In a wide-ranging discussion, panellists speaking at the 2020 Women in Treasury London Forum discussed career tips like the importance of sideways, not just vertical, career moves to build experience and they counselled female treasurers to clearly articulate their aspirations. They strongly encouraged female treasury professionals not to be afraid to ask for pay rises and promotions, and also to seize opportunities to work overseas for the diversity of experience it can provide which will pay dividends later in one’s career. Elsewhere, the forum discussed the need to support black colleagues also battling barriers and obstacles in their career progression, discussed how diversity is impeded by the lack of women in middle management positions and noted the rising importance of ESG.

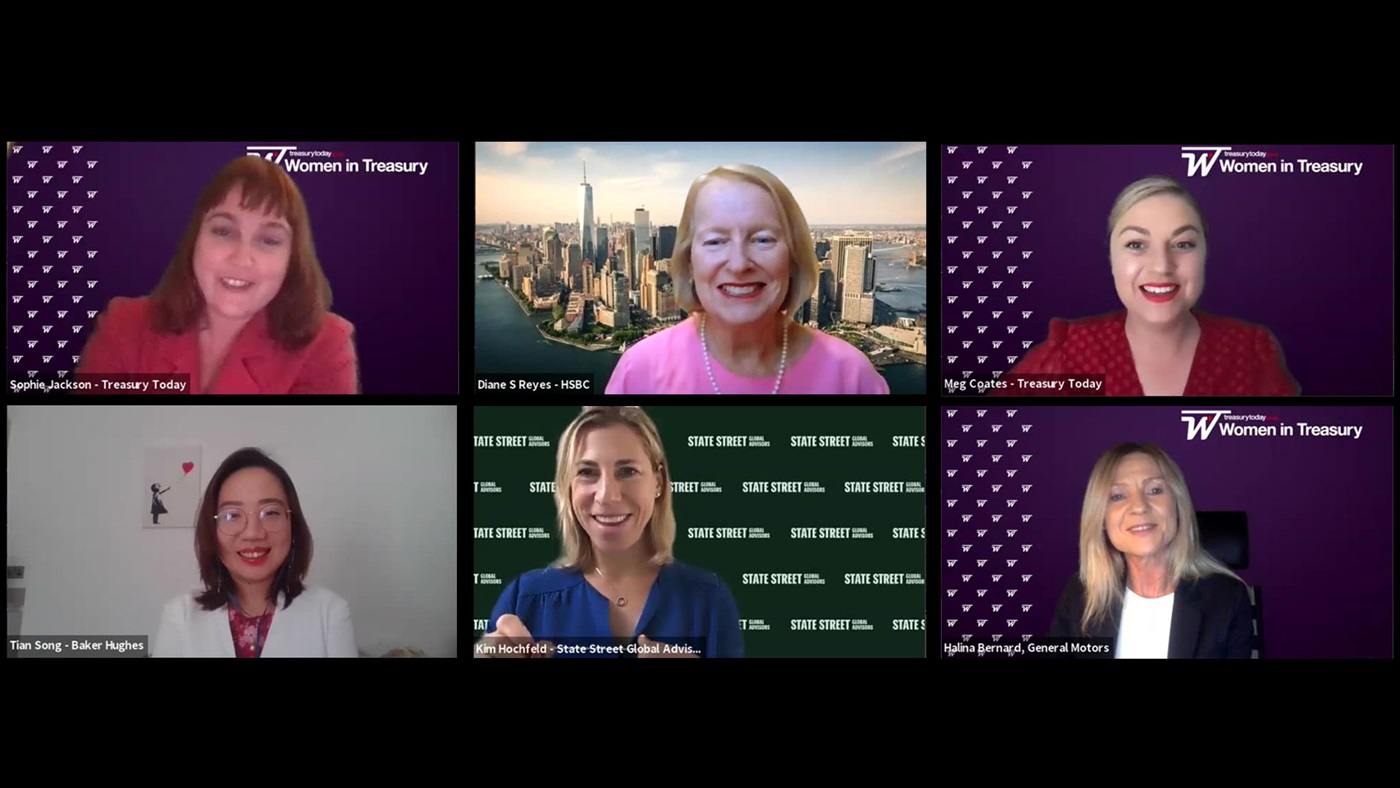

Attendees from over 15 countries joined Sophie Jackson, Treasury Today’s Publisher & Head of Strategic Content and Meg Coates, Publisher & Head of Operations, alongside expert panellists Tian Song, Senior Treasury Manager, Baker Hughes; Halina Bernard, Head of Treasury, General Motors Africa and Middle East Operations, Dubai UAE; Diane S Reyes, Group General Manager, Global Head of Liquidity and Cash Management, HSBC, and Kim Hochfeld, Senior Managing Director, Global Head of Cash, State Street Global Advisors.

The first pillar of the forum focused on panellists’ own career journeys. Halina described a trajectory spanning early Polish roots and a career in economics. Next came roles in London, New York and Switzerland which led to her current position heading up General Motors Africa and Middle East treasury department in Dubai, a company she joined in 2010. “Everything was a building block to where I am today,” she explained.

