UPS Capital teams up with Payoneer to entice more businesses to trade overseas.

There has never been a better time for businesses to begin trading overseas. It can provide an unrivalled opportunity to tap into new revenue streams and grow the business. However, the increased risk created by trading overseas often dissuades organisations from taking this step.

UPS Capital, the financial arm of global logistics leader UPS, has sought to address this issue with its new B2B secure payments solution. Launched in partnership with online money transfer and eCommerce payment service provider Payoneer, the solution looks to enable businesses to expand overseas with confidence. It does this by reducing the payment risk they face when working with unknown customers in far-flung markets.

Trading overseas

The proliferation of internet access worldwide, and the subsequent growth of eCommerce, means that it is easier than ever for organisations to reach new customers overseas. Companies are realising this opportunity. As a study last year by UPS indicates, exporting is vital for SMEs who are looking to expand and boost revenue.

Despite the desire to trade overseas, and the increased opportunity to do so, many organisations are still stopping short of taking this step. This is mainly because of the increased complexity and the risk it exposes the business to.

One big issue is the risk of non-payment. Indeed, a recent survey conducted by Payoneer found that this was a reason for 75% of SMEs turning down international business.

“There is a lot that can go wrong when trading overseas,” says Dave Zamsky, VP Marketing at UPS Capital. “And because of this, SMEs often lack the confidence to do business overseas and miss numerous opportunities to grow the business.”

Solving the problem

It is mitigating the risk of non-payment and giving companies the confidence to trade overseas, that is behind UPS Capital’s B2B secure payments solution.

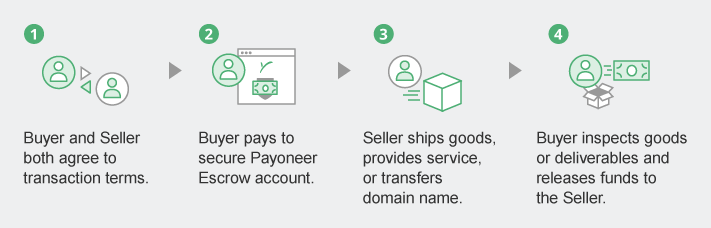

The solution is simple, notes Zamsky. “The buyer and seller sign up for the service and agree to the transaction terms for the trade,” he says. “The buyer then places the funds for the goods into Escrow, which is visible to the supplier.” At this point the supplier will ship the goods. “Then, once the goods are delivered and the buyer is happy, the payment is released from Escrow to the supplier.”

Aside from giving peace of mind and confidence to both parties in the trade, the solution provides additional benefits. “The buyer and seller can make and receive payment through whichever payment rail they wish. There is no need to change processes or set up new banking relationships,” says Zamsky. “Payoneer also handles all of the KYC and AML checks removing this burdensome task for our clients.”

How Payoneer Escrow works

Changing of the guard?

UPS Capital’s solution is another example of how disruptive forces are creating competition for the more traditional banks. “Traditional trade risk mitigation solutions, like letters of credit, are antiquated and do not meet the needs of business today,” claims Zamsky. “We are offering solutions that are relevant to our clients today.”