April 2019

Singapore’s de facto central bank, the Monetary Authority of Singapore (MAS), will hold its semi-annual monetary policy meeting in mid-April. Given the recent rapid changes in the global and regional economic outlook, market consensus for future policy direction remains divergent – but both the MAS’s actions and words could have significant implications for Singapore dollar cash investors.

A hawkish policy stance

Consistent with other central banks, the MAS’s primary policy objective is price stability – it currently believes that a core inflation rate of just under 2% is compatible with this objective. However, its monetary policy is unusual in that it is focused on managing the exchange rate rather than interest rates. Whilst this methodology is reasonable because key inflation factors are imported (food and fuel), it also implies a loss of control over domestic interest rates.

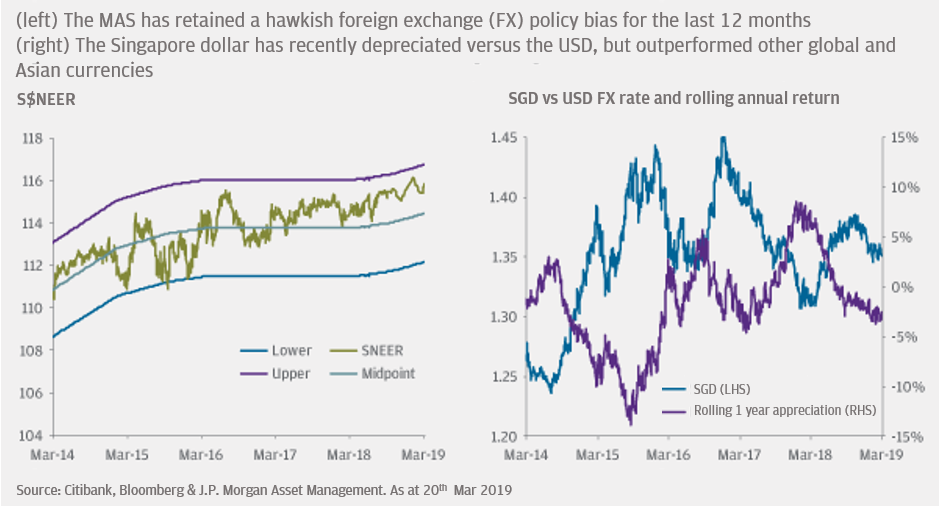

Since 2015, core inflation has gradually moved higher, towards the MAS’s target range, allowing the central bank to assume a more hawkish policy stance. In 2018, the MAS increased the slope of the Singapore dollar nominal effective exchange rate (S$NEER) by approximately 0.5% at both its April and October monetary policy meetings.

At its October meeting, the MAS retained a hawkish bias, expecting robust domestic demand to offset any future export weakness whilst continued labour market tightening would push wages and inflation higher. Consequently, most investors expected further policy tightening in 2019, taking the S$NEER slope to a more historically neutral +1.5% level.

