A syndicated loan is often part of a wider financing strategy, allowing a company direct access to both banks and institutional investors. But why might a corporate use a syndicated loan and how are these arranged and managed? We go back to basics to find out.

A problem shared is a problem halved, or so the adage goes. This certainly rings true when corporates need an amount of funding which cannot be supplied by one bank. In cases such as this, a syndicated loan can be used effectively to share the financing burden between banks – and, increasingly, other institutional investors such as hedge funds and pension funds.

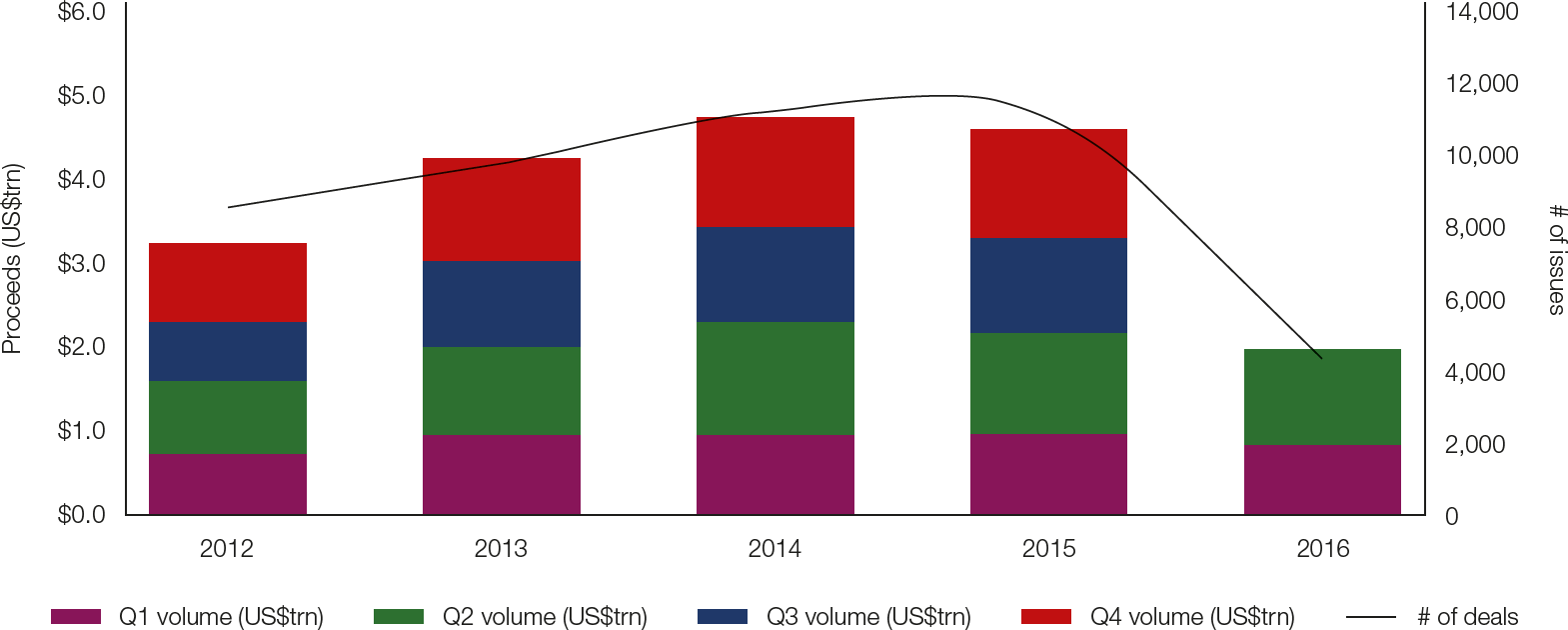

Corporates certainly noticed the value of the product pre-crisis. Indeed, global deal values peaked at just under US$5trn from over 9,000 issuances in 2007, according to Thomson Reuters data. While the market contracted significantly during the financial crisis, it has picked up in recent years: total global deal value reached US$4.2trn in 2013, up 29% from 2012. In 2014, global syndicated lending reached US$4.8trn, although this figure was slightly lower in 2015 at US$4.7trn.

