What lessons have treasurers learned during the last 12 months, and what will they be focusing on in 2023? From black swan events and high interest rates to APIs and ESG, here are some of the topics that will be top of mind for treasurers in the year ahead.

If a week is a long time in politics, a year is a long time in treasury. In the wake of the pandemic, treasurers may have been expecting a calmer year in 2022 – but the events of the last 12 months have brought numerous challenges of their own. As the new year begins, what lessons can treasurers take from their experiences in 2022, and what goals and challenges will they be focusing on in the year ahead?

The year that was

“I was asked 12 months ago what 2022 was going to be like, and we had a completely different 2022 in mind,” says Patrick Peters-Bühler, Principal, Emerging Markets at Citi Client Advisory Group. “We had the impression that everybody would be working on the post-Covid period – working on technology, and the opportunities that were there. But it was a year that turned out to be a perfect storm for treasurers.”

Peters-Bühler adds that in 25 years, he can’t ever recall so many different issues happening at the same time in one year. “We see that both on the funding side, with the increases in interest rates that were quite unexpected and quite steep,” he comments. “And we see it on the working capital side, because we did expect that after the scarcity of goods and commodities during the pandemic, that matters would settle down in 2022. Again, that didn’t happen – not because of supply chain issues, but because of the Ukraine war, that started in January 2022.”

Black swans and the new risk environment

Indeed, the experiences of the last couple of years have underlined the importance of being prepared for the next black swan event. As Peter Cunningham, Managing Director Head of Corporate, Commercial and Public Sector Sales & Marketing, EMEA at Citi, noted in a recent Treasury Today article, “A lot of unexpected things have happened in the last few years, and when we look forward, the crystal ball is fuzzier than it’s ever been.”

He adds that the more optionality treasurers can have in their operating models, the better – from FX risk management and hedging to having the right technology in place and working with the right number of banks to achieve the level of flexibility needed.

At the same time, treasurers will need to adapt to the new risk environment. Peters-Bühler notes that last year’s events have highlighted the importance of managing FX risk effectively – “for example, the UK’s currency lost 15%-20% of its value, which meant that most commodities just became 15%-20% more expensive.”

Jack Duffy, Assistant Director, Treasury Advisory at Deloitte, adds that with the return to a >1% base rate environment combining with increasing FX volatility and political instability for the first time in years, “corporates are starting to look harder at their risk policies in the context of today’s market, and ensuring that their technology supports them every step of the way.”

He explains this can be something as simple as codifying hedge policies to ensure real time compliance, “all the way through to advanced risk metrics like value at risk (VaR) and cash flow at risk (CFaR) where corporates with a large range of exposures can take advantage of natural hedging and more insightful risk metrics effectively in turbulent times.”

Harnessing higher interest rates

That said, the environment of 2023 comes with opportunities as well as risks – and for treasurers, the return to higher interest rates marks a significant shift compared to the low and zero rate environment that has persisted since the 2008 financial crisis.

“At Wolters Kluwer, every three years we reassess our strategy and develop a new three-year plan that considers market trends, competitive development, technology changes, and other opportunities and challenges,” says George Dessing, EVP Treasury & Risk at Wolters Kluwer, which provides professional information, software solutions and services for sectors including healthcare, tax and accounting, and governance, risk and compliance.

When it comes to supporting the strategic plan via capital allocation, Dessing says the company tries to strike a balance between investments in the business and returns to shareholders, “all under the assumption of maintaining optimal debt leverage.” From a treasury point of view, he notes, “this capital allocation is occurring within a significantly heightened interest environment, which we expect will remain in the near future.”

After years of negative or minimal interest yield, he says the organisation should now be paying closer attention to everything from payment terms and money market investments to working capital for the business units.

Talent and skills

Britt Jensen, Principal, EU & UK at Citi Client Advisory Group, notes that new ways of working in the wake of the pandemic, including remote and hybrid working patterns, are presenting additional challenges. “There is also a lot of concern about future skills,” she says. “All the new technology coming into the market will require an additional skillset in treasury, compared to what we’ve seen in the past.”

As she points out, these skills are useful not only in treasury but also in other areas – “which means we suddenly see a market which is far more competitive in terms of attracting, retaining and building on those skills.”

Likewise, Royston Da Costa, Assistant Group Treasurer at Ferguson plc, notes the significance of a new generation – Gen Z – entering the workplace. “As each year goes by, the benchmark for technology for new entrants into treasury inevitably goes up,” he comments. “Can corporates really afford to justify not implementing technology like a treasury management system (TMS) to manage their workflows?”

Technology and APIs

On the topic of technology, David Stebbings, Head of Treasury Advisory at PwC, notes that many companies are currently looking at their treasury technology, certain of them prompted by the need to upgrade their ERP systems, and by changing requirements and needs. With potential recession on the horizon, he says, CFOs don’t want to spend money on change – “unless they can save some money or solve a pain point.”