The economic outlook is evolving

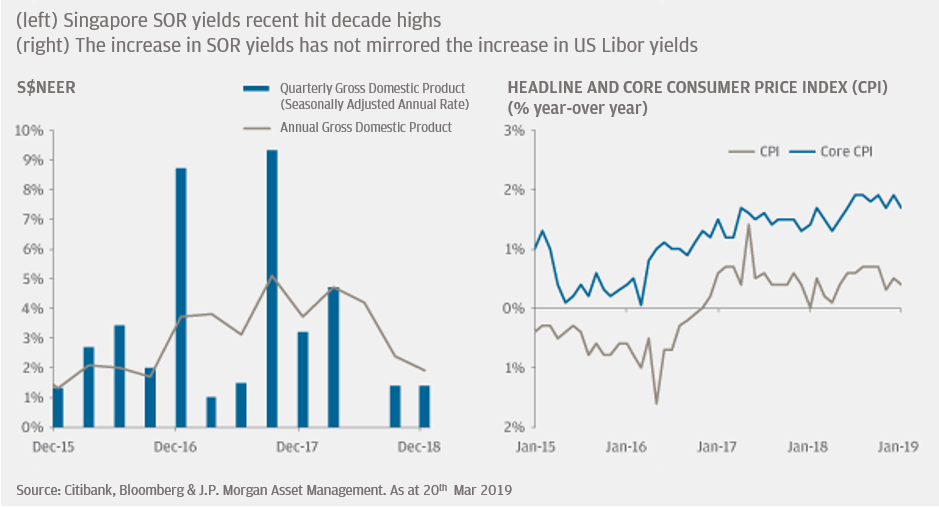

Unfortunately, Singapore’s actual economic activity during the past five months has not mirrored the MAS’s predictions. Growth has slowed, with exports sharply lower, private consumption has weakened and unemployment has edged higher.

Meanwhile, the fall in oil prices and sluggish wage growth are reflected in recent muted headline and core inflation data. Finally, the US Federal Reserve interest rate pause and scepticism regarding the strength of China’s economic stabilisation have created additional policy uncertainty.

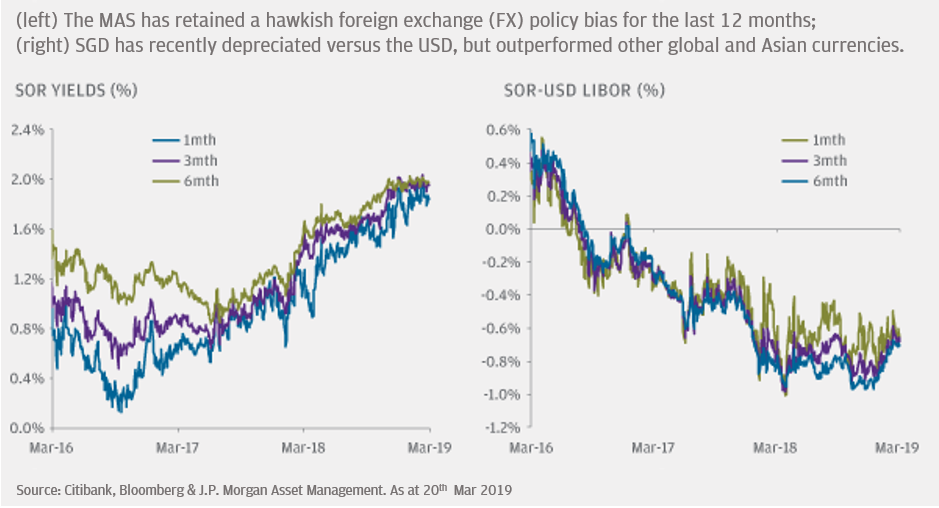

Despite sluggish economic growth, local short-tenor interest rates have moved higher. Given the MAS’s focus on controlling the S$NEER, US interest rates exert significant influence and the four federal funds target rate hikes in 2018 helped push Singapore swap offer rate (SOR) yields to a decade high.

Assessing the implications for investors

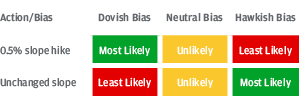

At its upcoming monetary policy meeting in April, the MAS has two potential policy actions and three potential wording choices.

The recent dovish comments by the Federal Reserve suggest no further US rate hikes for the foreseeable future, limiting the upside for US Libor rates. Nevertheless the MAS’s policy decision will impact the SOR-Libor spread, which remains, by historical standards, wide.

A decision to leave the S$NEER slope unchanged could push SOR rates higher, whilst an increase to the $NEER slope could pull SOR rates lower. However, at this policy meeting the MAS’s bias will, arguably, be more important. Weak economic data and muted inflation is likely to encourage a dovish or neutral bias, which would negatively impact investor expectations for future Singapore dollar appreciation, reducing the availability of local liquidity and paradoxically pushing SOR yields higher over the long-term.

For Singapore dollar cash investors, the recent higher SOR yields are welcome following an extended period of low returns and negative real yields. Regardless of the MAS’s ultimate decision, increasing diversification across asset classes and extending further out the curve where possible should help maximise potential Singapore dollar cash returns.