales by non-financial corporates in the region, issuance was relatively muted in 2015 and experts believe it could fall further in 2016 as the era of easy money draws to a close.

If the debt spree really is over, that means Asia’s corporates are likely to encounter some tough decisions on the road ahead. The Federal Reserve has ended the post-crisis era of ultra-low interest rates, China’s economy is cooling for the first time in a quarter of a century and commodity prices on a steep downward trajectory. Accordingly, emerging market (EM) currencies have plunged and refinancing costs – in the overseas markets especially – have risen. And this is all happening at a time when a considerable amount of debt is soon due for repayment.

Overall corporates and governments have an unprecedented $262bn worth of notes in currencies outside of their domestic markets to repay in 2016, according to data recently compiled by Bloomberg. Commentators disagree, however, on what this might mean for corporate issuers in the year ahead.

Trouble ahead?

Some say that they are confident there will continue to be sufficient liquidity for those firms who decide to tap the market for refinancing, irrespective of the pace of monetary tightening at the Federal Reserve. “The simple message we are getting from investors here is that there is still a lot of cash to be put to work,” says Leonard Ng, Director of Asia Debt Capital Markets at ANZ. “Gone are the days where if they did a USD deal, Asian issuers would have to rely on European or US investors for a big chunk of the transaction. These days we are seeing some deals in Asia where 80% of the deal is taken by the Asian investor base. Now we have a consistent pool of capital here that obviously gets recycled. Even though the issuer base has grown dramatically, the supply is still getting absorbed by the demand.”

Other analysts are, however, feeling more apprehensive about what lies ahead. “We have been warning against the risk of rapidly increasing EM debt for some time,” the Bank of International Settlements (BIS) wrote in its last quarterly review, published in December 2015. “Non-stop demand for EM credit has fuelled the credit boom, with corporates able to borrow cheaply and increasingly in foreign currencies. The turn in easy Fed policy will pose a threat to EM firms with a high level of dollar debt by increasing their debt servicing costs, which could in turn create solvency risks.”

