The payments revolution is picking up a head of steam globally and nowhere is it advancing quite so rapidly and innovatively as across Asia.

Few aspects of the global economy have evolved as rapidly in recent years as payments, with growing consumer and corporate demand for faster transaction experiences driving proliferation of platforms across the space.

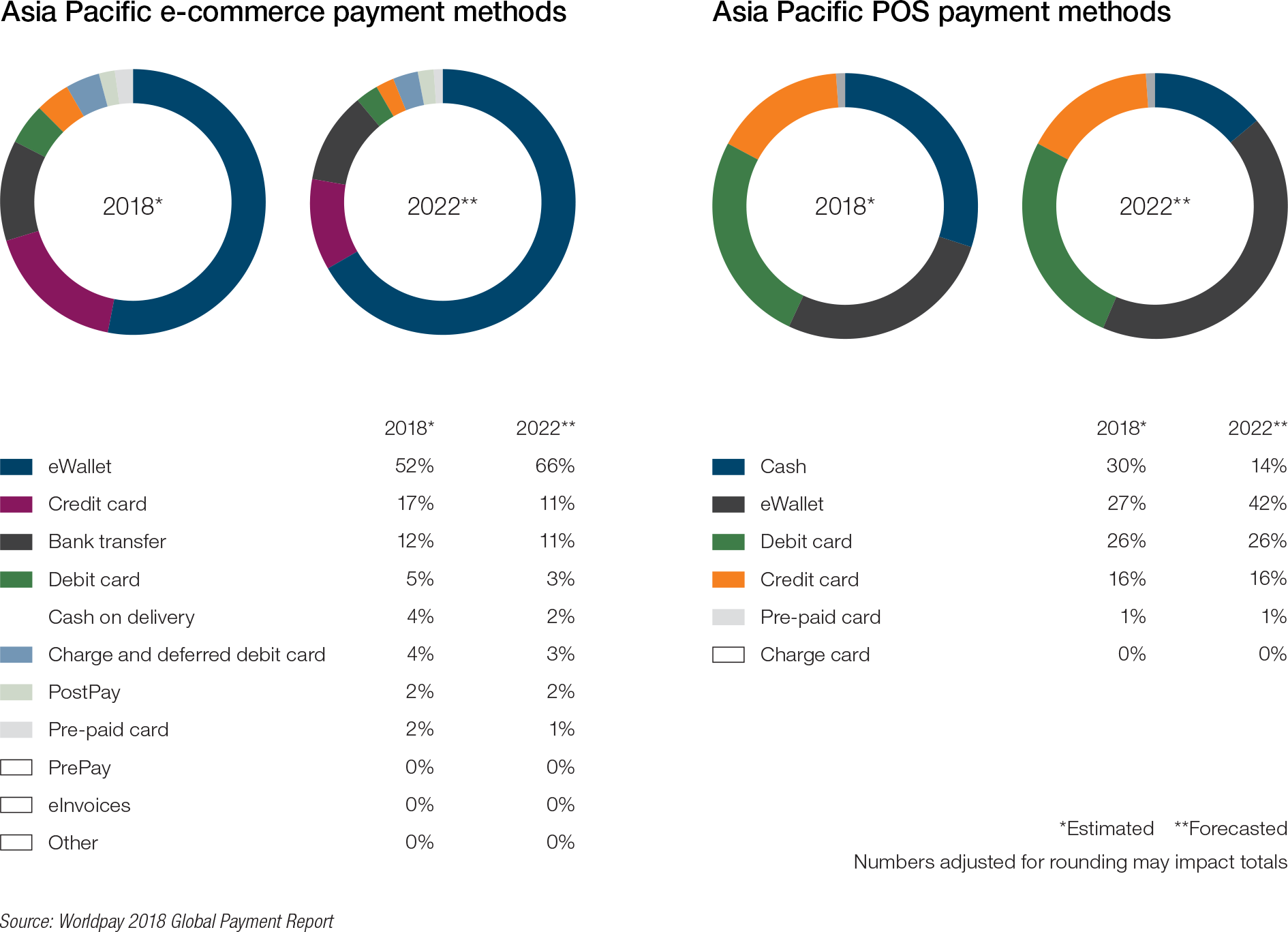

The meteoric rise of e-commerce accurately reflects the rise of the alternative payments and platform proliferation, with Worldpay’s 2018 snapshot of global payment methods reckoning the still relatively young industry’s volume will surpass US$4.6trn by 2022. According to Worldpay, alternatives to credit and debit cards now account for more than half of e-commerce transaction volume. A survey of 36 countries by the payments technology company, meanwhile, reveals there are at least 140 online payment methods in use today.

