Consumption patterns have been changing progressively over the last decade. The pandemic has accelerated the behavioural shift towards digital and online buying. Businesses of all sizes have adapted and become more digital to survive or, in some cases, to thrive. Currently, Asia alone represents more than 50% of global e-commerce transaction value, which according to the Worldpay FIS Global Payments Report 2021, is projected to exceed US$3.9trn by 2024.

Rupa Mankad

Asia Liquidity Product Solutions Head, Treasury and Trade Solutions

Digital commerce and real-time payments – business and revenue drivers

Retailers are focused on growing their share of direct-to-consumer sales by gaining first-hand information on customer preferences and omni-channel data insights. The ratio of digital commerce to total retail sales is becoming material and is expected to go over 20% of all retail sales worldwide by 2024 with Asian countries leading the way, according to Statista. Scaling up the digitisation of treasury and cash management will be the bedrock required to harness this e-commerce growth and support 24/7 always-on business models.

E-tailers are working to add new and localised mobile wallets and real-time payment methods to widen their digital customer base and grow their businesses. While doing so, there is a clear preference towards mobile and real-time payment methods vis-à-vis credit cards and cash on delivery payments.

This preference is driven primarily by traceability, instant settlement capabilities, and the elimination of interchange and charge back costs. However, for adoption of real-time payments to continue to increase at the same rate in the coming years, consumers will need to be lured by loyalty offerings and rewards programmes similar to credit cards. These could include value adds like Buy Now Pay Later (BNPL) to support customer credit needs, QR codes, and Request to Pay (R2P) for improved controls.