As of Q216 (the latest figures available at the time of writing), syndicated lending is down 9% compared to the first six months of 2015. From a regional perspective, the Americas are leading the way with 2,127 deals totalling US$1.2trn. Elsewhere, Europe accounted for US$439.7bn of the global total whilst Asia Pacific (APAC) accounted for US$202.3bn.

The purpose of the loan

Companies obtain syndicated loans for different reasons. Some, for instance, may use this as a key tenet of their core funding portfolio. This could be a typical strategy for corporates with a lower credit rating which are unable to access funding readily through the bond markets.

Syndication may be a good option for these companies because investors are able to limit their exposure to the corporate’s risk. To account for the increased risk, companies in this situation are likely to have to pay higher margins for the loan. Investors may also put covenants in place as further protection.

For companies that have a higher credit rating, and thus more financing options available to them, syndication may be used more strategically and as a backup to other sources of finance. For example, companies may use the loan to finance gaps in funding between the maturity of one loan and the receipt of funds after a divestment.

Chart 1: Global syndicated loans volume

Source: Thomson Reuters

With a higher credit rating the margin payable to the investors tends to be lower and few, if any, covenants restrict the way the company operates. The existence of the facility may also reassure investors holding other instruments issued by the company, such as commercial paper, allowing the company to benefit from a lower overall cost of funds.

Types of loan

Syndicated loans primarily come in two forms:

-

Term loan.

A term loan is a more traditional type of loan. The full amount is drawn either initially or in pre-determined instalments. The principal is either repaid over the term of the loan or at maturity.

-

Revolving syndicated loan.

This will have a specified term limit, but, in contrast to a term loan, the borrower can draw down funds and repay them as necessary, as long as the terms and conditions of the loan are met. This style of loan is more suited to companies which view the syndicated loan as a secondary source of finance or have a periodic need for funding.

Corporates also have a choice regarding how the loan is structured. For instance, some companies may wish their syndicated loans to comprise both a term loan and a revolving loan. This is most common if the company is a lower rated issuer. Investment grade credits are more likely to structure their loans into different revolving tranches, however. One tranche will be repayable in under a year whilst the other will have a longer maturity (typically three to five years). This provides the company with a longer-term source of funding, which is particularly useful as a backup to a commercial paper programme.

The maturity of the loan can also be designed to reflect the borrower’s needs. For instance, if a loan is sought by a shipping company to finance the purchase of a new fleet of its ships, the company may want to delay repayments until these are fully operational and bringing in revenue.

Relationship management

Before any bank is consulted about arranging the loan, the treasury needs to have a clear understanding of the role the loan will play in the company’s wider funding strategy. This will provide a crucial focal point when the company states its case to investors. A repayment strategy will also have to be outlined.

With a strong case built, treasury can appoint one or more arranging banks. This is typically completed through a tender process and, as with any selection procedure, can be difficult without prior experience.

In particular, treasurers need to be aware of the relationship implications of syndication. Appointing a bank to arrange a syndicated loan can be an effective way of rewarding a bank – or banks – which already provide the company with credit. However, the selection should take into account the entire relationship, how long it has existed and the company’s future plans.

To avoid this issue, a company can arrange a club loan – when no arranging bank is appointed and the loan is instead arranged by the company. However, this will result in a more labour-intensive process for the treasury.

A second consideration when selecting an arranging bank(s) is its geographic footprint. The selected bank(s) will need to have coverage in all the appropriate markets, particularly if the aim is to attract institutional investors.

Further considerations

The company will also need to work with the arranging bank to decide if the loan will be underwritten. If this is the case, the borrower will receive the full amount of the loan, irrespective of whether the arranger has successfully syndicated the deal. If the loan is to be underwritten, the arranger will usually try to involve other banks as underwriters as part of the syndication process – particularly for very large deals.

A ‘best effort’ understanding exists if the loan is not underwritten, meaning that the arrangers do not have to meet any shortfall if the syndication is not fully successful, with the borrower receiving the reduced amount. This type of arrangement is typically found when the aim of the loan is to provide backup financing.

