“As the newly appointed Head of the HSBC Payments and Cash Management business in Europe, I’m excited about the opportunities we have to help our clients to grow their business. With a presence in 33 European markets we are ideally placed to help clients across the globe expand into Europe and to help our European clients expand into fast growing markets in other regions.

We are seeing continued growth in multiple countries with increased investment in Spain, Poland, the Netherlands, Germany, Italy and Switzerland to name a few. Recently, we also became the first bank to implement a two-way RMB sweep between Europe (UK/Germany) and China. As the following article demonstrates, we have the international connectivity, presence and ability to facilitate working capital, supply chain, corporate card and liquidity management solutions flexibly, as part of our overall relationship with our clients.”

Eddie Norton, Head of Payments and Cash Management, Europe, HSBC

Eddie Norton

Head of Payments and Cash Management, Europe

HSBC

Brian Tomkins

European Head of Corporate Cards

HSBC

Stuart Rousell

Global Head of Working Capital Advisory

HSBC

Jennifer Doherty

Global Head of Commercialisation, Liquidity & Investment Products

HSBC

In the working capital space, one of the current pressing themes is the state of connection between the physical and the financial supply chain. They have been interlinked in the past, particularly for international trade, through documentary trade solutions such as Letters of Credit (LCs). However, as trade has shifted ever more towards open account practices, a divide has appeared and can be problematic for a number of reasons.

To facilitate the finance element on open account trade, the market has seen increased take-up of solutions such as Supply Chain Finance (SCF). Particularly prevalent post global financial crisis, this proposition remains largely independent of the physical supply chain, notes Stuart Rousell, Global Head of Working Capital Advisory, HSBC. With the implementation of Basel III, the trend of widening pricing gap between highly rated and less well rated is set to continue. This is such that the great task today is to re-integrate the connectors between both sides whilst retaining their functional independence. Whilst the pressure point for that integration is the availability, or otherwise, of sufficient and sensibly-priced finance, the real stimulus for bringing both back together is buyer concern around the financial resilience of suppliers along their supply chain. “Solutions that enable the co-existence of both physical and financial supply chains provide robustness and better future-proofing,” argues Rousell. “Where we bring both together, solutions provide logistical reliance on the need for finance, but the visibility is available to financing banks and is equally available to benefit suppliers to help take out the real cost of the supply chain.”

Exclusive systems

The data flows that exist in the procurement process often exist independently of finance solutions, often via third-party web portals or directly through Enterprise Resource Planning (ERP) systems. Indeed, says Rousell, “a number of e-Procurement platforms exist with payment, billing and even dispute management functionality. But these tend to be over-engineered for roll-out into smaller client sites, as are the majority of ERP systems; although tier one suppliers might have the resources to connect directly, the smaller tier 2 and tier 3 suppliers can often be left high and dry.” This, he notes, “usually creates a default to paper, adding unwanted costs.”

The real opportunity then lies in understanding the flow of procurement data and sharing it with banks more effectively at a transactional level, says Rousell. “There is no desire by banks to get in the way of a process that works between buyers and suppliers. What we want to do is supplement that process with perhaps a financing element; we can do that by capturing data from buyers and using that to identify suppliers,” he explains.

If the use of proprietary software means that at both ends of the chain there will be re-keying of data into different platforms, then the clarion call is for standardisation. This does not require a wholesale replacement of systems: many of the solutions that could be used already exist. These may be EDI (electronic data interchange) standards-based offerings capable of fulfilling an order straight through from purchase order to fulfilment.

EDI standards (such as EDIFACT and the US-centred ANSI) have been available for more than 30 years. However, one of the key issues for products using EDI-based software is still supplier on-boarding. “Many of the solutions in this space have been designed for the buyer not supplier,” notes Rousell. He feels there is also a lack of understanding amongst smaller businesses around what can be achieved with the existing toolkit. However, he does feel that there is at last “greater collaboration coming down the supply chain,” this being driven by an across-the-board need for efficient working capital management and a better view on where costs can be taken out. His ideal is clear: “We need to be heading towards common data being shared as an in-built process where, as soon as there is invoice acceptance, the next stage is automatic presentment of that invoice to the bank for financing; that is not an automated process today.” The most active users of EDI standards are the “logistically challenged” automotive and retail sectors. Even so, elements of the physical supply chain often act independently, with electronic delivery notes being followed by manual acceptance of delivery, frequently creating reconciliation issues for stock and payments. “But within the EDI environment, there is an opportunity to electronically pass that acceptance notice to a bank for financing.” Additionally, in the stock-control environment, across multiple sectors, universal GS1 Bar Code standards are being used to identity individual goods or parts so data can be captured at various points of the physical supply chain lifecycle. This can be shared between different stakeholders within that chain, including those in the financial supply chain.

