With negative rates, increasingly scarce liquidity in the money markets and regulatory upheaval in both Europe and the US, these are very challenging times for the corporate investor. In this article, Bea Rodriguez, Managing Director, Co-Head of International Cash Management and Chief Investment Officer for the Sterling and Euro Cash team at BlackRock describes how the liquidity management environment for corporates is changing, and outlines some of the alternative investment opportunities now being explored as a consequence.

Bea Rodriguez

Managing Director, Co-Head of International Cash Management and Chief Investment Officer for the Sterling and Euro Cash team

How would you describe the liquidity management environment for corporates at the present time?

‘Challenging’ is the word most of our clients are using to describe it. In any other historical period, a negative money market environment would probably have led to the vanishing or the ‘gumming up’ of that market completely. What negative rates tend to do is take out liquidity in an extreme way and collapse flow. What’s different this time around is that we are undergoing enormous change in regulatory architecture with Basel III which is dislocating money from banks and setting money in motion. It is this new dynamic which also means that negative rates may not only be a feature of currencies with negative deposit rates and we are still discovering the new steady state for money markets in general.

How are treasurers responding to these new realities? Is there a need for treasurers to evolve their investment policies in order to adjust to these new realities?

We were in close dialogue with our corporate client base as the market headed into negative territory and, while it is certainly not very palatable from their perspective, there is an understanding amongst most clients that this is just where rates are at the moment.

What is interesting is that we are starting to see a little bit of disparity amongst our investor base in terms of the response. The responses range from those of some larger corporates, who are accepting the situation and still see capital preservation as their primary investment objective, to others that are really trying to offset the negative impact and using this as an opportunity to segregate their cash a little bit more. Then we have those who are spending more to reduce the amount of cash they are holding. It’s not a natural thing to accept dealing with a negative for your cash – whether that is your own cash or your company’s – it just doesn’t sit well. As a result, it has even prompted some of our investors to look at taking on more risk and given the volatility we currently have in the market this needs to be very carefully considered.

We do think that the new investment realities treasurers are now facing mean that a more flexible approach within policies, or the ability to review them more often, will be required as we go through the next couple of years. A lot of corporates currently take an annualised approach to reviewing their investment policies, but that might not be enough. They need to be having dialogue with their boards around this changing landscape and really work out what the right policy is for them. Preservation of principal should remain the priority, though, because one of our biggest concerns at the moment is that the environment is pushing investors to take on too much additional unnecessary risk.

What in your view is the best strategy for corporate investors at the moment with respect to yield?

Our advice to treasurers is to be very wary of stretching for yield because we think that the risk is asymmetric. Even with the ongoing support of the European Central Bank (ECB) there are many scenarios out there that could throw the market; we have seen a number of such incidents over the past year. Moreover, the volatility attached to these events may be much higher now than it has been in the past. I think conditions will get more challenging from here, not less. Therefore, from a high level perspective, investors need to understand that from here the upside to investing is much harder to achieve than the downside.

The yield environment has spurred some interest in other types of investment products: separately managed accounts being one example. Interest in these products is not driven purely by the desire to offset negative yield though; for many, capital preservation is still the core of that strategy. Overall, corporates are realising they need to become far better and more targeted at segmenting their cash and finding ways to make it work that little bit harder. Unfortunately, the reality of the environment we are in today is that even if you are doing that, in euros you will probably still end up with a negative yield. It is a really difficult hurdle to get over.

Trading liquidity has been on a downward trajectory in recent years. What impact is this having on the short-term investment environment for corporates?

The issue of liquidity is absolutely front and centre, in every sense. In recent years it has been draining away from the banks and, as asset managers, we are going to have to hunt it in new places. I think BlackRock is perfectly positioned to leverage our counterparty base and access that balance sheet which we absolutely need in order to invest in these short-term markets. On the credit side, the changing regulation regimes in each country means investors are going to have to really understand where they rank in terms of seniority: deposits and certificates of deposit (CDs) may in some countries be higher than unsecured commercial paper (CP). Treasurers absolutely need to understand the intricacies around that hierarchy.

Be very wary of stretching for yield because we think that the risk is asymmetric.