Treasury must also be fully aware of the fees associated with the loan, which can include the following:

-

Margin.

The lenders will charge a margin over an agreed market benchmark.

-

Commitment fee.

Where a loan is not fully drawn, borrowers will be charged a commitment fee.

-

Utilisation fee.

In some cases, banks may be able to charge a small additional fee if a high proportion of the loan is drawn.

-

Arrangement fee.

The arranging bank or banks will normally receive a fee once the syndication has been successfully completed. This will be determined by the size of the syndication and the associated credit risk. In some cases, other lenders will receive an upfront fee (of only a few basis points) for participaltion in the syndicate.

-

Legal fees.

Companies will have to meet the costs of their legal advisors.

The art of negotiation

Negotiation takes place at all steps of the syndicated loan process. It is therefore important to understand what the other side wants. Treasurers need to identify each potential bank’s approach to, and appetite for, syndicated loans. Considerations include:

- The type and size of banks and whether they will sell their participation right away, or take a longer-term view.

- The importance of the relationship.

- The arrangement fee. If smaller syndications are divided between arranging banks, they may be dissatisfied with the reduced fee.

At the same time, it is important that the company gets what it needs from the syndication. In particular, the treasurer needs to identify any potential covenants or other restrictions which the company cannot accept.

Syndicated loans are increasingly popular because of the variety of ways they can be structured and the funds used. However, the treasurer does need to be aware of the company’s future funding requirements before the negotiations start so that appropriate terms and conditions can be agreed.

Send and receive

The final step before the syndication is closed is to appoint a bank to act as administration agent. The primary role of this bank is to collect interest payments from the borrower and distribute these among the lenders.

This bank will also administer any interim drawdown notices. Under the terms of a revolving credit, the borrower is entitled to call for a drawdown of funds at any time. Ensuring that all participants meet their obligations is a key determinant of the success of the syndicated loan.

Secondary market

For lenders, an important factor is the secondary market, where exposure to the syndicated loan can be managed by selling on part or all of a bank’s participation in a syndicated deal. The exact terms and conditions for this are set out in the loan documentation. Most transfers are made ‘by novation’, in which case the new lender becomes a ‘lender of record’. In these circumstances, the new lender simply replaces the original lender. The original terms and conditions apply, with the only change relating to which bank receives the interest payments.

The key factor in all cases is that the bank’s ability to sell loans in the secondary market reduces the counterparty risk associated with the decision to participate in the syndication. As a result, the secondary market enhances liquidity in the syndicated market.

What is sometimes less well understood, however, is the importance of the secondary market for borrowers. Indeed, the transferability of loans is an important component in the growth of the market. For the corporate borrower, the development of the secondary market has also enhanced liquidity in the primary market, arguably bringing down margins for all borrowers.

Digital disruption

Arranging and managing a syndicated loan can be an inefficient, labour intensive and lengthy process. While the various loan market associations around the world have made great strides in simplifying this process through the creation of standardised loan documentation and championing best practices, complexities remain.

The syndicated loan industry is, therefore, ripe for digital disruption, and a number of parties are already looking to digitise this space. In September 2016, for example, a group of banks including Credit Suisse, the R3 blockchain consortium, and fintech start-up Symbiont announced that they had taken steps to improve the process. The trial loan, arranged by Credit Suisse, employed smart-contract technology that sees contracts exchanged on the blockchain to quicken and increase the efficiency of loan trade settlements. Using this type of solution, paperwork can be reduced dramatically, as can the hurdles and inefficiencies that any trade market routinely sees.

“This project demonstrates the potential for blockchain technology to fundamentally reshape the syndicated loan market and the capital markets more broadly,” said Emmanuel Aidoo, head of the distributed ledger and blockchain effort at Credit Suisse following the announcement of the trial. “This demonstration sets us on a path to increase efficiency and reduce costs, which will benefit banks and clients alike. By connecting a network of agent banks through blockchain, we can achieve faster and more certain settlements in the loan market.”

It remains to be seen how long it will be until solutions such as these are fully implemented. But one thing is for sure: disruption in the syndicated loan market is coming, and will hopefully benefit the whole ecosystem.