China’s supply chain finance (SCF) market has evolved considerably in recent years – but there is still plenty of room for development. Taulia’s Steve Scott and Haiyan Zhuang talk about opportunities in China’s SCF market, the role technology is playing in driving progress, and how companies are using SCF to improve the resilience of their supply chains.

Steve Scott

Head of Asia Pacific

Haiyan Zhuang

Head of China

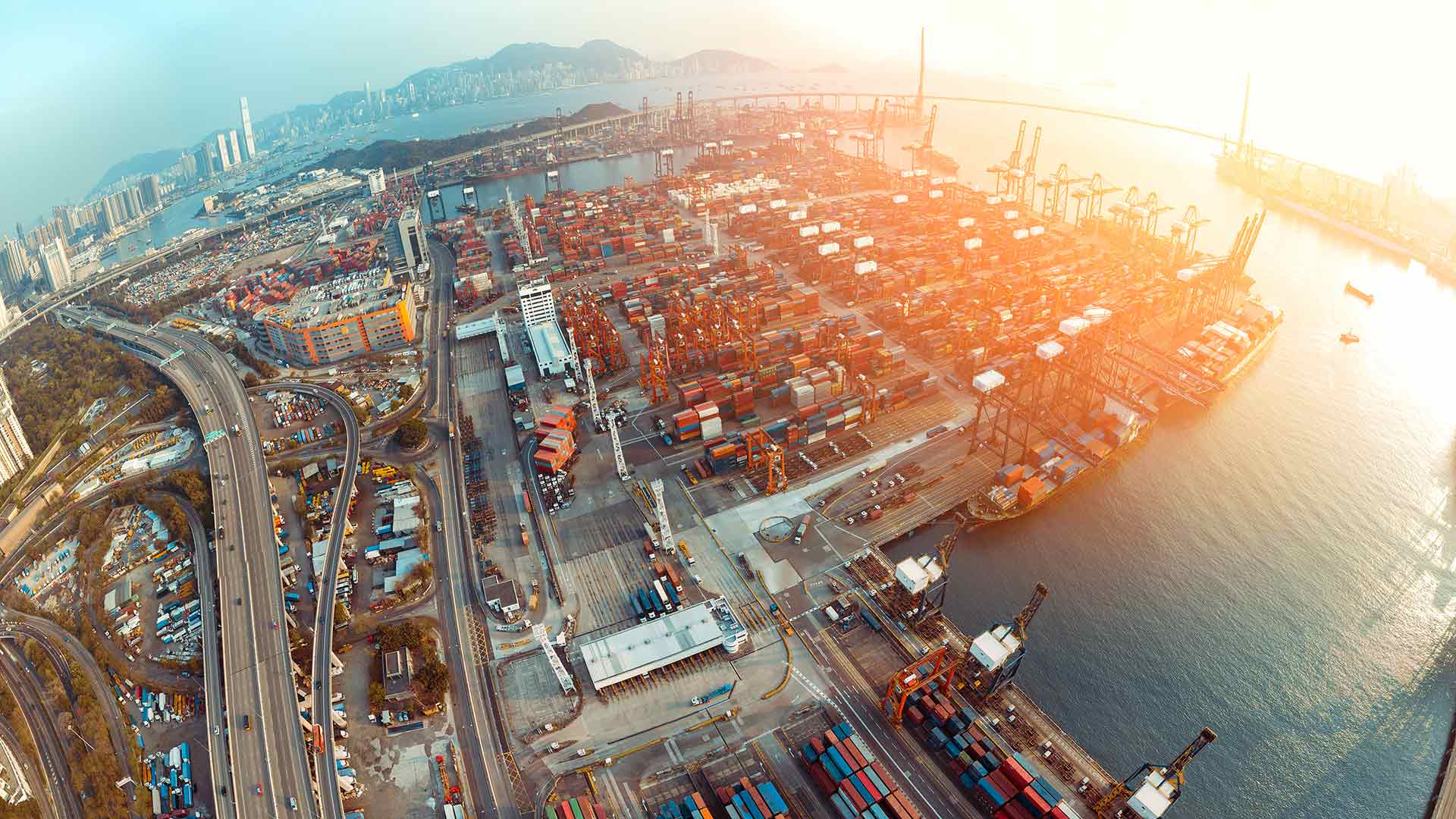

China’s importance in the global trade arena is well known: it is both the world’s second largest economy, and the leading global manufacturer. In addition, as the primary trading partner for 128 out of 190 countries around the world, China is the largest trading nation.

