October 2019

Over the past two decades, China has witnessed a substantial period of economic growth helped by robust exports and rapidly developing domestic markets. Underpinning this economic growth has been a massive increase in the size and scope of its fixed income markets: a combination of interest rate and financial market liberalization triggered a surge in the range of credit issuers, instruments and structures available.

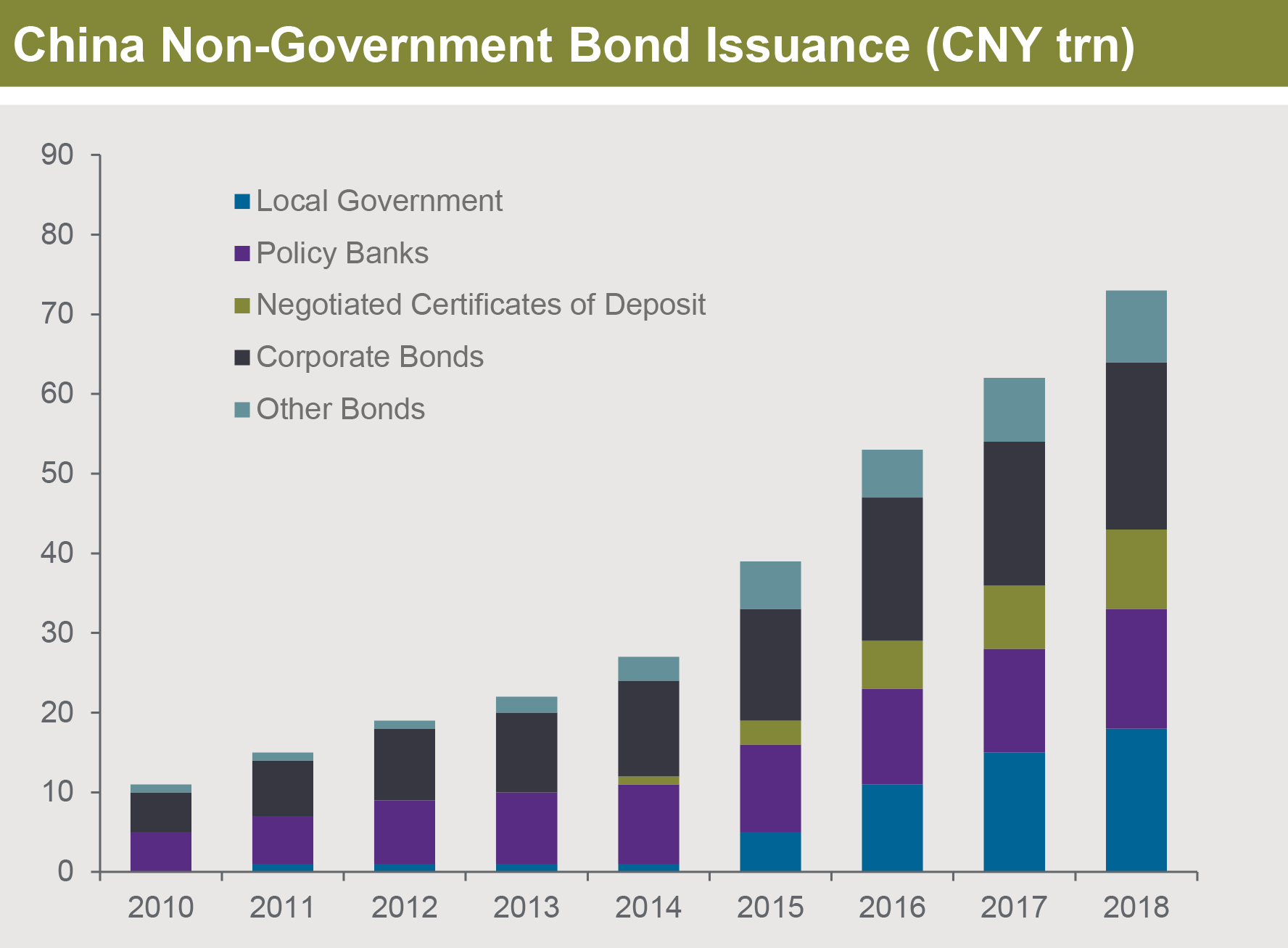

China now has the world’s second largest bond market (Exhibit 1), making it difficult for investors to ignore, both as a source of yield and diversification as well as its influence on global liquidity and interest rates.

Exhibit 1: China’s bond market has grown significantly over the past two decades

Source: Asian Bonds online; CCDC and J.P. Morgan Asset Management. As at 30th June 2019

However, with increased opportunities comes increased risk. The elimination of the implicit government guarantee on all commercial bank debt, combined with weak corporate fundamentals and the limitations of domestic rating agency methodologies, is creating significant credit analysis challenges.

Understanding China’s bond market structure is a critical first step toward addressing these issues. While there are many similarities between the Chinese onshore credit market and more developed offshore markets, there are also several significant differences – mainly due to local regulations, distinctive issuer and investor characteristics and unique local market practices.

Below we highlight six key areas for investors to consider when investing in the local Chinese credit market:

Investment Platforms:

Bonds and other fixed income instruments are traded on three different platforms: the interbank market, the exchange market and the commercial bank over-the-counter (OTC) market. The interbank market is the dominant bond platform, while the exchange market mainly focuses on retail and other non-interbank market investors. The OTC market is used exclusively by small retail investors.

Instruments:

There is a broad range of credit instruments available, which vary by platform and regulatory approval. These include commercial paper, negotiable certificates of deposit, medium-term notes and various types of bonds.

Issuers:

Local government bonds represent the largest sector of China’s credit markets and have been a major contributor to the growth of the onshore corporate bond market since 2015. Commercial bank issuers represent the second largest sector of China’s credit markets. Other credit bond issuers include state owned enterprises and private companies operating mainly in the construction, industrial, utility and energy sectors.

Investors:

Domestic investors dominate the onshore bond markets. Collectively, commercial banks, insurance companies, policy banks and securities brokers own a significant portion of corporate bonds, although these investors typically prefer interest rate bonds as a safe investment due to their low risk tolerance. China’s bond markets are now open to foreign investors, but participation remains low.

Characteristics and Pricing:

Chinese credit bond yields are more volatile than those of similar securities in developed markets. Multiple macroeconomic and technical factors, including central bank monetary policy, government fiscal policy, frequent regulatory changes and interbank liquidity conditions, all contribute to this volatility. Historically, credit ratings had a very low correlation with credit bond yields and spreads, especially for bonds rated between AAA and AA. Not until ratings fall to AA- or lower do credit spreads widen significantly, suggesting insufficient compensation for onshore corporate bond investors compared with credit spreads in offshore markets.

Domestic Ratings:

Several local rating agencies dominate the onshore rating market while the authorities regulate rating nomenclature and bond rating requirements. The combination of rating arbitrage and local agencies developing their own standards, which emphasizes implicit government support, has resulted in most issuers obtaining AAA ratings. This limits the ability of international investors to map domestic ratings to international rating scales.

Gaining a familiarity with local market structures is just the beginning. Equally important is the adoption of rigorous, independent analysis by issuers and counterparties to understand the true underlying risk characteristics of onshore credit investment. Moreover, a robust investment policy, independent credit research and an objective analysis of the potential level of government support are critical steps toward minimizing downside risks while taking advantage of increasing market opportunities.

To learn more, stay tuned for our upcoming primer on China’s credit market and visit our China money market resource center.

September’s thought

Back to all thoughts

November’s thought