Photo of Maifeng Hu, Irene Shu, Randy Ou, Olivia Yang and Roger Chen, Alibaba Group.

This e-commerce giant decided to develop a treasury management platform in-house. They have delivered a web-based system (TMI) which provides cash visibility, transaction based liquidity, investment and financing management systems with standard operational processes and a management dashboard.

Ou Chia-Lin (Randy Ou)

Treasury VP

Alibaba Group provides the fundamental technology infrastructure and marketing reach to help merchants, brands and other businesses that provide products, services and digital content to leverage the power of the internet to engage with their users and customers. The businesses are comprised of core commerce, cloud computing, digital media and entertainment, innovation initiatives and others. Through investee companies and related parties, the company also participates in the logistics and local services sectors.

The challenge

Alibaba Treasury was facing the following key challenges:

-

Rapid business expansion with emerging needs

With strong organic and merger and acquisition growth, the company has developed its business in multiple fields such as core e-commerce, cloud computing, mobile media and entertainment, and other new areas. The differences in business nature bring widely different treasury management needs.

-

Complexity of treasury infrastructure

The Group has established bank accounts with a diversified portfolio of banks in different geographic regions, with cash assets in multiple currencies. This growing complexity demands more time and effort spent in treasury management.

-

Resources constraints

Treasury needs to manage over RMB100bn equivalent cash assets under a complex infrastructure. But it is still the management mandate to keep headcount lean.

-

Customisation and agility requirements

The company business involves innovative business models in a fast changing industry. The existing industry standard solutions and off-the-shelf treasury management systems do not meet Alibaba’s specific requirements.

The solution

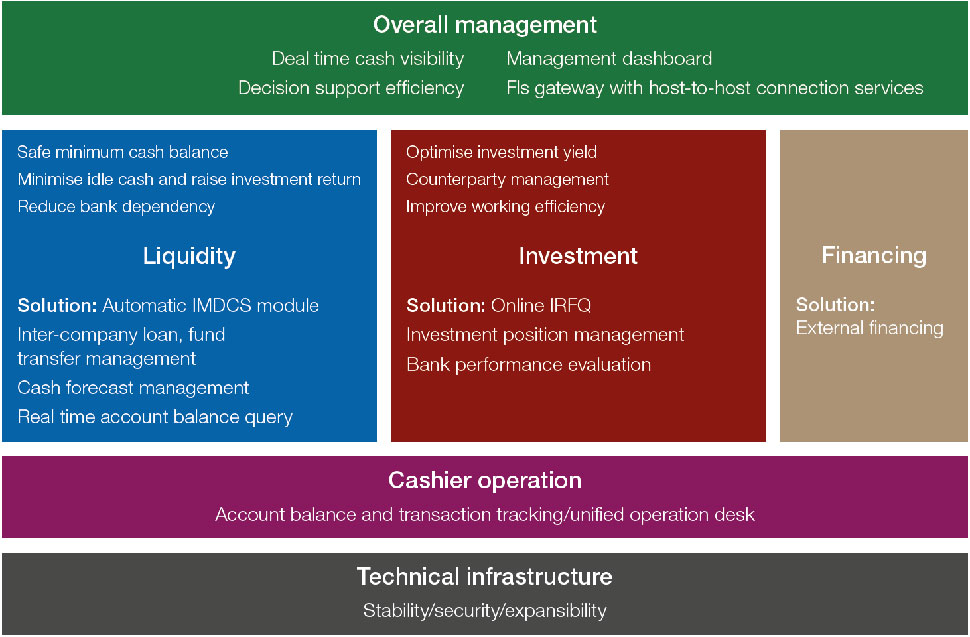

To overcome the challenges stated above, the Alibaba treasury team evaluated the situation and decided to develop a treasury management platform in-house. The treasury management intelligence (TMI) platform is a web-based treasury management solution which provides cash visibility, transaction based liquidity, investment and financing management systems, with standardised operation process controls in place and management decision-making support.

Treasury management intelligence (TMI) platform overview

TMI comprises several key modules as follows:

Management dashboard

Snapshot of the real-time cash assets information is shown in the home page of the platform, providing cash visibility with time series data and charts, analytics panel, risk monitoring, accounts information and credit facilities information.

Liquidity and cash forecast

Regular liquidity arrangements are completed automatically by the Intelligent Multi-banking Dynamic Cash Sweep (IMDCS) system. Specific cases can be handled manually by the Fund Transfer and Inter-Company Loan Management sub-systems, built-in with transaction query function. Actual cash flow records captured by the company Oracle ERP will be consolidated into the TMI for cash forecast purposes.

Investment

The entire process of investment decision-making, post-trade processing, and holding position tracking is completed in the platform through Online Investment Request for Quotation (Online IRFQ) and Investment Position Management systems.

Financing

The traceable documentation for external financing and credit facility usage records are available online and provided as an input to the bank evaluation process for bank relationship management purposes.

Transaction and auto accounting

The unified online cashier operation desk for transaction processing is provided, connecting with Standardised Financial Institutions Communication and Reconciliation (SFICR) system to enable straight through fund transfer and real-time account balances/transaction record query. It is also integrated with an auto accounting sub-system to generate structured and standardised accounting records for Oracle GL.

Mobile approval function

The liquidity and investment arrangement proposals were recorded in the platform and automatically routed to the company management approval system, with the option for approvers to complete approval via mobile devices.

Best practice and innovation

The TMI platform presents its uniqueness and strengths featuring the capabilities of multi-banking, automation, real time based data analytics, secure and reliable technical infrastructure, and user friendly interface. This is developed in-house with a strong onsite technical team, making agile development, high customisation and reasonable maintenance efforts all possible.

Randy Ou, Treasury VP explains, “TMI is a web-based platform with graphical presentation to users. The management dashboard with data and charts and all main systems with scroll down menu are shown in the home page. Users in different job levels can easily find or drill down into the relevant information for management decision making or operational execution purposes.”

Key benefits

- Enhanced efficiency and relieved resources constraints.

- Improved cash visibility – >95%.

- Reduction in idle cash by 30%.

- Enhanced bank relationship management.