Photo of Ma Bing, Aland Group and Tracy Ge, Citi.

Jiangsu Aland Nutrition (Aland) was looking to implement a global treasury structure which would help it consolidate funds from its global entities to support the company’s rapid development in China and Europe. The USD/GBP/RMB pooling solution implemented involves a non-resident free trade account in the SFTZ.

Ma Bing

CFO

Shanghai, China

Headquartered in Jiangsu, China – Aland Group was established in 2010 from a world-renowned manufacturer of API (active pharmaceutical ingredient). The company has production bases across China, America and Europe.

in partnership with

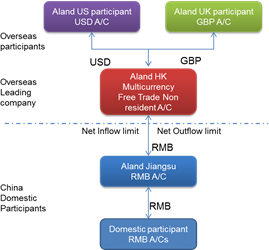

Non-resident free trade account in Shanghai Free Trade Zone key to this pooling solution

The challenge

IVC Nutrition Corporation (Aland Group) was looking to implement a global treasury structure which would help it consolidate funds from its global entities to support the company’s rapid development in China and Europe. With its main treasury team located in Shanghai, it was a challenge to select a suitable cross-border pooling solution either in RMB or in foreign currency, due to the currency mismatch between different markets.

Based on current Chinese regulations, the primary company of a cross-border pooling structure would ordinarily be required to open a special account in Jiangsu in order to implement the pooling arrangement. As Ma Bing, CFO recalls, “As our China HQ is located in Jiangsu province, we may have been subject to complicated regulatory approvals should we apply for cross-border pooling through our pool header account entity.”

The solution

Aland worked in partnership with Citi China to implement an advanced cross-border pooling programme through Aland Hong Kong as a global treasury centre.

This solution is the first case of its kind in which an overseas multinational launched an international treasury management centre by opening a free-trade non-resident account (FTN) in the Shanghai Free Trade Zone (SFTZ). The solution not only supports the group to achieve centralised global capital management in Hong Kong, but also concentrates domestic capital in the headquarters while at the same time ensuring the group can benefit from preferential policies in Shanghai and Hong Kong; two major financial centres.

The free trade account features free convertibility and the integration of domestic and foreign currencies, which makes it easier for the company to choose which foreign currency to utilise. The company in Hong Kong has the flexibility to collect cash denominated in major currencies to the free-trade non-resident account and allocate and convert it between domestic and foreign currencies; while the group’s domestic HQ can perform cross-border funding in RMB and open channels for internal cash allocation. Compared to the traditional cross-border RMB cash pool, this fully-featured pool is much more flexible. Firstly, it uses sufficient onshore RMB capital to broaden cross-border financing channels. Secondly, with more flexibility and convenience, the treasury centre can achieve improved all-round currency management, reduce the remittance costs through the use of intensive management of domestic and foreign currencies, and therefore help the group achieve higher cash utilisation efficiency and far greater benefits of centralised management.

Best practice and innovation

This new structure is an expansion of the FTN initiative to implement the People’s Bank of China’s (PBOC) policy to expand the financial service function and support technological innovation and economic progress in the SFTZ. By encouraging multinational corporations’ global treasury centres to open an FTN, non-FTZ registered entities, including overseas entities, will receive the benefits and convenience from the free trade policy.

Aland, as the pilot of this innovative solution, has benefited from the multicurrency efficiency and concentration flexibility. This solution has become a model for international companies that have similar requirements; it has become a preferred solution for clients who want to enjoy the benefits of cross-border pooling with China and leverage global treasury funding.

“The solution is honoured to be recognised as a Shanghai Free Trade Zone pilot case by Free Trade Zone government,” commented Bing.

Diagram

Key benefits

-

- Improved use of intercompany funds greatly reduced the need for third-party borrowing.

- Processing efficiency.

- Reduced number of accounts and related account maintenance.

- Mitigated costs of entrusted loans.

“With this programme, multinational treasury centres are able to centralise global funds in their original currency into FTN, then freely conduct FX conversion based on the business need,” concludes Bing.