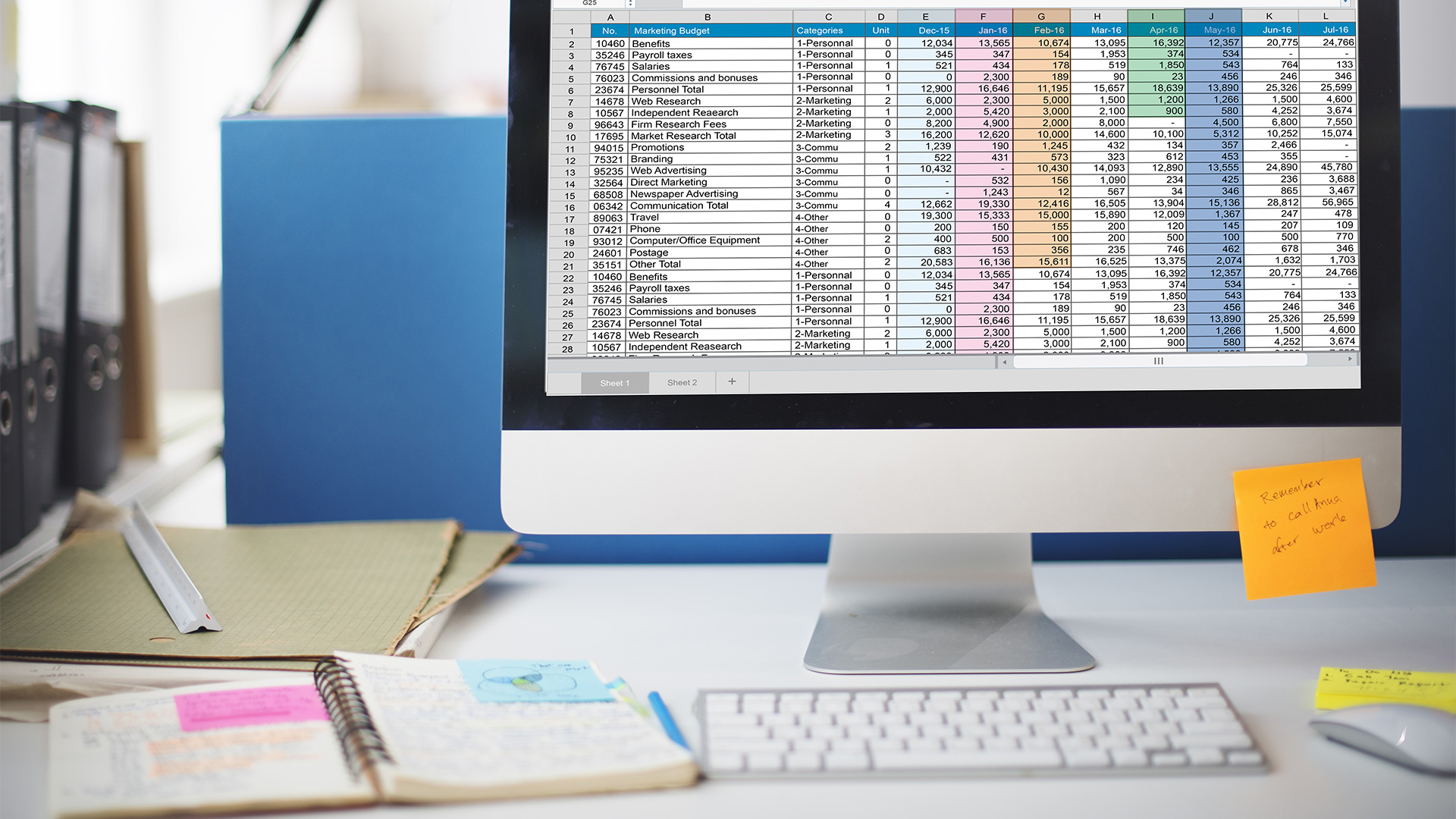

Technology firms have all the answers when it comes to meeting the needs of treasurers. And yet many still resort to their dependable spreadsheets. Why?

The trusty spreadsheet is beginning to succumb to the digital age. It feels increasingly outdated, even slowing business processes down, and is no longer compatible with holding business-critical data in a modern organisation. This is the conclusion of a report commissioned by financial technology company, AccessPay, that sought the views of 100 global treasurers and finance professionals about their current take on the matter.

‘Calling time on the spreadsheet: the 2018 Finance & Treasury Automation Adoption Report’ shows that global treasurers and finance professionals are amongst the most ardent users of spreadsheets but believes that they are “beginning to file them away for good, moving in increasing numbers towards automation”.

However, uptake of automation is still very much a work in progress, despite the availability of suitable technologies.

“The extent to which legacy systems are slowing down business was clear from the research,” comments AccessPay CEO, Anish Kapoor. With over 80% of global treasurers saying they experience delays in obtaining cash data, and only 19.1% having access to real-time visibility, he feels “this is neither acceptable nor necessary with the innovations that are available on the market today”.

If the need is there and the technology available, what’s the problem?

Dependency

A sample of both global treasurers and finance professionals were asked how dependent their teams were on spreadsheets. They were asked to score their response from 0 (not dependent at all) to ten (extremely dependent). The average score between the two groups was six.

Whilst respondents are no longer fully dependent on spreadsheets, they remain central to certain tasks. After all, they are familiar and dependable tools in the right hands.

Technologies that are being used by global treasurers and finance professionals include, unsurprisingly, online banking portals, with 73% of global treasurers and 79% of finance professionals reporting use of them across their teams.

ERP systems also have a solid uptake, with 69% of global treasurers and 56% of finance professionals accessing such integrated technologies. However, of global treasurers, less than half (44%) surveyed said they were using a treasury management system (TMS).

The report assumes that either treasurers are not aware that niche systems exist or that they are deemed too costly or complex to implement.

Drivers

Amongst global treasurers and finance professionals, delays in obtaining cash data, and the processes involved in balance sheet reporting are cited as major hold-ups. Over 80% of global treasurers experience delays in obtaining cash data, and just 19% have access to real-time cash visibility. Yet the report shows that only around a third of both groups have automated balance-sheet reporting.

With over half of the respondents from each group believing that their legacy systems were slowing down progress, adoption of automation appears to be out of step with demand.

The main barriers to implementation reported were cost, a lack of internal knowledge and expertise to work with such technologies, and lack of resources.

The report concludes that although finance and treasury professionals believe that technology could be a major boost for them, due to certain negative perceptions (mainly of cost and user-friendliness), they continue to rely on spreadsheets for fundamental tasks such as forecasting and balance sheet data compilation.

Education and proof

“We are still confronted with certain barriers to wholesale adoption of technological alternatives to legacy systems,” notes Kapoor with uncommon candour. “The key to increasing adoption of automation technologies lies in education and working to change attitudes. It is up to the fintech community to educate businesses, not just to the existence of these technologies, but to their affordability and ease of use.”

If technology firms wish to see a greater uptake of their products, it is incumbent upon them to educate their market. Above all, they need to demonstrate that their technologies will make the job of global treasurers and finance professionals easier, allowing them to focus more on adding value to their organisations. It’s a business case in-waiting.