When it comes to defining an interest rate risk management policy, a large number of choices have to be made. A new corporate financial risk management handbook aims to explain the options. Treasury Today reviews.

How can a balance be struck between formalising specific risk management parameters to protect the company against unauthorised use of derivatives, whilst not tying the hands of the treasury department at the same time?

It’s one of the many imponderables that a new Handbook of Corporate Financial Risk Management – 2nd edition aims to answer. Written by BNP Paribas’ Head of Risk Management Advisory, Stanley Myint and Head of Global Markets Corporate Sales, Fabrice Famery, it explores a range of corporate risks in some depth.

The section on interest rate risk management policy in particular offers treasurers a view of current best practice. In defining the scope of any interest rate risk management policy, the authors explain that companies have a choice on how far forward to look in terms of expected debt and cash position. That choice, they say, is similar to the choice on the currency side between hedging only the contractual foreign cashflows or also the forecast ones.

In fact, the two choices (on the FX and interest rate sides) are clearly linked, since forecast foreign cash flows impact the forecast amount of debt and cash. The major difference is that contractual liabilities on the interest rate side are normally much longer in duration than on the currency side.

For instance, a company that has issued a ten-year fixed coupon bond can decide to swap it to floating much more easily since the bond is likely to stay in place for the next ten years. Very few companies have the same level of certainty about their foreign currency cashflows. Most companies define the scope of interest rate policy as their current exposures, and some also look to pre-hedging future debt issuance.

Approaches to risk management

We can broadly divide approaches to risk management into three groups:

- Conservative (roughly 30% of companies) – low level of risk appetite. The main aim is to avoid possible losses due to market fluctuation through a total hedging of the exposure.

- Opportunistic (around 10% of companies) – material level of risk appetite. The main aim is to outperform market levels by actively managing positions.

- Dynamic (around 60% of companies) – a compromise between conservative and dynamic approaches, it involves an intermediate level of risk appetite. The objective is not to exclusively minimise the impact of unfavourable market movements, but also to benefit from positive variable changes while minimising the overall risk and the cost of such strategies. This approach requires dynamic management focussed on constant market trend monitoring, which allows the capture of market opportunities by partial repositioning of a hedging portfolio. Instruments used include interest-rate or FX options.

