Applying ESG1 considerations to investing is perhaps more obvious when dealing with companies where pollution, health and safety and other issues can be tied to their activities and be tackled more easily. However, in money market investing too, it is valuable to scrutinise ESG standards when addressing, for example, climate change or the energy transition.

Thibault Malin

Money Market Investment Specialist

Here also, we implement our policy on responsible business conduct2. This follows UN guidelines as well as our own guiding principles around investable sectors and those excluded from our portfolios.

Admittedly, stringent rules can curb the range of eligible investment opportunities and affect portfolio yield, but we believe making a positive impact avoiding controversial practices is an important priority.

Responsible business conduct

Under our responsible business conduct policy, we exclude issuers such as tobacco or coal companies, even if that would limit – and it actually does – the returns that can be earned on the portfolio.

Per our coal policy, we exclude companies generating 10% or more of their revenues from thermal coal – even if they have interesting yields. We should note that across the broad money market investment universe, there are still about 3,000 issuers that qualify for the ESG category.

Excluding issuers with controversies, such as health problems in the case of tobacco or stranded assets in the case of oil and gas, represents sound risk avoidance. We should point out that issuers in these sectors might have reduced credit ratings affecting portfolio eligibility. Their issuance might be less liquid, and thus less attractive to us, given an investor reluctance to invest in such sectors.

ESG and SRI-labelled money market investing

Before we quantify the effect, we should clarify that our money market funds universe follows two approaches:

- Money market funds integrating ESG criteria.

- Money market funds using best-in-class selection (‘SRI-labelled funds’)3.

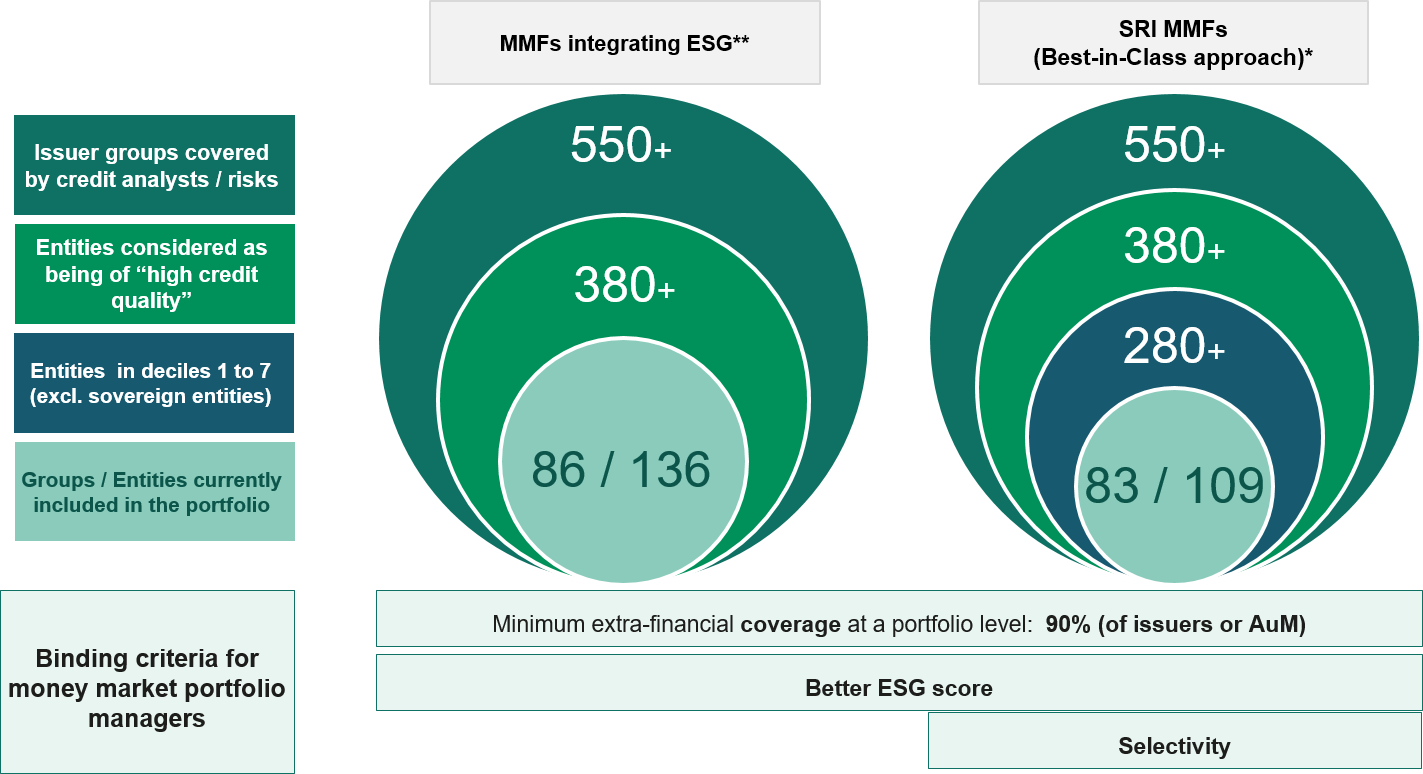

All our money market funds are classified as Article 8 under SFDR4, requiring a minimum extra-financial coverage at the portfolio level of 90% of issuers or the assets under management. They also target a better ESG score5 than that of their investment universe on a daily basis. Best-in-class funds have an added selection criterion: they exclude the 20% worst performers in terms of their ESG score.

