How is technology supporting the evolving role of the treasurer? And how can treasurers tap into everything from AI and data analytics to AML solutions as they take on a more strategic position within their organisations? In a recent virtual roundtable held by Treasury Today and the BottomlineTreasuryXpress team, industry experts discussed the latest developments.

Treasurers are no strangers to technology. But in the last couple of years, the rise of new technologies like artificial intelligence (AI) and machine learning (ML) have brought additional opportunities for treasurers. At the same time, the increasingly strategic role of the treasurer has made it more important to harness efficiency and automation wherever possible. And of course, the COVID-19 pandemic has sharpened treasurers’ focus on digitising processes.

With this in mind, a recent virtual roundtable hosted by Treasury Today and Bottomline explored some of the latest developments in this area, and the skills treasurers need to succeed in this evolving landscape.

In the last few years, treasurers have increasingly had to become fluent in the topic of digital transformation – namely the ability to use and understand good quality data and make the most of emerging technologies like artificial intelligence and machine learning.

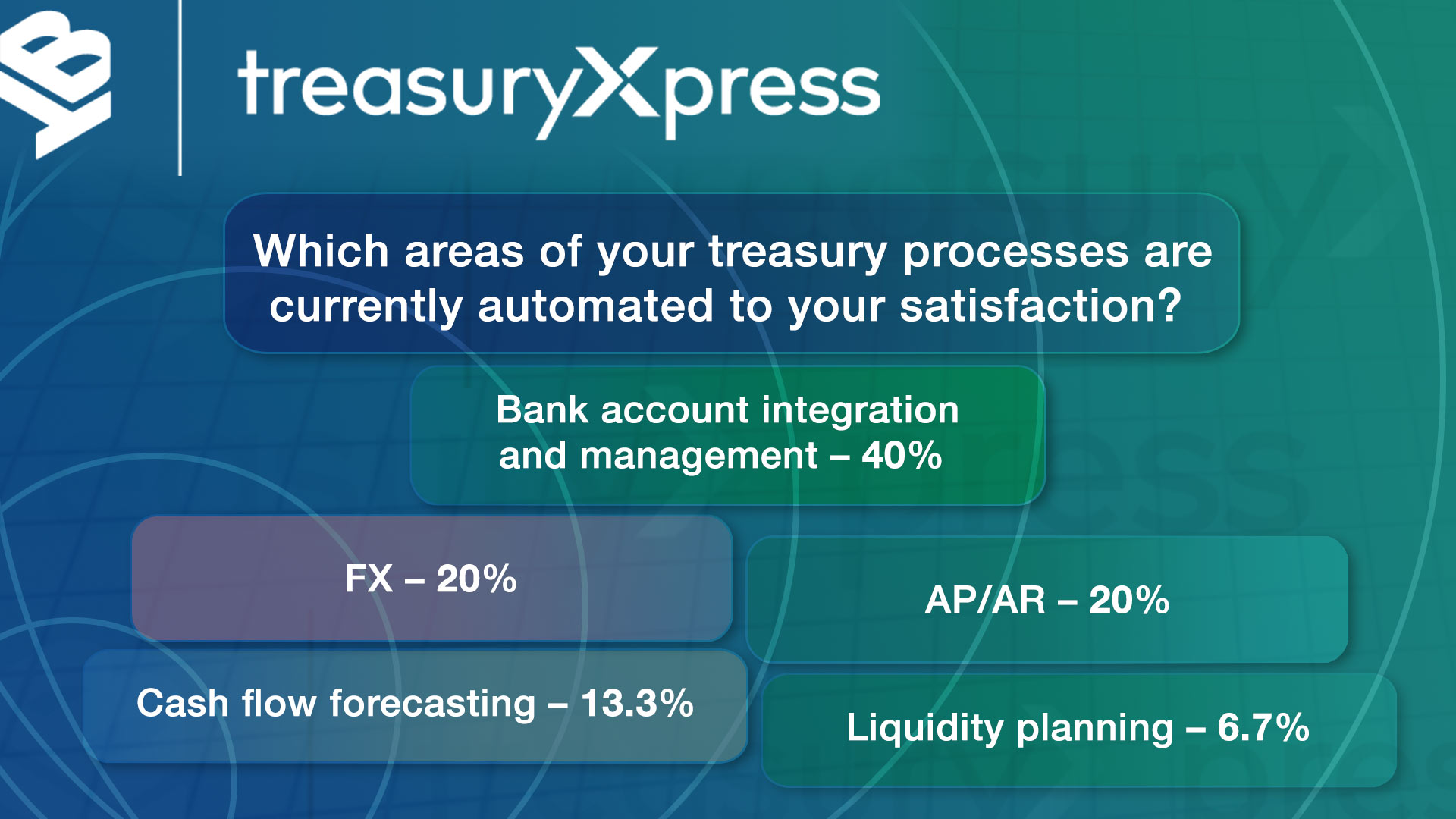

This shift has only accelerated during the pandemic. “The transition from the physical to the virtual office has been the catalyst for a lot of change, especially around payment approval,” says Tom Leitch, Director of Sales and Business Development, Treasury, Bottomline. For example, he notes that treasurers are interacting more frequently with the system on activities such as liquidity planning and cash flow forecasting.

For many, this has placed additional demands on the treasurer’s skillset, as well as a growing emphasis on the role of the treasurer as a strategic partner within the organisation. In some cases, this means bringing additional experts into treasury conversations. “What we’re now seeing in conversations with treasurers is that they often have software engineers and data engineers with them in the discussions,” says Leitch. “So, we’re having much more in-depth conversations about how treasurers can access the data within software, and I think that’s a big shift. Treasurers are now looking to derive intelligence from their operational data.”

