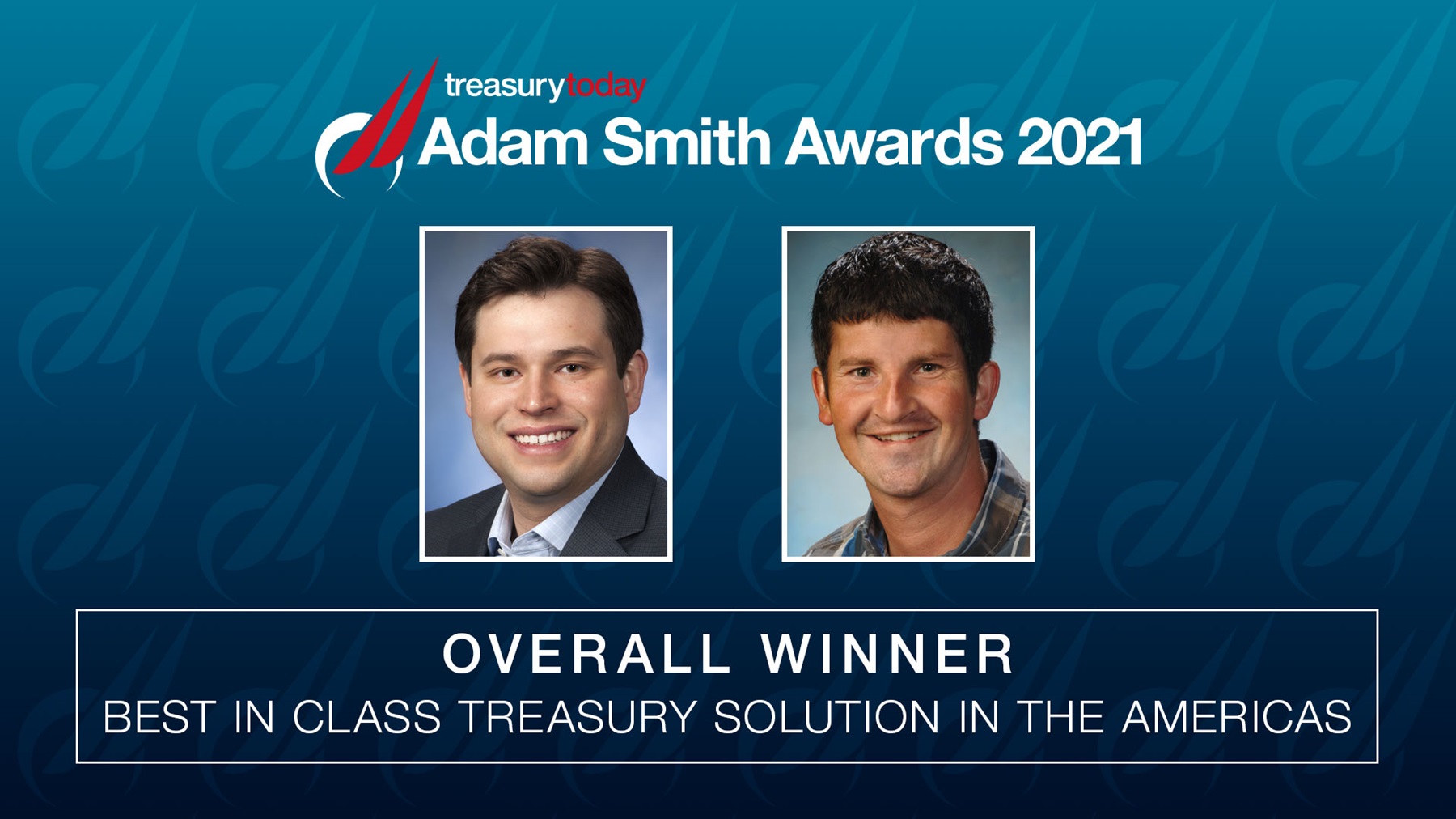

Photo of Kevin Kachur, Treasury Operations Supervisor and Jon Martin, Advanced Financial Analyst.

