The persistence of cash

Rumours concerning the death of cash appear to be much exaggerated. Again. For a payment form that has been slated for demise for many years, it seems to be hanging on remarkably well.

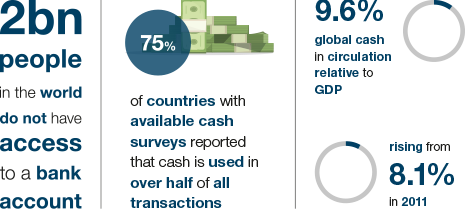

In most jurisdictions, cash remains fundamental to many day-to-day transactions. The ‘experts’ may try to convince us that it is waning in influence but the evidence (at least the evidence of the latest World Cash Report from G4S), shows that the demand for cash “is growing in absolute terms and relative to GDP”.

It seems people like cash. They trust it. It’s free to use. It’s readily available for consumers. It can’t be hacked. It doesn’t run out of battery power. Perhaps more of interest to certain elements in society, it is also a rather confidential and untraceable payment mechanism. “These unique qualities continue to hold significant value to people living on all continents,” comments Jesus Rosano, Chief Executive of G4S’ Global Cash Division.

The World Cash Report truth is that people like a range of payment options. Despite the rise of electronic and mobile payments, cash remains hugely important all over the world.

In this issue we look at the cash conundrum through the eyes of treasurers. In trying to manage this awkward beast, what means are available to keep it under control? Turn to our Insight & Analysis article and witness ‘The death of cash…again’.

Elsewhere, we consider the technology angle of running treasury on a budget before saluting the rise of the treasurer as the corporate change manager and revealing some of the key methods of unlocking value in the supply chain. As part of our continuing Back to Basics series, in this issue we offer a guide to negotiating with your bank.

Key numbers from the World Cash report