Using blockchain and private wallets, KYC-Chain believes it has developed the solution that will finally drag the antiquated process of KYC into the 21st century. Here, Edmund Lowell, Founder and CEO explains how.

Edmund Lowell

CEO & Founder

Tell us a bit about yourself and your background. How did you get into fintech and what has made you want to solve the KYC challenge?

My background spans law, technology and finance. After graduating from Northeastern University I set up a company that offered outsourced corporate secretarial services to companies setting up their operations. Part of this role included opening bank accounts and I remember being amazed how it took banks 28 days to perform KYC checks that we would be able to complete in one day. It was especially onerous when doing this across borders and it was here that I started thinking about how the KYC space could be improved through the use of technology.

Before founding KYC-Chain I worked across numerous roles and industries including being CFO for a company with over 100 employees. I know enough about finance to be dangerous. I have also established some successful technology start-ups that proved to be very good learning experiences. In more recent years I have become fascinated with distributed ledger technology and the opportunities that this provides to make financial services more secure, transparent and efficient.

In marrying all these experiences together, I established KYC-Chain in 2016. KYC is an interesting and very complex area and because I do not come from a banking background I feel that I can look at some of the processes through a different lens. We can kill some sacred cows. What is most obvious when working with banks is that their focus is on incremental change – and there is a good reason for this, they work in a highly-regulated environment and are risk averse. But with KYC-Chain we believe that we can partner with banks to drive revolutionary change and make the KYC experience exponentially better for banks and their clients.

What makes fintech such an exciting space to work in?

You just have to look at the pace of change and how the corporate and financial landscape is changing. Take Ant Financial, this is a spin off from Alibaba Group and it is valued more than Goldman Sachs despite being just a few years old. What has facilitated this? Technology. In the right hands technology has the power to facilitate exponential change.

The relationship between technology and finance is speeding up. For a long time, there has been technology component in finance but the environment is changing at a rapid pace where some technology companies that have got into finance are now bigger than the banks. See Ant Financial, Ping An Insurance and disruptor banks in the UK – these are technology companies at their core. People need banking services but they don’t necessarily need them from a bank. Banks should partner with technology firms to stay relevant, especially those that will enable them to serve their customers better. It may come to a point where if it’s easier (or less annoying) to do KYC with one bank, then they have a competitive advantage over other banks.

Do you think that the banks see fintech as friends or foe?

The mindset is changing though and banks are increasingly seeing the fintech community, even those companies that position themselves as disruptors, as an industry that they should begin working with.

What other challenges exist for fintechs today?

This depends on the market that the company is operating in, a company operating in the payments space will have different challenges to us. Regulation, for example, worries some companies because it could theoretically impede a lot of what the company is trying to do. At KYC-Chain, however, we like regulation, it facilitates our business model.

More broadly speaking, though, there is a fear that regulators will always side with established financial organisations if there is ever conflict between fintech and banks. Regulators have a hard job balancing competing interests, but ultimately, they have long-standing relationships with banks so human nature says they will back these instead of fintech.

The other challenge for fintech is that the landscape will continue to change. Companies will come and go and there will be consolidation in the market. We have seen this happen since the dot com boom and it will happen in fintech as well.

