Adam Smith Awards Asia

The treasury team, led by Annapoorna Venkataramanan, embarked on a transformative journey to future-proof its financial operations. The challenge was to scale its treasury capabilities to support a projected fivefold increase in transaction volumes, while enhancing control, efficiency and strategic agility.

In early 2024, Haier Group announced one of its most significant strategic moves in recent years: the acquisition of Carrier Commercial Refrigeration (CCR) for an enterprise value of US$775m. This deal marked a pivotal moment in Haier’s evolution, signalling its ambition to expand beyond its stronghold in home refrigeration and become a leading player in the global commercial refrigeration market.

With approximately 80% of its business concentrated in Asia, DKSH needed to establish robust cash management capabilities to support its US expansion while maintaining centralised oversight from its global treasury centre based out of Singapore.

In today’s fast-paced global economy, companies often face daunting challenges in managing liquidity across diverse subsidiaries operating in different regions and currencies. This was the case for CCCC Overseas Treasury Management Limited (COTC), a leading multinational corporation with over 50 subsidiaries spanning various countries and industries.

When Grasim Industries embarked on its most ambitious transformation in decades, the challenge extended far beyond launching new business divisions. The company needed to ensure that thousands of suppliers across India’s industrial corridors could participate in and benefit from this evolution while maintaining the financial discipline that has characterised the group’s 76-year legacy.

OMH embarked on an exercise to refinance its legacy project finance, comprising a US$118m long-term loan and a US$101m working capital facility. This move was necessitated by the downturn in the commodity market cycle that squeezed profit margins and reduced cash generation.

As one of Australia’s largest independent payment services providers and an authorised deposit-taking institution (ADI), Cuscal’s journey toward listing on the Australia Securities Exchange (ASX) on November 25th 2024 was driven by a strategic need to broaden its access to capital, expand visibility in the Australian financial system, strengthen financial resilience, and position itself for continued innovation and growth.

As Goldwind expanded globally, it inevitably faced challenges associated with cross-border operations, varying country-specific regulations, unfamiliar project jurisdictions, diverse currencies, and distinct owner and stakeholder expectations. Navigating these complexities required deep knowledge, strategic foresight and proactive risk management.

Ant Group’s treasury was fragmented, manual and under strain. On joining the business, Charles Cao, Group Treasurer, was handed a box of 40+ bank tokens, symbolic of a deeply inefficient system. Payments required late-night manual processing, and teams were overwhelmed, creating high error risk and staff turnover.

On June 18th 2024, Shell announced an agreement to acquire Pavilion Energy from Carne Investments Pte. Ltd., a subsidiary of Temasek and the deal closed on March 31st 2025. The Pavilion Energy group, headquartered in Singapore, comprises eight entities (seven in Singapore, one in Spain) and more than 100 employees.

Greater uncertainty around the world requires prudent treasury policy and treasury management and the role of the Thai Union Group’s treasury department has been evolving changes recently to be more of a strategic partner than an operational function.

The Hitachi Group operates more than 25 legal entities across India, spanning digital solutions, energy, infrastructure and financial technology. This complex corporate ecosystem created significant liquidity management challenges for Hitachi International Treasury.

BYD’s rapid growth brought several challenges. Difficulty in navigating diverse and evolving regulations across different countries, including complex cross-border transaction regulations, intricate tax requirements, transfer pricing rules and data protection requirements.

Aligning financing instruments with ESG initiatives is inherently challenging. Similar to green and social loans, these financial options require investments in eligible projects. Identifying the right projects has become a critical factor in arranging these loans; however, it can be difficult to find suitable projects.

Manulife Hong Kong needed a streamlined approach to optimise operating liquidity, minimise idle funds and enhance cash yields. The financial services group was also stymied by manual processes which made consolidating operating funds, scattered across multiple banks, challenging and led to inefficient cash deployment and delayed investments.