Kevin Kachur

Treasury Operations Supervisor and Jon Martin, Advanced Financial Analyst

Marathon Petroleum Corporation is an American petroleum refining, marketing and transportation company headquartered in Findlay, Ohio. MPC operates the largest refining system in the United States with approximately 2.9 million barrels per day of crude oil capacity across 13 refineries, and plays a significant role in providing refined products for everyday use.

in partnership with

Project Unify delivers best in class for MPC

The challenge

Marathon Petroleum Corporation (MPC) had built a complex cash management process that involved ERP systems and bank accounts across several banking partners. This resulted in an opportunity to streamline the company’s cash optimisation process and optimise its ability to quickly determine an enterprise-wide cash position.

“We also were looking for innovative ways to improve how we compiled and consolidated information for cash forecasting, and to address redundancy in bank account management responsibilities, such as managing account users and access, reviewing fees and account documentation,” explains Kevin Kachur, Treasury Operations Supervisor.

To address these needs, MPC defined a vision to create a truly modern, best in class treasury organisation that would move it away from its traditional banking structure while developing and implementing an innovative, technology-driven solution that would set the foundation to meet the organisation’s growth plans for years to come.

The solution

Project Unify was launched to increase visibility into cash flows, further optimise liquidity across the enterprise, rationalise MPC’s bank account structure while streamlining bank account management, leverage the scale of treasury operations to reduce overall costs and continue to effectively manage fraud risk. In developing Project Unify, MPC’s treasury team consulted with Deloitte to establish their strategic direction and create an execution plan. While Kevin Kachur and Jon Martin spearheaded the initiative, there were significant contributions from fellow MPC employees Mary Shinavar and Cory Imm, as well as consultant Ashok Bodduru and Deloitte representatives Tushar Agrawal and Chandra Gorantla.

Best practice and innovation

The project secured senior sponsorship of MPC’s CFO and Treasurer, which was key to its success. In-house cash is the backbone of the solution and is going to be used to process internal and external payment transactions within a group or company. This will reduce the number of external physical bank accounts that are needed and will streamline intercompany settlements, vendor payments (by utilising POBO), and customer receipts (through ROBO). MPC is also working with its bank to implement API connectivity for its new ERP system, which will provide MPC with an intelligent cash management experience. This will allow MPC to have real-time cash position information, the ability to track and trace payments end-to-end, and set up users without having to log in to their banking portal.

Key benefits

- Bank accounts rationalised.

- Intercompany netting enabled.

- FTE savings.

- Reduced bank fees estimated at US$1m.

- Liquidity optimised.

“We recognised that in order to be of greater value to the organisation and support the company’s growth plans, having a best in class treasury system is mission critical. By developing and implementing a plan to reinvent treasury, our team is laying a foundation that will enable us to take advantage of technology and payment innovations for years to come. It is this forward thinking and planning that is paving the way for our success,” concludes Kachur.

In addition, the elimination of manual processes and the implementation of digital tools means that the MPC treasury team will be able to better utilise staff time for value-added activities and serve MPC’s leadership team with greater focus. The new MPC treasury system is a great model for how to bring internal and external teams together to achieve a best in class treasury solution.

The Adam Smith Awards is the industry benchmark for best practice and innovation in corporate treasury. The 2021 Awards attracted a record-breaking 309 nominations spanning 40 countries. To find out more please visit: https://treasurytoday.com/adam-smith-awards.

Brian Kramer

Executive Director

J.P. Morgan

Rather than settling for just one way to improve treasury processes, Kevin and the Marathon Petroleum Corporation (MPC) team had the ambition and foresight to blend several best practices to increase the efficiency and optimisation of their treasury functions. The resulting initiative combines three best-in-class treasury concepts – in-house cash, virtual accounts, and automated receivables – into one cohesive and synchronised solution.

By identifying the most innovative treasury solutions available and leveraging technology to intertwine them seamlessly, MPC has set themselves up to be a best-in-class treasury organisation for many years to come.

We are delighted that this forward thinking has been recognised as a Best in Class Treasury Solution for the Americas – congrats to the entire team involved!

in partnership with