Co-operation with leadership

“If the parts of the solution already exist, then what is required to make it work is increased co-operation around working capital between business functions,” explains Rousell. Driving change internally thus rests with the fundamental question of working capital ownership. It could equally be claimed by operations, procurement, financial control or treasury, but each has a different agenda. This, he observes, means “too many silos leading to too many conflicting processes.” One way to break down these silos is to establish a head of working capital. Reporting to the CFO, the role should focus on driving efficiencies and costs through analysis of key elements such as Days Sales Outstanding (DSO), Days Payable Outstanding (DPO) and Days Inventory Outstanding (DIO) and aligning objectives.

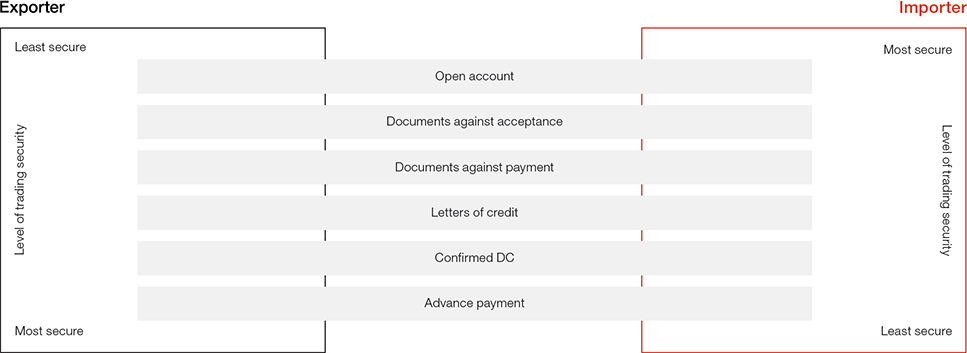

Chart 1: Payment risk ladder

Source: HSBC

In a wider context, (using the automotive sector as an example), the collaborative model will require a change of practice by some suppliers to enable acceptance of electronic delivery notes. “If we can get to a stage where there is further integration of banking into that process, we can get to a point of providing finance,” explains Rousell. “This would be self-liquidating at an individual transactional level, not merely on aggregated values.”

The value of virtual

Further to the above, a simple form of financed payment is a corporate card. When it comes to purchasing solutions a number of opportunities have opened up in recent years. Perhaps one of the most surprising developments in the business to business (B2B) space, and one not necessarily associated with the supply chain, is the rise of the humble card to a position of significant status within a treasurer’s tool box. Traditional Travel and Expense cards have evolved into broader B2B card programmes, for supplier payments. The ever-improving security and more sophisticated usage controls has seen payments values rise accordingly and can provide treasurers with the confidence to make card payments upwards of £1m. And perhaps the most significant development to arrive in the card arena – and facilitate the security of these larger payments – is the creation of virtual cards.

The ‘one-time use’ virtual card leverages the existing card network for acceptance and settlement in the B2B space, whilst effectively locking down the card number to a specific purpose or set of purposes, controlling factors such as purchase type, value, date and supplier. The inherent flexibility of virtual card numbers is complemented by an array of interfaces which can be used to generate them, for example, a traditional payment file can be used to create a batch of virtual card payments. The most recent evolution of the virtual card has even seen the cards being processed directly into the acquiring network so that the beneficiary need never touch the card data; the details are sent directly to its own bank where it will be processed and paid directly into the relevant account (usually within a day or two).