In the current negative yield environment, the lack of liquidity is becoming especially pronounced. When the money fund peer group went negative earlier this year – we were one of the bigger providers to go negative at the beginning of April – it was interesting because not all securities were trading with the same liquidity. Government securities traded on both bid and offer. In the credit market, in CP and CDs, the bid-offer spread started to widen whilst MMFs teetered at the zero yield level. Credit was offered at negative, but not bid at negative. It was an interesting dynamic and it took the gross yield on the peer group going negative for it to change. The bid-offer spread in credit is still wider than on the sovereign side in money markets.

For a MMF, it means that you have got to be thinking about raising the quality of your portfolio in order to maintain liquidity without increasing your cost of trading. A negative rate environment by virtue of being inherently less liquid will tend to switch you from thinking in an active portfolio sense, to a more buy and hold stance and it is important for investors to understand this dynamic.

The regulatory environment is changing in the European MMF space. How do you see the reforms agreed earlier this year by the European Commission impacting the corporate investor? Will so-called low volatility (LVNAV) funds serve as a viable option for the corporate investor who is used to using stable NAV funds?

On the face of it, we think the proposed LVNAV will be more palatable for our corporate clients, it being much closer to the constant NAV (CNAV) funds many of them use today. Conceptually, it could deliver some of the key CNAV features that investors cherish such as same day liquidity, intraday liquidity and a stable net asset value. We remain somewhat sceptical, however, with respect to the detail of the regulation. How that is mapped out over the coming months will be crucial. At the moment, the proposal has a sunset clause in it, which we do not see as being particularly helpful. The technical and the operational build around creating a product that has the ability to switch to VNAV on a day’s notice is actually really complicated. It is expensive to create.

But if the sunset clause is not there, then where the trigger threshold is set will be the main determinant for the success of LVNAV. If that ends up at a reasonable place – and the industry is comfortable with Parliament’s proposed 20bps threshold – then this could be a really workable solution, one which will deliver some of the key features that our corporate investors like. Realistically, from an investment side, the tightness of the trigger threshold will obviously de-risk the proposition, because from a fund manager’s perspective there is no incentive to want to be hitting those thresholds, at any point, and the best way to avoid doing so is to de-risk the fund. That is effectively what will happen if the regulators impose a trigger materially south of 20bps.

There is still a long way to go on this debate, though. The European Parliament passed the framework for MMF regulation in April and now the next step is for the Council of Ministers to provide opinion and text. The Council is by no means bound by the Parliament’s text – the member states retain divergent views on some key issues. The Council’s review is unlikely to be completed through 2015 while the Presidency sits with Luxembourg, a strong MMF centre that may not be deemed wholly independent by the broader EU community. The Council Presidency will pass to the Netherlands in January 2016 and we anticipate the MMF regulatory debate to gather pace around that time. Only upon the Council completing their review can the Trilogue process begin, through which the Commission, Parliament and Council will agree on the final text. Throughout the next steps in the process much of the technical detail behind the framework will be resolved and an implementation timeframe agreed. As such it could be that we are at least two years away from anything happening.

How do you the see investment market developing for the corporate treasurer in the coming months and years?

One trend that we are already seeing a lot of in the post-Basel III environment is an increase in structured paper being offered. We are seeing more structured repo; more term repo; and we are seeing a lot more structured CP being offered. That’s existed in the past, of course, but there is more of it being issued.

Banks are looking for new and innovative ways of financing trade receivables for their high quality corporates too, which is also a form of structured product financing. But the thing with all of these structures is that they inherently have no liquidity attached to them. That means they can be a part of the solution, but they may not be an entire solution.