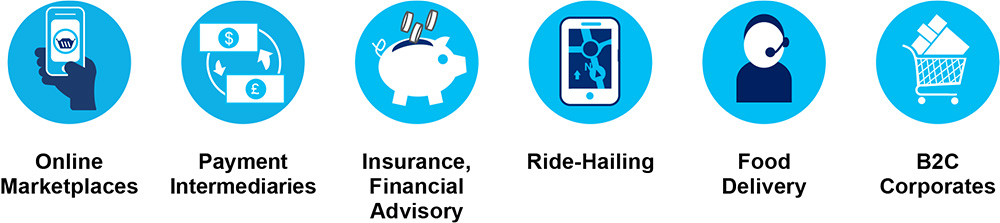

Industries leading real-time payment adoption

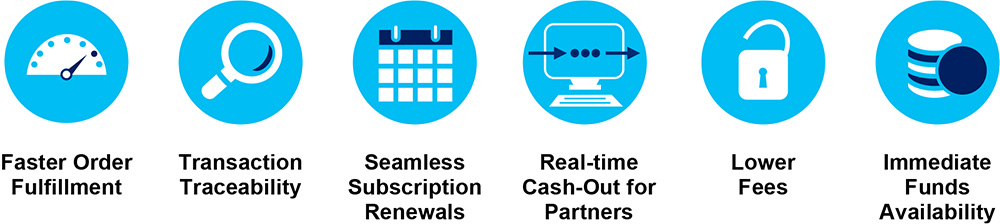

Efficiency gains from real-time payments

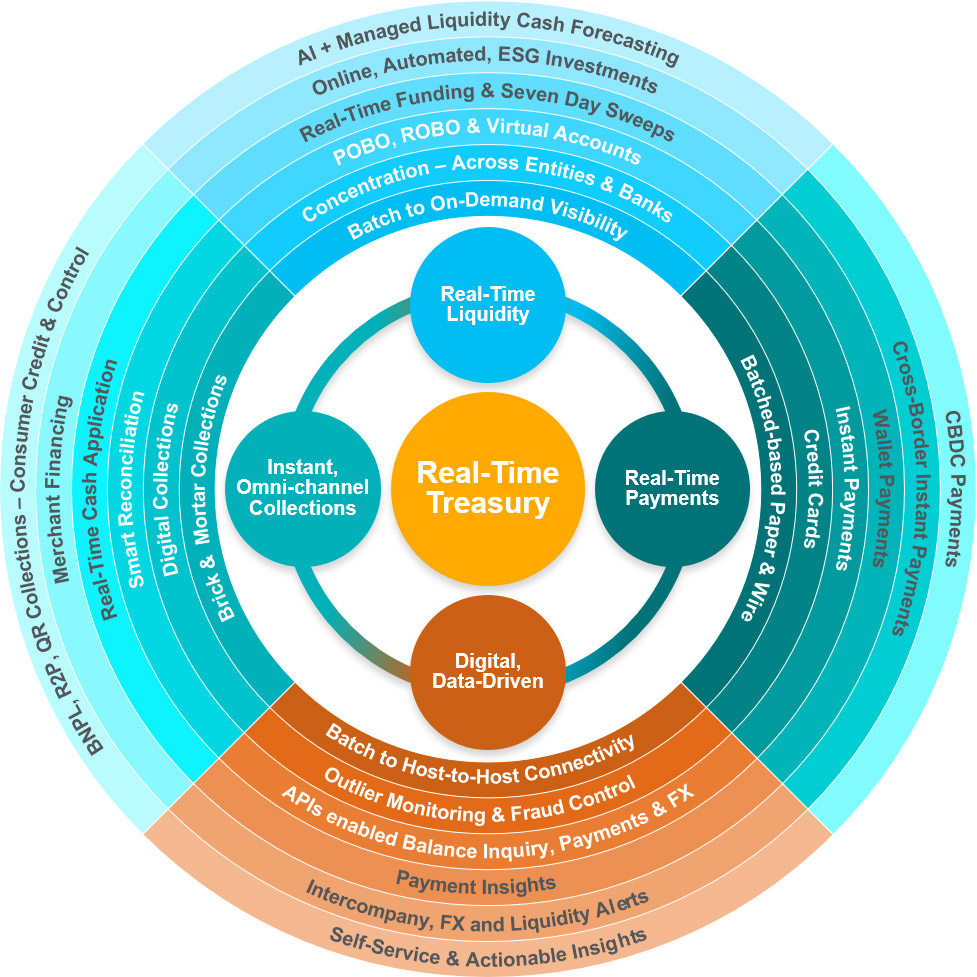

Tipping point for a real-time, digitised treasury

Given the regulatory ‘payment amount’ restrictions on instant payment schemes in most markets, the usage to date has largely been for consumer-to-business (C2B, B2C) flows. This is, however, expected to change, given the planned increase in amount thresholds of real-time payments and RTP scheme roll outs. There is also an increased focus by central banks on building cross-border instant payment rails using interoperable distributed ledger technology (DLT). These changes are set to propel the business-to-business (B2B) usage of domestic and cross-border instant payments. This B2B usage coupled with increasing share of C2B digital sales is expected to make up a very material portion of the operating flows for corporates real-time, and further drive-up the working capital cycle velocity requiring treasuries to be truly digitised and real-time.

However, not all payment flows and treasury processes need to move to real-time. There are several costs associated with real-time payments. Apart from the obvious technology-related costs in terms of bank connectivity, robotic processing, security and fraud controls, the liquidity buffer costs are expected to become significant with increased C2B and B2B adoption. The cost benefit analysis and justification for real-time payments and treasury processes is likely to be dependent largely on the business model and the share of real-time payments in a business’ overall working capital.

Digitisation and data: enablers for a real-time, 24/7 treasury

During the pandemic there has been heightened attention on liquidity risk management. Treasurers have transitioned from periodic liquidity checks and reporting to building direct connectivity between their enterprise resource planning (ERP), treasury management system (TMS), foreign exchange (FX) platforms and banking partners, vendors and suppliers. In 2022, the current batch-based weekday only connectivity with banks is expected to evolve to its logical next stage. The use cases for Application Programming Interface (API) based on-demand, near real-time balance visibility for all days in a week across multiple banks are expected to widen beyond insurance and payment intermediary companies. This will require treasuries to invest in and evolve their own technology stack and further digitise their day-to-day back-office processes using DLT and artificial intelligence (AI) based technologies.

