China’s fast-growing onshore credit market is as diverse as it is complex. Investors thinking about investing in this arena need to understand the risks involved if they want to reap the rewards.

Aidan Shevlin, CFA

Head of Asia Pacific Liquidity Management

Andy Chang, CFA

Credit Analyst, Asia Pacific Liquidity Management

When it comes to comparing the Chinese onshore corporate bond market with developed bond markets across the world, there are many similarities, but there are also some fundamental differences. These include investment platforms, rating methodologies as well as issuer and investor characteristics, not to mention unique local market practices. All of these go hand-in-hand to make investing in the Chinese onshore credit market incredibly challenging.

A decade of financial reform, combined with rapid financial market innovation has increased the range of Chinese credit issuers and the variety of instruments available – contributing to a twelvefold surge in the size of China’s onshore credit market – and contributing to their depth and liquidity.

China’s corporate bonds are traded on multiple platforms, but the interbank market dominates. Local government bonds make up the largest segment of China’s onshore credit market mix while commercial banks are a close second, other issuers include state owned enterprises and private companies.

“Chinese credit market yields are more volatile than those of similar securities in developed markets due to multiple macroeconomic and technical factors,” says Shevlin. “Therefore, credit market investors are dominated by local asset management companies, attracted by their potential for higher investment returns.”

Ratings – different methodologies

International investors rely on the long-established international rating agencies when buying credit bonds. Until recently however, none of these had licences to operate in China and their coverage was limited to Chinese issuers who required an international rating due to their foreign bond issuance – a small minority of the domestic credit issuers.

Instead, several domestic rating agencies currently dominate the Chinese onshore rating. “By law, bond issuers are only required to have one rating, making competition between domestic agencies intense and encouraging rating arbitrage,” says Chang.

Local rating agencies have also developed their own unique methodologies – and this has limited investors’ ability to map local ratings to international rating scales. With local rating agencies placing considerable weight on the implicit presence of a government guarantee, the majority of issuers are rated AAA, and there is little relationship between an issuer’s rating, financial strength and credit spread.

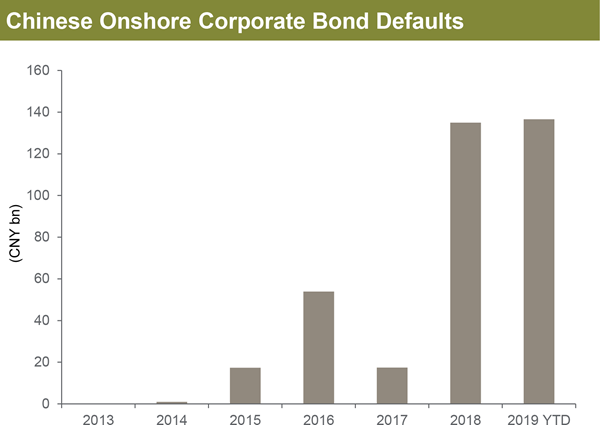

Exhibit 1: Since the bond market’s first-ever default in 2014, the pace and size of defaults have risen dramatically

Source: S&P, Moody’s and J.P. Morgan Asset Management; data as at June 30, 2019.

Escalating credit risks – investors beware

Prior to 2014, China’s bond markets had never witnessed a default and investors had never suffered a loss as failing entities were bailed out at the behest of the government. “This practice underpinned the belief that corporate debts would always be underwritten by an implicit government guarantee,” says Shevlin. “The first bond default shocked the market and established a link between risk and return.”

This link was solidified by new regulations designed to stop issuers offering principal guarantees, coupled with a new deposit insurance scheme. Both reforms significantly eroded confidence in the implicit government guarantee and magnified the challenges of investing in the onshore credit market. The sudden seizure of Baoshang Bank in May 2019 highlighted the weakness of smaller commercial banks.

“Investors need to realise that Chinese credit risk is increasing,” says Chang. “The complexity of China’s onshore bond markets highlights the importance of due diligence and rigorous independent analysis, in order to balance the risks and returns of investing in this arena.” He believes that ultimately, credit research is critical; “Chinese credit issuers should primarily be assessed on their standalone capital, asset quality, management, earnings and liquidity. Only then should the potential level of government support be considered.”

The Chinese corporate bond market continues to grow in size and importance and is now too large for investors to overlook. Rigorous analysis of issuers and counterparties is critical to understanding the true underlying risk characteristics of onshore Chinese credit risk investments. Managing renminbi cash in today’s volatile world need an expert guide. To find out more, visit jpmorgan.com/chinamoneymarket