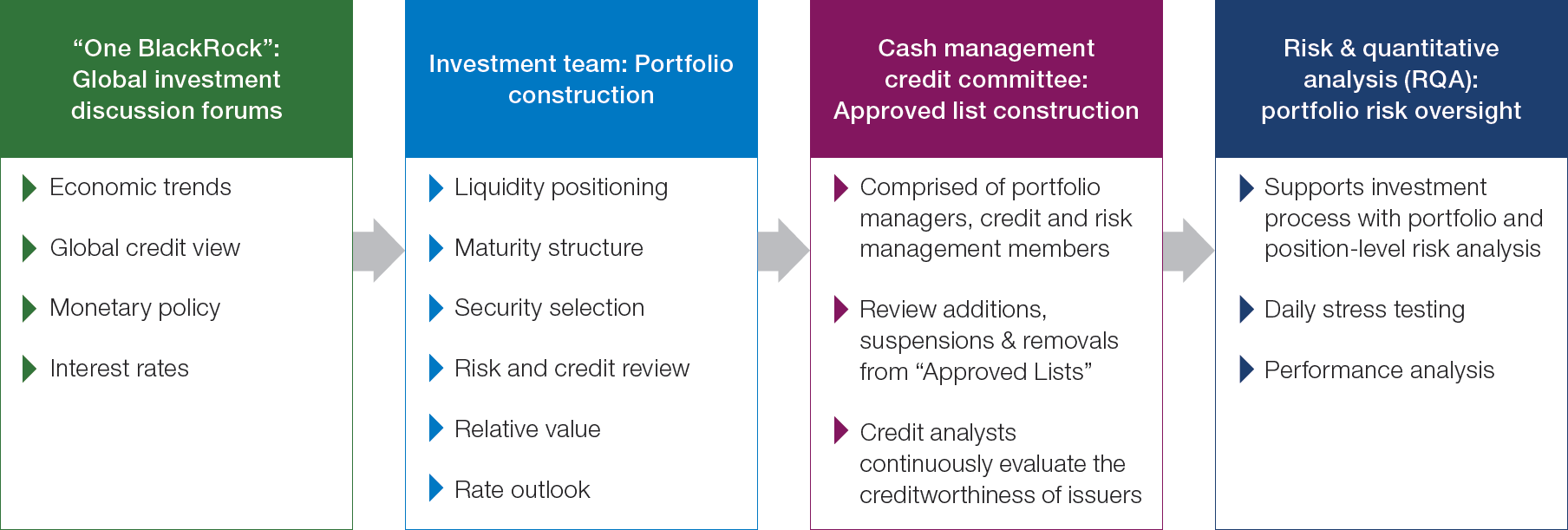

Corporates have been talking more about the different products they can access and, certainly with the larger corporates, looking closely at things like repo. We think that can work for some of our client base, but again, it all comes down to the ability to access liquidity. Corporates need to have a large amount of counterparties set-up, and need to take a flexible approach to the collateral that is accepted. They also need to be more flexible with respect to duration, operating in that favourable space for the banks that tends to be over the 90-day mark. Ultimately, the market is moving towards more of a ‘buy and hold’ stance. That means the credit piece is becoming an even more crucial part of the corporate investors’ strategy. Corporates will need to allocate more resources towards credit and those who do not have them should think about outsourcing to an investment manager with extensive resources and a highly disciplined process involving credit, risk and portfolio management (see Chart 1).

Chart 1: Liquidity investment process

Source: BlackRock

Disclaimer

This material is for distribution to Professional Clients (as defined by the FCA Rules) and Qualified Investors only and should not be relied upon by any other persons.

Issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: 020 7743 3000. Registered in England No. 2020394. For your protection telephone calls are usually recorded. BlackRock is a trading name of BlackRock Investment Management (UK) Limited.

Issued in the Netherlands by the Amsterdam branch office of BlackRock Investment Management (UK) Limited: Amstelplein 1, 1096 HA Amsterdam, Tel: 020 – 549 5200.

Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested. Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time.

Any research in this document has been procured and may have been acted on by BlackRock for its own purpose. The results of such research are being made available only incidentally. The views expressed do not constitute investment or any other advice and are subject to change. They do not necessarily reflect the views of any company in the BlackRock Group or any part thereof and no assurances are made as to their accuracy.

This document is for information purposes only and does not constitute an offer or invitation to anyone to invest in any BlackRock funds and has not been prepared in connection with any such offer.

© 2015 BlackRock, Inc. All Rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, iSHARES, BUILD ON BLACKROCK, SO WHAT DO I DO WITH MY MONEY and the stylized i logo are registered and unregistered trademarks of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners. TLS-0068