It’s no exaggeration to say that Lucia Ma, Group Treasurer at Klook, had an unconventional entry into treasury. She used to be a social media editor at the experiences platform; stepped into corporate finance – to support fundraising efforts – but then took over Klook’s treasury function in 2021 during the COVID-19 pandemic, one of the most challenging times for the industry.

Vineet Sood, Executive Vice President, Head of Treasury & Finance at HCL Technologies leads treasury operations across 178 entities scattered over 50 countries with a team of just 20 professionals. He has built a centralised, highly automated treasury function that combines efficiency with scaled and institutionalised innovation that now spans tokenisation and blockchain technology.

IHH Healthcare embarked on a major transformation journey over the past three years to harmonise and optimise its operations and align its finance function to support an ambitious growth strategy.

While Kuaishou has expanded globally into key markets Brazil, South-East Asia and the Middle East, Brazil stands out as a top market. Kuaishou’s international strategy emphasises user acquisition through high-frequency, micro-value incentive payouts.

Prior to 2020, Marsh’s global treasury activities were managed from the US and UK, with no treasury presence in Asia Pacific. But with significant organic and acquisitive growth coming from the region, Marsh needed to establish a regional treasury centre in Singapore. Nicholas Hardy, Asia Pacific Treasury Director, led the build out of Marsh’s regional treasury function during the pandemic.