Tian said that she didn’t begin her career in treasury but started out as a strategic consultant instead for her first internship. “Treasury in China is not a mature concept at that time,” she said. She turned to treasury following an undergraduate placement with GE that led to joining the company’s graduate programme in China, a process that unearthed her “passion” for corporate finance. GE’s subsequent integration with Baker Hughes led to the establishment of a new treasury team and the opportunity to build procedures from scratch.

Despite progress around the use of metrics and data to measure diversity, Diane flagged the continued need to support women in middle management positions to move into senior roles. She said the solution required nurturing talent and coaching to provide a “funnel” so that when openings arise, qualified women are “on the slate.” She also stressed the importance of targets across recruitment, and said lessons learnt in the quest to improve gender diversity should now be applied to ethnically diverse and black candidates too. “Diversity leads to better decisions and innovative solutions,” she said.

Reflecting further on the importance of diversity, she said it amounts to “bringing your true self to work” and not hiding things out of a fear that it will lead to being treated differently. She added that she hoped her career illustrated to other women in treasury that it was possible “to have a career and have children.

Time abroad

As for advice on career progression, Kim noted that working abroad helps executives “build more diverse and inclusive teams” because of the experience of “being an outsider.” Diane also advised attendees to value lateral moves as highly as vertical career progression. “Some people think every career move has to be vertical,” she said. However, a lateral move “gives the tools,” such as risk management, to make the next vertical move “much more successful.” Halina also noted the importance and value of a sideways career move. “Moving up the ladder is not always the best,” she said, adding that when you move laterally you gain experience that means you ultimately move towards senior finance and C-level roles faster.

Next the conversation turned to pay rises and promotion for women in treasury.

Kim told delegates struggling with these types of conversation to compare it to other important issues they don’t shy away from confronting. She also said it came down to “challenging boundaries” and flagged that it is easier to negotiate pay “going into a job” rather than wait until it has begun. Halina said that by pushing for salary increases, women also showed they were “doing their best negotiation on behalf of the company.” Recalling her own request for promotions and pay rises earlier in her career, she said “she was told no” but was later “recognised.”

Speak up

Next the conversation turned to the importance of speaking up. Diane noted that speaking up either formally or informally is a priority at HSBC. “It is a huge area we are focusing on,” she said. Noting it was possible to speak up “without being arrogant,” she explained how she had missed an opportunity earlier in her career by not voicing her aspirations. She also urged female treasury professionals to volunteer to help others across the company so people can see you “upfront and close.” She added: “People remember you when you have done something for them.”

Tian voiced her own experiences of adapting to a new environment and culture. Noting that relocating and taking on a new intensive job at the same time was challenging, she advised against doing both together. Recalling the challenge of understanding British and Italian accents in her first oversea job outside of China, she urged others to “go with” such cultural obstacles and “not panic,” also noting that building relationships with colleagues with different cultural references took time. However, her business English soon improved, and she “connected” and built friendships with colleagues overtime.

Kim also noted the challenges of being a foreigner and a woman in a male dominated industry. She recalled “having to work harder” to build connections, but noted she challenged her own preconceptions in the process. “I hope it has made me better at listening and taking on other peoples’ suggestions and ideas,” she said. “Being an outsider forces you to stop and think more inclusively and embrace diversity.”

The panellists also reflected on today’s new working environment. For Diane this has brought an appreciation for “soft skills,” an awareness of wellness amongst colleagues and a fresh emphasis on “what matters”.

In one upside, Kim said working from home had made it easier to connect with treasury teams overseas in a “more seamless manner.” She is spending less time travelling and noted that the pandemic has been an “equaliser” in treasury from a geographic perspective.

Getting noticed

Diane also noted that remote working and zoom conference calls “are equalizer.” She urged treasury professionals to ensure they are included in zoom calls and carve out an opportunity to chat. For those seeking to get noticed and build their brand, she advised practising their “elevator pitch” to advertise their skills and ability to help across the company. She said employees should practise public speaking and noted that “many great” CEOs have taken coaching.

Halina noted that treasury has become much more visible in recent years. She said liquidity, cash management and strategy has been pushed centre stage and treasury has grown in sophistication. She also noted the focus on automation, and new treasury requirements around KYC and regulation. “You need to spend more time managing this activity,” she added. “Nowadays if there is an ongoing discussion, treasury has to be part of it from the beginning.” She said COVID-19 has put more emphasis on overall risk management and ensuring technology is working safely. “There has been a big acceleration in moving away from paper to digital.”

Kim noted that State Street Global Advisors now asks all the companies it owns to publicly publish their strategy on ethnic and racial diversity. She said women, armed with the personal experience of being a minority, must appreciate and try and understand the position of black colleagues, urging attendees to not stand by but “embrace and talk about” the challenges and obstacles faced by black colleagues.

ESG

In a final note, Baker Hughes’ Tian said that ESG was becoming much more of a priority in treasury as banks increasingly reference ESG in their lending decisions. “Banks ask us about ESG commitment and propose to include a green solution in our revolving facilities. They also discuss pricing linked to ESG achievements. It’s being taken more seriously by debt / equity investors as well and its being pushed down to the companies impacted.”