Foreign direct investment flows into the Philippines remain robust, with the country’s promising economic prospects, relatively young population and a mammoth infrastructure programme proving to be major attractions.

Even as China battles against a slowdown and uncertainty looms over the US and European countries, some other regions look to be bucking the trend, with the medium-term outlook for India and South East Asian economies – particularly the ASEAN five of Indonesia, Malaysia, Philippines, Thailand and Vietnam – looking especially promising.

The OECD, for instance, is projecting average annual growth of 5.2% for South East Asia overall for the period 2019-2023, slightly faster than the rate posted by the region over 2012-2016. By comparison China is forecast to have an average growth of 5.9% in 2019-2023, slower than its 2012-2016 average of 7.3%. India’s medium-term growth is forecast to be 7.3%, surpassing the average of 6.9% in 2012-2016.

While markets have been active in factoring the outlook for China and India – upcoming elections in the latter notwithstanding – it is the outlook for the ASEAN five countries that is arguably surprising investors on the upside. And among them the Philippines, which delivered growth of 6.2% in 2018 and, as of January, 79 consecutive quarters of growth, certainly stands out. The OECD forecasts the Philippine economy will grow by 6.5% over 2019, second only to the 6.7% growth seen for Vietnam this year. Moreover, the organisation reckons that over 2019-2023, the Philippines will experience average annual GDP growth of 6.6% – the highest among the ASEAN five for the five-year period.

Foreign direct investment (FDI) metrics for the Philippines and, more broadly, South East Asia certainly provide support for the upbeat projections for the country and region. According to United Nations Trade and Development Agency (UNCTAD), global FDI volumes during 2018 slumped by 20% to US$1.2trn, with the body blaming the fall primarily on US tax reforms having encouraged big firms there to bring home earnings from abroad – mainly from western European countries.

Trade disputes, notably the US-China tariff war, proved to be another drag on global FDI flows, with the accompanying anti-trade rhetoric and protectionist stances further undermining investor confidence and forcing companies affected to review their investment strategies and locations of their operations.

Yet while Europe and the US suffered heavy falls in FDI inflows (by 73% and 18% respectively), flows into Asia were generally resilient, with the region seeing them rise by 5%. Indeed, UNCTAD says, East and South Asia, which experienced inflow increases of 2% and 11% respectively, took the lion’s share of foreign investment, accounting for one-third of global FDI in 2018 and almost all growth in FDI to developed economies. That prompted James Zhan, Director of Investment and Enterprise at UNCTAD to proclaim South East Asia as now “the main FDI growth engine”.

And the Philippines has been doing its bit to justify Zhan’s conclusion. The country’s central bank, Bangko Sentral ng Pilipinas (BSP), expects investment inflow in 2018 to reach US$10.4bn, well ahead of its original projection of US$8.2bn, and up from US$10.05bn in 2017 – the previous all-time high – and US$8.28bn in 2016.

In a further indication of the Philippine government’s confidence in its policies for ensuring the country remains a favourable destination for hard investment, the BSP sees 2019 FDI inflows easing a little but still totalling a robust US$10.2bn.

BSP’s assistant governor, Francisco Dakila says the FDI flows remain “very strong”, with investors attracted by the country’s strong macroeconomic fundamentals and high growth prospects. Corporate investor interest in the Philippines is especially strong in Singapore, Hong Kong, the US, Japan and China, with capital from these countries being targeted at a host of sectors including manufacturing, financial and insurance sectors, energy, real estate and arts and entertainment.

Build, Build, Build to drive growth

The BSP’s bullish outlook is backed up by the Joint Foreign Chambers (JFC) of the Philippines, a coalition of the US, Australia-New Zealand, Canadian, European, Japanese and South Korean chambers and the association of multinationals (PAMURI). The body, which represents over 3,000 member-companies engaged in more than US$100bn worth of trade in goods and services and some US$30bn in investment in the Philippines is also predicting that FDI over 2018 will once more top the US$10bn level. Furthermore, it believes that “prospects are high that, with continuing political and economic stability, FDI will be above US$10bn in 2019 as well”.

The JFC says the creative, infrastructure, manufacturing and tourism sectors will be the key drivers underpinning FDI inflow over 2019. Creative industries – which include media and publishing – “are the country’s newest sunrise sector”, it says.

The body praises the Duterte administration’s giant “Build, Build, Build” infrastructure programme which, it says, has achieved much higher levels of public sector spending on infrastructure and is proving a key factor in supporting economic growth and encouraging foreign corporate investment: “Without it the economy would regress,” says the JFC.