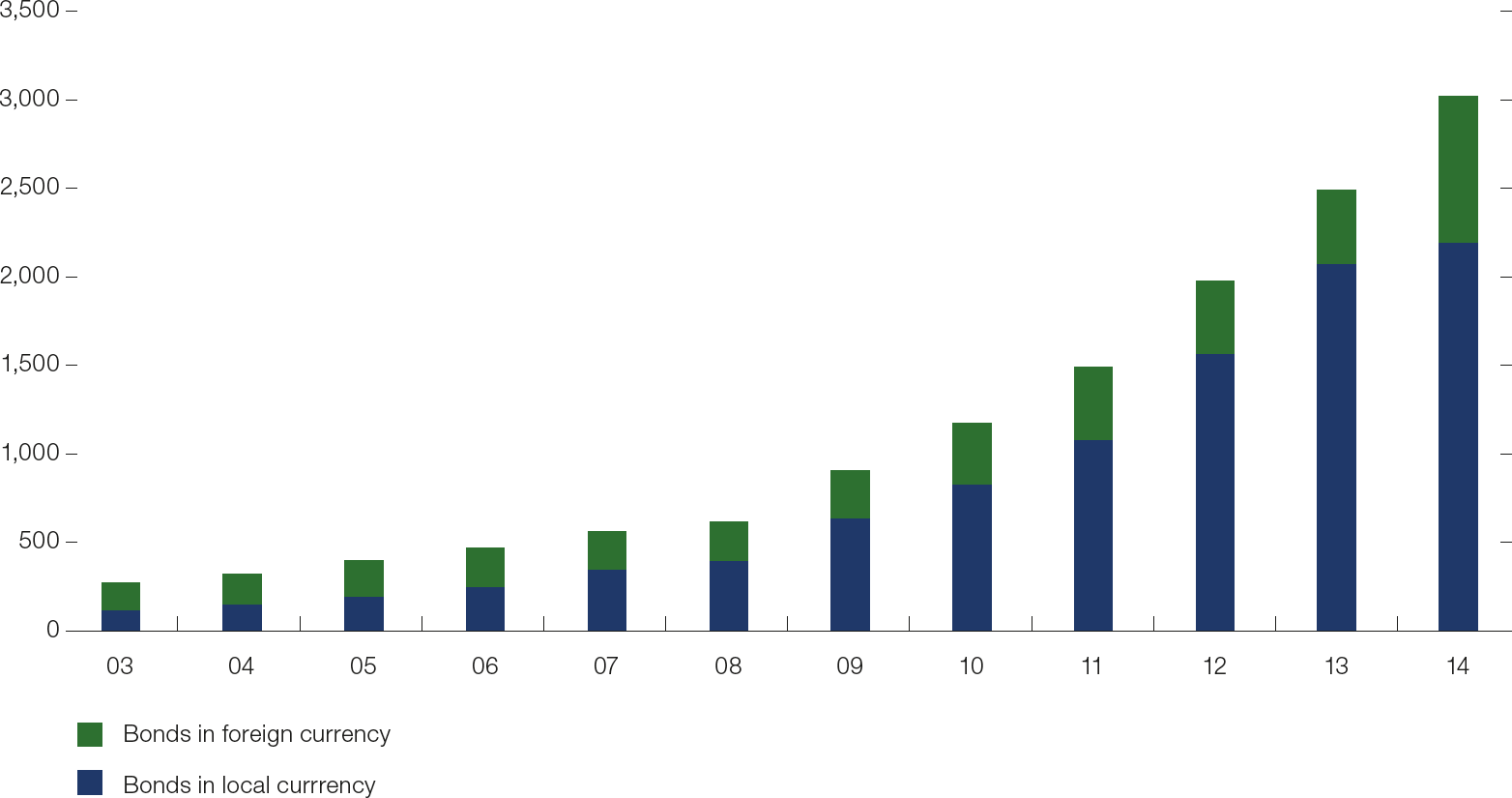

Chart 1: EM corporate bond composition (billions of US dollars)

Source: International Monetary Fund

Either way, those issuers needing to refinance appear to be biding their time Vicky Münzer-Jones, a Singapore-based debt capital markets lawyer for Norton Rose Fulbright told Treasury Today. Besides a handful of large issues that have skewed the overall figures somewhat, the markets, she says, have been very quiet lately relative to the figures notched up in the previous three years. “This year we have seen concern regarding corruption allegations in Malaysia and not as much progress as hoped in Indonesia. Then there is still Greece, which has been creating challenges for European banks, and China with its own set of problems. It feels that there are lots of issues that have arisen to bring about a situation where companies that you would expect to see in the market are not here.”

Perhaps, Münzer-Jones ponders, this is a sign that those pressures the BIS and others have warned us of are now beginning to be felt at some firms. Once market access declines, elevated debt servicing costs (a consequence of higher rates and depreciating currencies) and instances of companies experiencing rollover problems are perhaps all but inevitable. “We are now reaching a situation where some companies might begin to default,” she says. “Given that there are fewer bond issues at the moment and the loan market has not been looking very strong either, I feel that we will see companies getting into trouble at some point especially with commodity prices still down.”

With some companies beginning to struggle to generate the cash needed to service their debts – a situation exacerbated by the dollar’s recent strength – defaults are beginning to mount. According to Standard & Poor’s, defaults in EM economies hit their highest level since 2009 in 2015, and were up by over 40% on the year before. Some treasurers may be looking at such trends and feeling understandably nervous about what lies ahead, now that the era of easy money is drawing to a close. Fortunately, there are measures that otherwise healthy companies can take to actively mitigate risks where covenants in existing bonds are likely to come under stress.

Breathing space

Above all, treasurers of companies faced with such circumstances need to be thinking about the debt the company has in place and whether the various terms, borrowing rate and tenor agreed are the most favourable they can obtain. “If companies are finding it difficult to refinance their bonds which are maturing, they may start looking at some form of liability management,” says Münzer-Jones. “They may look at an exchange offer or consent solicitation, for instance, which would amend the terms of their bonds to defer an interest payment, extend the maturity or reduce the interest rate – ultimately something that reduces their liabilities.”

Very often it is tender offers and exchange offers (where the company is exchanging its bonds for new ones issued by itself on different terms or by a parent company or third party or doing something that could be presented as enhancing the debt for the investor, she adds. This is not uncommon. “But when companies are looking to extend or amend in order to reduce their liabilities that tends to be part of a bigger discussion between the issuer and its bond holders, and the bond holders are in a position where they feel they are going to lose out if they don’t agree to a certain amendment or deference of payment.”

Noting that a lot of companies have left liabilities – dollar and renminbi – largely unhedged, Keith Pogson, Senior Partner, Financial Services, Asia Pacific at EY is also of the view that liability management exercises will inevitably feature on the agenda for some companies over the coming months.