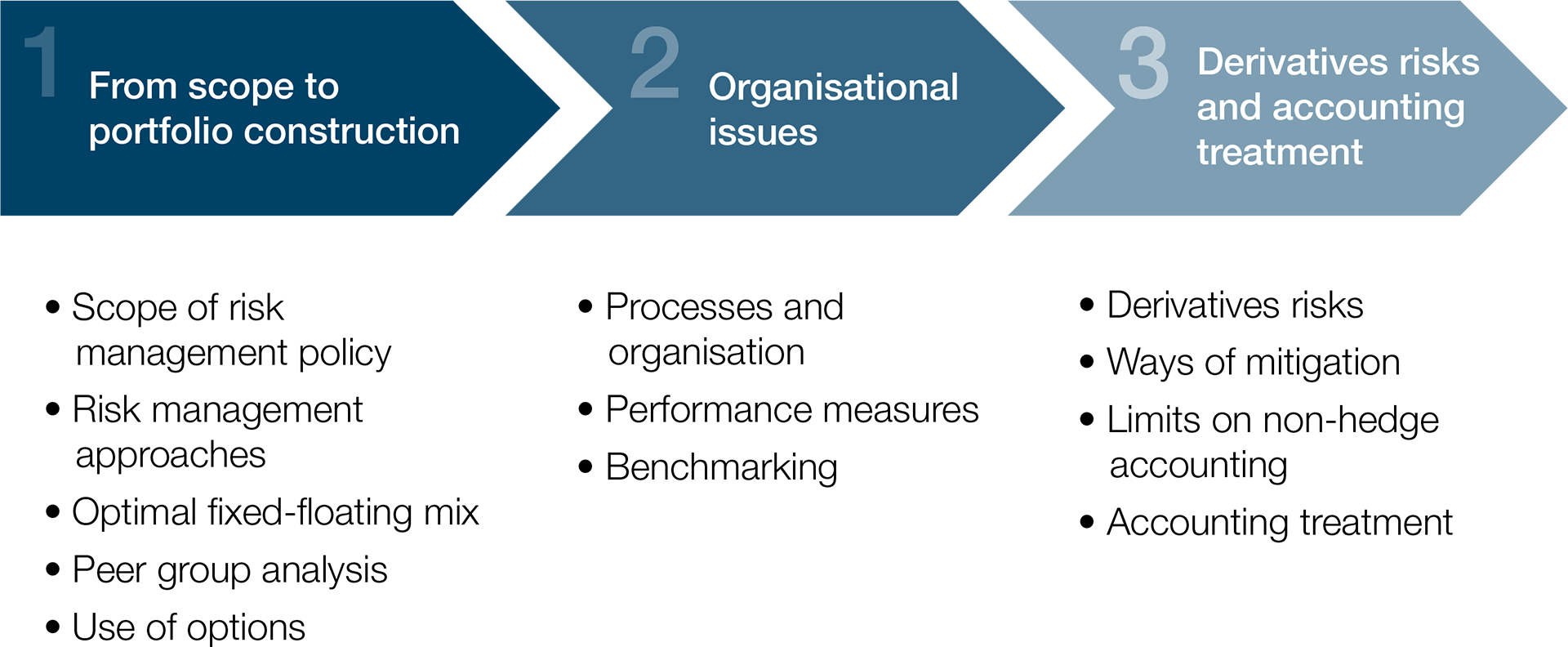

Towards the optimal liability structure: step by step

Once you have decided on your approach to interest rate risk, the next step is to create a hedging portfolio with a composition that would best satisfy risk management objectives. A typical interest rate risk management policy can also be split into three elements:

- Fixed debt (eg bonds of various maturities).

- Floating debt, with coupons linked to Libor or Euribor (eg loans or floating rate notes, FRNs, of various maturities).

- Cash and short-term deposits, which are all floating.

Determining the optimal mix

When determining the fixed-floating mix, it is necessary to define precisely the part of the overall debt to which the required proportion applies. However, determining the optimal mix is complex. In general it can be reached separately for each of the main debt currencies, based on two considerations.

The first are the expected benefits in terms of interest rate saving realised by swapping from fixed to floating or by changing duration from long-dated fixed to short-dated fixed. The second is the additional amount of interest rate risk from such an operation (including the impact of netting debt against the cash positions).

In determining the benefits and risk, treasury should take into consideration account market variables, ie current and forecast short and long interest rates and their volatility, and how these compare to history.

Peer group analysis can also play a role in this process, because most European and North American companies report their fixed-floating mix in annual reports. However, it is an oversimplification because it ignores duration (a one year bond is not the same as a 30 year one), it ignores currency composition and it ignores other derivative strategies (for example caps or collars).

