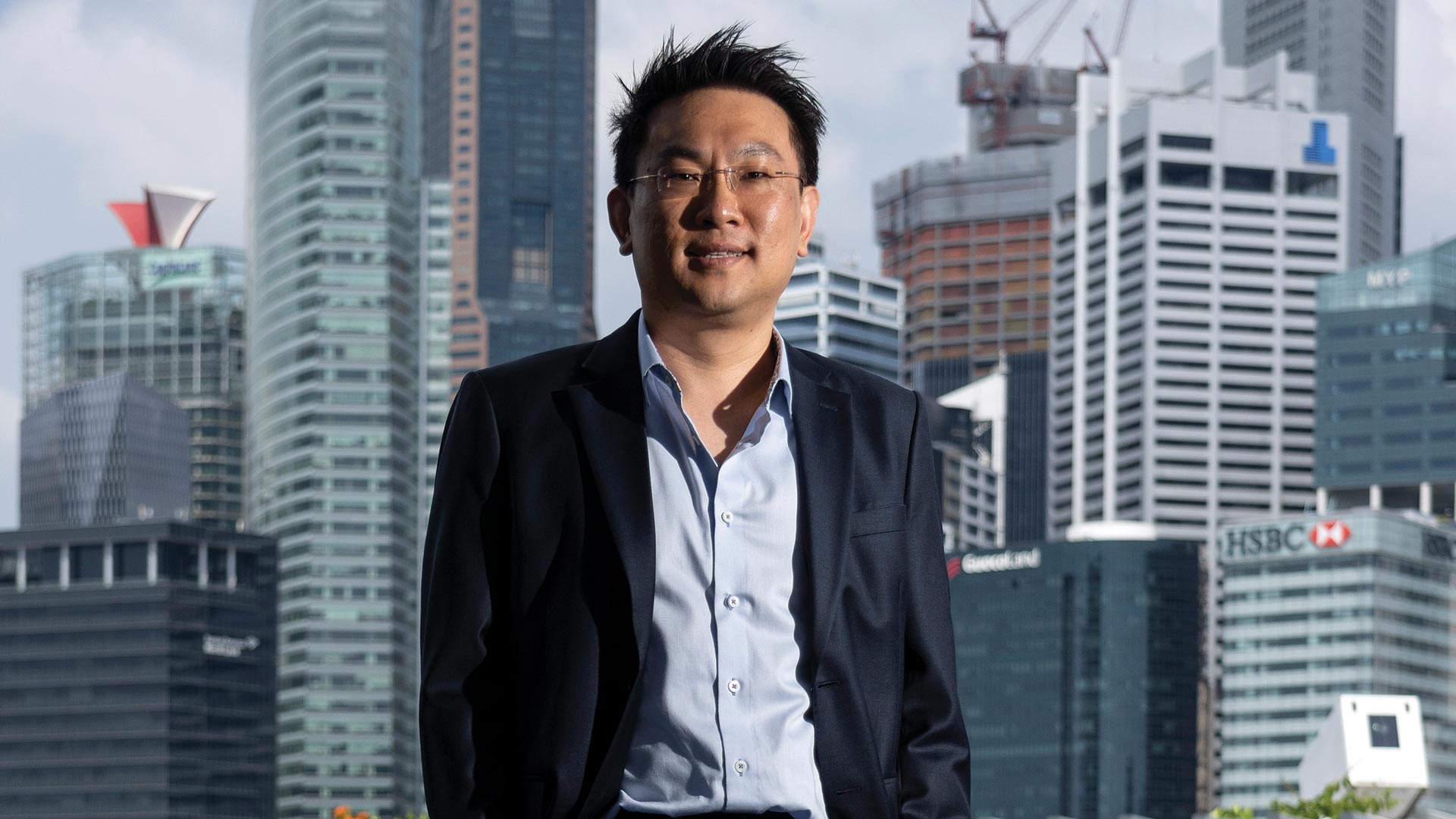

Headquartered in Singapore, JERA Global Markets (JERAGM) was established to consolidate the global trading activities of thermal coal and liquified natural gas (LNG) between JERA and Électricité de France (EDF). Working to optimise the treasury processes and ensure an efficient and successful treasury department, is Siang Chee Chew, Head of Treasury.

Tell us how you came to your current role

I’ve worked in treasury for my whole career, and I kind of fell into it by accident. When I graduated in 2003/2004, the economy wasn’t doing especially well. Like many fresh graduates at the time, my preference was to work for a bank. Since the banks were not really hiring, I ended up joining the treasury of shipping firm BW Group.

I was there for four years and then moved on to Cargill, first as an FX trader, then as a Treasury Advisor. I had a front row seat for the 2008 global financial crisis, I saw how liquidity dried up, how funding between banks dried up, and how the Australian commercial paper market dried up. Observing how the senior treasurers in the firm reacted to these challenges taught me that strong liquidity management ensures survival in tumultuous periods, and I carried this understanding through to my later roles.

I went on to be the Asia Treasurer at Mercuria Energy Trading S.A., where I had the opportunity to actually set up an Asia Treasury. I was involved in setting up regional liquidity structures and long-term funding for the group in Asia, and I managed in excess of 30-40 banking relationships. I had to understand what each bank was looking for and how to work with numerous banks. That was fairly early on in my career, and it helped significantly in terms of completing my profile as a treasurer.

In 2016, I took a break from the corporate world and worked as an independent consultant. That gave me the experience of doing business without a big corporate brand backing me. I then joined JERAGM in 2017, with the primary goal of establishing a treasury and trade finance function.

What would you say have been the most valuable lessons you have learnt in your career to date?

Aside from learning that strong liquidity management is key to survival, after witnessing the global financial crisis and then the oil price crash in 2014/2015, a key lesson I learned was the importance of banking relationships. During the oil crash, I diversified banking relationships to focus on more regional banks, which were relatively less exposed to commodity markets and understood Asia better.

The recent decrease in globalisation and the growing trend towards protectionism and nationalism is only adding complexity to doing business. Asia is not only a big market, but it’s also very diverse in terms of its regulatory and legal environments, and it makes doing business more difficult comparted to ten-15 years ago. Because of this, the ‘one size fits all’ banking solution simply doesn’t work anymore.

For example, large international banks are reporting poorer results and are taking a step back from the international market. Various European banks, in particular, are cutting their presence in the international market and focusing on their home countries, and then more local and regional banks are stepping up to fill some of these spaces. Are these banks definitely going to fill the shoes of the big international banks? Perhaps not. It just means that we have to work with local and regional banks much more, as well as leveraging on the benefits that international banks can offer the business.

What personal skills does a successful treasury professional need?

Treasury professionals must be inquisitive to ensure a successful career. Treasury is so diverse and it’s important to work at understanding both the business and the competition. As treasury professionals, we need to be versatile, we need to be resourceful, and we need to have intellectual curiosity to understand what’s going on within the firm.

Across all the roles I’ve had, I’ve found that you need to have a genuine interest in the world economy and the financial markets – and more indirectly, in the inner workings of the systems. That means looking at risk management systems and the accounting systems; asking how risk is being managed and how the middle office assesses those risks. This interest is what allows treasurers to gain insight into how best approach a range of tasks.

The full version of this interview will be available in the May/June edition of Treasury Today Asia.