Jinfeng Zhang

Treasury Analyst, Yolanda Zhang, Treasury Manager and Jeremy Zhu, Head of CCTT

Vitesco Technologies Holding China Co Ltd

Headquartered in Regensburg, Germany, Vitesco Technologies is a leading international developer and manufacturer of modern drive technologies for sustainable mobility. In 2020, Vitesco Technologies achieved a turnover of €8bn and employs more than 40,000 people at around 50 locations. China is a key market for Vitesco Technologies, in January 2021, Vitesco Technologies China is certificated as regional headquarters by Shanghai Commission of Commerce.

in partnership with

Listen to podcast

The challenge

After its spinoff from Continental, Vitesco Technologies became a fully independent entity that had to rebuild its cash management infrastructure worldwide from scratch, and it needed to do this within a short period of time as per its transition agreement with Continental. In addition, it had high levels of idle cash in China; this was because despite Vitesco Technologies strong revenue growth in the market, it was unable to move surplus funds back to its HQ in Regensburg due to China’s strict regulatory requirements governing cross-border funds movement. Vitesco Technologies Treasury in Regensburg desired a solution that would enable the firm to facilitate the mobility of funds into and out of China seamlessly.

The solution

Vitesco Technologies implemented a comprehensive structure in China that comprises a combination of innovative cash pooling, cross-border sweeping and host-to-host (H2H) solutions.

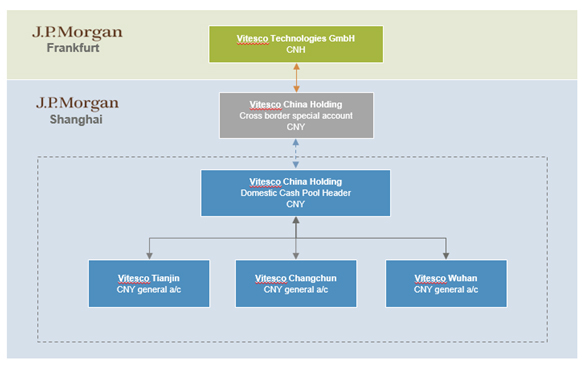

The structure involves a renminbi (RMB) domestic cash pool to concentrate all the surplus cash of the four Vitesco Technologies entities in China. To enable the seamless transfer of funds between the Chinese entities and the headquarter in Regensburg, a special account compliant with central bank regulations was set up in Shanghai, connecting the RMB domestic cash pool to the group treasury in Regensburg via a cross-border sweeping facility. While the sweeping facility was being put in place, Vitesco Technologies managed to secure a special arrangement to provide lending to its headquarters to cover any urgent cash needs until the sweeping capability was activated.

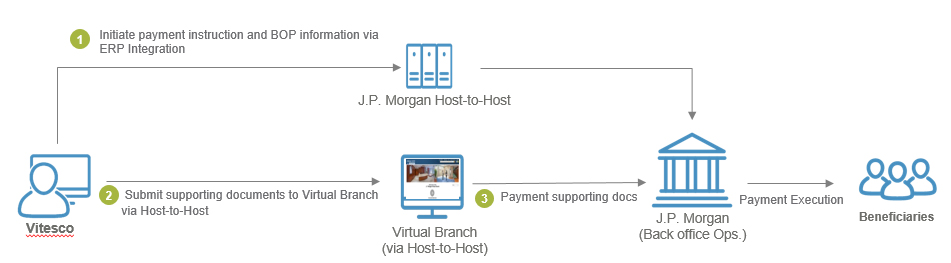

The solution also boasts two H2H connections; the first enables the end-to-end automated delivery of payments instructions and reports through to J.P. Morgan’s Virtual Branch, while the second is a first-to-market H2H connectivity in China that enables the transmission in bulk of supporting documents, a regulatory requirement for all cross-border payments by corporates in China. The unique offering means the process for cross-border transactions is now completely paperless and the bulk process further enhances efficiencies.

Vitesco Technologies is now well positioned to be eligible for the China’s Cross-border Simplification Program, a new initiative by regulator State Administration of Foreign Exchange (SAFE).

“The entire solution was executed in two months, well within our allotted timeline of setting up a cash management structure for China,” explains Jeremy Zhu, Head of Central Finance and Controlling.

First-to-market host-to-host connectivity, China Virtual Branch solution

CNY cross border cash pooling and sweeping structure

Best practice and innovation

Vitesco Technologies demonstrated treasury excellence with its ability to put in place, within a very tight timeframe, an entire cash management solution in China to ensure it is able to meet the deadline of being decoupled from Continental as a spinoff company, allowing the firm to continue its business at full speed despite being a completely new business structurally.

The solution also provides a combination of pooling, sweeping and connectivity mechanisms that has enabled seamless movement of funds between Vitesco Technologies’ domestic entities as well as allow the surplus cash in China to be swept to its Regensburg headquarters.

Vitesco Technologies’ treasury team also took one step further to improve its treasury efficiencies by adopting innovative H2H connectivity for the transmission of supporting documents in China, that greatly streamlined the cross-border payment process.

Key benefits

- Close to CNY2bn in trapped cash has been mobilised from China.

- Quick and seamless migration.

- Flexible and multiple cross-border funding arrangements available.

- Improved visibility.

- Enhanced efficiencies.

“During a corporate spinoff, it is treasury’s top priority to ensure a seamless transition during this period and no impact on the firm’s existing operations and we achieved this,” says Zhu.