While cash remains the leading payment at the point of sale (POS), here too its long reign of supremacy is nearing its end. Worldpay’s study projects that cash will be supplanted by debit cards as the leading POS payment method in 2019, falling to fourth place in 2022, trailing debit cards, credit cards, and eWallets.

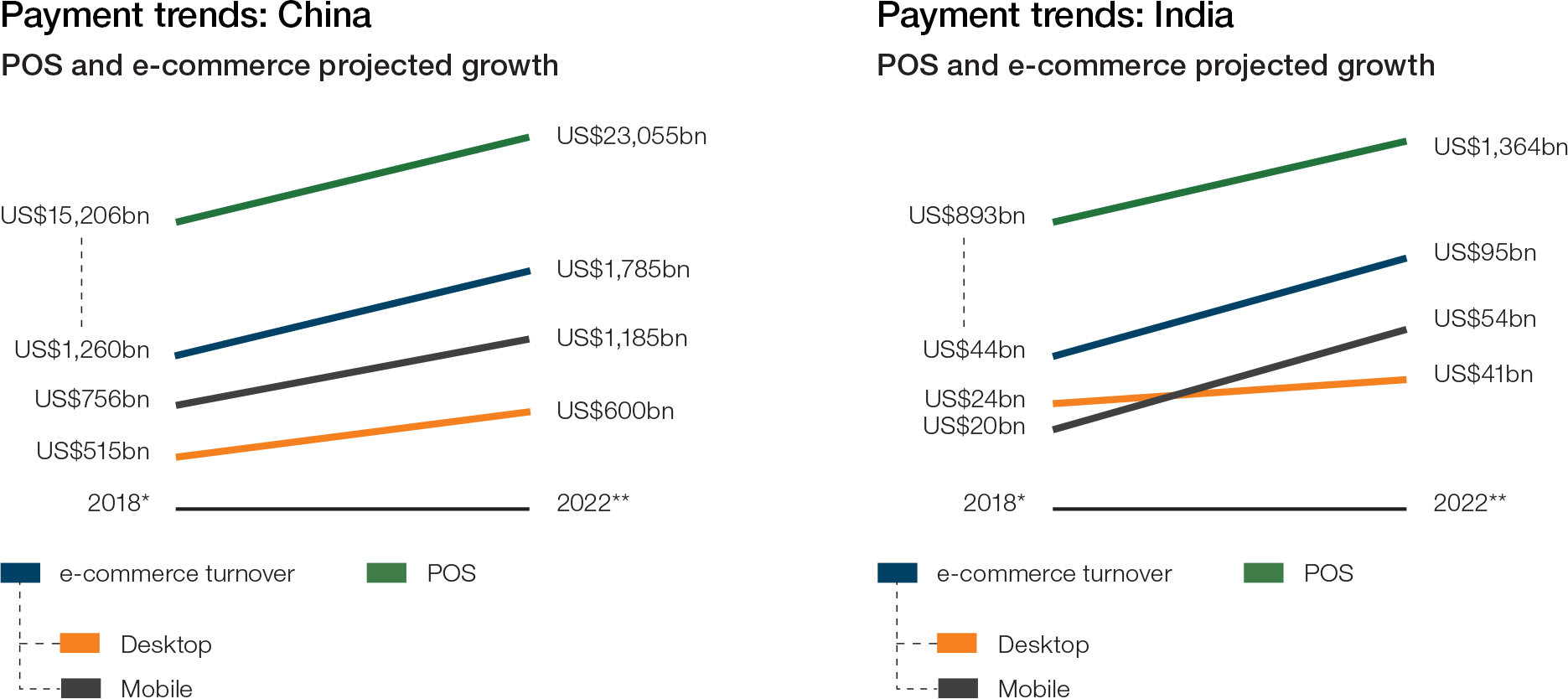

While the payments revolution is a truly global affair, at the regional level it is Asia that undoubtedly stands at the forefront of payment innovation, particularly in mobile commerce. Worldpay says the outlook for e-commerce across the region continues to be defined by “extraordinary” rates of growth, with five-year compound annual growth rates projected at 21.3% in Malaysia; 20.2% in Vietnam; and 18.6% in the Philippines and Indonesia. In China, the headline payments story remains the widespread adoption of digital wallets: “Led decisively by Alipay and WeChat Pay, app-based payments via mobile devices redefine the scope of the possible. Chinese consumers are categorically choosing the seamless integration and trusted environment offered by these all-inclusive apps.”

