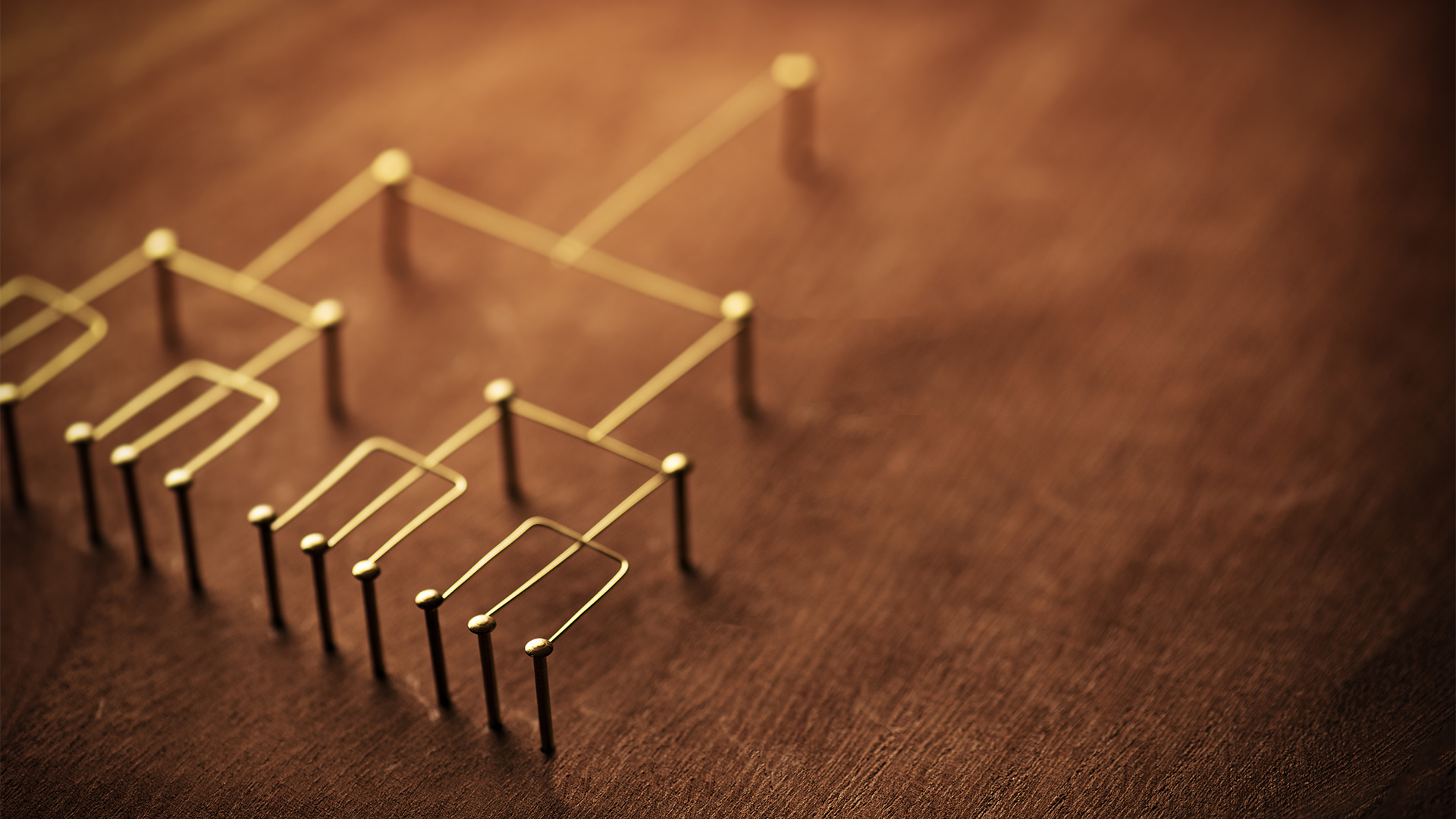

For many larger companies that have grown by acquisition, a complex and unwieldy structure is something that they have to work around. It need not be like this. A Corporate Structure Simplification exercise can free up the business to do what it does best.

For many companies, the idea of a streamlined structure that is both easier to operate and explain is something worth aspiring to. In a recent Treasury Today Corporate View article we heard from the Assistant Group Treasurer at RELX Group how this vast business had undergone a recent “simplification” exercise and how it was now the better for it on many levels.

But there are many more businesses that have grown through acquisition into immense empires of sometimes seemingly unconnected entities. This is where process and financial inefficiencies and increased risk can lurk.

“It’s not uncommon for an organisation to have hundreds of companies in its structure,” said Eddie Bines, Director at global advisory firm, Duff & Phelps. Writing in a piece in the Global Banking & Finance Review, he added that “even when these companies no longer serve an obvious purpose, groups often retain them, leaving them ‘as-is’, rather than toying with the status quo”.

By keeping these entities, Bines argues, firms are not only exposing themselves to additional costs and risks, it can also hinder the progress of more pressing strategic initiatives. It is his belief that Corporate Structure Simplification (CSS) is a project that is demanding attention now within many medium to large businesses, “either on its own, or as a component of wider strategic transformation/reorganisation initiatives”.

A well-managed CSS exercise can be used to eliminate the unnecessary entities, manage the risks, and to create a generally leaner enterprise. For investors, financiers, employees and other stakeholders, this means transparency and understanding.

CSS should be undertaken as part of a long-term entity management programme, to ensure regular reviews and clear-outs. There are no hard and fast rules as to when CSS is needed but, said Bines, “if you can’t describe your own corporate structure internally, if it doesn’t match your organisational culture of transparency, if it takes up a whole wall in your office or if your employees are facing and raising day-to-day challenges caused by the complexity, those are some of the signs”.

Benefits

The CSS process, in essence, is about “identifying and mapping where everything is, getting rid of unnecessary clutter and putting things where you want them”. But is it worth the effort? Bines lists what he believes to be the key benefits:

- Reduced audit, tax, regulatory and other compliance costs.

- Reduced internal costs associated with maintaining unnecessary entities – executive, finance, legal, company secretarial and human resources will all benefit from focusing on core activities.

- Mitigation of corporate risk and director personal risk associated with compliance failings, fading or lost corporate memory and potential contingent liabilities.

- Improved governance and transparency (and therefore reduced impact of disclosure requirements and corporate governance reform) – increasingly valuable in a world that is demanding it, with legislation and guidance changing to improve it.

- Resolution of issues resulting from unnecessary complexity such as tax inefficiency and dividend blocks.

- Releasing capital tied up in balance sheets of individual entities.

- Restricted scope and cost of future improvement and transformation efforts.

- Synergies achieved through the alignment of the entity structure with operational activities.

For the treasury and finance function, Bines believes CSS can help “promote good corporate governance, as well as release capital, increase corporate efficiency, and reduce the financial and administrative burden faced by many businesses”. It has to start somewhere but is treasury ready to make a clean sweep in 2019?