There are a number of reasons why the virtual card concept might appeal to a business. “Firstly, it is a very data-rich product,” explains Brian Tomkins, European Head of Corporate Cards, HSBC. “Once a payment has been settled with the supplier, having been processed through the card network as usual, the client can access real-time transaction information, making use of multiple client-selected data fields. This ensures clients can track and reconcile each payment made and offers stronger client oversight and control over spend patterns. In addition to this, as these are commercial credit cards, it also gives up to 56 days of interest free credit from the issuing bank. This heralds a distinct cash flow benefit: the supplier receives earlier payment and the buyer receives interest-free cash flow.”

In practice

“There are a number of B2B payment scenarios where virtual cards add value,” observes Tomkins. One-off payments for new suppliers that have not yet been brought into a purchasing programme would suit this format, with rich payment and invoicing data still being provided by the bank. Even more traditional high volume, low value payments can be optimised using the virtual card concept. If paying a courier or a travel management firm for example, where there are many transactions per month, it may be beneficial to lodge a virtual card with that supplier so all transactions can be billed to just one account. Rather than processing multiple invoices, the dedicated virtual card account means just one payment per month, for many transactions, with the benefit of enhanced data available for reconciliation of each transaction. Tomkins also notes that “increasingly, cards are being used as a simple means to enhance cash flow. In any sector where a business is typically expected to pay its bills before it is paid (such as the construction industry) the effect on cash flow can be challenging. A card programme alleviates the pressure, allowing the business to effectively create a free ‘extended float period’ enabling up to an extra 56 days to collect on its receivables.”

Of course, the supplier has to agree to be paid in this way and will be charged a fee to accept a virtual card payment, similar to any other commercial credit card. The challenge lies in ensuring the fee does not outweigh the advantage of enjoying earlier settlement of receivables. For long-term core suppliers and for those where the payment value is substantial, the traditional supply chain finance programme might still be deemed preferable. However, a major benefit of using cards over the traditional model is that it removes the often complex three-way legal contract between buyer, bank and supplier, making the on-boarding process quicker and simpler as well as opening doors to the circa 38 million suppliers that accept cards today.

The perfect mix

The simplicity of virtual cards, combined with commercial benefits, means that this is a focus area for card issuers. “There is big focus from HSBC on the B2B space because it is still a largely untapped area compared to the more heavily penetrated T&E sector,” notes Tomkins. “This is really being driven by our clients and their level of interest on optimising payments within their supply chain” he adds. Rather than cards competing with our financed payment products, such as supplier finance programmes, virtual card programmes have complementary effect. “One of the biggest challenges in financed supplier payment products is that there is no ‘one-size-fits-all’; when we look at a client’s accounts payable file there are clearly different financing payment products that work better for some suppliers and their payment profile than others.” From international trade finance to local invoice finance solutions, the inclusion of a card programme helps to create the best possible, holistic, solution. “There is a harmonious balance to be struck between the different payment methods available. At the high end there is traditional trade finance, whilst supply chain finance is well suited to the middle ground. The fluidity of a card programme means it can effectively capture the high volume, smaller value transactions all the while providing the same benefits without some of the wider complexities,” says Tomkins. The virtual card concept will only serve to reinforce this and contribute to a wider acceptance and trust in the value and security of a card solution.

The impact of regulation

The evolving regulatory landscape – particularly Basel III and its European interpretation, Capital Requirements Directive IV (CRD IV) – plays a significant part in the development of treasury solutions. Whilst Basel III may initially have been viewed by corporate treasurers as a challenge only for the banks, it is becoming increasingly apparent that what affects banks will indirectly be ultimately reflected in the corporate world. Today, whilst the concepts of account rationalisation, cash mobilisation, centralisation and yield optimisation remain core to most treasury operations, the arrival of Basel III – and the flurry of other major regulatory initiatives – has shifted their focus by a degree or two as treasurers need to consider the regulatory impact on their banking partners and on themselves.