Building skills

Treasurers are also looking closely at how they can build out their own skills. Kemi Bolarin, Director, DKB Treasury, observes that the pandemic has shown that resilience needs to be part of the treasurer’s core skillset. Where technical skills are concerned, treasurers also need data intuition skills – “How do we identify data that will result in actionable intelligence? How can we manipulate the data into insights that then provide entry level understanding to the people that are going to use the data?”

As such, Bolarin makes a point of spending 30 minutes a day on LinkedIn Learning in order to top up her existing skills in areas including AI, ML and robotics. “As treasurers, we can’t be shy of technology,” she says. “Social media is where you can pick up a lot of information around the rapidly changing landscape around digital technology.”

Likewise, Séverine Le Blévennec, Senior Director EMEA Treasury at Honeywell, explains that she spent time teaching herself about robotics and completed a developer certificate so that she could help the company automate repetitive processes – an exercise that has saved almost three hours a day.

Harnessing analytics

Treasurers are also paying closer attention to the importance of data analytics when it comes to getting more value out of data. “The data revolution is here – there’s no escaping it,” says Bolarin. “We’re talking about significant digital data flows landing on our desks.” Following the pandemic, she expects CEOs and CFOs will increasingly invest in the tools needed to help treasurers leverage information more effectively to make smarter decisions.

James Marshall, Head of Treasury at Virgin Media, says that while a lot of the company’s cash forecasting is based on drilling into ERP systems, “We get the other half of the story through receipts and collections, which is a little bit more difficult.” As such, business analytics data represents a valuable source of information that the team can use to inform the forecasting process and make more strategic decisions.

