The world of corporate treasury is full of talented people. But how can treasury departments make the most of their teams and what can individuals do to progress? In this article, we propose some tips for climbing the career ladder, as well as highlighting the benefits of embracing, and supporting, a diverse, ambitious treasury team.

Diversity and equality

Diversity is a topic close to Treasury Today’s heart having run the successful Women in Treasury initiative for four years now. The motivations are simple: despite concrete evidence that having more women in senior roles is good for business, equal opportunities are still a long way off. For example, Treasury Today’s Women in Treasury Global Study 2015 found that 33% of female respondents believe they are paid less than their male counterparts and 45% did not feel their career prospects are the same as male colleagues.

Yet evidence has proven that gender-diverse companies perform better. In fact, companies in the top quartile for gender diversity are 15% more likely to outperform other companies, a report, titled ‘Diversity Matters’, from McKinsey & Company indicated. But diversity isn’t limited to gender – the same research showed that companies in the top quartile for racial and ethnic diversity were 35% more likely to have financial returns above their national industry medians.

What’s more, it’s not just that bottom-quartile companies are not leading – they are lagging. For both gender and ethnicity and race, the least diverse companies are statistically less likely to achieve above-average returns.

Diversity in terms of age, gender, ethnicity, sexuality, background and so on creates diversity of thought which is a strength in business because it ensures different ways of approaching the same problem are suggested. “Alternative ideas allow us to come up with the best solutions,” says Debra Todd, VP, Global Treasury Services, BP.

Therefore, when corporates are hiring they should consider the dynamic of their existing treasury team – and consider which aspects could need more prominence. As Todd says: “It’s important that we look at whole teams, rather than just at individuals. If you consider six people that are the same and have similar strengths, that team would be a lot weaker than six very different people who boast diverse strengths.”

In order to develop such strengths, talent needs to be nurtured. As corporate employers reap the rewards of a successful treasury team, it is in their favour to support the progression of individuals’ careers. Internal and external training programmes are beneficial, as well as supporting those who are studying for additional qualifications. Ones of note include: the Association of Corporate Treasurers (ACT) qualifications, the Certified Treasury Professional (CTP) or the Association of Chartered Certified Accountants (ACCA). Some professionals also look into the Chartered Institute of Management Accountants (CIMA), but it is important to be aware, as the title suggests, this is not as treasury focused as the first two.

In terms of encouraging a team who want to succeed, senior executives are responsible for providing a good example. The CEB Corporate Leadership Council™ analysed data from more than 150,000 employees and identified that senior executives acting as good role models for developing employees is the single most important factor for driving leadership quality. What’s more, excellence here increases an organisation’s probability of being a top-tier leadership organisation by 84.1%.