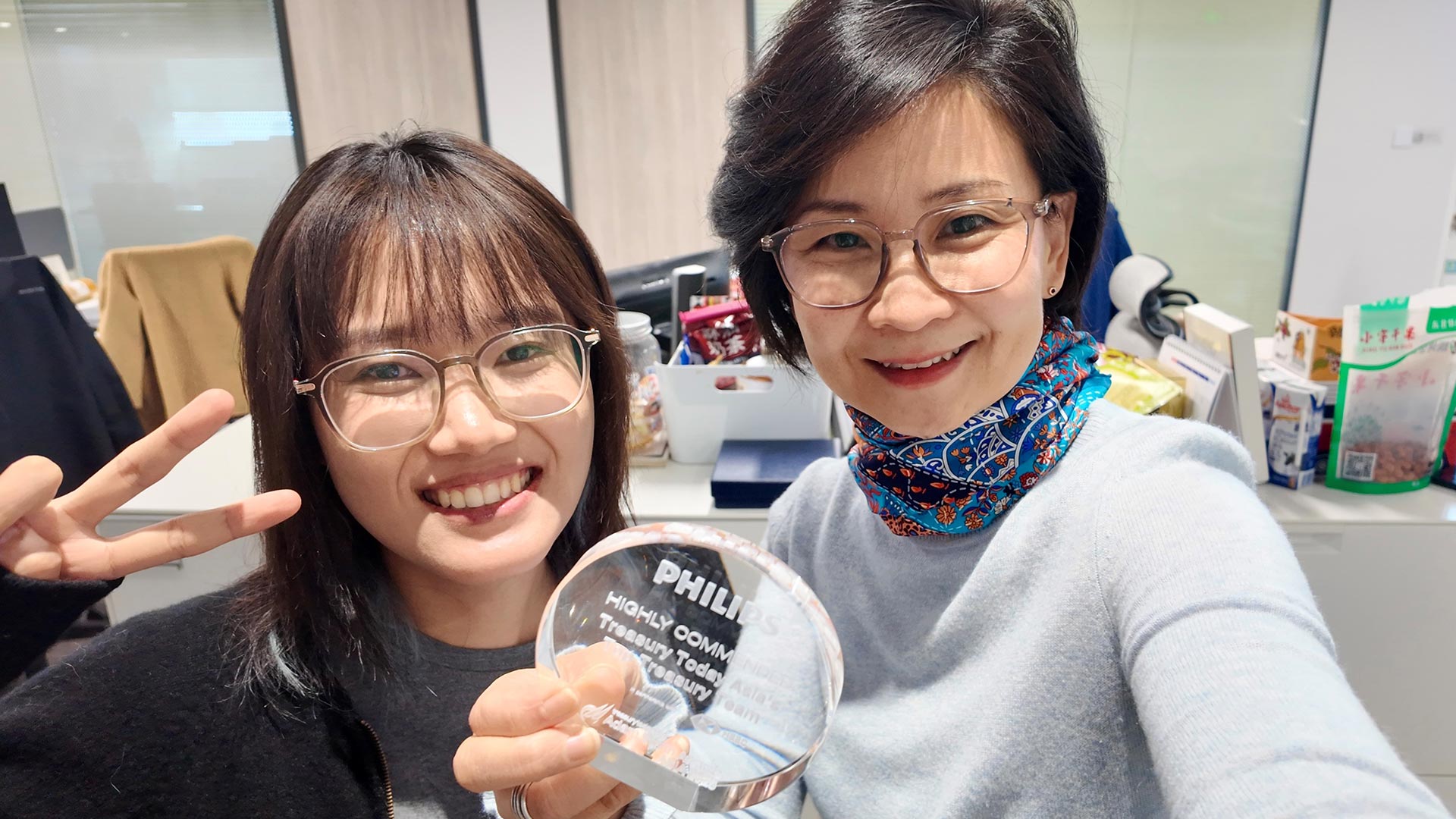

The challenge for Philips’s APAC treasury team was to bring further innovation, centralisation and standardisation to the heart of its complex operation in APAC. To this end, the team implemented several market leading solutions, including netting, cash pooling, on-behalf-of (OBO) payment factory model and Swift FileAct connectivity.

Shenzhen Transsion Holding’s (Transsion’s) far-reaching presence and scale in emerging markets brought forward a unique set of challenges in its treasury management.

Fortescue’s strategic transformation from a leading iron ore producer into a diversified technology, energy and metals group significantly increased the scope and complexity of its treasury operations. As the company expanded its global footprint, the number of bank accounts ballooned to more than 180 creating additional challenges in liquidity management, cross-border payments and FX operations.

Historically, Kulick & Soffa (K&S) relied on spreadsheets to consolidate cash flow data from multiple departments, including accounts receivable, accounts payable, tax and payroll. This process was highly manual, time-intensive and prone to human error. Each month, the treasury team spent approximately 20 hours collecting and analysing data to produce cash flow forecasts.

Following a significant transformation, spinning off from GE, the team faced the critical task of establishing a best in class cash pooling and treasury solution to address several challenges.

The challenge of moving money between entities; KLA had been managing its treasury function globally, which created widespread inefficiencies in terms of time and money.

Following its successful entry into Europe, ZEEKR set its sights on expanding into Asia Pacific. ZEEKR launched its line of electric vehicles (EV) in Hong Kong SAR and Australia in 2024, and is eyeing further expansion into Thailand, South Korea, Malaysia, Australia and New Zealand.

China Railway Group Limited (CREC) is a key participant in China’s Belt and Road Initiative, with contracts in more than 90 countries around the world and keeps exponentially expanding its overseas business coverage. CREC’s multi‑jurisdictional operations present a variety of challenges including, but not limited to, complexity brought by usage of different banks, cost burden, settlement inefficiency and suboptimal capital deployment.

Land Transport Authority (LTA) of Singapore was managing the construction of numerous critical infrastructure projects and faced two major challenges in its payment ecosystem.

As Australian investors increasingly diversified their portfolios with global assets, FinClear recognised the urgent need to address the inefficiencies in existing foreign exchange solutions. The shift to T+1 settlement for US equities further accelerated this demand, as wholesale brokers requiring same-day FX settlement capabilities.

With a vast and growing vendor ecosystem, many of whom are micro, small and medium enterprises (MSMEs), the company’s treasury team identified two key challenges.

In recent years, the rapid growth of the domestic market in India has caused financial pressure. However, the local borrowing rate in India is as high as 7% or more, and some overseas suppliers, such as Fusheng group’s subsidiary in Shanghai, also have high lending rates. The group’s finance department has been struggling to find an affordable and efficient financial solution while coordinating the fund allocation of various subsidiaries.