Combatting financial crime

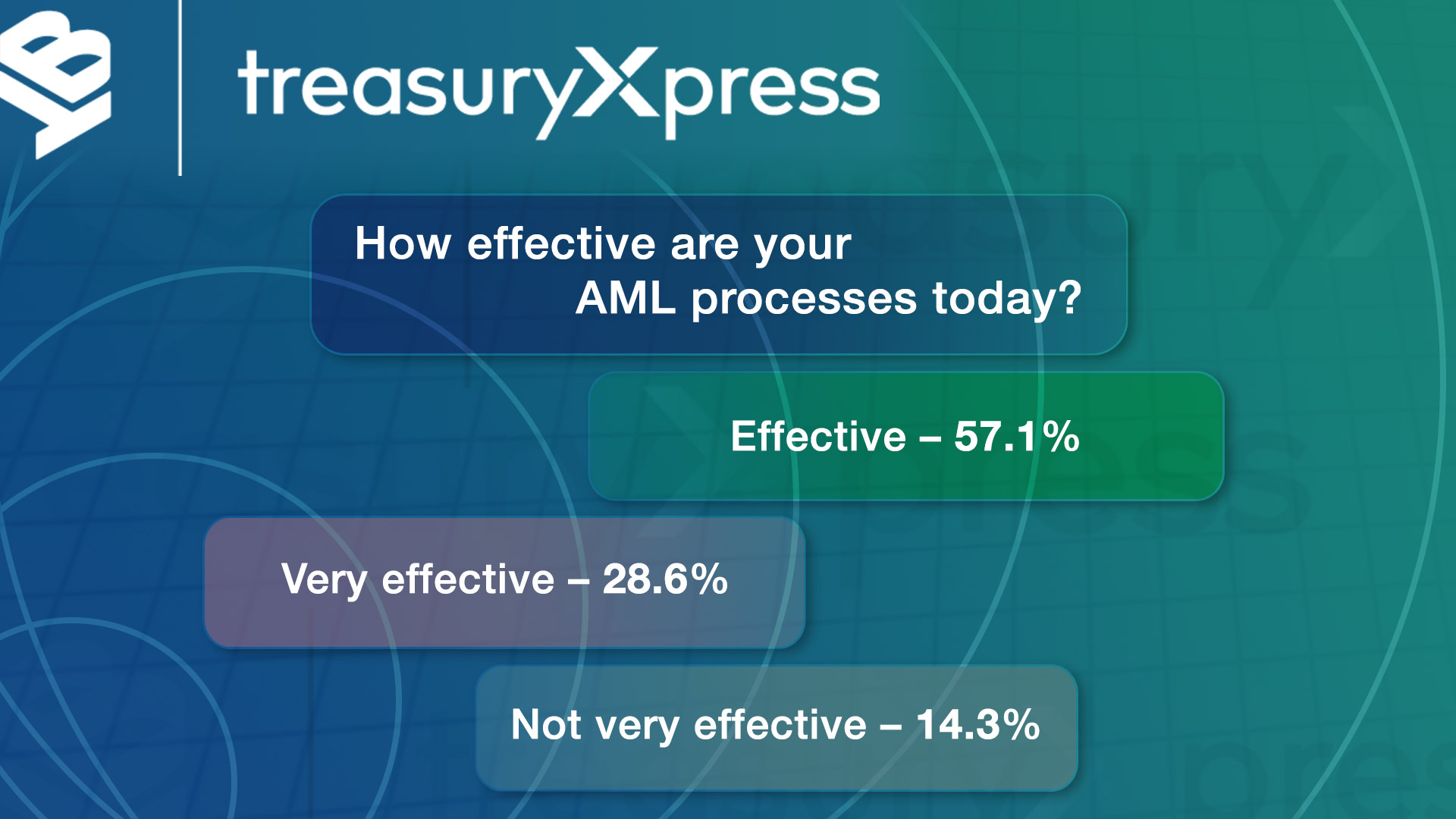

A further area of focus for treasurers is the role technology can play in helping with anti-money laundering (AML) initiatives. Charles de Rougé, Head of SaaS Solutions at Bottomline, notes that five years ago companies regarded AML as the responsibility of banks – but more recently, concerns about reputational risk and deepening regulatory requirements are prompting companies to looking more closely at AML and sanctions screening.

“At Bottomline, we have two tools that are embedded in everything we do,” he explains. “These are anti money laundering/watch list screening, and the anti-fraud tool, which is based on machine learning and artificial intelligence.” By using specialist solutions, treasurers can “tick those boxes and prove that they’re doing everything they can to mitigate the risk, to avoid bad publicity and loss of money.”

Working together

Royston Da Costa, Assistant Group Treasurer at Ferguson plc, argues that while fintechs and treasury teams have stepped up to the mark during the COVID-19 pandemic, “the banks have been slightly slower to act.” He adds: “My ask to the banks is that they seize this opportunity to develop their technology and provide value added solutions to their customers, in order to stay ahead for example accepting digital documents (KYC) and improving security around payments (Two Factor Authentication). I’d like to see more corporate treasurers pushing the agenda with their banking partners, and to some degree their vendors – but I do think most fintechs are doing what they should be doing.”

Indeed, many treasurers are taking a proactive approach when it comes to driving development. Le Blévennec notes that there are plenty of opportunities for treasurers to embark on co-creation initiatives, both with banks and with technology providers. “If we want to invest the time, they are more than happy to get our feedback,” she says. “It’s a way to be more demanding and have things that work better for us.”

Summing up the conversation, De Rougé noted that digitisation is inevitable. “It’s so great to see all of your individual initiatives,” he said. “The tools that used to do basic things are now doing much more to bring actionable insights and decision-making assistance. It’s exciting, it’s fast-paced, it’s the future.”