The Path to Sustainability: Bank of America and Treasury Today present actionable learning points for treasurers

There is no doubt now that sustainability and ESG factors have become an extremely important part of doing business. Both bring about obvious societal advantages, and it’s well understood that sustainably focused businesses enjoy an enhanced commercial experience too.

The aim, of course, is for every business to adopt these practices, indeed, for them to become second nature. To get to that point, every employee must both understand and accept their responsibility to try to make a positive difference.

Whilst for some functions and roles the steps to be taken may be obvious, and their impact immediate and powerful, for others, this is less so. But every action counts.

Fortunately, most treasurers by now will be aware at least of the concept of green bonds and sustainability linked loans, even if most do not yet use them. Many will also have started exploring other ways in which they can begin using ESG and sustainable practices.

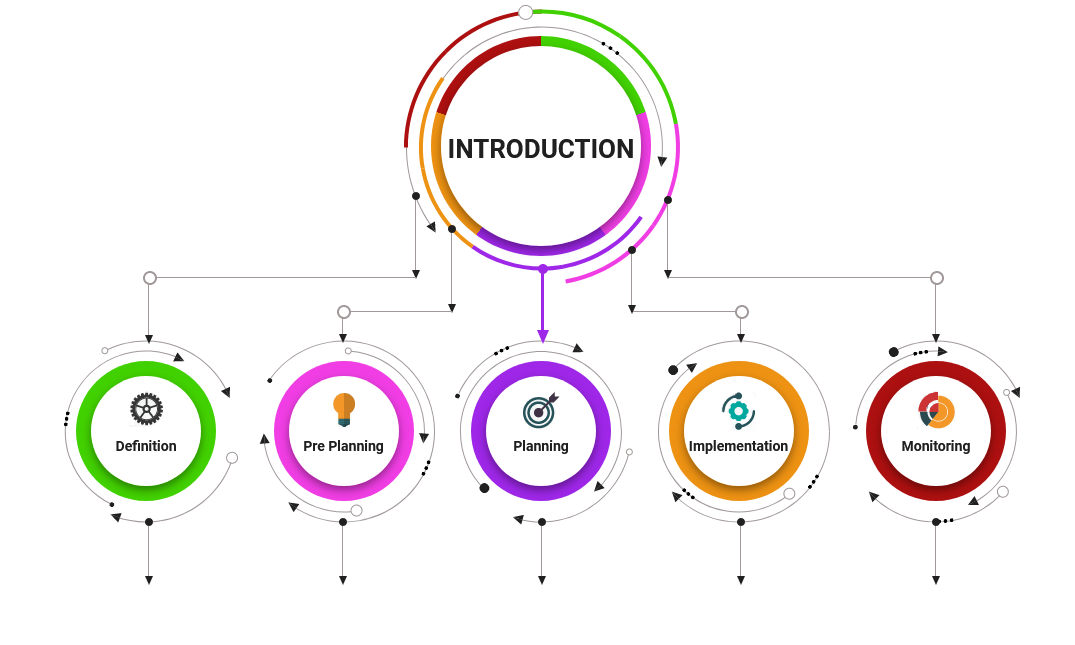

For those that have not yet begun their journey, and for those that want to know how to move from their existing sustainability level to that of best practice, this Bank of America and Treasury Today guide takes you through the key stages of programme development.

By using a clear flowchart format and by highlighting the challenges and opportunities faced within the treasury context, we hope it helps you establish and maintain an active sustainability and ESG programme.

Henrik Lang

Head of Liquidity, Global Transaction Services

Introduction

The Path to Sustainability

At Bank of America, our commitment to sustainability goes back to responsible growth, which is a core component of our corporate strategy. Everything we do is linked to and anchored in this core principle.

One of the ways we offer leadership in the environment, social and governance (ESG) space is through thought leadership, like this series. We want to share our experiences and best practices whilst also demonstrating new sustainable products, solutions and approaches. This will help our clients to turn their treasury department to be more ESG friendly.

We don’t just focus on making Bank of America more sustainable. We serve thousands of clients across our global franchise and we engage many of them on the topic of ESG. If they all focused just a little bit on sustainability and ESG, it would make a much greater impact on the world around us.

We’re really excited about this ESG flowchart in partnership with Treasury Today Group.

Firstly, it provides a comprehensive and holistic approach to sustainability. It has distinct phases, and a diverse application.

Secondly, it provides practical advice, it provides actionable steps. There’s been so much talk over the years about ESG in a broader, more generic sense. However, there aren’t many pieces out there that are available to treasurers that can translate the principles of ESG into actionable steps. This series will provide treasurers with something they can act on today, no matter company size, location or industry.

Lastly, this series will broaden the horizon for treasurers. Historically, client discussions have always been about ESG in a broader sense, perhaps with a focus on sustainable finance. This series will highlight that there’s more to a sustainable treasury beyond green bonds and sustainability-linked loans.

This ESG flowchart cuts across many different parts of treasury including internal policies, provider selection and ensuring a diverse workforce. It will also highlight new and innovative ESG products and solutions. It will help treasurers by exploring various parts of their operation. For example, are treasurers allocating part of their excess cash to green or sustainable investment options? Are they leveraging the full breadth of digital solutions available to cut back on paper? Are they using new solutions within the trade finance space to reward minority and sustainably focused suppliers in their supply chain?

At Bank of America, as a committed supporter of sustainability, we’re excited to see the progress that has been made in sustainable corporate treasury. But we know there is still some way to go. We hope this flowchart helps you to bring sharper focus to your activities so that ultimately, we know we are all doing as much as we can to make a positive difference.