There is something else at issue here. During the corona years, consumers shifted their spending patterns from services to goods. This is why higher inventory levels were required in the goods sector, certainly when all manner of supply lines – especially computer chips – were disrupted.

During this period, prices of goods – and food – rose exceedingly rapidly. The situation has since changed drastically, with consumers spending as much on services as they used to. Also, most supply lines for goods have been restored. This is why there are too many rather than too few stocks of goods at this point.

By far the most important supplier of manufactured goods is China. The current inventory correction is therefore hitting the country hard. However, there are all sorts of other factors that are slowing down economic growth in China:

-

China is starting to be faced with a shrinking workforce and a declining population.

-

Debts in China have risen enormously. Total debt/GDP ratios are currently around 300%. If they exceed 270%, this is generally regarded as a highly risky situation. This means that Beijing is not keen to provide the economy with fiscal and/or monetary stimulus.

A deflationary spiral

At this point, there is a risk that a self-sustaining deflationary spiral will be triggered in China as a result of declining commodity and house prices, high debt and declining economic growth.

Beijing will therefore have to make the very difficult choice of whether to provide renewed fiscal and monetary stimulus or unleash a deflationary spiral.

A number of other factors also play a role here:

-

The excessive rise in debt has mainly been due to massive speculation in property – both by consumers and governments. How useful is it to inflate this balloon even further if one knows that, one way or another, air will have to escape from the balloon at some point?

-

President Xi Jinping has repeatedly shown that he does not have much economic insight. He would rather teach the speculators a lesson and curtail the influence of the private sector while increasing the role of the Chinese Communist Party in the economy. This is why, according to his instructions, a great deal of time will have to be spent on re-educating the Chinese by teaching them far more of his values.

-

Increasing Western sanctions against China are not helpful either, as is the pressure on Western companies to reduce their dependence on China by reallocating some of their supply chains to other countries.

As a result of all this, China is once again starting to exert downward pressure on prices in the West due to the following factors:

-

Lower import prices in the West, because Chinese manufacturers are looking to boost sales and the Chinese yuan has declined in value.

-

Less increase or even a decline in commodity prices. Indeed, China is a major consumer of commodities.

-

Europe and many Asian countries export a great deal to China. This is becoming increasingly difficult now. Incidentally, the US is less affected by this, as US imports from China are very high, but exports are fairly low.

Most analysts assume that there will be sufficient monetary and/or fiscal stimulus to prevent an economic crisis, but not enough to avoid lower growth and downward pressure on prices. In other words, for Western central banks, but especially for the ECB, this will provide additional support in the fight against inflation. They even have to monitor China closely to prevent the country from plunging itself and, with it, the whole world, into an economic crisis.

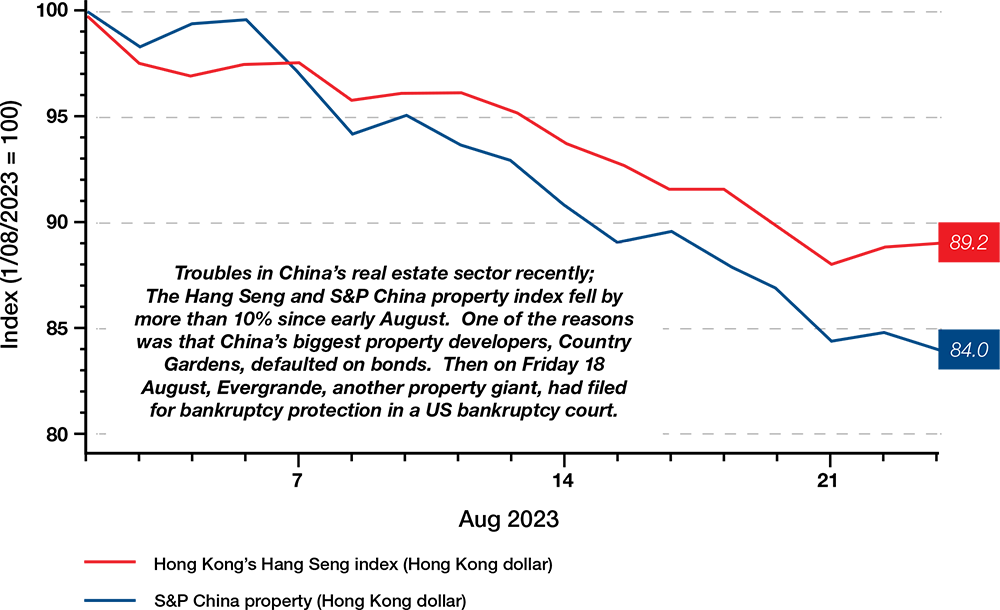

Chart 1: Early warning signals of an accelerating property crisis in China?

Source: Refinitiv Datastream/ECR Research

The Chinese yuan

Amid all the challenges the Chinese government and economy are facing, a weaker currency would be helpful to support the struggling export sector. The yuan has already weakened quite considerably in the summer months, due to increasing interest rate differentials and an outflow of foreign capital.

However, a weaker yuan also comes with some caveats. First, China is a major importer of commodities, which are priced in dollars. A weaker yuan will push up import prices, negative impacting the purchasing power of an already hesitant consumer. Second, China would like to weaken the role of the dollar as the worlds reserve currency, while increasing the role of the yuan as a reserve currency. There are a number of preconditions for the yuan to become a dominant reserve currency, one of them is the yuan becoming a strong and stable currency.

It therefore seems best to keep USD/CNH around 7.30 as far as possible for the time being. Given our outlook for EUR/USD, this means that EUR/CNH will gradually decline from around 7.90 to around 7.60. However, as soon as a recession erupts in the US, the yuan can be pulled down with the dollar and the rate may far exceed 8.00.