Collections are the foundation of treasury management. So why are many corporates still struggling in this area? In a recent webinar hosted by Treasury Today, senior product executives from BNP Paribas discussed why this is the case and what changes corporates can make to solve the issue.

Watch on demand

For every company on the planet, receiving payments is an everyday occurrence. Yet it is an area fraught with challenges. This may be because customers do not pay on time, requiring the seller to chase down payments, wasting valuable time and resources. Or it might be because incoming payments are not easily reconciled, leaving the seller unsure who has paid them and for what.

According to Coralie van Zyl, Head of Product Development Payments and Collections at BNP Paribas, the root of the problem is the friction that often exists in the invoicing and payments process. But it is friction that can, with a few changes, be removed.

Dennie Servranckx, Product Manager Collections at BNP Paribas advises that there are three key areas that corporate sellers can address to improve the buyer’s payment experience, and the likelihood of them paying on time. These are:

- Communicate payment instructions clearly and consistently: this will prevent the buyer making mistakes and having to spend time re-entering payment details into their own system.

- Consider the payment culture of the payer and adapt to this: there are clear differences in the way corporates in certain countries pay.

- Offer the payer a range of payment methods: forcing a company to act in a certain way can delay payments and even damage the relationship. Analyse customer needs and offer their preferred payment methods.

Addressing these areas can not only ensure corporate sellers are paid on time, they can also help solve the issues sellers face once they have received the payment. For example, van Zyl notes that one of the biggest collections issues for corporates is reconciliation.

“Corporate sellers face challenges here because they are often reliant on the buyer inputting data about the payment in the payment file,” she says. “Typically, this information is either incomplete or not completed at all, leaving the seller in the dark regarding what they have been paid for.” As a result, it is not surprising that over 50% of invoices require some manual intervention, according to a recent client survey by BNP Paribas.

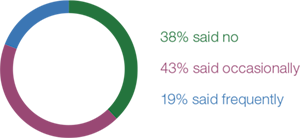

Poll results: Are you using data for optimising collections?

Making payments frictionless for the buyer can solve this issue. Indeed, BNP Paribas has found that there is a high level of correlation between frictionless payment methods and high levels of STP collections. Servranckx highlights the use of credit transfers – one of the most common forms of B2B payments – as an example. “These can be very easy to use for the buyer but when wrong or no information is included, there can be a lack of straight through reconciliation for the seller,” he says. “To change this, the seller can start using products such as virtual accounts and begin achieving better reconciliation rates without impacting the buyer’s processes.”

Servranckx further suggests that corporates look at e-invoicing platforms as a way to make life truly frictionless for their customers. “All the payer then has to do is accept the invoice to generate a credit transfer, these are especially effective in the B2C space,” he says. “For the seller, reconciliation is easy because all the information is there.” Direct debit and the acceptance of cards can have the same effect.

To conclude, van Zyl recommends that corporates evaluate their current collections processes to highlight the problems. She then recommends that they put themselves in the shoes of their customers, to find out where the friction is being created. “If you operate in a market where you know credit transfers are popular, for example, then offer that method of payment to your clients,” she says. “You can then supplement this with a virtual account solution to make sure that these payments can be easily reconciled.”

If you missed the webinar and would like to hear the full recording:

Watch on demand