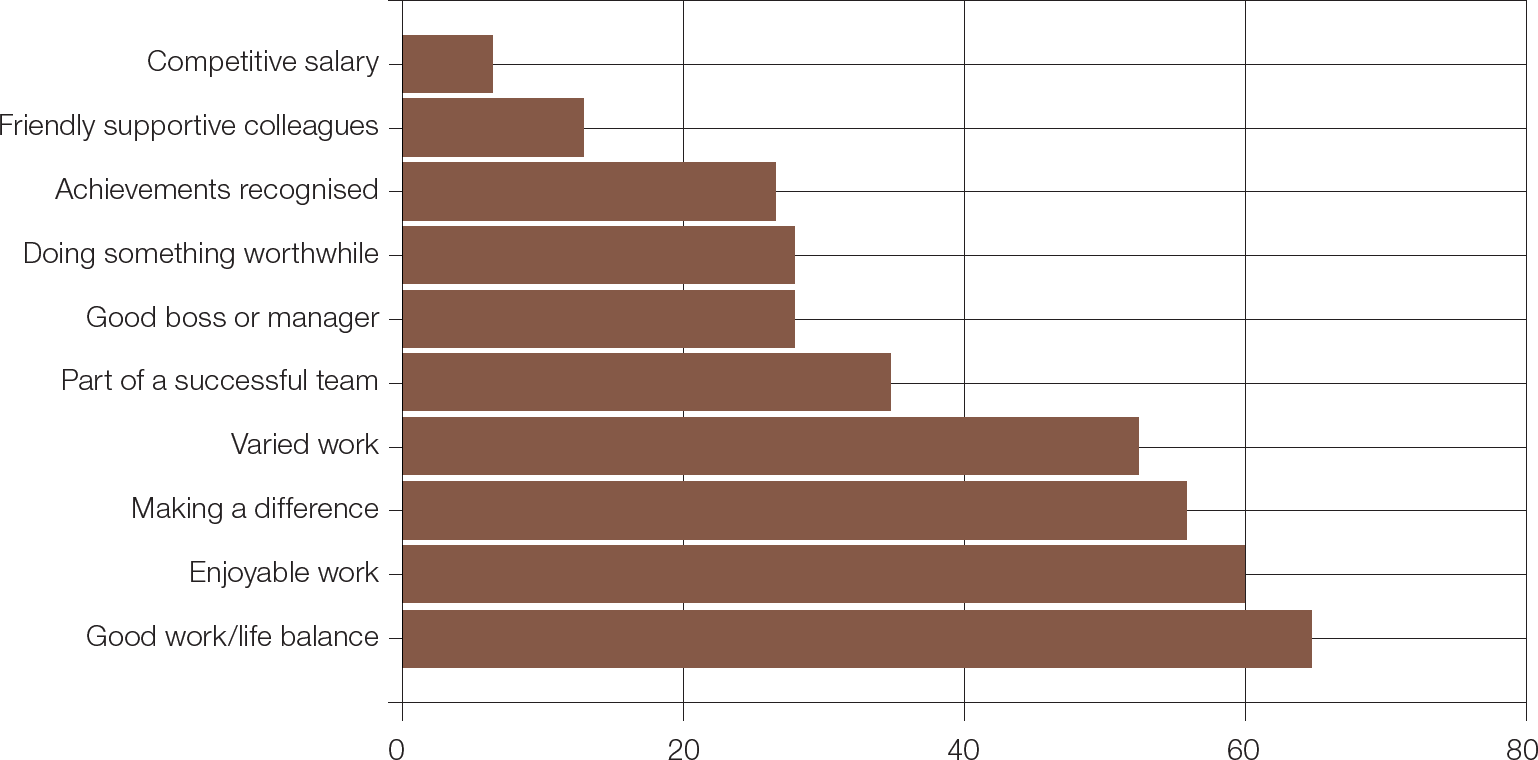

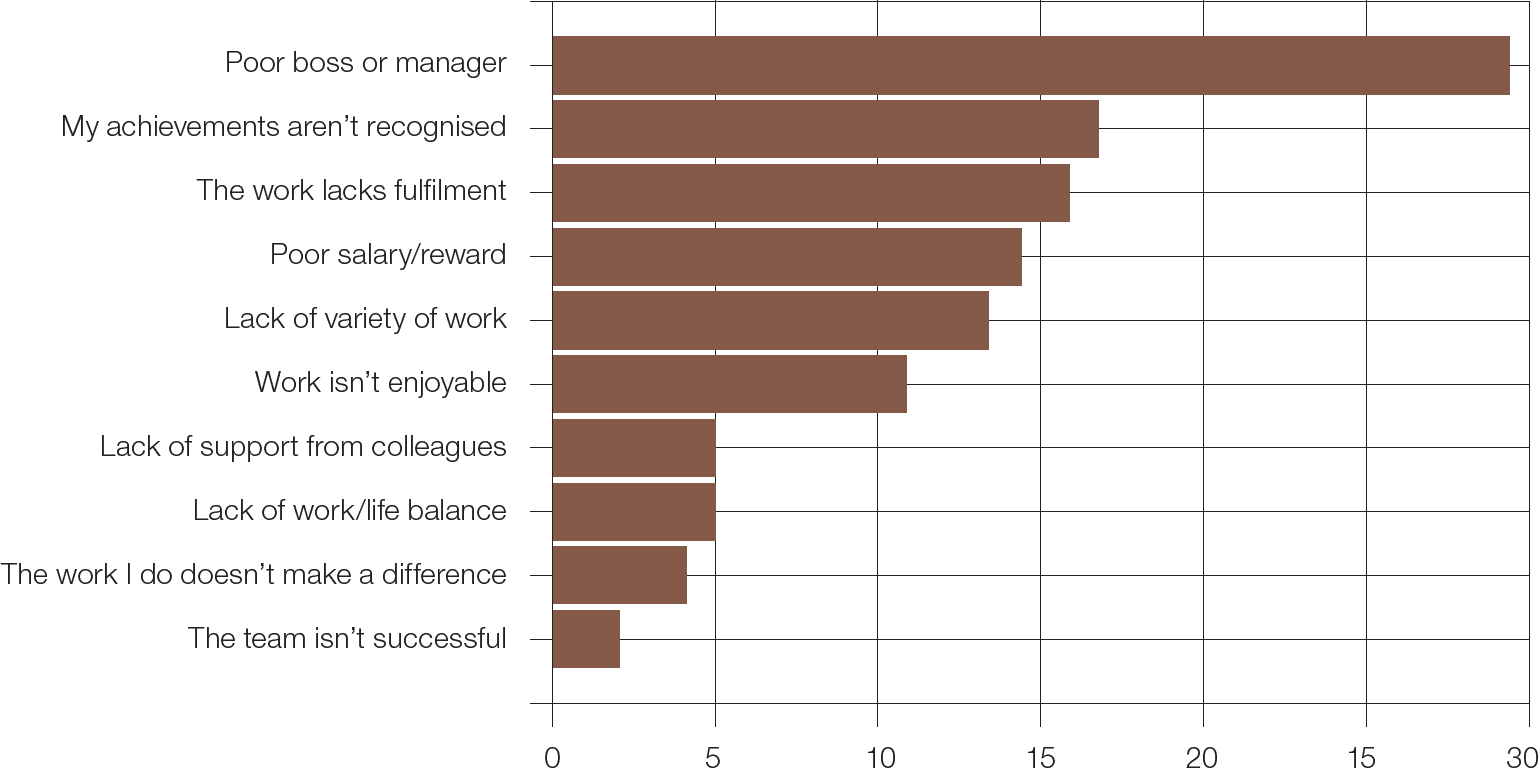

Top-tier leadership, the CEB Corporate Leadership Council™ says, is characterised by managers who prioritise and act on employee development needs. Whether this is further training, support for flexible working or backing for a career change perhaps, these are some of the areas good managers keep an eye on. Not only that, but it is often recognised that professionals don’t leave jobs, they leave managers. A Gallup poll claimed that 75% of workers who voluntarily left their jobs did so because of their bosses and not the position itself. As the graphs below confirm, a competitive salary is rated as the least influential factor in a treasurers’ happiness (Chart 1), whereas a poor boss or manager is the most influential factor in their unhappiness (Chart 2).

Chart 1: Why treasurers are happy in their roles

Source: MR Treasury Recruitment Global Treasury Salary Survey

Whilst it may have become somewhat of a cliché, the most important company resource is its people. Supportive working environments and the opportunity for career progression are key to attracting and retaining great talent.

Chart 2: Why treasurers are unhappy in their roles

Source: MR Treasury Recruitment Global Treasury Salary Survey

Mentoring frequently comes up as a springboard for success; many corporates cite mentoring programmes as critical in helping them navigate new organisations and supporting them with different perspectives throughout a career. Mentees can gain a lot from the experience of those around them, picking up new skills and knowledge. It is an opportunity to have conversations in a risk-free way as a key aspect of mentoring is confidentiality.