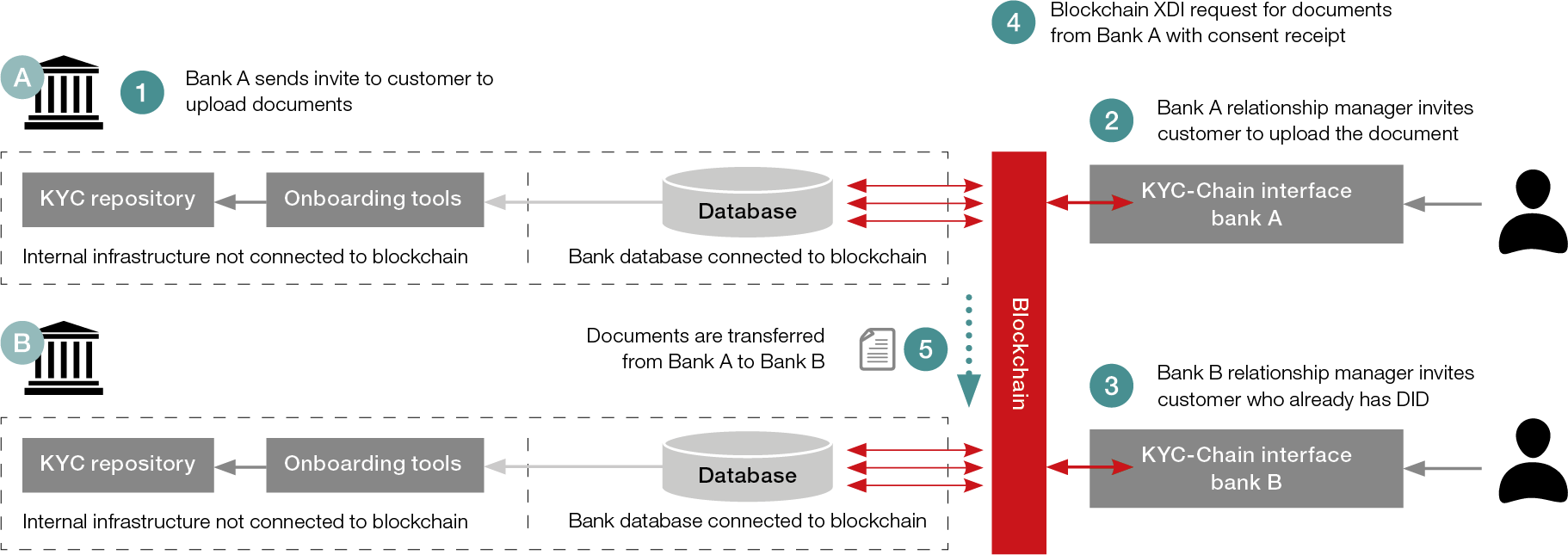

Customer journey from bank view

Source: KYC-Chain

KYC 2.0

“The world we want to move into is one that is more transparent, more private and more secure,” says Edmund Lowell, Founder and CEO at KYC-Chain. “At present KYC is the polar opposite of this. It still relies on paper, the processes around it haven’t been standardised and the information is not easily shared from one person or institution to another. The fact that there are still scans of passports moving around the world in unsecured email and snailmail is almost embarrassing when you consider the technological progress made in other areas.”

It is this legacy world that Lowell and KYC-Chain are trying to solve. “We want to make the document and data information exchange between the end client and the financial institution easier and more efficient for all parties,” he says.

Solution in action

The customer of the bank controls this information at all times in a private wallet that is secured by a set of private keys. Through this wallet, the customer is then able to permission its banks to view the information they need when they need it. The data rests within the banks servers, but the user retains control and access.

“Unlike traditional KYC processes, this really puts the control of the document exchange bank in the hands of the customer where it should be,” says Lowell.

In practice, this means that no longer will customers have to deliver physical proof of identity to the bank when opening a bank account. There will also be no wait time between delivering these documents and having access to the account, as the private wallet has an authentication layer that will enable the customer to access the bank account right away.

In an effort to drive further security, KYC-Chain employs agent software that allows two siloed data sets to talk to each other using cryptographic keys. What this allows is for documents to be shared in the traditional manner (the full document) or identity can also be confirmed through a zero-knowledge based proof. “This shares the least amount of information satisfied to meet requirements,” says Lowell. “For instance, if you simply need to show that you are over a certain age, you could choose to share only that bit of information, as opposed to sharing more than is needed. Traditionally you would have to show a government issued ID which would also reveal other items like your address, sex or exact date of birth.”

Solution delivery

Although there are numerous ways that this solution can be deployed, right now, KYC-Chain is offered as a dockerised SaaS application to the banks who then provide their own branded interface to customers. “It makes sense to offer the solution this way because it is the banks that are asking for this KYC information, not KYC-Chain,” says Lowell.

But what he believes is crucial is that blockchain isn’t a centralised store of information, meaning that the customer’s data is not hosted on KYC-Chain’s servers, or the blockchain itself – unlike some of the other companies who are working in this space. “The data is hosted on the bank’s servers, but it is locked down and only the customer can decide when this information can be accessed,” adds Lowell.

Treasury interest

Any solution that can go some way to solving the KYC burden is bound to gain the attention of the treasury community. “The benefits to corporates are clear, it can help make their information more secure, private and give them more control.”

The next step for KYC-Chain, says Lowell, is the continued development of the authentication layer within the platform. “There is a natural synergy between what we are doing now and acting as an authentication layer,” he says. “It will happen as a natural evolution and utilise tokens and biometrics.” This will potentially eliminate the need for treasurers to carry around multiple authentication devices to access their banks, something that all in the corporate community will welcome.

Company timeline

1. January 2014

Published whitepaper on KYC on blockchain

2. May 2014

Prototyped on Bitcoin

3. December 2015

Started recruiting team

4. January 2016

Founded KYC-Chain

5. April 2016

Prototyped on Hyperledger

6. August 2016

KYC-Chain joins Accenture Fintech Lab

7. September 2016

Setup HK office

8. October 2016

Prototyped on Sovrin Blockchain

9. January 2017

Competes in Fintech Finals 17 as finalist

10. April 2017

POC with Standard Chartered Bank

Source: KYC-Chain