On 9th October, the Future Treasury & Finance Leaders Forum came to Palo Alto in Silicon Valley for the first time. Treasury and finance professionals came together to engage with industry leaders, exchange valuable insights and help to shape the future of finance.

The event, which was sponsored by BNY, HSBC and MUFG, included a wealth of insightful panel discussions and workshops focusing on treasury best practice, award-winning journeys and technical innovation.

Lessons from award winners and elite practitioners

Opening the event, Sophie Jackson, CEO of Treasury Today, explained that the Future Treasury and Finance Leaders Forums launched last year in Singapore, New York and London, expanding to five locations in 2025.

“The format is to create a new alumni network of award winners and elite best practitioners, so you can get into dialogue with each other on your career paths, the evolution of best practice and award-winning experiences,” she said.

Winning solutions

First up was a panel discussion with three industry experts: Anita Mehra, who recently retired from her role as Corporate Vice President of Global Treasury & Financial Services at Microsoft; Catherine Portman, VP, Treasurer at Palo Alto Networks; and Tom Halpin, Head of Global Payments Solutions North America at HSBC.

The panellists discussed their experiences of award-winning projects. Portman emphasised that she saw winning an award as testament to her team’s efforts in seeing through a transformational project, as well as an opportunity to tell the team’s story: “I get a lot out of these forums, with the connections, networking and storytelling, because we’re all in it together.”

Reflecting on HSBC’s role in supporting winning projects, Halpin observed that success in programmes like the Adam Smith Awards gives companies the opportunity to attract talent more effectively. “Any time you win an award that is centred around innovation and problem solving, it attracts talent – it gets people excited that you’re moving your company forward, or in some cases the whole industry,” he said.

Continuous learning

Turning to the evolution of best practice, Mehra spoke about the importance of seeing continuous learning as a personal responsibility, while also creating the right environment to develop team members.

“There are never enough people,” she said. “There’s never enough money. There’s never enough technology in our teams, whether you work for a startup or a large company. So how do you create that space for team members to have the time to continuously learn while delivering results?”

When it comes to leading and inspiring a team, Portman added, it’s important to set the pace effectively. “You need to adjust and modify in terms of what your teams are receptive to. If you overwhelm them with the pace setting, you’ll need to throttle back.”

Data science and treasury

Portman said that in her current role and in addition to leading the Global Treasury function, she supports college internships and early in career programmes for the CFO organisation. For this past summer’s internship programmes, her CFO asked her focus on recruiting interns to work solely on AI projects across the finance functions. They therefore focused recruiting on not just traditional student profiles – accounting, economics, finance majors. “We considered students with double majors or majors in data science, data analytics.”

“The summer intern programme helped accelerate our team’s thinking around how AI and new technology will enable faster decision making and reduce manual efforts. Instead of spending hours and days manually pulling data into multiple spreadsheets, we have the data more quickly now. We’re in the process of building out agents to advance deep analysis and business decisions towards value accretive investments. As a result of this summer’s programme, the company has hired five AI Financial Analyst to continue the work and momentum across all of the finance teams. “

For others in treasury who do not have a data science degree, it’s important to stay curious and learn, noted Mehra. “It’s not like when we started using Power BI or other data visualization tools, or when we were doing more Monte Carlo simulations – if you didn’t have the technical skills, you couldn’t do it,” she explained.

“Now, with AI driven solutions, all you need is the ability to use natural language to pull up the report and get the insights you need whether it is your revenue by geography or foreign exchange exposure trends. All of this is already embedded in spreadsheets and other tools. Stay curious, ask thoughtful questions and consider what decisions you can drive based on the insights that AI provides.”

The importance of flexibility

Halpin observed that information is at the heart of what treasurers need – “and they need to get it in real-time to make better and faster decisions. So the problem is a lack of speed, and technology-wise, there are a lot of ways to solve it. We don’t jump in and say that AI is the answer to everything, because customers are going to be at different stages in their journeys.”

He explained that HSBC’s approach includes solutions such as virtual accounts which can create a simpler structure. The bank has also recently launched tokenised deposits in several markets. “We’re not saying one size fits all – we recognise that we need to have a level of flexibility.”

Harnessing best practice

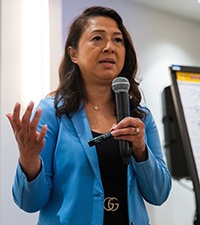

In the next section of the forum, Jackson introduced her co-moderator, Tami Nguyen, a treasury consultant with over 20 years’ experience. Nguyen’s previous roles include Assistant Treasurer at Electronic Arts and Keurig Dr Pepper.

Nguyen invited attendees to break into smaller groups to discuss best practice and innovation. Alice Xu, VP, Corporate Treasurer at Workday, pointed out that best practice can vary between companies – “so best practice is to figure out what possibilities are out there, and then come back and evaluate what we currently have.”

Likewise, different companies have different levels of resource available for innovation. “We also have to realise that our team has day-to-day activities to handle, so it’s a balancing act,” Xu said. “Encouraging people to be curious and open to ideas is a training process, and it’s about leading by acting.”

Kenny Tse, Head of Treasury Tech at Google/Alphabet, explained that one of his team’s best practices is to evaluate all the technology buzzwords they hear and decide whether they want to invest in building solutions for different developments. “And a decision to not invest too much time in a particular buzzword is a big decision, because it’s choosing not to do something. Hindsight is 20/20; if you’re right, it allows you to spend the time prioritizing better technology. If you’re wrong, you can fall behind”

Nate Hughes, Corporate Banking Relationship Manager at MUFG, shared three takeaways from his group’s discussion. “The first was to give your team the time and encouragement to come up with crazy ideas and take those risks,” he said. “The second was attending every single Treasury Today event so you can see your peers and hear what they’re doing! And possibly the most important point is to support your direct reports and be that firewall – if they make a mistake, you own it with them.”

On another note, Shannon Alwyn, Director, Treasury at Netflix, argued that innovation “doesn’t always mean technology”. Instead, she expects every team member to innovate in their particular realm, with or without technology.

Technical innovation, risk and resilience

Nguyen introduced the second panel discussion with Google/Alphabet’s Kenny Tse and Amit Parikh, Managing Director, West Coast Lead at BNY.

Tse explained that Google is currently “doubling down and tripling down” on various AI technologies. These include agentic workflow, which the company is currently applying in the area of short-term investments.

“When we’re talking about AI and agentic workflow, it’s not just applying the AI and ML technology on the cash forecasting portion,” he said. “Ultimately, even if you have the perfect cash forecast, you have to do something with that number. Our longer-term vision is about evaluating what your options are to determine what you could do with that money and executing deposits at a scale unimaginable before.”

Acknowledging that not many companies have the same resources available to Google, Tse explained that treasurers can also use tools to extract content from large documents. “We used to read through vendor contracts to see which clauses pertain to treasury,” he said. “You don’t need to do that anymore, because there are existing tools to help you do that.”