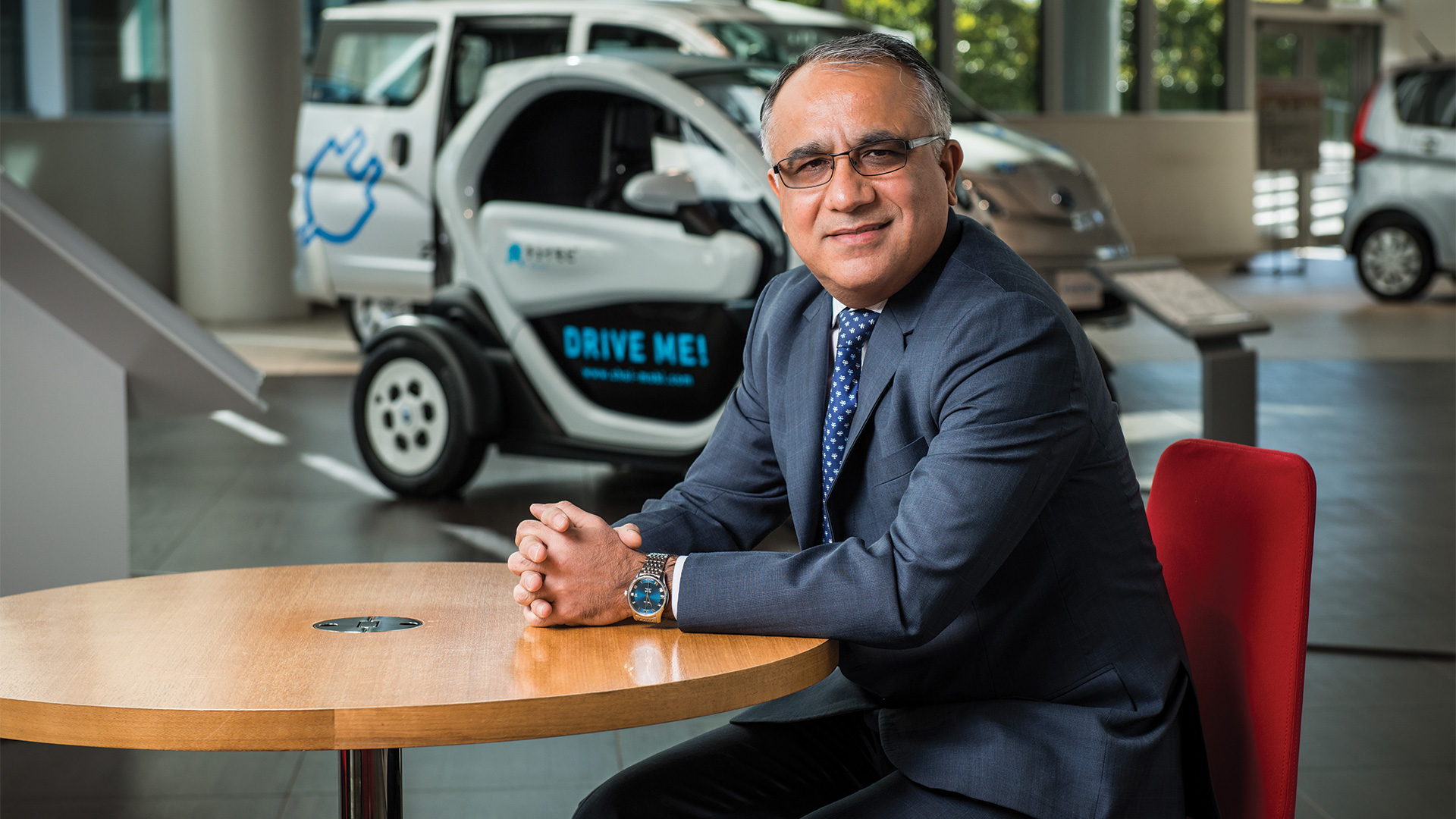

Rakesh Kochhar has been working in treasury in Japan for a decade. He tells Treasury Insights what this experience has been like and why more treasurers should consider a spell working in the land of the rising sun.

Why is Nissan’s global treasury function in Japan?

No matter what the business, treasury should be where the headquarters are. The job of the global treasury function is to be strategic and part of the management committee making decisions around risk management and M&A, you cannot do this if you are not sitting where the decisions are made.

For our business, global treasury being in Japan has other advantages when it comes to banking relationships. This is because the Japanese banks, which form a large part of our banking syndicate, value having face to face relationships with clients.

What is it like managing a global treasury function from Yokohama, Japan? How does it compare to when you have worked in other regions?

I have led treasury teams in the United States and Singapore and I really do not see much difference between managing treasury from these locations and Japan.

Japan has all the components required to make an excellent global treasury centre location. There is lots of good talent available, there is great technology available and all the major banks are present in the country.

In fact, in some cases, it is easier to run treasury in Japan, especially in comparison to the United States. For example, we use Asset-Backed Securities (ABS) as one of the main sources of funding. In Japan, I can complete a transaction in ten days. In the US, it takes 30 days minimum because of various reporting that must be completed.

Why haven’t all Japanese companies set up similar structures?

There is an imbalance in the level of treasury sophistication amongst Japan Inc. with many departments still very operationally focused and senior management is yet to see the value a strategic treasury department can add. This is often down to the way that Japanese companies have developed, with many taking a very decentralised approach to business. There has also been a lack of openness towards global best practice, which has also led to this phenomenon.

As a result, you often find many companies outsourcing their treasury function to their banking partners. This is clearly not ideal as there is a big conflict of interests being created. It is also hampering the broader development of the treasury function in Japan.

Nissan is quite unique in this respect. We have a multicultural senior leadership team that has brought in global best practices in various functions including treasury and across the business. As a result, we operate much like any other multinational, whilst remaining true to our Japanese heritage.

What impact is digitisation having in Japan?

Japan has always been ahead of the curve when it comes to technology. I remember when I first arrived here ten years ago people were using NFC payments with their phones to pay for train tickets, which was streets ahead of how people were behaving in the US. This continues today and Japan remains at the forefront of innovation, especially in the automobile industry.

From a treasury and finance perspective, lots is happening to upgrade the infrastructure in Japan. The big banks are also very keen to explore new technologies like blockchain and cryptocurrencies. There perhaps is not as much noise being made here when compared to Singapore, for example, but there is lots happening.

What would you say to any treasury professionals with the opportunity to come and work in Japan?

Do it. It is a fantastic place to live for me and my family. There is lots to do and it is incredibly safe.

From a professional point of view, it can provide a unique and rewarding challenge. In fact, I am surprised there are not more treasurers from overseas working in Japan already. But as the country begins to open further to immigration I expect more to come and help boost the status of the profession in the country.

Last week, Treasury Insights reported on how many Japanese companies are looking to establish a global treasury centre in Japan. Find out why.