Cost management is vital for every business and for most, setting budgets is based largely on what happened last year. But in the current business environment, where volatility and unpredictability are the watchwords, a more accurate method seems appropriate. We go back to basics with the concept of zero-based budgeting.

A 2018 Accenture report showed that over 91% of zero-based budgeting (ZBB) programmes met or exceeded their targets. Before 2011, only 2% of surveyed companies had initiated a ZBB programme but between 2013 and 2017, Accenture notes that ZBB adoption grew by 57% every year amongst the world’s 85 largest companies. ZBB, it seems, has arrived, at least on the big stage.

Does it work? McKinsey reports that “when properly implemented, ZBB can reduce selling, general and administrative (SG&A) costs by 10% to 25%, often within as little as six months”.

But it is not a silver bullet for cash management difficulties nor is it an easy fix, warns Accenture. Indeed, companies reported some serious obstacles to overcome before finally reaping the rewards: 67% said cultural buy-in was the hardest, followed by change management problems (41%) and the perennial issue of data visibility (33%).

Perhaps one of the key difficulties in getting buy-in is that ZBB is an ongoing process that represents, for some, both a cultural and business process about turn.

Accenture now advocates a far wider use case for the ‘zero-based mind-set’ (or ZBx, as it calls it), with potential, it argues, to tackle the entire P&L, including general and administrative expenses, direct and indirect labour costs, sales and marketing, logistics, and cost of goods sold. For now though, we’ll focus on its original target.

Basics

The ‘zero-based’ concept was the brainchild of Peter Pyhrr, an account manager at US technology firm, Texas Instruments. Pyhrr developed his concept in the 1960s and wrote about his success with it in a 1970 article for the Harvard Business Review. The Accenture report referred to earlier shows that it has since met with favour at many a large corporate and has been advocated for use by small businesses too because of its inherent accuracy.

ZBB requires a company’s income less its expenses to equal zero. In other words, its expenses need to match what comes in during the budgetary period. The idea is that every single unit of currency (euro, pound, dollar, yen, rupee et al) has a well-defined function, so that everything the company spends, saves, gives or invests is equal to that period’s income.

ZBB means there are no balances to be carried forward from prior periods and no expenses that are pre-committed. It is literally a zero-balance for each period. But it is more than just ‘a new budget from scratch’. It is, as McKinsey has argued, a way to “build cultures of cost management throughout the organisation by using a structured approach to facilitate cost visibility, cost governance, cost accountability, and aligned incentives.”

Indeed, by connecting the budgeting processes to the different business functions – production, sales and marketing, logistics and so on – it allows the grouping of diverse cost bases. Current but rather more granular expectations of expenditure across the business can then be analysed, giving a far more strategic view.

The ZBB model is a means of banishing arbitrary and potentially inaccurate and costly blanket increases or decreases over the previous period’s budget. It means that it is now possible to create an accurate and detailed rolling budget over an extended period. Here, reviews can be called from small groups of managers from different functions at different times, rather than imposing them en masse, and still maintain accuracy.

The fundamental process demands a re-evaluation of every line item of a cash flow statement, justifying every expenditure that is to be incurred by each department. Every expense for each new period is thus calculated on the basis of actual expenses that are to be incurred and not the rather less accurate assumption (as is the case with traditional budgeting) that previous incomings and outgoings will continue.

Good practice

The idea that arbitrary incremental spending increases over previous budgets is somehow appropriate when costs and market conditions are as volatile as they are today seems wide of the mark. Whereas traditional budgeting seeks to justify only new expenditures, using the last period’s actuals as the template, ZBB wipes the slate clean for each new period.

The main aim of the ZBB model is to lower business unit costs by pinpointing where these can be sensibly cut. By knowing precisely where every dollar (euro, pound, etcetera) is going, the vagaries of the market can be more effectively managed. As McKinsey has pointed out: “A world-class ZBB process is based on developing deep visibility into cost drivers and using that visibility to set aggressive yet credible budget targets.”

The basic principles encourage:

- Identifying specific business goals and/or tasks for each function.

- Analysing and developing new ways of achieving these tasks.

- Exploring new sources of funding for these.

- Setting the budget numbers and prioritising the direction of funding.