There are some myths to debunk, however. Mentoring isn’t necessarily restricted by gender. Males can mentor females and vice versa. Also, mentoring doesn’t have to be formally ‘set up’ by a programme or organisation. What is perhaps less emphasised is informal mentoring. Rather than going through an established mentor programme (as not all companies have them), similar relationships can evolve in a more natural way, within the same company or from outside. Senior executives have a wealth of knowledge others can tap into and the recurring thoughts Treasury Today hears suggest that most professionals are more than willing to share their understanding – and time – with others.

For informal or formal mentoring to be successful though, mentee and mentor must have commonalities, meet regularly and have areas of experience identified which the mentee wants to gain from. For the mentor, it can be hugely rewarding to see someone develop and progress. Fifty-eight percent of respondents to Treasury Today’s Women in Treasury Global Study said they would be interested in being a mentor to others.

Moreover, successfully leveraging networks is a great way of meeting other professionals, making friends and learning. You may also hear of suitable vacancies and are more likely to receive recommendations from those who have worked alongside you in the industry.

Indeed, sponsorship is said to be another – potentially more lucrative – way of progressing your career. It is a case of ‘who knows you, not who you know’ as a sponsor is essentially an ally who will be your advocate when it comes to staffing decisions. It is worth noting that employees of all seniorities can champion colleagues.

To attract sponsors, Catalyst, an organisation with a mission to expand opportunities for women and business, recommends the following:

-

Be seen.

You – and your work – must be visible. If your achievements aren’t seen, how can colleagues or managers champion you?

-

Take risks.

Sometimes you need to go outside of your comfort zone to progress – for instance, applying for positions you don’t yet possess the entire skill set for.

-

Ask for what you want.

So long as you have a clear understanding of what you want, don’t hold back on articulating these career ambitions.

More than anything, though, your work should speak for itself.

