Deloitte’s biennial Global Corporate Treasury Survey studies the global treasury community to understand the challenges, mandates, use of technology and the new opportunities and solutions that they offer. We asked the firm’s Global Treasury Lead to dig deeper into the results.

Treasurers feel they need to help their organisations improve the bottom line and need technology to succeed says Deloitte’s 2019 Global Corporate Treasury Survey, published recently. The survey quizzed treasurers from over 200 companies on matters such as:

-

What challenges and mandates are treasurers facing?

-

What is the current use of Treasury Management Systems (TMS)?

-

What new technologies are available to treasurers?

-

To what extent have treasurers utilised opportunities and solutions that new technologies offer?

Surprising results

Melissa Cameron, Global Treasury Lead at Deloitte, found herself “pleasantly surprised” by some of the results from this year’s survey. The percentage of participants that now believe contributing to the bottom line performance nearly doubled from 15% in 2017 to 27% in 2019. Cameron notes that most respondents weren’t thinking about proprietary trading, but instead about how they help their businesses improve bottom line performance – linking this to the 84% of respondents who said they have a mandate to be a strategic adviser to the business.

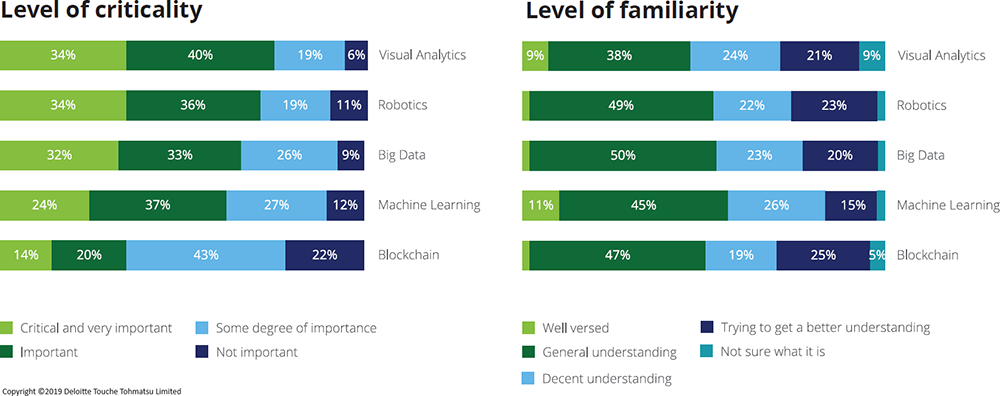

However, Cameron expressed disappointment in the percentage of companies that have not yet adopted leading technology. Only 6% deemed visual analytics ‘not important’ to treasury functions, 94% believing it to be ‘critical or very important’, ‘important’, or of ‘some degree of importance’, yet only 47% are using it. Part of the reason for lower adoption is only 9% consider themselves “well versed” in visual analytics.

Similarly, just 11% believed robotics process automation (RPA) was not important but almost none said they were well versed, and 49% said they had a ‘general understanding’.

Treasuries need to become well versed in these topics if they’re going to adopt them, she warns. “I think this is one of the reasons why we haven’t seen the adoption levels that we’re typically seeing across other parts of finance, but it strikes me that treasury is lagging other parts of finance when it comes to use of both visualisation and RPA as an example.”

Case for blockchain

For blockchain specifically, the survey found that 34% thought it was critical, very important or important, and yet a negligible amount is well versed, and only 8% have ‘a whole dedicated team or a few in-house experts’. Seventy eight percent simply aren’t using blockchain technology at all. Cameron believes that the most compelling use cases for blockchain are those where there are global distribution and third-party vendors. Treasury will follow in certain circumstances.

“The question was very much targeted on ‘are you using it in treasury?’ and this is why we had the drop-off,” she says. She continues: “I think a lot of treasuries get confused about bitcoin and blockchain. You can do blockchain without adopting bitcoin.” One case for that is inter-company transactions. “In situations where there are multiple ERPs and transfer pricing is not embedded in those ERPs, then tools like blockchain can be used,” she explains.

Treasury trailing

Part of the reason treasury is lagging behind on using technologies like visual analytics is the headcount of the treasury teams, according to Cameron. “They might be 15 people or less, in fact a lot of them might be five to ten people in the treasury department,” she says.

Another key reason for the lack of adoption is that many third-party provided treasury management systems (TMS) don’t necessarily have a strong visualisation overlay. “Where the TMS vendors are able to offer more of this within their tools, I think that would be an easier path for most within the profession,” she adds. “That is something that you have to do in addition to your TMS, and for many companies even getting a TMS is a big deal.” Indeed, implementing a TMS can be a six-figure cost for some companies and many outside of treasury don’t realise the extent of this.

Surprisingly, under the ‘strategic challenges’ section of the survey, 47% of those with a TMS stated that their treasury systems infrastructure is inadequate. Yet, says Cameron, they haven’t adopted the tools to actually make it sufficient. “I think there’s more investment required overall to get this done,” she adds.

The case for more tech

Cameron says there are several ways that treasuries can make the business case to get more technology. “One is that they need to have a good relationship with their IT organisations and be inquisitive about where the company is broadly going around these topics,” she says. Treasurers need to be proactive with making the case for technology, explaining what it is and does, how it would be beneficial, and then passing that on to either internal or third-party IT consultants to help build them.

Organisations failing to progress will simply become less relevant, warns Cameron. “When other companies have better information, they make better decisions.” Some 34% of the survey’s respondents cited ‘digital disruption’ as a strategic challenge for the businesses they work for. In an increasingly technological world this is only going to become more of an issue. “For companies that are being affected by digital disruption, they can either lift their game or get disrupted,” she says. “When approximately a third of companies are saying that digital disruption is happening, all parts of the organisation need to think about how they can do things differently.”