Photo of Nitesh Gupta and Hin Hao Liaw, Ecolab Inc. and Martijn Stoker, J.P. Morgan.

The multi-entity/multi-currency solution implemented here is based upon a ‘follow the sun’ model, enabling funds to be moved from Asia to Europe to the US in a 24-hour cycle, resulting in reduced costs, improved cash visibility and standardised documentation and reporting.

Allison Rakitin

Global Treasury Director

Naperville, Illinois

Ecolab is a global leader in water, hygiene and energy technologies and services that make hospitals, hotels, restaurants, schools, manufacturing plants and many other locations cleaner, safer and healthier. Headquartered in Minnesota, United States, Ecolab has around 48,000 employees. It posted net sales of US$13.8bn in 2017.

in partnership with

Cash never sleeps thanks to this ‘follow-the-sun’ liquidity solution

The challenge

Prior to 2017, Ecolab’s approach to liquidity management in Asia Pacific was inefficient so they wanted to address the following:

- High costs associated with FX hedging across multiple currencies, expensive wire and correspondent banking fees.

- Inability to efficiently move surplus cash from Asia to fund its businesses in other regions.

- Liquidity value sometimes being eroded for Asian currencies in certain markets with early cut-off times, eg Japan.

- Lack of cash visibility due to multiple local banking relationships, especially in Japan.

“A year and a half ago, our treasury team embarked on a project to improve and simplify global liquidity. The goal was to make cash visible and accessible on a global basis. Implementation of this project started in Asia Pacific with an implementation of cash pooling,” recalls Allison Rakitin, Global Treasury Director.

The solution

In partnership with new banking partner J.P. Morgan, Ecolab undertook a phased approach and adopted a fully automated liquidity platform that supports its regional operations while providing the flexibility to meet ever-changing regulatory requirements as well as scalability to keep pace with the company’s growth plans.

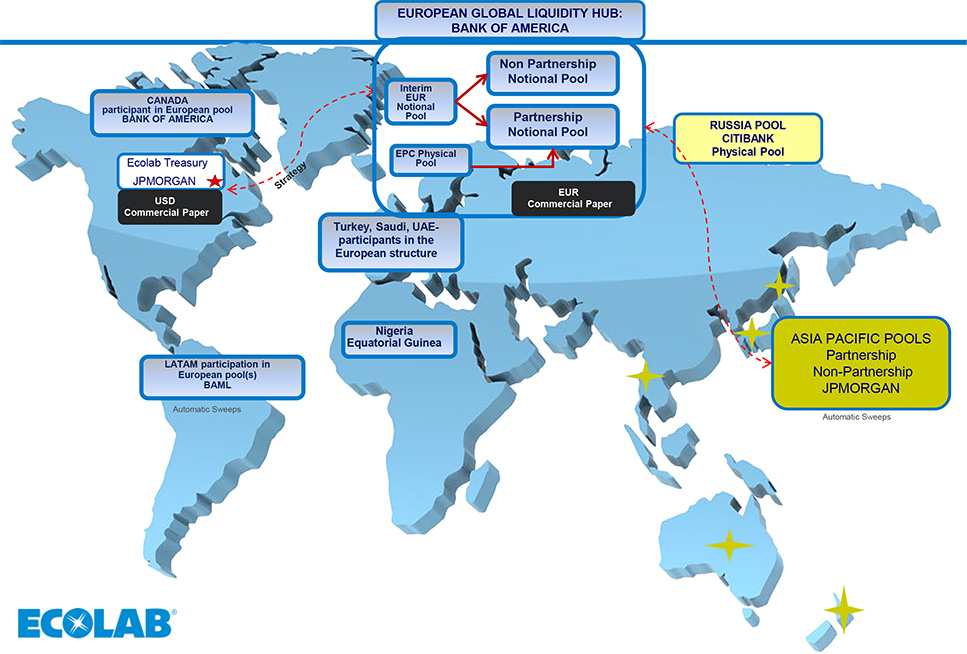

For the first phase, Ecolab implemented a multi-entity, multi-currency notional pool (MEMCNP) across five markets – Australia, New Zealand, Japan, Singapore and Hong Kong. This entailed opening accounts for 11 entities and establishing 18 multi-bank sweeps across seven currencies in the MEMCNP. The solution was tailored to take Ecolab’s existing flows into account, along with legal and tax considerations for each market, and was designed to ensure the ease of integration into its global liquidity platform, with the flexibility to include additional countries and currencies in the future.

When the MEMCNP went live, US$37m was automatically concentrated and deployed to Ecolab’s in-house bank in London. The solution is facilitated by:

- A cross-border, multi-bank physical sweep to move surplus balances between Ecolab’s local cash management banks in Australia, New Zealand, Japan, Singapore and Hong Kong, to its MEMCNP in Singapore.

- A cross-region sweep to shift funds from the MEMCNP to the in-house bank entity account with J.P. Morgan London.

- A same-day value multi-bank sweep with third-party banks to integrate its APAC regional pools to the in-house bank, while allowing entities to maintain relationships with local banks.

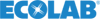

Planned global cash liquidity overview

The solution is now being implemented in China, as part of phase two. Ecolab will further integrate entities in Taiwan into the liquidity pool by 3Q 2018, and Thailand, South Korea, Malaysia and the Philippines in the near future.

“You could say this project has created a night and day difference for global liquidity in Asia Pacific,” said Rakitin. “It has created many wins for our finance team – from helping to reduce costs, to improving visibility, to standardising our documentation and reporting across the countries and regions. It allows local controller and finance managers to focus on operations and stop worrying about minimising/optimising cash balances.”

Best practice and innovation

Ecolab wanted to consolidate cash from multiple entities across Asia Pacific back to its in-house bank in London. The firm seamlessly implemented an overlay structure to automate and efficiently manage its liquidity across multiple regions, markets and banks using a variety of cash management tools including multi-bank sweeps, domestic sweeps and notional pooling.

The result is a global liquidity platform that leverages a ‘follow-the-sun’ model, ensuring that cash is repatriated back within the same day without losing value.

Ecolab’s multi-entity, multi-currency notional pool

Key benefits

- Reduced costs.

- Improved visibility.

- Standardisation through the use of consistent documentation and reporting across countries and regions.

- Cross-regional partnerships and relationships built.