The challenge

Envision Pharma Group faced a challenge as its international footprint grew. It had dozens of bank accounts in different countries holding different currencies and serving different subsidiaries creating a complicated treasury operation.

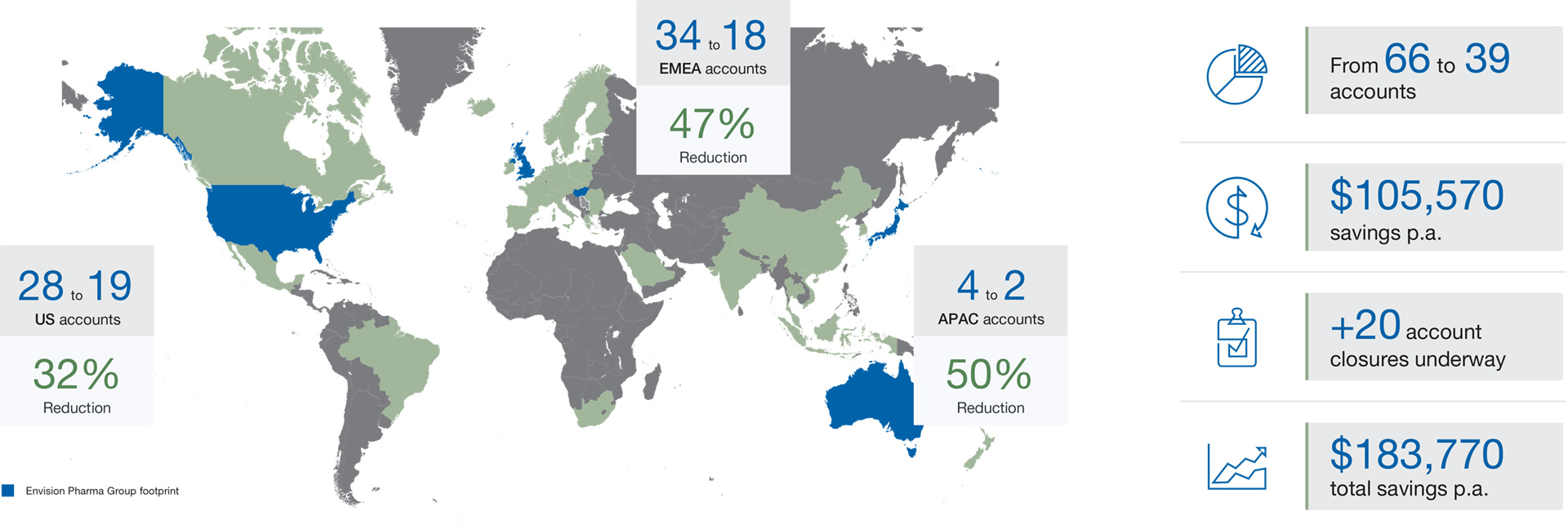

As Envision grew over the past two decades, many of its acquisitions’ banking accounts remained in use. By early 2022, Envision was managing hundreds of millions of US dollars and other currencies in 88 accounts at 15 different banks across the US, Europe, the Middle East and the Asia Pacific region.

The company sought a new strategy to make treasury operations more efficient, with increased cash visibility and more streamlined connections between accounts. Following an account rationalisation study with J.P. Morgan Commercial Banking, Envision identified where it needed accounts and where it didn’t.

The solution

Envision worked quick to declutter. Today, the company’s treasury operations use around 40 accounts with just three banks, a reduction of more than 50% in bank accounts and an 80% reduction in banking institutions. This was a complex project that Envision managed to complete in approximately six months with a dedicated project team based in the UK and the US.

The next chapter for Envision’s treasury journey includes the virtualisation of its accounts. During the account rationalisation study, J.P. Morgan identified an opportunity for Envision. The company could operate eight physical accounts globally, and the remaining accounts could be virtual. This could allow Envision to further reduce operating expenses related to maintaining physical accounts, streamline reconciliation processes and centralise liquidity without the need for cash concentration structures.

Best practice and innovation

Account rationalisation is a goal at many organisations, but it can often be delayed or sit unfinished in favour of more urgent priorities. Envision’s account rationalisation stands out because the company made it a top priority and saw the process through carefully, quickly and consistently.

The best practices in account rationalisation are to:

-

Aim for one bank account per legal entity, per currency.

-

Maintain a minimum number of multicurrency accounts for each entity.

-

Concentrate as many accounts as possible with one banking institution.

Envision’s treasury team made a major investment in an Oracle NetSuite system to run its accounting. By simplifying its bank accounts, the company is getting the most out of its new system. The company gains smoother connectivity with J.P. Morgan and other banking institutions and can reconcile its accounts more quickly. And the solution is scalable – when Envision makes new acquisitions or expands to new markets around the globe, it can realise costs savings immediately.

Key benefits

-

Cost savings.

-

Number of banking partners/bank accounts reduced.

-

Process efficiencies.

-

Increased automation.

-

Risk mitigated.

-

Improved visibility.

-

Increased system connectivity.

-

Future-proof solution.

-

Exceptional implementation (budget/time).

To date, Envision has reduced its number of accounts worldwide by more than 50%, leading to savings of more than US$183,000 per year – directly improving its group EBITDA margin year-over-year.

Account rationalisation opportunity for Envision Pharma

Source: J.P. Morgan