As we near the US Federal Reserve’s terminal rate, treasurers should rethink their cash investment strategy.

Kyongsoo Noh, CFA

Portfolio Manager for Managed Reserves Portfolios, Global Liquidity

J.P. Morgan Asset Management

Even though the Federal Reserve (Fed) has indicated there will be no more tightening of policy for the foreseeable future, the effective fed funds rate, which targets the overnight level that banks charge each other for loans, has edged up to within just a few basis points of the top of the target range.

It’s a state of affairs that for Kyongsoo Noh, Portfolio Manager for Managed Reserves Portfolios, Global Liquidity, J.P. Morgan Asset Management means we are near the Fed’s terminal rate. And being so close to the end of the monetary tightening cycle requires investors to begin reorienting their investment strategy and consider adding duration.

Every economic cycle is different but there are a number of factors to consider for late cycle investment, the timing of the downturn being among them. Noh anticipates it could materialise in late 2020 or 2021 so investors still have some time to act. However, while they do not need to be at maximum duration today, Noh believes investors should have more duration in their portfolios now than they did last year when the Fed was raising interest rates more aggressively.

Explaining further why investors have some time to act on duration before the next downturn, Noh first points out that in 2018 US GDP growth was about 2.8%, well above US trend growth of 2%. This above trend growth was due to a sizeable fiscal stimulus package implemented last year: “The stimulus is still in effect this year and while its effects are unlikely to be as strong as last year, it still means growth will probably be slightly above trend, maybe 2.25%. As such, the economic expansion in the US should remain intact for this year.”

Volatility is another issue to consider. After a turbulent 2018, volatility has eased considerably; with factors such as the Fed’s dramatic turn from hawkish last December to dovish just a month later and progress on the US-China trade talks, as being responsible for the decrease in overall volatility. Volatility is likely to remain low in the near term, but Noh believes investors could see volatility pick up again towards the fourth quarter as year-end effects take hold.

One way to add some downside protection to portfolio returns during volatile periods is to buy more government bonds. As part of their late cycle investment strategy, ultra-short investors in USD portfolios should, over time, consider gaining more exposure to US treasuries: “They serve to lengthen duration of portfolios, are always liquid, and are important diversifiers against credit holdings.”

In the past when the Fed was raising rates more swiftly, Noh was focused on buying one-year treasuries but with the Fed near the terminal rate, he is looking to buy, going forwards, longer maturities, even out to two to three years.

With respect to credit risk, Noh favours financial corporate bonds, and particularly bank paper: “As a direct result of the financial crisis, regulatory pressure has encouraged banks to deleverage their balance sheets and reduce risk taking. The upshot today is a much stronger global banking system than before the crisis.

“On the other hand, in the years that followed the financial crisis, we have seen US industrials take advantage of near zero interest rates and increase their leverage. That does not mean we should avoid US industrial corporates altogether, but it does mean that the sector warrants some caution.”

Put cash in its place

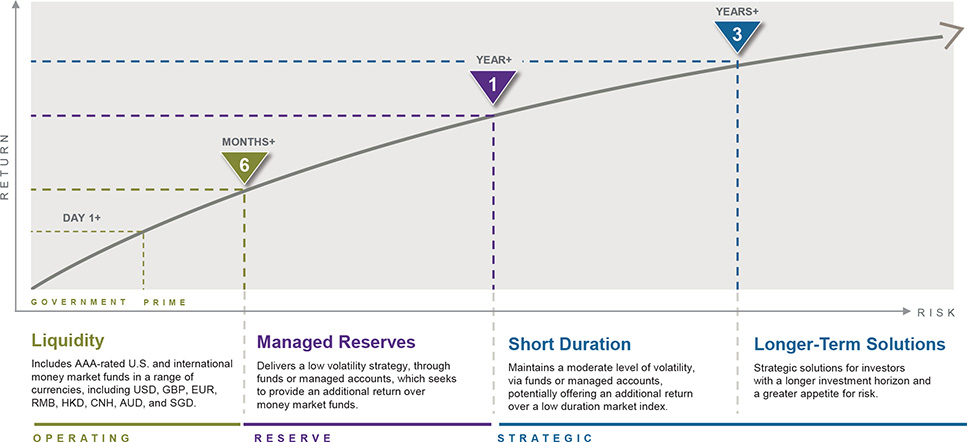

In considering the broad framework for late cycle portfolios and adding duration, cash segmentation is key. The idea here is that investors can deploy risk into their portfolios more efficiently if they segment cash by the need to call on it. So, there will be cash treasurers need on a daily basis (operating cash); cash that might be called on once or twice a year (reserve cash); and cash required only once every one to two years (strategic cash).

Noh explains that by segmenting cash into these various “buckets”, increased duration risk can be taken with the longer-term cash. “One of the things we’ve seen our clients do is that with operational cash, they’ll often go for deposits and/or money market funds. With the once or twice a year cash they can implement ultra-short fixed income strategy. And for longer-term cash, we see some corporate treasurers investing into a short duration strategy.”

A wide range of investment vehicles can be leveraged for cash segmentation, ranging from money market funds to bond funds and, in some cases, exchange-traded funds. While investors may view allocation differently depending on their appetite for risk, Noh says the most important thing for treasurers in implementing cash segmentation “is to ensure they have a robust investment policy that allows for different investment types and different vehicles”.

Exhibit 1: Investment strategy per cash segment