September 2019

Around the world, we continue to see growth slowing, trade tensions rising and interest rates falling. The US Federal Reserve has already responded by cutting interest rates in July and financial markets are expecting further easing. The European Central Bank (ECB) is preparing to follow in the Fed’s footsteps and start a programme of monetary easing. Markets have already priced in a 10-basis point (bp) cut to the deposit level in September, which today stands at -40 bps, while forward projections go as low as -70 bps by July 2020.

The September meeting will be Mario Draghi’s last as ECB president before he passes the baton to Christine Lagarde. Some economists expect more details to be shared at the September meeting with regard to kicking off another round of quantitative easing. Lagarde has already acknowledged the downside risks to the Eurozone economy, noting it is “therefore clear that monetary policy needs to remain highly accommodative for the foreseeable future”.

Record-low yields

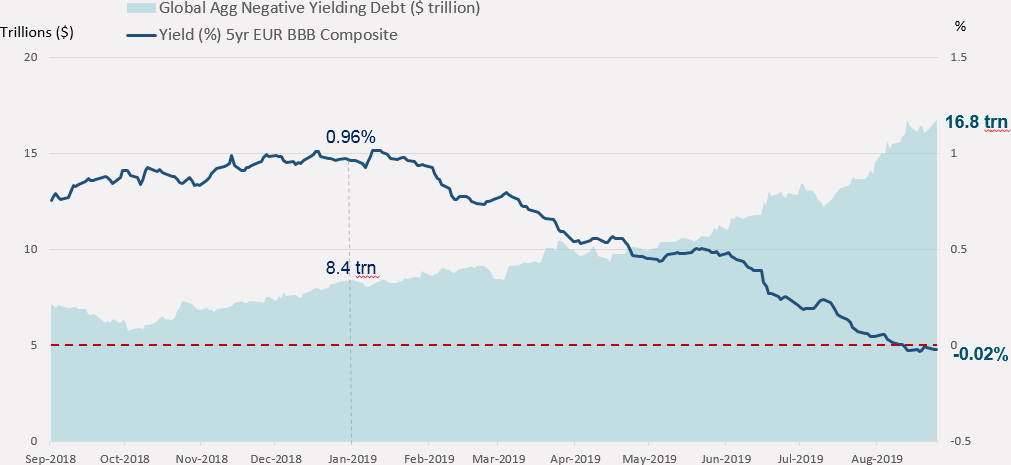

Unsurprisingly, negative interest rates are pushing yields below zero. European government curves have actually fallen to all-time lows; the yield on the German two-year bond has fallen 30 bps this year to -93 bps, and even the 30-year bond is negative at -18 bps (as at 30 August 2019). The rally in bonds has extended into credit, with Nestle issuing the first 10-year euro corporate bond at -1 bp in August. Even BBB-rated five-year bonds are now offering a small negative yield (see chart). And this phenomenon has gone global, as nearly USD 17 trillion worth of global bonds, including a handful of high yield and emerging market debt issues, are trading with negative yields (see chart) as investors flee risk assets.

Source: Bloomberg, J.P. Morgan Asset Management. As at 28 August 2019.

What can investors do?

Long-term inflation and growth outlooks remain weak, particularly for Europe, meaning the period of deeply negative yields could be here for some time. Investors are re-calibrating expectations as to what risk-adjusted returns are achievable in light of the declining yield backdrop. The risks ahead include the end of the credit cycle, increased spread volatility and potential squeezes on liquidity.

Low-risk investors are actively segmenting their assets between those required near-term, which must then tolerate yields of -50bps or lower in liquidity funds, and those assets which can be invested more strategically in ultra-short duration strategies to achieve higher returns.

In a world of negative rates, many investors long for the days of zero yields. On the positive side, bond prices continues to rise and investors can still achieve positive returns through conservative credit exposure and currency hedging.

To find out more, please visit www.jpmgloballiquidity.com or contact us at [email protected]

August’s thought

Back to all thoughts

October’s thought