There are many reasons why corporates might buy or upgrade their treasury technology. “Obviously control continues to be an important driver, but cost savings are often key,” Stebbings observes. “Many cite resourcing and banking costs. but with higher interest rates the opportunities to save on interest cost by using technology to better manage cash have increased.”

On another note, he says the market volatility of the past year and concerns about the impact of future black swan events have given many CFOs a better feel for the potential effects of treasury risks not being managed properly. “All in all,” he notes “the business case for treasury technology is somewhat better than it was a year ago.”

Where specific technology trends are concerned, the use of APIs in treasury continues to be a hot topic. Da Costa predicts that in 2023 this will be “a huge part of the Open Banking initiative taking off, with corporates taking advantage of real-time data and improving cash visibility.”

Duffy says that corporates are continuing at pace to replace file-based solutions for their statements and payments with real-time API connectivity with their banking partners. “Now more than ever, corporates cannot continue to rely on prior day information for their positioning and decision-making with regards to cash,” he says. “A high inflation and interest rate environment presents very real opportunity cost for any corporates that do not have real time insight into their balances.”

On the topic of payments, he notes that it is crucial for corporates to maintain a solid reputation as partner to suppliers and customers, adding that payment APIs help to ensure real-time and reliable payment connectivity to the benefit of the entire community. “The intense focus on this is highlighted on every system vendor’s roadmap as a high priority going into 2023,” he says.

Real-time treasury vs on-time treasury

But while real-time treasury may be a hot topic, Chris Jameson, head of Product Management, GTS EMEA at Bank of America, argues that not every company is focused on the need for real-time payments around the clock.

“Based on client feedback, this year our dialogue with clients will centre around ‘on-time treasury’, rather than real-time treasury,” he says. “Many of our large corporate clients have got existing technology, infrastructure and processes geared up for batch processing of payments, a good example being that most of our corporate clients know that they’re going to pay their employees’ salaries in three weeks’ time. So are real-time payments really necessary in all instances? An on-time payment might be more relevant, and more cost effective in the majority of cases.”

For example, he says there is a growing focus on using commercial card rails to pay suppliers on time, while enhancing working capital for the corporate. “The key is really to understand the client’s need, and not force real-time payments when actually that may be contrary to the working capital benefits they are looking to achieve,” he adds.

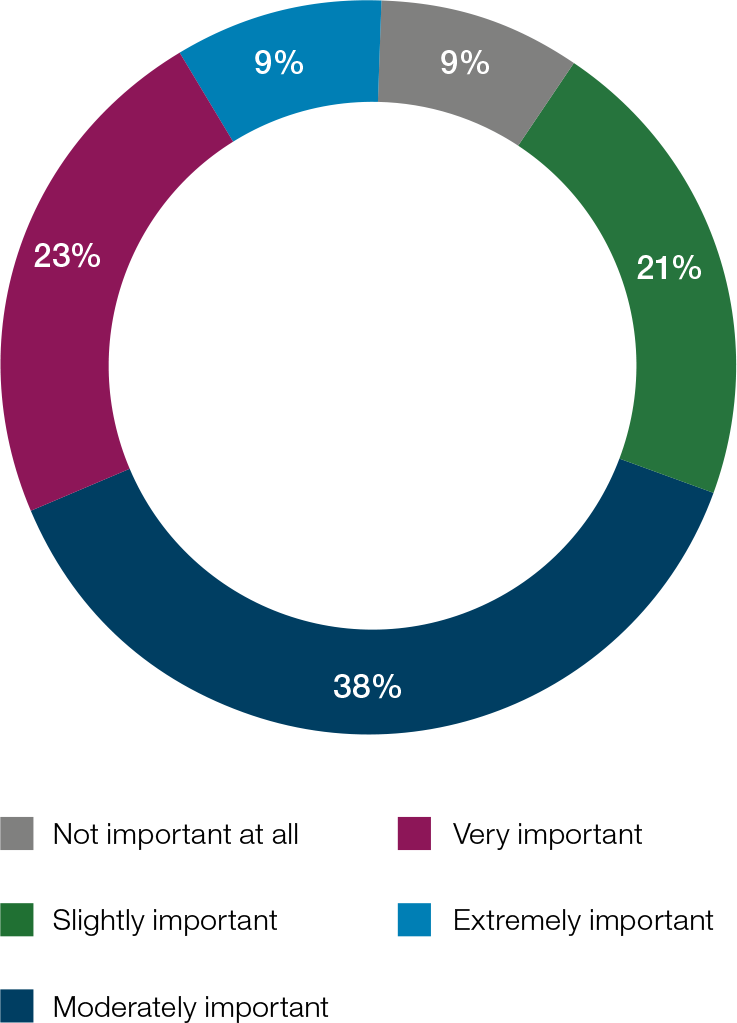

Chart 1: How significant is impact of ESG on the treasury agenda?