What does that mean for the investment universe? For ESG money market funds, we have identified more than 550 issuers that are covered by in-house credit analysts. Some two-thirds – more than 380 – can be considered ‘high credit quality’ and are eligible for investment by all BNP Paribas Asset Management money market funds.

For SRI-labelled money market funds, the process chosen at BNP Paribas Asset Management involves the exclusion of issuers with a poor ESG score in each sector. That leaves 280 eligible issuers for SRI-labelled funds after excluding the ESG laggards (ie a reduction of about 100 issuers, or 25% on our internal buy-list). We have calculated the opportunity cost of this selectivity as being a negligible one basis point.

On top of this exclusion criterion, SRI-labelled funds aim to better the CO2 footprint and the gender diversity of their investment universe.

Exhibit 1: Money market investing – a two-pronged approach

Source: BNP Paribas Asset Management Money Market, Risk & Sustainability Centre as at 28 June 2022. For illustrative purposes only. *BNP Paribas Mois ISR taken as reference **BNP Paribas Money 3M taken as reference

Do no harm with ESG integration

This underscores our belief, as part of our sustainable investment approach, that ESG integration improves risk-adjusted returns, even if – as is the case for money market funds – there is a trade-off between the ESG score and the yield. A high ESG score means a lower yield, in most cases.

However, that stands to reason since a higher score reflects a lower risk, which means a higher credit rating on average. That in turn allows an issuer to borrow more cheaply in the market.

We have found that even with this inverse relationship, we have been able to earn yields that exceed those of the funds’ benchmarks, bringing home the point that ESG integration does not have to come at the expense of performance.

Transparency is key

We believe ESG integration6 creates value for clients, also when it comes to money market funds. Here too, we apply our stewardship philosophy7 through which we engage with issuers and seek to use our influence to advocate for a low-carbon, inclusive economy and encourage them to improve their practices. Out of the eligible corporate universe for money market funds we engaged with 80 issuers in 2021.

A key element is this approach to money market investing, and one that sets us apart, is being fully transparent on the exclusion policy and the thresholds set in our reporting to clients, on the quality and availability of data for our ESG analysis and scoring, on issuers’ ESG scores and how we act as stewards and engage with issuers.

Footnotes

- Related to environmental, social and governance issues

- Also see Responsible Business Conduct Policy at BNP Paribas Asset Management

- Socially responsible investing

- Also see SFDR – Understanding and implementing it – Investors’ Corner (bnpparibas-am.com)

- Also see ESG Scoring Framework at BNP Paribas Asset Management

- Also see ESG Integration Guidelines at BNP Paribas Asset Management

- Also see Stewardship Policy at BNP Paribas Asset Management

Disclaimer

For professional investors. BNP PARIBAS ASSET MANAGEMENT UK Limited, “the investment company”, is authorised and regulated by the Financial Conduct Authority. Registered in England No: 02474627, registered office: 5 Aldermanbury Square, London, England, EC2V 7BP, United Kingdom. This article has been prepared by the company. This article is produced for information purposes only and does not constitute: 1. an offer to buy nor a solicitation to sell, nor shall it form the basis of or be relied upon in connection with any contract or commitment whatsoever or 2. investment advice. Opinions included in this material constitute the judgment of the investment company at the time specified and may be subject to change without notice. The investment company is not obliged to update or alter the information or opinions contained within this material. Investors should consult their own legal and tax advisors in respect of legal, accounting, domicile and tax advice prior to investing in the financial instrument(s) in order to make an independent determination of the suitability and consequences of an investment therein, if permitted. Please note that different types of investments, if contained within this material, involve varying degrees of risk and there can be no assurance that any specific investment may either be suitable, appropriate or profitable for an investor’s investment portfolio. Given the economic and market risks, there can be no assurance that the financial instrument(s) will achieve its/their investment objectives. Returns may be affected by, amongst other things, investment strategies or objectives of the financial instrument(s) and material market and economic conditions, including interest rates, market terms and general market conditions. The different strategies applied to the financial instruments may have a significant effect on the results portrayed in this material. This article is directed only at person(s) who have professional experience in matters relating to investments (“relevant persons”). Any investment or investment activity to which this document relates is available only to and will be engaged in only with Professional Clients as defined in the rules of the Financial Conduct Authority. Any person who is not a relevant person should not act or rely on this article or any of its contents. All information referred to in the article is available on www.bnpparibas-am.com. As at June 2022.