“Some of those that have paper may well be thinking about that in a more active way,” Pogson says. “I think most treasurers are probably thinking through now what they should be doing in the different scenarios that could play out. Some companies will be running dollar funding risks and some will be looking at upward curves and considering whether it makes sense now to extend their risk and take cheaper funding for longer.”

Sweeten the deal

Yet given the way in which industry analysts expect the market to evolve over 2016, the window of opportunity for cheaper funding may not be around for long; indeed, for some firms, it may have already closed. Treasurers may, therefore, need to start thinking more creatively when it comes to financing on the capital markets.

“By using collateral, for example, you might be able to reduce the cost by de-risking the strategy,” says EY’s Pogson. “I think treasurers are realising they need to be a bit smarter now, and looking for ways to keep those costs under control.” The collateral pledged by companies to secure their notes might come in the form of the traditional types of securities held on the balance sheet such as T-bills, or stocks and bonds of other companies. Equally though, it could be something less traditional. We have seen numerous examples in recent years of companies unlocking value in assets on their balance sheets not traditionally considered by lenders. Adam Smith Award winners Etihad Airways, for example, used landing slots at Heathrow Airport to support a transaction; while Intellectual Ventures similarly won in the Best Financing Solution category at last year’s event for creating a new asset class through the securitisation of the company’s intellectual property portfolio.

Don’t panic

Given that the level of preparedness for higher funding costs differs so greatly across the region, it stands to reason that there will be some firms that find it more difficult to service their debts. But the changing conditions should only pose an existential risk for a small number of companies as experts maintain that, overall, Asia’s corporates have not overstretched themselves with foreign currency issuance and rising leverage.

In terms of leverage, one could certainly argue that with such favourable conditions on the bond markets some issuers have been tempted perhaps to take on more leverage than they could otherwise afford. But this is not characteristic of the market as a whole and, for the most part, the record borrowing we have seen merely reflects the region’s recent growth trajectory. “Yes, leverage may have gone up, but I don’t think it is the case where they have over committed themselves in an irresponsible way,” says ANZ’s Ng. “If you look at the growth rates in Asia – people talk about a slowdown in China but they are still growing at 5-6%. I think leverage from their perspective is still relatively well managed.”

Although, as noted above, defaults are on an upward trend in Asia, ANZ’s Ng reminds us of the importance of retaining some perspective. “The simple fact is, if you look at default rates across Asia – without going down into specific countries – default rates are still at or near historical lows,” he says. “Every now and then we do see one or two cases that make headlines, and every so often the press may be tempted to call it the first of many to come, but we have seen enough that they tend to be very isolated cases.”

And especially if the treasurers of other companies plan, early on, what mitigative steps they can take in the event the covenants in their bonds come under stress, then isolated cases they should remain. Naturally, renegotiating the terms of the debts early on has to be preferable to defaulting altogether.

From banks to bonds

The role of the bond market finance has grown rapidly as a share of corporate debt in Asian economies since the global financial crisis.

Recent data from Dealogic, for instance, shows that bond issues in Asia have gained since 2010 as a share of GDP while syndicated loans have fallen. In aggregate terms, syndicated loans and bonds can be substituted for one another, depending on whether the issuer prefers to opt for the liquidity of the loan market or the longer tenors typically on offer in the bond market.

High investor demand due to the search for yield has been one of the factors fuelling the surge in bond issuance. “When there is a lot of liquidity yields become compressed and we do bonds or medium-term note (MTN) programmes, primarily because with those instruments we can raise funding at a cheaper rate than with the banks,” says Joel Cheah, Treasurer, Cambridge Industrial Trust Management, a firm which has raised over $200m on Asia’s debt capital markets in the past 18 months.

There is also another – more strategic – motivation for treasurers shifting to financing on the bond markets: the desire to reduce the dependency of their firms on bank funding, and the fact that the bond markets offer greater flexibility. “Debt capital markets can provide a lot of operational flexibility. It is also about risk management though: your options can become very limited if your funding begins to dry up.”

ANZ’s Ng agrees with this assessment. “The financial crisis in 2008-2009 marked the turning point,” he says. “Some of the banks were facing issues and withdrew from some of the markets – and that left some corporates hanging without any access to bank funding. It was around that time that CFOs and treasurers began looking at the capital markets for an alternative.”