Historically, banks have managed their balance sheets with a more asset centric approach impacting the scope and extent of lending decisions, says Jennifer Doherty, Global Head of Commercialisation, Liquidity & Investment Products, HSBC and a speaker at Eurofinance Copenhagen 2015. However, as Basel III’s Liquidity Coverage Ratio (LCR), Leverage Ratios (LR) and Net Stable Funding Ratio (NSFR) comes into play, banks will need to look more holistically at the impact of their client relationship on both the asset and the liabilities side of their balance sheets. Compliance with the new liquidity and leverage ratios means that banks have already begun to assess the impact of nominal value of their assets as well as the deposits profile of the liabilities. For certain deposits that cannot be redeployed for lending, sufficient high quality liquid assets (HQLA) need to be held to maintain LCR. This in turn could impact the leverage ratio and capital cost.

One point to note is the increasing importance of the ‘Operational Deposits’. These are frictional deposits that help in facilitating clients’ payables and receivables activities. As Operational Deposits are linked to daily activities, they are deemed to be more stable from a longer-term funding perspective and they reduce the LCR requirement. As the Operational Deposit requires substantially less HQLA to be held against it, the deposit derived from operational business becomes more valuable to the banks. This will lead to a rise in the importance of the operational banking relationship. Unlike historic pricing trends based on higher interest rate and yield for larger balances, Operational Deposits must be ‘priced without giving an economic incentive’ as per the Basel III directive. From a stable funding and capital cost perspective, operational relationships are therefore growing in importance for banks. Economic value for moving cash to a non-operating bank or an over-lay structure may not be as rewarding for clients as in the previous regulatory environment.

“We need to work with our clients to find different ways to make it work for both them and the bank. Clients who not only understand Basel III but also engage with their banks will have the edge,” says Doherty. “It is more important than ever for clients to segment their cash and understand what will be considered as operational. Clients should work with their banks to understand the most suitable deposit and investment offerings for their segmented cash.”

Innovative design

The quest for a mutually beneficial position has seen the financial sector become more innovative with Basel III-compliant products such as the 30+ days Evergreen notice accounts offering. “Innovation in this space will also see current operational burdens being removed as clients can automatically and seamlessly move their cash into other suitable off balance-sheet instruments (such as money market funds or short-term cash investments) without the need for last minute placements that may not produce optimal returns,” notes Doherty. This requires an intelligent approach to liquidity investment. “Our subject matter experts are on the ground talking to clients, discussing the likely impacts of Basel III and other regulations,” says Doherty. “Although Basel III is still at a relatively early stage of its implementation (LCR will be finalised later this year and the net stable funding ratio (NSFR) follows in January 2018) HSBC is already fielding questions ranging from ‘how will the new regulations impact treasury management on a day-to-day basis?’, to specific questions such as how CRD IV will impact notional pooling.”

Commenting on the latter, Doherty says banks may take different views on how CRD IV will impact their pooling proposition depending on their regulatory and financial reporting (GAAP, IFRS etc) structure. Over time, she feels that there will be a shift in focus towards cash concentration solutions as banks become increasingly sophisticated with their offerings in this space. By offering the ability to calculate and post interest, for example, they enable the use of this model but without the additional administrative burden of an inter-company loan. However, Doherty does not see notional pooling disappearing altogether. She believes, “there is still an appetite for it,” but due to the leverage ratio implications, banks have already started engaging in deeper dialogue with clients for managing gross pool positions. “Clients will start closely monitoring their positions within their notional pools to ensure they are being used as intended, as a short-term working capital tool rather than as a source of long-term funding.”

The need to know

As the regulatory landscape becomes more complex, so too does the level of market concern. Corporates must keep in touch with these changes and understand how they may be impacted. They also need to understand the fundamentals of the regulation and how it impacts their operations and the relationship with their banks. “Regulation can be perceived as a challenge but with it also comes opportunities,” notes Doherty. “It ensures banks and clients re-evaluate their respective positions and ensure their solutions are fit for purpose.” She believes that treasurers are now well placed because most corporates have multiple bank relationships, they have access to a diverse range of advisory services and subject matter experts. “They should be using all that knowledge to enable them to draw their own conclusions and obtain the best outcome possible for their businesses in this new environment.”

In increasingly uncertain times, a strong treasury team will find new ways to make working capital work as hard as it can to contribute to cash flows whilst educating colleagues about good working capital management. But in the push for working capital optimisation, it is clear that treasurers need to work with banks who have a wide product offering with international connectivity and the ability to facilitate working capital and supply chain solutions flexibly, as part of the overall relationship.