As such, supply chain finance (SCF) – a solution that allows companies to offer their suppliers early payment of their invoices via a third-party funder – has much to offer companies operating in China. In a nutshell, SCF allows companies to free up working capital for themselves as well as for their suppliers. It also improves the predictability of payments for suppliers and reduces supply chain risks, thereby increasing the resilience of supply chains.

China is already embracing the benefits of this approach: the local SCF market is highly sophisticated and has attracted significant investment by a number of different parties. Haiyan Zhuang, the newly appointed Head of China at working capital solutions provider Taulia, notes that China’s SCF market has been estimated to be around RMB 10-15trn (US$1.5-2.3 trn) – and that the government has been proactively encouraging the support of SMEs in China, particularly through the use of SCF.

“For example, in 2019 the China Banking Regulatory Commission (CBRC) and People’s Bank of China (PBoC) published a specific policy to promote SCF in China,” he says. “And last year, eight government ministries issued an updated SCF policy to promote and enhance its development.”

SCF in China: challenges and opportunities

Nevertheless, regulatory considerations can also present challenges as well as opportunities for SCF providers. Financing and banking are highly regulated in China, as is technology and the use of data. “The regulatory regime is very different in China compared to Europe or North America, as are the customer personas, expectations of technology, and business models,” Zhuang comments.

Another notable feature of China’s SCF market is that for suppliers, the cost of funding can vary considerably. Different cities and provinces have varying levels of maturity, and risk levels can also vary depending on whether funding is sought pre- or post-shipment. As a result of the many variables, Zhuang says the cost of funding for suppliers could be as low as 3-4%, or as high as 10-15%. On the flipside, suppliers’ access to capital has improved in recent years for a number of reasons, including the rapid development of the local SCF market and the arrival of new players in the market.

Another important driver is the rise of new technologies. From harnessing big data for quick credit profiling and information on the likelihood of default to the use of natural language processing (NLP) to handle requests more efficiently, there are many ways that technology can streamline SCF. And while the market has developed considerably, there is still plenty of room for improvement: “We believe technology can continue to play an important role in increasing efficiency across the whole SCF process,” says Zhuang.

Harnessing SCF in China

So where does SCF have the most value to offer in China? Steve Scott, Head of Asia Pacific at Taulia, explains that the solution works best “where there are complex supply chains – and also longer supply chains, in terms of the cash conversion cycle.” He adds: “Technology creates so much efficiency in the delivery of SCF that we can penetrate a deep supply chain, from strategic spend focused on the very large suppliers, all the way down to the mid tail and long tail of suppliers.”

In particular, SCF tends to be focused on physical manufacturing industries such as electronics, machinery, equipment and consumer goods, explains Zhuang. “The typical SCF customer will have certain characteristics, such as high domestic or cross-border trading volumes or turnover,” he says. “They will also usually have a high number of suppliers and distributors included in their supply chain, and multiple tiers of suppliers. The other factor is that payment terms across the supply chain tend to be quite substantial.”

From localisation to cross-border capabilities

For Taulia, given the dynamic and competitive nature of China’s SCF market, two themes are of particular interest – namely the importance of localisation and the need for cross-border capabilities:

- Localisation. Given the differences between the market in China and other countries and regions around the world, Zhuang notes the importance of growing “in line with the local regulation, legal framework, banking operations and processes around areas such as electronic KYC and connecting to government agencies for automatic verification and registration of accounts receivable.”

- Cross-border. Taulia is focusing on MNCs that operate in China, with local sourcing and overseas exports – and also on large local corporates that purchase significant volumes with other countries. “Our key objective for Chinese corporates is to present our solution and our global capabilities, and demonstrate how we can improve funding efficiency across multiple locations,” Zhuang says.

By focusing on these areas, the company aims to expand the reach and benefits of its solution to clients in China – such as enabling customers to transmit data efficiently through Taulia’s platform, allowing suppliers to view data easily, and supporting banks in processing funding requests rapidly.

Future prospects

Looking ahead, Zhuang says the government is currently targeting 6-7% GDP growth – modest compared to China’s growth in recent years, but nevertheless substantial – “so I believe the market will continue to expand.” In the meantime, he notes that China’s 14th five-year plan, the word ‘digital’ features many times.

“Building digital capabilities and a digital society is a national strategy,” Zhuang concludes. “So I believe the relatively high growth rate, and continued wave of digitalisation, will mean that market conditions continue to be favourable as we bring our unique value to the local market in China.”