ZBB in action 1

ZBB requires close and granular scrutiny of all departmental expenses each period. A company making widgets uses this process to identify that the cost of a part that it has been buying in to make these widgets increases by 7% every year. Instead of increasing the budget for this part, and either absorbing the cost or passing it on to the customer, it uses departmental cost analysis to work out that it could make the part for less in-house. Having weighed up the positives and negatives of in-house manufacturing, and the costs of ZBB itself (as a more involved process), it decides to manufacture in-house.

ZBB in action 2

The budget for a manufacturing unit is set for US$12m. The decision to award this figure is based on a traditional model of last year +10%. All things being equal, management could have used ZBB, whereby the manufacturing budget disregards all previous figures and instead calculates the expected expenses of the unit, then justifies each of these. Once agreed, the figure may turn out to be slightly higher or lower than the incremental model, but either way, the ZBB figure reflects the actual cost for manufacturing to function effectively, neither being wasteful nor underfunding the operation.

Buy-in

The creation of a ZBB demands the buy-in and involvement of relevant employees. Department managers need to think about how every dollar (or pound, euro) is spent in every single budgeting period. This requires that they describe and justify all old, recurring and new expenditures before they can be included within a new budgetary period. Only that way, argue ZBB’s proponents, can a business optimise both its costs and revenues.

This is in contrast to the potential over- or under-funding that comes from blanket incremental increases. With traditional budgeting, managers typically need to spend their budgetary allowances in each period to ensure they do not lose it, regardless of need. With ZBB, every expense is accounted for and so there is no loss of budget, only access to what is needed, when it is needed.

Advantages

Managers must justify all expenses, so it is not an issue if their new budget is higher or lower than the previous one; they will receive what they can justify. Because justified expenditures are in their budgets, ZBB helps to drive the allocation of resources directly toward activities which benefit the organisation most and remove those that offer little or no value.

