March 2019

After a decade of anaemic returns, cash rates moved decisively higher in 2018 – at least in the US. Three-month Treasury yields pushed through the 2% mark, while dollar money market yields actually rose above the yield available from many broader fixed income benchmarks.

This represents something of a turnaround from the ultra-low interest rates that had held sway since the 2008 financial crisis. And although the pace of interest rate increases is likely to slow this year, dollar cash rates should remain competitive against other asset classes.

Outside the US, sterling and euro investors have so far not enjoyed quite the same pickup in cash yields as dollar investors. The Bank of England is raising rates, but is moving cautiously as it assesses the potential economic impact of Brexit. Meanwhile, the European Central Bank (ECB) is trailing well behind, with ECB president Mario Draghi warning that euro rates will remain at -40 basis points (bps) “at least through summer” of 2019 and that risks “have moved to the downside”.

Nevertheless, although the UK and the eurozone are lagging behind the US, the direction of travel is the same, with monetary policy becoming tighter. We therefore recognise that higher cash rates could become much more of a global theme as we move through 2019 and beyond.

In this environment, it’s important for treasurers to remain positioned for rising yields, and to be prepared just in case central banks move faster than expected. It can be painful if you’re unable to respond quickly when the yield curve steepens.

Source: J.P. Morgan Asset Management. For Illustrative purposes only.

Make sure you’re able to take advantage of rising interest rates

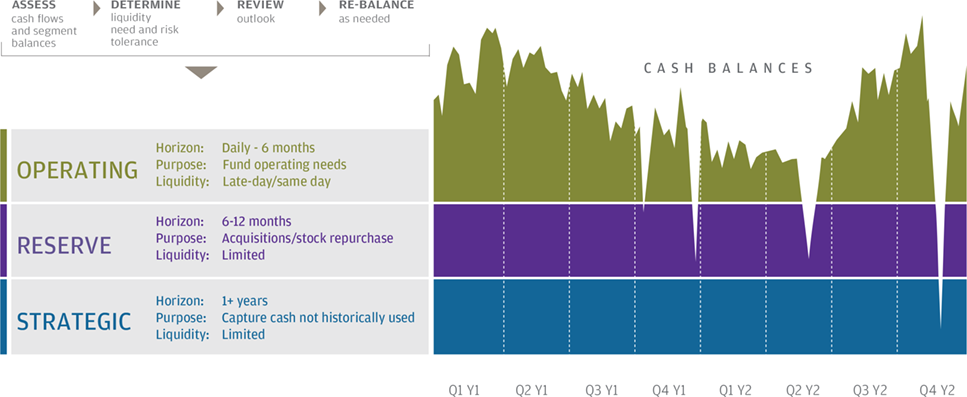

Cash segmentation can help corporate treasurers to utilise longer-term investments that have the potential to deliver incremental returns. Treasurers will need to first ensure that they have a robust investment policy in place, which clearly states their organisation’s investment goals, how much of the investment portfolio must be in cash, and how much duration and credit risk is acceptable.

Accurate cash flow forecasts are also important. This means considering when and where surplus cash is held, how much of it is available and for how long, and the likelihood and timing of any events that could have an effect on the cash position – for example, a bond issue, the sale of part of the business, an acquisition, or a share buyback.

It’s only when an accurate cash flow forecast is available that an organisation can determine the percentage of its cash holdings that needs to be immediately accessible for operating purposes, the percentage required for potential reserve requirements, and the percentage that can be viewed as strategic, longer-term cash.

To maintain security and same-day liquidity, operating cash should always be invested in highly rated short-term instruments, or government and prime money market funds (either with a constant or variable net asset value). But it’s the next step up into reserve cash – and beyond into strategic cash solutions – where we expect to see further strong demand this year.

Ultra-short-duration strategies, for example, can have a greater duration budget of up to one year portfolio duration and can buy into a broader range of investment grade securities, providing a compelling way for treasurers to earn incremental returns on surplus cash balances, while also attracting fixed-income investors looking to reduce duration in their portfolios and guard against the rising rate environment.

To find out more, please visit www.jpmgloballiquidity.com

February’s thought

Back to all thoughts

April’s thought