The challenge

Following its spin-off from American conglomerate Honeywell International, Garrett Motion (Garrett) was looking to rebuild its cash management infrastructure; and specific to Asia Pacific, its regional treasury team in Shanghai had two key priorities.

The first priority was to mobilise regional cash to its treasury HQ in Switzerland. While Garrett had established cross-border sweeps to move funds from Japan and Australia to its HQ in 2020, a significant portion of its liquidity remained in China, where the company faced strict regulatory requirements governing cross-border movement of funds.

The second priority was to put in place standardised treasury processes across the five markets (China, Australia, Japan, Korea and India) in which it operates. Garrett’s finance teams were utilising multiple e-banking portals to initiate vendor payments, a process that was fragmented and inefficient. Vendor information was also maintained across the disparate portals, where data could potentially be altered, requiring additional controls for the firm.

The solution

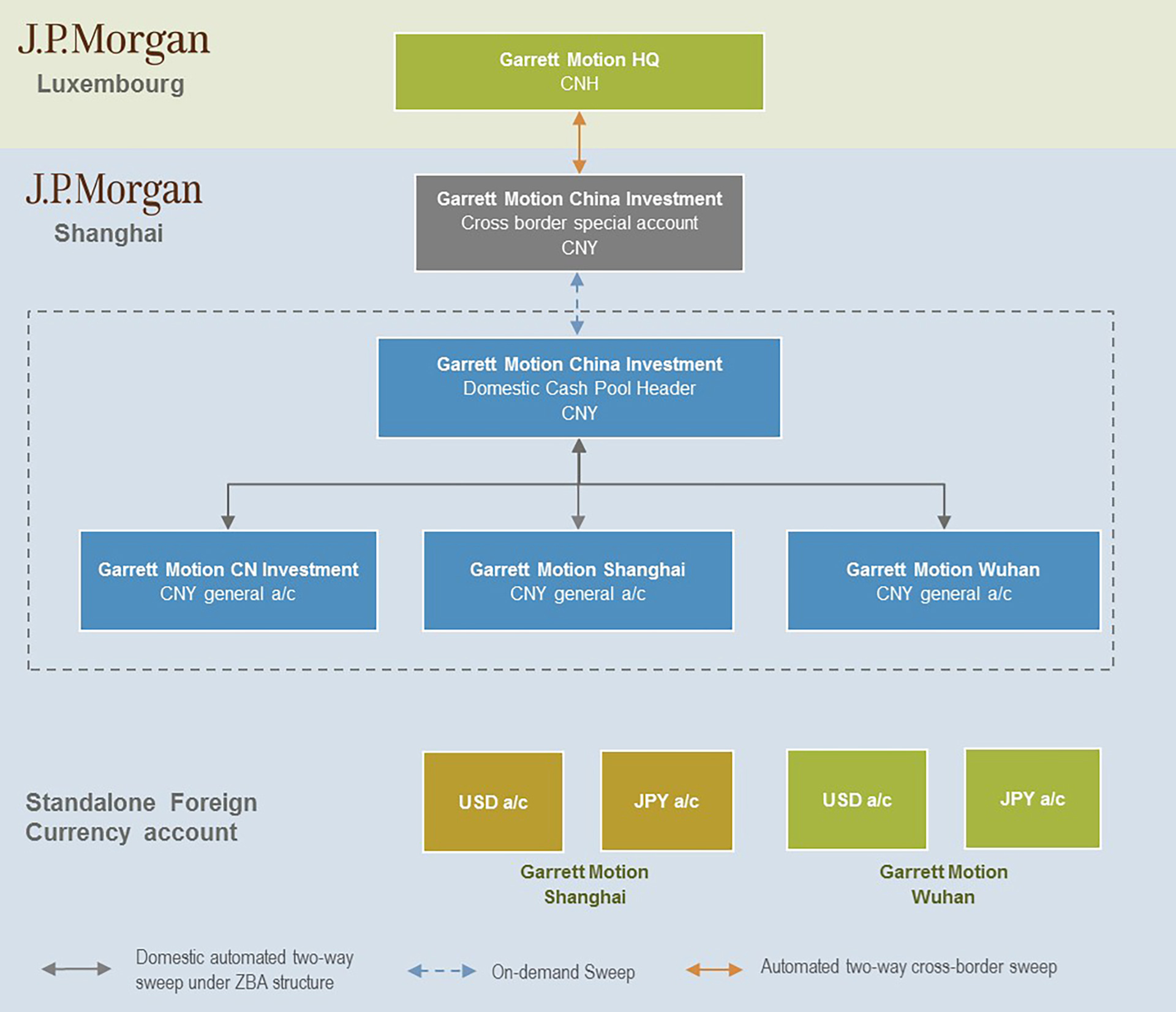

J.P. Morgan helped Garrett’s regional treasury team put in place a comprehensive cash management solution that combines pooling, sweeping and connectivity mechanisms to seamlessly move funds between Garrett’s entities in China to its HQ pool, to complement existing cross-border sweeps from Japan and Australia.

Garrett worked closely with J.P. Morgan to navigate China’s intricate cross-border funding regulations, where the bank helped obtain regulatory approval to set up a special cross-border account for Garrett in the Shanghai Free Trade Zone (FTZ). The special account – which serves as Garrett’s header entity in China – will concentrate the firm’s domestic CNY funds, which is further mobilised to its HQ via cross-border sweeps.

An on-demand sweeps mechanism was also established between Garrett’s special cross-border account and its domestic pool, providing its regional treasury team with flexibility and control of its cross-border funding arrangements in terms of timing and amount.

As Garrett rebuilt its treasury structure, it replaced its dependence on e-banking portals by adopting SWIFTNet host-to-host (H2H) connectivity to streamline the end-to-end bulk transmission of domestic and cross-border payments, standardising its payments processes across Australia, China, India, Korea and Japan.

Best practice and innovation

The solution, which involved obtaining regulatory approvals from China’s local authorities as well as ensuring close coordination among its finance teams across five markets despite the time zone differences, further validates the regional team’s pursuit for treasury excellence.

Key benefits

- Cost savings.

- Headcount savings.

- Process efficiencies.

- Increased automation, reduction of manual intervention.

- Risk mitigation.

- Improved visibility.

- Errors reduction.

- Increased system connectivity.

- Scalable solution.

- Exceptional implementation (budget/time).