Preparing for career success

Indeed, it is the responsibility of individuals to manage their careers. Seeking out an informal mentor or attracting a sponsor could be part of this. According to Singapore-based recruiter Megha Khare, Manager, Accounting & Finance, Page Personnel: “For somebody who is very keen and passionate about treasury, if they plan it well, they can have a good career ahead of them.”

But don’t run before you can walk. The emphasis here is on planning – knowing where you’d like to progress to and the best methods to help you get there. A career road map can help to boost your mobility.

A common piece of advice Treasury Today hears from the industry is to put yourself in the right place at the right time so that you are having the right conversations with the right people. Martha Pierce, Senior Consultant at UK-based recruitment firm Hays Treasury says that a common gripe made by candidates to recruiters is that there aren’t sufficient opportunities within their current company. “But I will be having a conversation from the other side and line managers will say ‘they are great at their job, but are not showing much eagerness to learn’.”

It is the responsibility of all employees and managers to start having conversations which ensure staff know their employers are willing to invest in them. “In my experience, it’s difficult to recruit at the moment so businesses, most of the time, are going to give you that opportunity to gain more experience,” Pierce adds.

C-suite ambitions

For some treasurers, the ultimate goal is to become a member of the C-suite. There are, of course, certain things a treasurer can do to improve their chances of this happening. Making themselves more visible (for the right reasons), getting closer to the operational side of the business and expanding their scope of responsibilities, for example.

Chief Financial Officer

The CFO role necessitates the capability of translating business decisions into numbers and explaining the impact on the company’s bottom line. Looking into the future – and all the time translating reality into numbers and numbers into reality – is a vital part of the job. As Maciej Müldner, Finance Director, Skanska Property Poland says: “There is no ‘safe haven’ for a CFO, so whilst many talk about it, the role isn’t for everybody.”

Typical financial qualifications are good to have, as well as a Master of Business Administration (MBA) or alternative forms of management study. Working in the treasurers’ advantage is the fact that they are already, in their current role, exposed to some of the most critical contacts within the CFO’s reach – financial institutions (FIs) and suppliers, for instance.

Additionally, it is “second nature for a treasurer to look for financial risk; they understand how operational, financial and strategic risks are all linked and can trigger each other”, says Mustafa Kilic, CFO and Member of the Board of Directors, Candy Group Turkey. “In their existing roles, treasurers have already built up a good perspective of credit and market risks too.” All of which are key components for a CFO.

Indeed, the skills valued in the role are all within the reach of the corporate treasurer who can “add these abilities to their current skillset and maximise their chances of becoming a CFO”, says Kilic. Desirable skills, he says, include an in-depth understanding of an individual company’s business operating environment, risk management skills, and the ability to communicate well with people from governments, banks and also local populations.

Ten top tips for climbing the career ladder

- Don’t be afraid to ask for help or advice.

- Experience may not be found where you expect. Taking on roles or projects outside of the department can give you fresh and valuable perspectives.

- Try and make sure you stand out by going the extra mile for colleagues.

- Plan where you’d like to be, and how best to get there – but don’t expect it to always be a straightforward route. You can learn from bumps in the road.

- Know where your strengths lie, and keep a record of accomplishments.

- Maintain a healthy balance between your work and home life.

- Don’t expect your colleagues or bosses to be telepathic. You’ve got to communicate well in order to achieve common goals.

- Keep up-to-date with current trends, technology and industry developments.

- Avoid getting dragged into finger pointing and blaming. It is important to keep your integrity, even in challenging times.

- Understand the manual processes behind the treasury systems you use. If – or when – they break, you will be in the best position to cope.

Chief Executive Officer

According to the ninth annual Robert Half FTSE 100 CEO Tracker survey, more than half (55%) of today’s FTSE 100 CEOs have a background in finance and accounting or financial services, compared to just 21% in retail, 15% in engineering and 14% in technology. Almost one in four (23%) CEOs are qualified chartered accountants.

Although formal qualifications are not usually specified for the CEO role, having a university degree and even a post-graduate qualification helps. The majority of FTSE 100 CEOs have at least one university degree, and more than a quarter have either an MBA or a PhD. Nevertheless, it is worth noting that some very high profile chief executives either dropped out or never went to college. This list includes luminaries such as Richard Branson, founder and CEO of Virgin Group, Michael Dell, founder and CEO of Dell Computer and Bill Gates, co-founder and former CEO and Chairman of Microsoft.