Treasurers are finding it hard to manage the ebbs and flows in working capital velocity given the increase in miniature direct-to-consumer ecommerce flows. This is compelling them to graduate from Excel-based forecasting and cash position management. Treasurers are now focusing on building on-demand, near real-time data consumption and AI based forecasting models to support dynamic decision making. Without the evolution to a real-time treasury – in terms of visibility, predictable forecasting models and decisioning, the costs of liquidity buffers (actual and notional) to fund real-time payments will outweigh their benefits.

Hidden yield: real-time liquidity and working capital management

A shift in business strategy towards digital commerce, near-shoring and digitisation of the supply chain is having a significant impact on liquidity and working capital management. Treasurers are adapting their liquidity structures to manage this shift and seamlessly facilitate commercial success.

Traditionally, corporates with a B2B business model have been comfortable with once-a-day inter-company sweeps to fund their group companies for their payments and short-term working capital requirements. However, with the increased direct-to-consumer flow share and working capital velocity, treasurers are now keen to reap the liquidity cost benefits of funding real-time payments on-demand or just-in time rather than building up intra-day, overnight and/or weekend buffers. Corporates focused on C2B growth and/or liquidity cost efficiency, are expected to graduate to balance triggered real-time sweeps to fund their group subsidiaries and their group subsidiary payments just-in-time. Deploying liquidity generated from real-time collections to support faster delivery, release merchant limits, fund group companies with their working capital requirements or make just-in time investments is becoming pivotal.

Real-time liquidity sharing across entities, helps corporates with multi-entity business models to increase reliance on their own group’s intra-day liquidity to fund payments in a frictionless manner instead of relying on bank credit. Businesses that do not have in place sophisticated forecasting capabilities are able to benefit from real-time liquidity sharing by achieving higher straight through processing rate of payments and eliminating intra-day and end-of-day liquidity costs to fund payments. In addition to the abovementioned use cases of real-time intra-day liquidity sharing between physical accounts, the adoption of real-time liquidity sharing between multi-entity virtual and physical account structures is expected to grow not only for corporates with mature treasuries, but also for expanding digital natives as they diversify their businesses and chart their course towards becoming super apps.

For corporates, where weekend activity of instant payments is becoming material, there is a clear need for seven-day sweeps emanating to avoid weekend overdraft charges. Select corporates are transitioning from end-of-day zero balancing sweeps to targeted balancing sweeps to have enough liquidity to fund after hours domestic and cross-border instant payments.

Traditionally treasurers reviewed their sweep structures once or twice a year. Treasurers are turning to their banking partners to provide them liquidity sweep structure visualisation tools with the ability to self-serve and make changes dynamically. These active changes will help optimise the use of liquidity surge on sales days or to support unplanned shortfall in group cash position. While adoption of electronic submission of e-signed documents started in 2021, this digital onboarding of liquidity structures is set to become the norm in 2022. Rule-based automated investments will be an area of attention for cash surplus treasurers in this pandemic where the market has been flushed with liquidity and there is a huge focus on yield improvements in the low-rate environment.

Risk management: automation and intelligence

Treasurers will continue to stress on real-time payments security and fraud risks by building front-end validations, fraud analytics and outlier behaviour monitoring tools. The risk management focus will become especially important as the amount thresholds for these payments and their adoption increases. There is also likely to be an increased adoption of cross-currency sweeps to manage both liquidity and FX risks in an automated manner.

Several banks offer automated counterparty risk management support to their corporates by mobilising liquidity in excess of defined limits and basis rule-based priorities to other trusted banking partners. This multi-bank liquidity mobilisation tool usage is expected to become more real-time once the amount threshold of instant payments continues to be increased by regulators. This is expected to fuel cross-bank real-time funding of payments and investment automation while supporting with liquidity risk management.

For more information visit: Institutional Clients Group (citi.com)