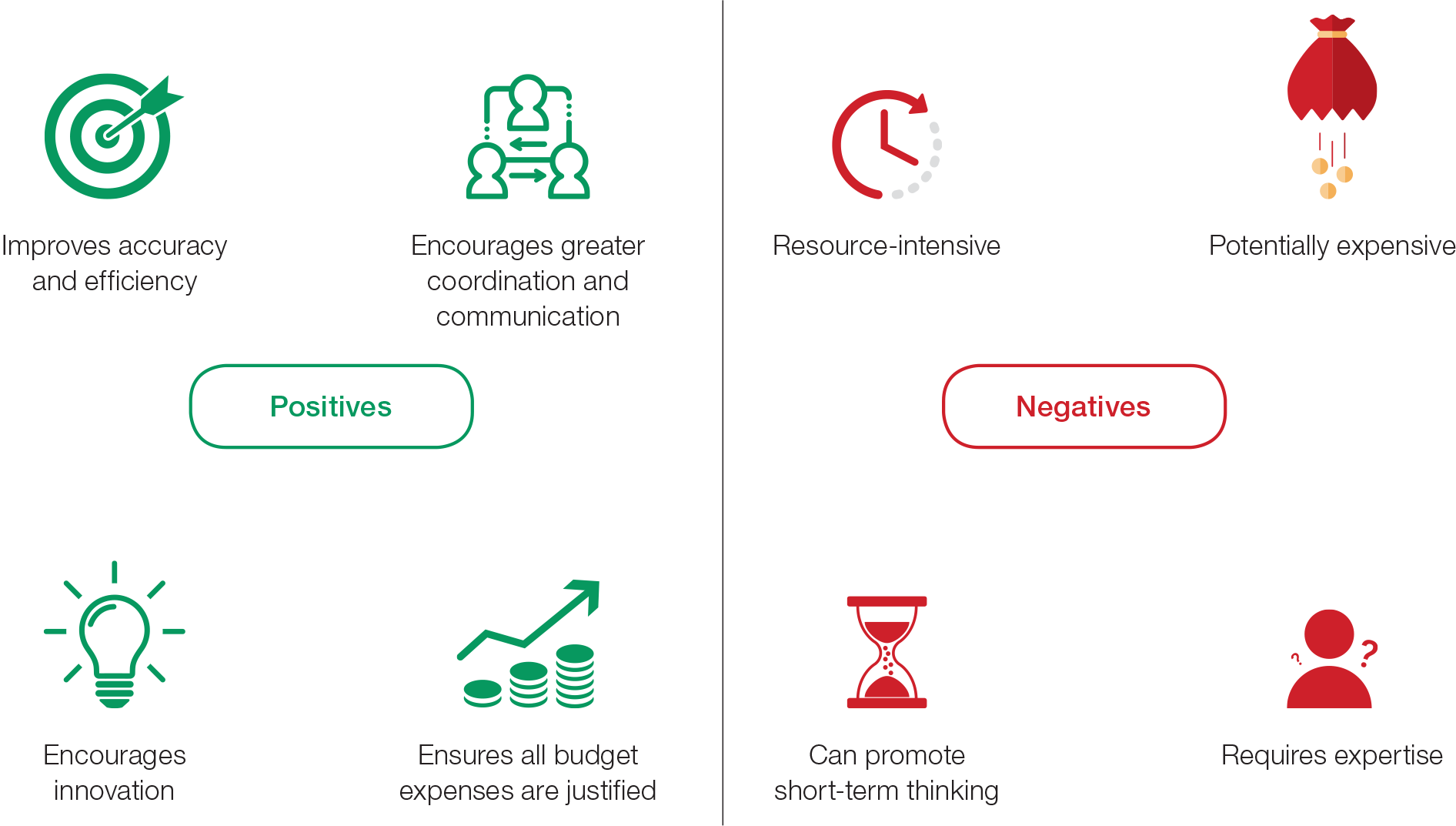

Here are some further plus points for ZBB:

Improves accuracy: by ensuring every function revisits every item of its cash flow and calculates its true operational costs, it helps give an accurate set of figures for the whole business in terms of cost versus expected performance.

Drives efficiency: the ZBB process creates a set of flexible budgets that have at their heart a deep understanding of current costs, and a far more disciplined approach to budget execution and distribution. Allocation of budget and resources need not be based on historical numbers where actuals are available. By using actuals, ZBB aims most resources at activities which generate most revenue and/or are most critical to the survival of the business.

Removes waste: by seeking repeated justification, ZBB stops any resource being diverted to activities that no longer offer value, either from a risk-reward ratio perspective or from a cost-benefit analysis. This helps to optimise all current activities and avoids wasteful expenditure by wiping out any legacy expenses or misallocation of resources that have crept upwards over time without any real understanding of why these costs are as they are (see ZBB in action 1).

Stops budget inflation: justification of every expenditure counters the inefficiency and waste of incremental budgetary inflation.

Improves co-operation and communication: McKinsey has said that ZBB “is very detailed, structured, and interactive in order to facilitate meaningful financial debate among managers and executives”.

Encourages innovation: ZBB encourages managers to be more innovative in how they reduce costs or raise output as they seek to justify their allocation of resources.

Disadvantages

Resource intensive: the ‘from-scratch’ process that characterises ZBB is its main downside. There is no escaping the fact that it is more time-consuming and resource-intensive than traditional budgeting methods. Indeed, it takes a lot more time and effort to closely review and justify every budget element; building a whole new budget from the ground up could require the input of many more employees.

It may be that certain functions or departments do not have the resources to comply and this will clearly hinder any attempt to deploy ZBB across the organisation. Whether the benefits of ZBB outweigh the far heavier demand on resources than traditional methodologies require is a call that the individual business must make. That said, McKinsey suggests that initial rollout of a new ZBB programme can be led by a central team and completed in four to ten months.

Can promote short-termism: ZBB is easier to practice within functions generating direct revenues (such as sales) because their contribution is easier to measure, and therefore justify, than indirect sources such as training, customer services and R&D.

By focusing the direction of resources on areas that the company knows will be profitable in the next budgetary period, there is a risk that that longer-term investments, especially those that do not directly deliver revenue (such as the aforementioned training, customer services or R&D), could lose out on budget. Obviously, this would be damaging for the long-term prospects of the business, and thus must be managed.

Exposes lack of expertise: ZBB requires a qualified professional skillset to undertake and thus demands serious commitment. There will almost certainly be a requirement for training of managers to be able to understand and use the process effectively and extract the most benefit for their respective functions and for the business as a whole.

Pros and cons of zero-based budgeting

Is ZBB a winner?

ZBB is a means of reflecting the actual expenses that a department may incur in going about its business. It requires time, skill and understanding and the buy-in of managers for it to work. However, it is also a means of creating a rigorous culture of cost management across the enterprise. It can offer what McKinsey describes as “unprecedented cost visibility, a unique governance model, accountability at all levels of the organisation, aligned incentives, and a rigorous and routine process”. If used sensibly, ZBB removes unproductive costs, enabling the business to divert funding to areas that can ensure future growth. In an unpredictable and volatile world, anything that can do that must surely be worthy of consideration.