Designed to modernise the country’s infrastructure backbone, the Build, Build, Build programme has been budgeted at US$160-180bn over 2017 to 2022 and, along with education, is a major priority for the Duterte administration. Indeed, the government believes the programme can help push annual economic growth over the next few years to 7-8%, well above analyst expectations.

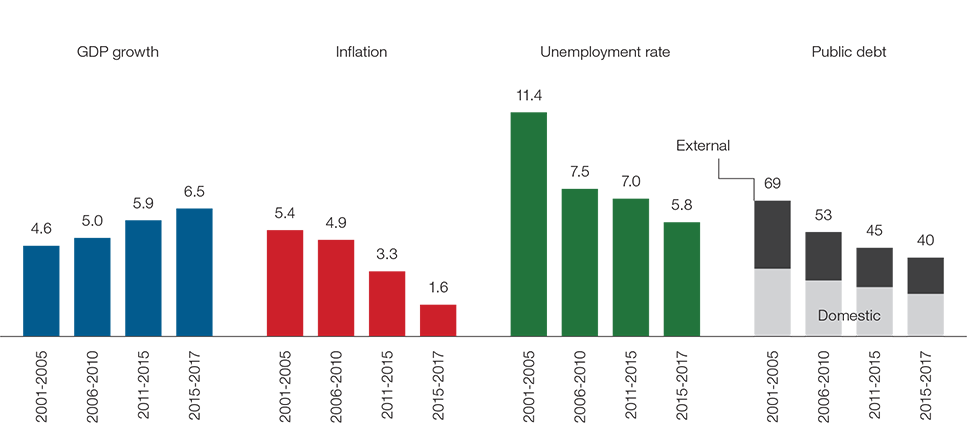

Source: Haver Analytics, Philippines, Department of Finance; and IMF staff

The infrastructure programme features 75 flagship projects, including six airports, nine railways, three bus rapid transits, 32 roads and bridges and four seaports to help bring down the costs of production, improve rural incomes, encourage countryside investments, make the movement of goods and people more efficient, and create more jobs.

The enormous scheme also includes four new energy facilities to help ensure stable power supply at lower prices; ten water resource and irrigation systems to help raise agricultural output; and five flood control facilities that will help protect vulnerable communities against the impact of climate change.

Such is the scale of the Build, Build, Build programme that Fitch Solutions, the research arm of Fitch Ratings, sees it driving growth of 10.9% for the Philippines’ construction sector in 2019. As well as the healthy project pipeline, the growth will be aided by rising foreign direct investments in the sector, says Fitch Solutions. The growth in FDI inflows into construction are being supported by the administration’s efforts to ease ownership restrictions for foreign contractors in selected construction projects from 25% to 40%. Fitch believes such efforts to attract foreign capital will have long-term benefits for the country in terms of plugging the financing gap in its transport sector.

Japan has historically been one of the Philippines’ largest sources of foreign direct investment but Fitch Solutions expects that going forwards more Chinese capital will flow into the country to support the growth of its overall infrastructure sector.

Elsewhere, the JFC sees opportunities for the Philippines manufacturing sector to emerge from the US-China trade dispute, as companies divert investment or relocate facilities to other countries to avoid the fallout from the spat. To ensure the Philippines is attractive to such companies and beats off competition from elsewhere across South East Asia, the administration should offer “a menu of tax incentives that compensate for the country’s currently lagging basic infrastructure”.

The Philippines would also benefit considerably by broadening access to foreign markets, says the JFC. It urges the administration to continue talks with the European Union aimed at securing a free trade agreement and begin negotiations to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). It would also like to see the Philippines secure a trade and investment agreement with the US.

The potential, additional boost for the Philippine economy from the Build, Build, Build programme and access to foreign markets on favourable terms are clearly enormous but for the short term the JFC is “hopeful that with continued politico-economic and regulatory stability, 2019 will be a year of more high growth, tempering inflation, and high FDI for the Philippines”.

Ranking demotion rankles

More broadly, the JFC is keen to see a rapid improvement in the Philippines’ international competitive rankings, including the World Bank’s Ease of Doing Business rankings. The bank’s assessment of the Philippines for 2018 saw the country improve its score slightly but its rank slipped, as welcomed reforms by the Duterte administration, such as streamlining transactions and strengthening shareholder rights to better protect minority stakeholders, were offset by a drop in “Getting Credit” metrics, increased layers for import inspection and higher tax registration costs.