Communication skills

CFOs and senior treasurers will be far ahead of their bosses in financial acumen, and at least on par in terms of decision-making, thinking strategically and taking a global perspective, wrote Gary Burnison, CEO of executive recruitment firm, Korn Ferry, in a recent white paper. However, he says CEOs “have a clear right-brain advantage that wins the day on the leadership front”. This, he argues, means they are “better at building relationships and at influencing, engaging, and inspiring others; they are more courageous and optimistic; and they have a stronger customer focus”.

The firm’s analysis of current CEOs in the global Forbes 2000 list 2015 reveals that only 13% moved into that position from the CFO role – somewhat at odds with the Robert Half UK observation. In addition, Forbes 2000 CEOs who previously held senior-level financial officer positions (controller, treasurer, chief accounting officer, senior vice president/vice president of finance, chief tax officer, vice president of investor relations, or CFO) accounted for only 18% of the total. It adds that little has changed in the past few years. The most noticeable gap for CFOs seeking to take the CEO chair is in their ‘people skills’. The need, says Burnison, is to develop “more social leadership skills to influence, engage, and inspire others”.

Similarly, Pratibha Advani, CFO of Tata Communications, told Treasury Today that for a financial executive to succeed in leadership it requires balancing the responsibilities of stewardship with those of business partnerships. “We cannot just be number-crunchers; we should also be able to communicate the logic behind those numbers. Today’s finance professionals are not like old-fashioned bean counters – we have a much more proactive role to play as business partners in drafting and implementing business strategy.” From this point, the well-rounded treasurer has every chance of becoming CEO.

The recruiters’ perspective

In working at the ‘coalface’, recruiters have a unique view on what the treasury jobs market will look like in 2017 and beyond. Treasury Today talks to Martha Pierce, Principal Recruitment Consultant, Hays Treasury and Mike Richards, Managing Director, MR Recruitment, about what to expect:

Current state of play.

Although the pace has slowed down somewhat of late, Pierce says, “the treasury recruitment market has become increasingly busy over the last couple of years”. This has been largely driven by transformation projects within treasury functions requiring corporates to bring in project people or increase headcount and it is a trend she sees continuing into 2017.

SMEs have been increasingly realising the value of a treasury function too, she adds. “In general, treasury has been improving in terms of vocalising the value it can add to a business. As such, organisations are just more aware of the value-add it can provide, even in cases where a dedicated role didn’t previously exist.”

Brexit.

For Richards, Brexit and the volatility it has helped to create will put treasury in the spotlight again and, as such, the recruitment market will get busier, he predicts. “On Thursday 23rd June, there was only a remote chance of stormy times but as soon as the results [of the UK EU referendum] were announced, treasury was placed in the eye of the storm,” he says.

In demand.

In fact, candidates are in the driving seat at the moment. As Richards says: “Two years ago, companies were in charge but the balance is more in favour of treasury professionals now.” For corporates in the process of recruiting, this means focusing on what the role offers and communicating the reasons why candidates would enjoy coming to work for you. “Do not put obstacles in their way – such as tests – before they have even walked in the door.”

Qualifications.

Nonetheless, according to Pierce, qualifications are “hugely important” because “businesses are more risk-averse and they want those qualifications to confirm what level that individual sits at”. A Hays survey, titled ‘DNA of a Head of Treasury’, surveyed over 100 senior treasurers across the UK and found that 38% held the ACT qualification, 21% the ACA and 20% CIMA.

Cross-training on the job.

In addition to qualifications, professionals will need to expand their “toolboxes” in order to progress in the future, says Richards. “Those who would like to move into slightly different roles can look at shadowing others to learn new skills on the job. This is a great way of getting different tools in their toolbox to be able to then apply for different roles.”

Salaries.

Whilst salaries have stagnated in recent years, says Richards, the treasury community might finally see increases as the demand for their specialist skills “will increase in these tough times”.

Communication skills.

It seems whether you are in a junior or senior role, the way you communicate is a factor that drives progression. Both Pierce and Richards agree that softer skills will continue to be valuable in 2017. “Understanding the core workings of an organisation and how treasury benefits the company’s objectives as early on in a treasury career as possible is advised,” says Pierce. “In the process, individuals will increase their visibility too.”

It is that visibility, and being able to communicate what value you add in your role, which enables treasurers to command higher salaries too, adds Richards.

Keep in touch.

Whether looking for a new role in 2017 or not, it is important for treasurers to keep an eye on the recruitment market and think about long-term career paths. Few professionals are better placed to help with this than recruiters – so keep in touch. “After all, treasury professionals at any stages of their career will have similar concerns about where best to go next to benefit their careers,” concludes Richards.