Samsung’s dealers are spread across Vietnam, and it is challenging to manage them across different geographical locations, in terms of collections and tracking payments. Dealers need to draw on their own capital or obtain financing at high interest rates to import goods from Samsung.

AM/NS India required efficient offshore capital access to fund its Capex India expansion while centralising global treasury operations within the group. Establishing a Global Treasury Centre (GTC) in India was critical to optimise funding costs, streamline cross-border flows and support its ambitious growth targets.

Facing increasing competition and the risk of import substitution in India’s growing tyre cord market, Bekaert needed a strategic expansion to secure its leadership position. While holding a dominant 49% market share as the sole local producer, Bekaert’s advantage was under threat from emerging domestic players benefitting from government ‘Make in India’ initiatives and efforts to reduce dependence on Chinese imports.

In line with the historic nature of the acquisition of its first Boeing 787-10 Dreamliner, Korean Air sought to ensure every aspect of the transaction reflected its national identity and strategic financial priorities. From the aircraft’s custom livery – symbolising the airline’s first rebranding in 41 years – to the structure of the financing, Korean Air pursued a solution that was both innovative and aligned with its long-term treasury goals.

The dynamic nature of private equity fund management operations, particularly the need to manage multiple special purpose vehicles (SPV) entities in various currencies across jurisdictions, meant PAG was managing over 500 fund-related accounts over time.

PowerChina is one of the largest power design and contracting firms globally, managing some of the world’s largest infrastructure, energy and hydropower developments. With major sub-brands like SinoHydro, HydroChina and SEPCO, the company operates close to 780 entities in 130 countries.

Risk is often incompletely defined and undermined and lies on the treasury desk in the form of a ticking bomb. Gone are the days where treasury and risks were considered cousins. Modern day multi-country treasury and risk are twins who operate together, 24/7.

HP Inc.’s global cash management spans 180 legal entities worldwide and 926 bank accounts. With high transaction volume and transaction diversity, real-time cash visibility and forecasting accuracy are critical to effective decision‑making. However, the legacy process was labour‑intensive, spread across 14 systems (including SAP and multiple banking portals), and heavily reliant on manual intervention where automation was possible.

Singtel manages extensive payment flows, from supplier disbursements and refunds, to mass consumer and enterprise billing and reconciliation challenges and bank account management across business units. The company faced several critical challenges.

The rise in cross-border e-commerce driven by increased purchasing power (projected US$12trn by 2030) presents unprecedented opportunities for global trade. However, this growth is limited by payment challenges prevalent in emerging markets. Alibaba.com merchants face hurdles in receiving payments due to under-developed financial infrastructures, volatile currencies and complex regulatory landscapes.

The objective was to build a next-generation treasury that balances centralised global oversight with local execution agility in less than 14 months. The company wanted to achieve cost savings from operational efficiency through automation and banking digitisation globally.

As Pop Mart rapidly expanded its global footprint across 23+ diverse markets, its treasury team emerged as a strategic enabler, navigating complexities of globalisation while ensuring resilient and scalable financial operations.

Travel services grew post-pandemic and Trip.com’s transaction volumes have surged. The company also added new international destinations which required increased cross-currency transactions to support a growing vendor base.

ANTA has embarked on a path of global expansion in recent years with a direct-to-consumer (DTC) model. This strategy includes a diverse portfolio of brands aimed at developing a strong overseas customer base. As of June 2025, ANTA has established over 200 retail stores overseas, primarily located in South-East Asia (eg Thailand, Malaysia and Singapore).

Ninja Van has experienced significant growth over the past few years as a new economy starter, having expanded its business operations organically across multiple countries in South-East Asia. Over time, Ninja Van developed an extensive and fragmented panel of more than 40 banks and payment service providers across various countries and entities.

As Smart Axiata prepared for major investments to enhance network quality and future technology readiness, the company needed a financing approach that safeguarded liquidity while supporting long-term growth. Conventional funding routes, whether internal resources or long-tenor facilities were not optimal given ongoing operational priorities and broader market conditions.