The World Bank’s Doing Business 2019 report ended up ranking the Philippines at 124th out of the 190 economies tracked, down 11 places from 113th in 2017. The demotion in rankings, however, deeply rankled the Philippine government, with the Department of Finance and the Department of Trade and Industry expressing “strong objections” to the bank’s assessment and methodology. They insisted the bank’s report, published in October 2018, was inaccurate, as it did not take into account a larger dataset in gauging individuals’ and firms’ access to credit and demanded a correction.

The fallout appears to have had little impact on institutional assessments of the country’s outlook and investment credentials, however. Like the OECD and IMF, Citi too is upbeat on growth prospects for the Philippines, predicting 6.5% in 2019 as inflation declines to moderate levels. “Household consumption remains supported by overseas remittances and wage growth. Fiscal spending is expected to remain strong, especially with a good pipeline of infrastructure projects, while more memoranda of understanding signed with Japan and China suggest further improvement of economic ties and sustained momentum of the government’s Build, Build, Build infrastructure plan,” says Nalin Chutchotitham, Thailand and Philippines economist at Citi Research.

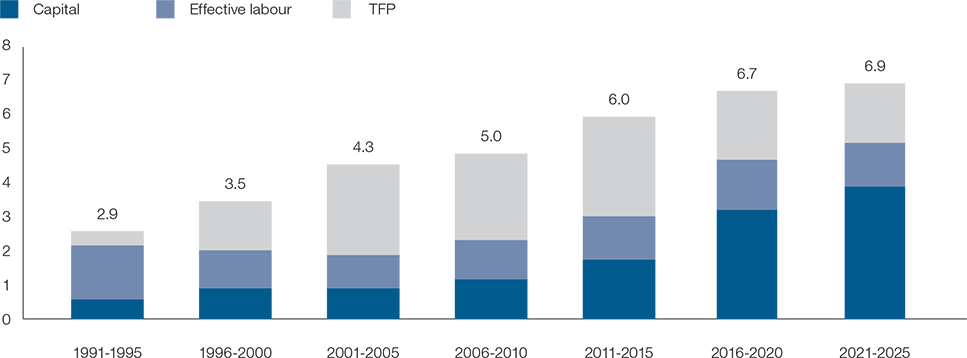

The Philippines: potential GDP growth

(In percent, adjusted for inflation)

Source: Barro and Lee (2016) Educational Attainment Data set and IMF staff estimates

Singapore’s United Overseas Bank expects growth of the Philippine economy to hold up at 6.5% in 2019 compared to 2018’s 6.2%. Domestic demand remains the key growth engine, anchored by the sizeable infrastructure and education spending programmes, it says. HSBC’s Chief Market Strategist for Asia, Cheuk Wan Fan, meanwhile, is less bullish and sees GDP moderating to 6% this year, which it describes as still “relatively resilient” and in line with the synchronised global slowdown scenario that is taking shape.

And in January Moody’s reiterated its “Baa2” rating, a peg above minimum investment grade, with a “stable” outlook. The ratings agency expects growth to top 6% this year and points to the country’s reserve buffers, among the strongest in global emerging markets, as among its positive features.

Young country

Another major factor driving both domestic economic dynamics and foreign corporate investment interest is the highly supportive labour market. According to the United Nations, the population of the Philippines, where poverty has been declining over recent years but is still very high, stands at 107m and the country boasts a median age of just 24 years. The huge, relatively young population, coupled with bright economic prospects and the mammoth infrastructure programme, is proving very attractive to corporates.

In February, Jean Francois Laval, Airbus Executive Vice President for Sales in Asia, hailed the economic performance of the Philippines, citing the positive outlook and population growth as major factors that are now making the country the best place to invest in Asia as far as the aviation industry is concerned.

Airbus is forecasting that air traffic growth over the next 20 years in the Philippines will be 6.1% per annum, primarily driven by domestic traffic as its population swells to 135m by 2037, outpacing the aircraft maker’s traffic growth forecast for Asia overall. Such metrics place the Philippines at the forefront of aviation, Laval said.

As if on cue, ANA Holdings, the parent firm of Japan’s biggest airline, All Nippon Airways, announced in January it is acquiring a minority stake in the country’s largest airline, Philippine Airlines, for US$95m.

Other sectors to have enjoyed positive investment news recently include energy, with Indonesian oil and natural gas company Pertamina announcing it is planning to invest US$1bn in a regasification hub project in the country. In November 2018, private US-based commodities giant Cargill revealed it will be spending US$235m in the Philippines over the next two years to expand its animal feed and nutrition business and poultry processing operation. At the country level, China was the top foreign investor in the Philippines over 2018, funnelling US$930m into the country, with funds focused on manufacturing and agricultural sectors.