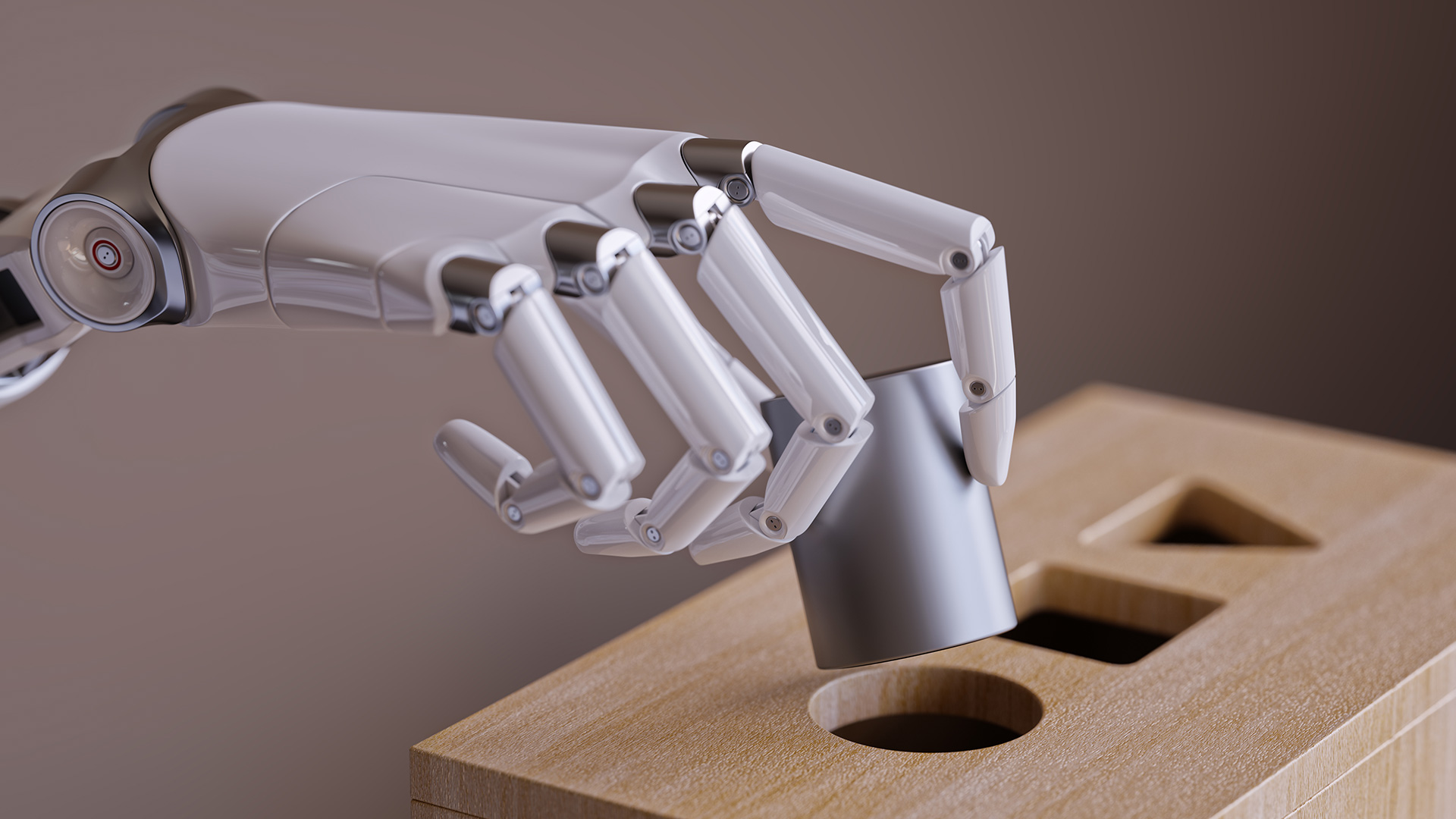

It’s talked about a lot but many treasurers are yet to get to grips with what artificial intelligence (AI) really means for them in a professional capacity. We asked SAP’s expert for his view on an AI future.

Treasurers are increasingly being asked to ‘do more with less’. Treasurers are also taking on the role of strategic partner to the business. There’s a bit of a gap here, as many practitioners will have noticed. But how can it be filled? AI might provide an answer.

The opportunity to hand over certain processes to intelligent automated solutions, based on the assumption that such a setup can deliver greater efficiencies at lower cost, has been part of the FX traders’ world for some time, notes Dr Arif Esa, SAP Director of Treasury Management, SAP. It has also been seized upon in some shared services centres where, for example, reconciliations can be automatically managed by business rules-driven solutions.

When applied directly to treasury tasks, Esa says it is now possible to see diverse scenarios such as intelligent FX trading based on liquidity needs, intelligent cash application based on bank statements, and intelligent pre-payment fraud screening. But for him, intelligent systems could deliver so much more.

Predicting the future

Based on historical data and analysis of payment behaviours, AI could be used to predict when a payment will be received. “If they know the time of payment, treasurers have the possibility to improve the accuracy of their cash forecasts and therefore their working capital management,” says Esa. The benefits to the wider business, including improved supply-chain finance, more timely funding and liquidity decisions, he says are “immense”.

If outgoing payments can be automated too, based on intelligent analysis of incoming invoices, payment channel optimisation, then the efficiencies are amplified says Esa. In global trade too, where huge numbers of documents flow back and forth between stakeholders, he suggests that the use of blockchain combined with AI could accelerate the approval process, reducing risk and improving the flow, and thus profitability, of trade itself.

Furthermore, Esa believes there is scope for intelligent FX hedging, using process automation. If AI can be used to provide treasurers with a simulation such as ‘cash flow at risk’, in alignment with treasury’s hedging policy, it would be possible to automatically determine the net open exposures, sending hedging requests to the trading platform and executing deals accordingly.

No more treasurer?

All these ideas are currently being investigated. Should they come to fruition, surely the role of the treasurer looks increasingly redundant? Not so, states Esa. “Is it possible to automate leadership? I don’t think so.”

Gartner predicted back in 2015 that by 2018, 45% of the fastest-growing companies would have fewer employees than instances of smart machines. The accuracy of this projection is not yet known but what is certain, says Esa, is that many jobs will have to change as the adoption of technology increases and businesses strive to become what SAP refers to as the “intelligent enterprise”. In this model, companies connect internally, giving visibility and agility across the board, using all their data assets effectively. This is the perfect environment in which AI can flourish.

AI has been in use in a business context for some years now, most applications intended to make the user’s life easier, says Esa. In a treasury context, he believes AI will not replace jobs as long as treasurers adjust the way they work.

In a modern treasury, where personnel numbers are already minimal and ‘more with less’ is the common aim, he argues that the profession must now use technology such as AI to enable a stronger focus on becoming the strategic partner to the business. After all, computers are not yet capable of delivering the kind of insight and expert judgement that the skilled professional is able to contribute.