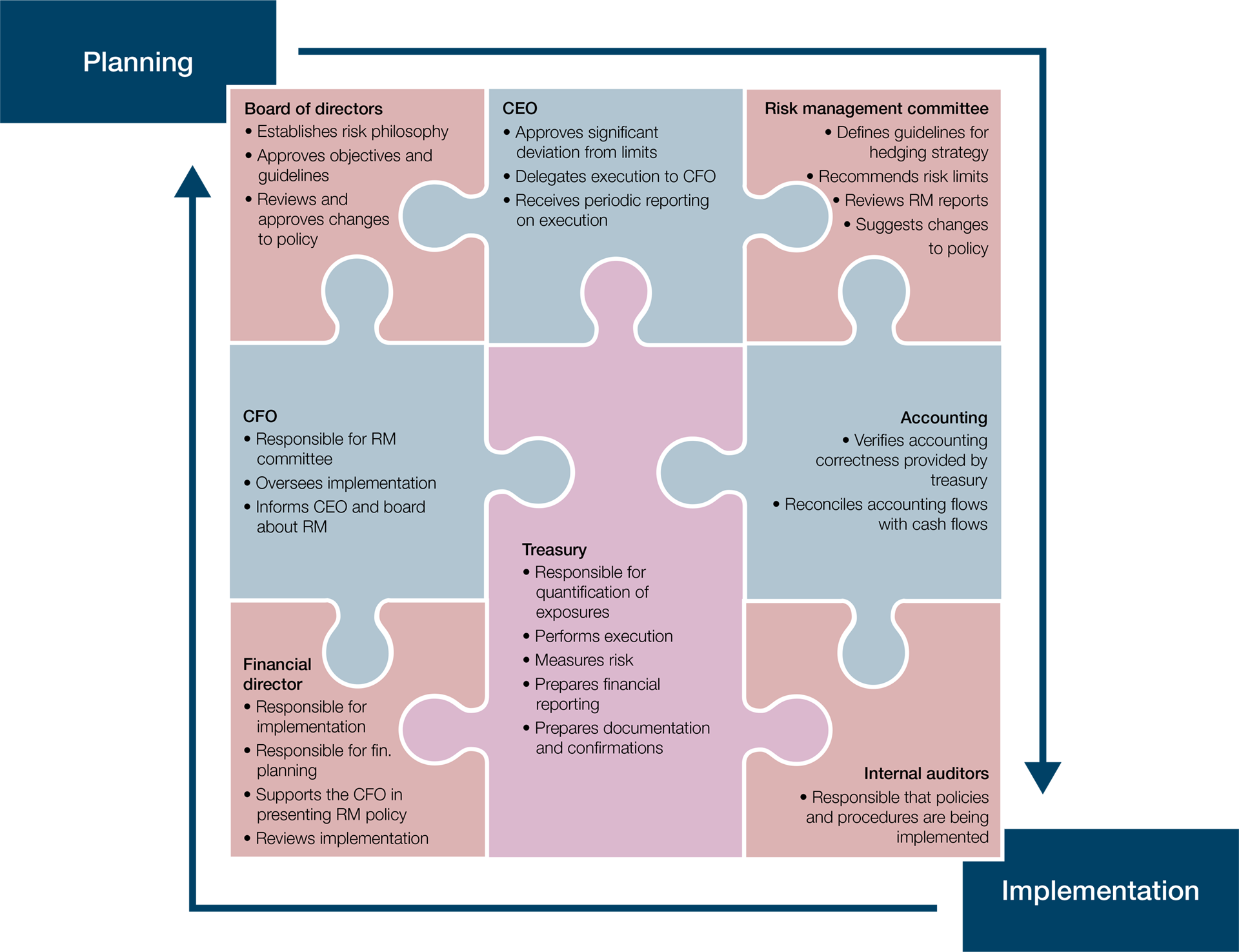

Risk management roles and responsibilities

Derivative risks

Finally, the use of derivatives comes with additional risks:

- Valuation – the risk of changes in the level of derivative prices due to changes in interest rates, FX rates, commodity prices.

- Liquidity – the risk linked to the changes in the ability to sell or novate derivatives.

- Counterparty – the risk that a counterparty will not settle an obligation for full value when due.

- Settlement – a form of counterparty risk involving both credit risk and liquidity risk.

To mitigate these risks, derivatives used by a company must be easy to price and measure, easy to unwind, liquid in the sizes needed and have an acceptable worst-case scenario. Treasury should therefore work closely with the internal accounting team to understand the implications of various hedging strategies. This is particularly important for interest rate derivatives, since they are normally longer dated than other hedges and therefore the potential accounting implications can be more significant.

Most multinational companies have in place an interest rate risk management policy that is well-established and has withstood the test of time. Occasionally companies may decide to review and update this policy, so consult banking partners, consultants and sometimes friendly peers from other sectors. No one-size interest rate risk management policy fits allbut if you recognise the limitations of policy implementation and the views of management, you’ll at least find one that fits you.