While wallet use is ubiquitous in China online, accounting for nearly two-thirds of e-commerce transactions, Worldpay also notes that eWallets are so popular among Chinese consumers that they also lead payments at the point of sale, representing more than a third of card-present market share.

Elsewhere across the region, Worldpay is forecasting growth and dramatic shifts in payments in India: “Home to the world’s second largest population that remains far from saturation in either internet access or mobile phone penetration, we project e-commerce growth in India at 21.2% CAGR for the next five years.”

Looking forward, Worldpay believes Asia offers seemingly “infinite promise for commerce and payments” though, with payment methods varying widely across the region, both between and within countries and across the spectrums of development from urban to rural, “companies operating in Asia face a complicated and demanding payment landscape”.

While local conditions across Asia may vary, Worldpay can readily discern some key regional trends: “At the point of sale, we project dramatic shifts from cash to eWallets over the next five years with debit and credit cards maintaining current share. On the e-commerce side, meanwhile, we project continued global leadership in the adoption of eWallets; led by China, we expect eWallets to account for two-thirds of regional payment volume by 2022.”

Worldpay’s assessment of Asia, the vitality of payment innovation across the region compared to other geographies, is echoed by Jonas Falk, Managing Director of ball-bearing manufacturer SKF’s Treasury Centre, Asia & Pacific in Singapore. He says that in comparison to Europe and the Americas, Asia appears to be moving much faster in developing and adopting novel financial technology and solutions, with the rapid development of faster payment rails across the region one of the results. Indeed, Falk believes the pace at which payment rail technology and its application is evolving across the region means that getting the right regulatory frameworks in place to accommodate advances in the space has become “especially urgent”.

Looking further ahead, Falk believes it not unreasonable to hope that at some point in the future SKF itself might end up with just one bank account for functional currencies per country: “Today, if you look at the payments landscape we have a lot of different types of payments…domestic, international, clearing, different types of cross-border payments and so on. I hope payments in the future will be just like sending an SMS.”

He adds: “In many ways we are still having to deal with platforms, IT infrastructure that date back to the 70s. Over the next few years that is going to change, we will have more options. We are really beginning to see it happen now, we are seeing a lot of open source, open banking applications, APIs, customised peer to peer connectivity, with boundless financial functionality such as funding, discounting, payments and settlements and all integrated with existing processes.

“Over the last year or two we have seen an enormous trend in banks launching portals to attract communities; they are opening up now and deliver connectivity. It’s a very exciting time as it seems we are taking some important steps that will inform the future of banking and payments. We don’t have a global payments platform as yet but in the future that may be possible. That would create a lot of data so analysing it, exploiting it, will be very important and beneficial not just for treasury but for the organisation as a whole.”

Banking on real-time

Among the banks, HSBC, which derives the bulk of its global profits from Asia, also believes the region is at the vanguard of the payments revolution. Thomas Halpin, Global Head of Payments Products, Global Liquidity and Cash Management, HSBC says: “Asia Pacific has some of the most advanced real-time payment schemes in the world. Countries across the region are not only accelerating their adoption of real-time payments but also using the latest mobile payments technology in their schemes. The key driver has been the need to serve a modern digital consumer who is always connected, values convenience, and expects a great experience across all of their devices, especially on mobile.”

Halpin explains that up until just a few years ago the traditional payments infrastructure in Asia was unable to meet digital consumer needs. As a result, internet platform providers – such as India’s Paytm and PhonePe; Indonesia’s Go-Jek; and China’s Alipay and WeChat – were able to use eWallets as an alternative, providing fast and convenient payments as part of a broader mobile enabled user experience.