Aliaxis has hired a new global treasurer, and with the strong support of the CFO and CEO, she immediately decided to launch a global transformation project.

In November 2023, Broadcom announced the acquisition of VMware Inc (VMware). Post-merger, Broadcom’s 2024 annual revenue rose to US$51bn (up 42.5%) while revenue for its software division nearly tripled to US$21.5bn. For Broadcom’s treasury team, it had six months to integrate 73 VMware entities in 59 countries, including 13 entities in 13 countries in APAC, into Broadcom’s banking and cash management structure.

Tech Mahindra faced a fragmented expense management system which led to delays in reimbursement, manual paperwork and inconsistencies in approval workflow. Financial teams lacked real-time visibility into spending which resulted in compliance gaps and missed opportunities for cost optimisation.

Agilent treasury operates a regional hub in Singapore supporting Asia Pacific and EMEA in cash management, FX, corporate financing, risk insurance and advisory. In China, the high volume of transactions and manual processes require significant resources, making it a priority to improve efficiency for operational excellence.

PetroChina International Co., Ltd. (PCI) is the core international business operation platform of China National Petroleum Corporation (CNPC). With three major oil and gas operation centres in Asia, Europe and America, and six major resource bases in Central Asia, the Middle East, Africa, Australia, North America and South America, PCI has nearly 400 overseas bank accounts, distributed in over 20 countries.

With hundreds of millions of USD in operating cash spread across over 20 legal entities and multiple banking relationships, Flex supports net sales of US$4.3bn in China, contributing 17% of Flex group’s total net sales of US$25.8bn. By FY25, Flex strived to develop a comprehensive cash and liquidity management system to achieve 24/7 real-time cash centralisation and visibility and facilitate high-efficiency payment processing.

A central pillar of GLP’s business model is advancing sustainable projects (eg green energy warehouses, AI database, robotic factories and food security etc) which engage owners, core buyer partners and suppliers across China and globally.

With the Paris climate agreement in force, the European Union (EU) is more committed than ever in its transition towards a low carbon economy. One of the key levers to realise the ambition is the upgrading of public transportation systems to make them cleaner and more energy efficient.

According to a recent report by the World Economic Forum, the accelerating impact of climate change is intensifying health risks and placing growing pressure on healthcare systems worldwide. These challenges extend beyond direct health outcomes – climate-related disruptions are affecting supply chains, diminishing operational efficiency and constraining access to essential resources.

Treasury operations were heavily dependent on MS Office tools like Word and Excel. These tools, while useful for basic tasks, were not suited for managing complex financial workflows, leading to inefficiencies and increased operational burden.

PhotonPay operates as a critical financial infrastructure for SMEs seeking to compete in global markets. Licensed across multiple treasury jurisdictions, the company faced escalating operational constraints that threatened its ability to serve this vital customer base effectively.

With extensive global growth, ZTE’s overseas income totaled over US$5bn in 2024, counting for a significant portion of ZTE group income. With presence and exposure across 160 countries, ZTE was concerned with emerging and frontier market risks. These currencies, which made up an important part of the exposures, often experienced sudden sharp depreciation and shortage of USD liquidity.

Thomas Cook India leverages a uniquely structured treasury model that mirrors an investment ecosystem rather than a conventional cash function. Through its AD II license, multi-country nostro network and proprietary forex infrastructure, the treasury supports dynamic flows across 28+ geographies in 17-18 currencies – creating built‑in diversification.

As a result of its expansion and multiple acquisitions, Yageo faced increasing complexity in its treasury operations due to acquired companies having diverse banking relationships across 32 countries, involving over 100 partnership banks and 800 bank accounts worldwide, each with different account structures and online banking platforms.

Hannisel Obedicen, Head of Treasury APAC, has been instrumental in shaping Inchcape’s treasury across Asia in a role that has spanned steering major transformation projects, introducing new technology and delivering liquidity and risk management solutions. She has also recruited and developed a treasury team from scratch.