The challenge

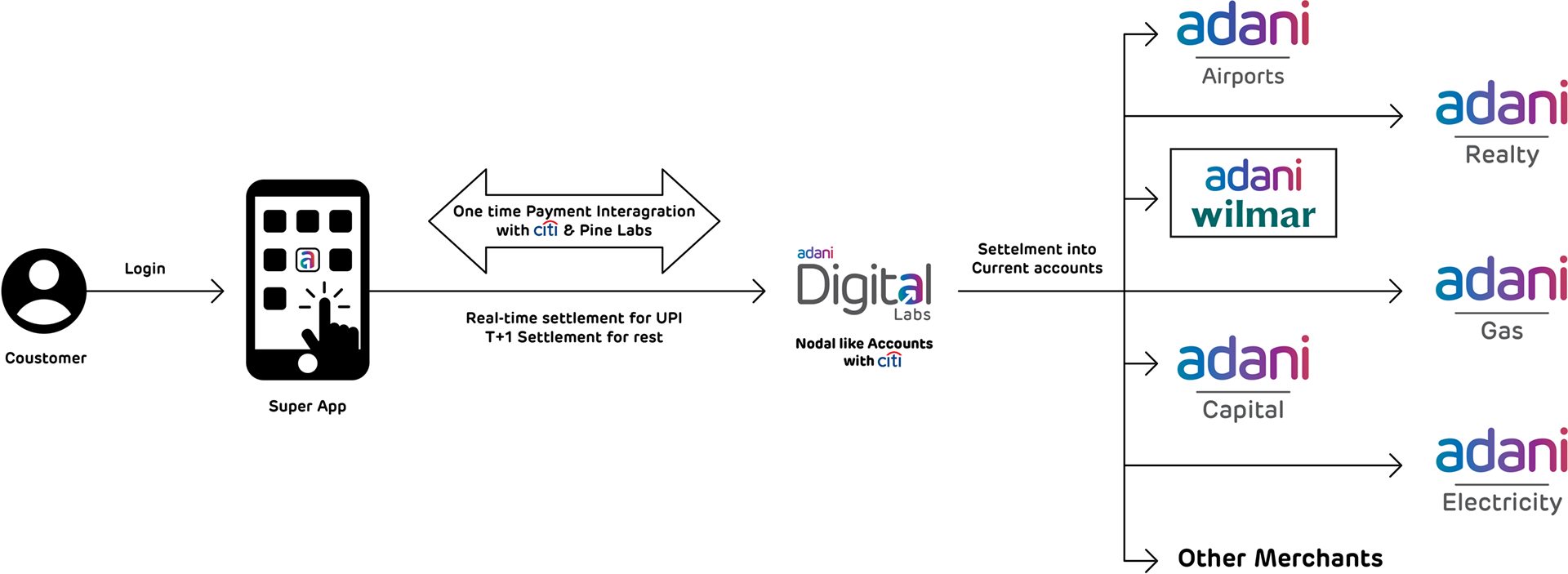

Adani Digital Labs (ADL) aimed to bring all the 400 million end-consumers engaging across the ecosystem of Adani Group under a single digital umbrella. Adani Digital would be the central entity in a hub and spoke model, through which the order booking and collections for all the device-to-device (D2D) businesses, as well as ecosystem participants, would be routed. ADL envisioned designing a digital platform which would offer all the Adani Group products and ancillary services as a unified platform. Through this strategic vision, the Adani Group aimed to provide a digital platform for its six key consumer-facing businesses: Airports, Realty, Wilmar, Capital, Electricity and Gas, as well as multiple business units and offer a common interface to the end consumer.

ADL wanted to enable a unified collections solution to efficiently handle receipts across multiple channels and seamlessly add participants and merchants to the ecosystem.

The solution

Citi implemented a customised solution for ADL’s key businesses, providing a single window offering with a payment layer integrated with Adani’s digital platform. This was enabled by leveraging Citi’s Faster Payment capability and bringing in a fintech partner, Pine Labs, to offer a unified collections solution. An API was set up with ADL for real-time collections, and an additional integration was established with the partner for additional payment types such as credit/debit cards, internet banking and digital mobile wallets. Citi also supported the client with critical regulatory advice on the account set-up as required for the marketplace model in accordance with the latest regulatory guidelines.

Best practice and innovation

The suite of digital solutions is designed to enable the ADL ecosystem to function at its best. This has been achieved by careful design to address the needs of various Adani entities and their end consumers.

Citi partnered with a fintech to customise the collection model across offline and online channels, offering a holistic solution to ADL. The solutions have been designed to generate statements, MIS and other documents required by the client to satisfy accounting/regulatory requirements.

Key benefits

- Cost savings.

- Process efficiencies.

- Increased automation.

- Reduced errors.

- Manual intervention reduced.

- Increased system connectivity.

- Future-proof solution.

- Exceptional implementation (budget/time).

“The solutioning phase required a thorough understanding of the prevailing regulatory guidelines, meticulous analysis of data, and customisation in line with taxation and compliance boundaries, to perfect solution relevance and establish optimal implementation methodology. The result is a gamut of solutions, many of which hinged on digital transformation coupled with strong analytical support to future-proof us on our journey ahead,” says Nitin Sethi, Chief Digital Officer.