Chart 1: Asia Pacific payment methods

Source: Worldpay 2018 Global Payment Report

“Now, the rapid upgrade of payment rails across Asia Pacific is accelerating the trend towards mobile payments. For example, use of overlay solutions such as QR codes are key features of real-time payment schemes in the region to a far greater extent than they are in other schemes around the world.

“At the same time, financial inclusion is also fuelling the growth in real-time payments across the region, as governments see an opportunity to use new technology to provide financial services to citizens who previously did not have bank accounts.”

As payment rails proliferate and diversify across the region, so do the challenges and opportunities for banks and their clients. Nicholas Soo, Regional Head of Payments Products, Asia-Pacific, Global Liquidity and Cash Management, HSBC, is clear that for banks the development of real-time payments presents a tremendous opportunity to help clients transform their business: “We are talking to treasurers about how they can use real-time payments to streamline payments and collections, and how they can harness the new infrastructure alongside technologies such as APIs to gain a competitive edge.”

As an example of this in action, Soo points to how in India HSBC is helping a large microfinance institution to instantly verify applicant account details, via an API callout to the real-time payments network, prior to making the payment. The solution aims to ensure that there are no returns due to incorrect bank details and the applicant has access to funds almost as soon as the loan is approved.

Soo says that one of the big challenges for banks operating across the region is lining up the resources to go live with real-time payments in multiple countries simultaneously. “As well as new markets going live, many countries are upgrading existing infrastructure or adding new overlays. Often, we work to tight timelines for new real-time payment implementations and no two schemes are ever exactly the same. However, we are able to apply some lessons learned from one country to another.”

He strongly advises corporate treasurers to work with other teams across the business to understand the impact of real-time payments on internal practices and their client and vendor relationships: “For example, our corporate clients are working out how to treat inward credits from their customers over the weekend.

“Buyers are taking advantage of the 24/7 nature of real-time payments, which means they expect their credit lines to be updated in real-time on a Saturday or Sunday, to enable them to get deliveries on Monday. As a result, corporates are having to adapt their own ways of working.”

Critical mass

While the region continues to power ahead in developing real-time payments infrastructure and platforms, Soo says success ultimately depends on their widespread usage and achieving that is by no means straightforward: “You can only reach critical mass when regulators, banks, payment solution providers, and large corporates work together. This was particularly true in India – it’s Immediate Payment Service (IMPS) launched in 2013, but volumes grew exponentially over the past 24 months with the confluence of a large number of banks going live, greater consumer awareness, and business need for instant disbursements and refunds from large corporates, non-bank financial institutions and e-commerce players.”

Countries that have seen the biggest uptake in real-time payments are those where regulators have made it their mission to drive adoption, he says. Hong Kong, for example, is looking at different use cases to enable government departments make payments using the Faster Payments System, or to receive payments from the public settling government bills in the same manner. In addition, the Hong Kong Monetary Authority and financial institutions are looking to promote wider adoption of mobile retail payments through a common QR code standard for merchants and consumers.

Chart 2: Payment trends in China and India

Source: Worldpay 2018 Global Payment Report

Soo adds: “The importance of financial inclusion in some countries provides a powerful reason for regulators to ensure market participants move to real-time payments. To take India again as an example, the launch of Aadhar (a unique 12-digit identity number for residents) enabled millions of Indians to open bank accounts, and it is expected that most of the payments will be through the real-time payment rails.”

For HSBC’s Halpin one of the most remarkable aspects of the transformation under way in payments across APAC is that even though it is a relatively new development for the region it already seems like business-as-usual, such is the speed with which infrastructure and novel are being adopted by banks and corporate across the region.

Looking ahead, he believes the development of real-time payments will accelerate the move to open banking, the internet of things and smart cities – all of which are predicated on the fast and secure exchange of large amounts of data, which is made possible by real-time networks.

“The next step will be for the real-time revolution to spread to cross-border payments. SWIFT gpi is already increasing the speed and convenience of international payments. But there remains a real opportunity to better connect different real-time schemes around the world. So, a traveller from Singapore could scan a QR code and pay for a purchase in Thailand within seconds.

“As with domestic schemes, success will require regulators, banks and corporates to collaborate, albeit on an even larger scale. But the prize will be even greater ease, speed and certainty for businesses and consumers making international payments across the region.”