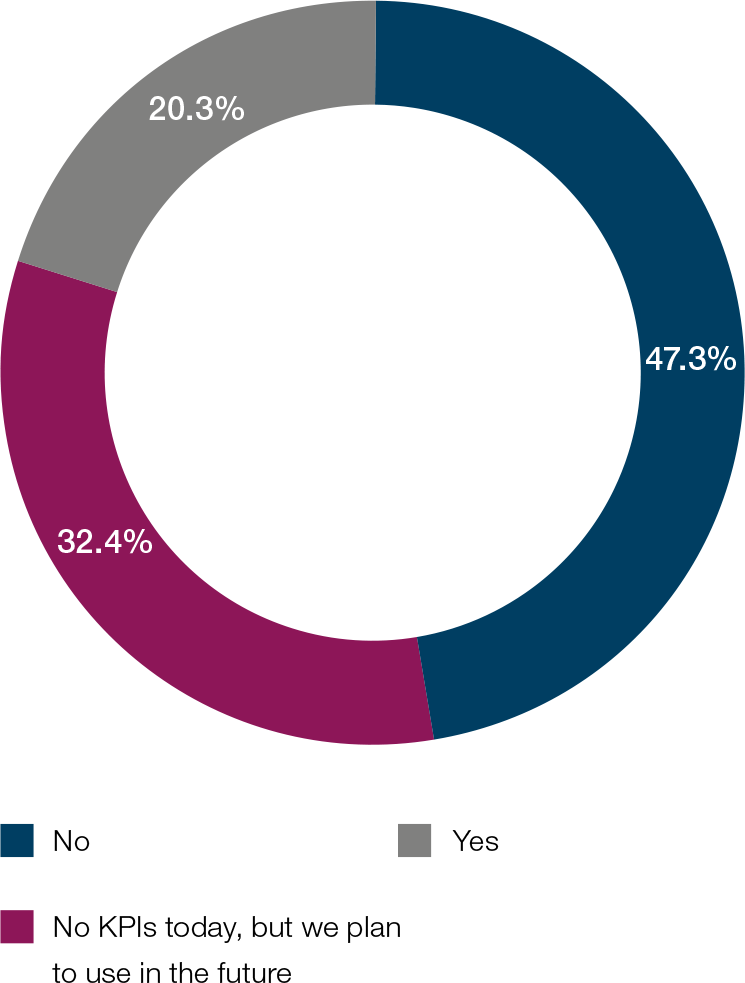

Chart 2: Do you have any treasury KPIs linked to ESG?

Incorporating ESG considerations

Finally, no summary of topics in the coming year would be complete without a mention of ESG. Indeed, Da Costa describes ESG as “the most important topic” for corporates and treasury departments, both today and in the future. “Corporates need to improve their carbon footprint, and treasurers need to consider the various options available in the market – eg green bonds and green revolving credit facilities (RCFs) – when supporting their companies’ drive to reduce their carbon footprint,” he adds.

“In our new strategic plan, we plan to advance our performance and capabilities around ESG,” comments Wolters Kluwers’ Dessing. “On the environmental front, we continued to execute on two key programmes that reduce our emissions: reduction of our global office footprint (m2) – by over 10% in the last two years – and our cloud migration program, ie, decommissioning of on-premises servers.” He adds that ESG KPIs are part of the company’s senior management remuneration, as well as being included in the company’s €600m multi-currency credit facility.

Baris Kalay, head of Corporate Sales, GTS EMEA at Bank of America, says that ESG is now “central to every client discussion we have – even on an RFP, clients are asking the bank abouts its ESG policies, because they want to make sure they are working with banking partners that are aligned with their goals.”

Kalay also highlights the role that supply chain finance can play in helping companies further their ESG goals. As he points out, companies can use supply chain finance to allocate working capital to their suppliers in an efficient way, while making sure they select ESG-friendly suppliers across their supply chain. “This could be more on the ‘E’ side, which the industry is getting more familiar with – but there are more discussions on the ‘S’ side as well,” he adds. “This includes making sure that women-owned or minority-owned enterprises are identified and recognised.”

On another note, he says the bank is looking at different ways to incorporate ESG considerations into its products and offerings, for example by issuing commercial cards that are made from recycled plastics.

Conclusion

While the environment looks likely to remain challenging in 2023, the lessons learned during the last 12 months will mean that treasurers are better placed to overcome the hurdles that lie ahead. Meanwhile, the evolving landscape is set to bring plenty of opportunities, from higher interest rates to the latest developments in technology.